Current Report Filing (8-k)

February 21 2017 - 8:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 18, 2017

FARMLAND PARTNERS INC.

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

001-36405

|

|

46-3769850

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

4600 S. Syracuse Street, Suite 1450

Denver, Colorado

|

|

80237

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(720) 452-3100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01

Entry into a Material Definitive Agreement.

On February 18, 2017, Farmland Partners Inc. (the “Company”) entered into a Termination Agreement (the “Termination Agreement”) with Prudential Capital Mortgage Company (“Prudential”) pursuant to which the Company and Prudential agreed to terminate, effective as of March 31, 2017, the Amended and Restated Sub-Advisory Agreement (the “Sub-Advisory Agreement”), dated as of October 23, 2015, by and among American Farmland Company, American Farmland Advisors, American Farmland Company L.P. and Prudential and certain related property management agreements (together with the Sub-Advisory Agreement, the “Prudential Agreements”).

The Termination Agreement provides that, as of March 31, 2017, Prudential will no longer provide services to the Company under the Prudential Agreements. The Company has agreed to pay Prudential $1.6 million in cash, which is equal to the fee that would be owed to Prudential for services through the quarter ended March 31, 2017, plus a termination fee of approximately $160,000.

Item 1.02

Termination of a Material Definitive Agreement.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

FARMLAND PARTNERS INC.

|

|

|

|

|

|

Dated: February 21, 2017

|

By:

|

/s/ Luca Fabbri

|

|

|

|

Luca Fabbri

|

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

|

|

|

|

|

3

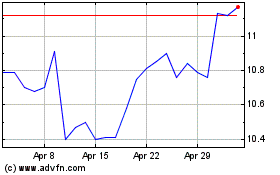

Farmland Partners (NYSE:FPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

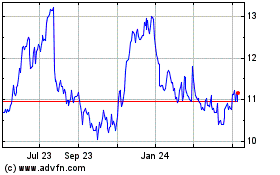

Farmland Partners (NYSE:FPI)

Historical Stock Chart

From Apr 2023 to Apr 2024