Anglo American Swings to Profit on Rising Commodity Prices

February 21 2017 - 2:49AM

Dow Jones News

By Scott Patterson

LONDON--Fueled by surging commodity prices, Anglo American PLC

(AAL.LN) swung back to profitability last year, a dramatic rebound

for a company that only a year ago was planning to implement a

sweeping restructuring plan.

The U.K.-listed miner reported net income of $1.6 billion for

the year ended Dec. 31, 2016, compared with a net loss of $5.6

billion the previous year. Revenue was largely unchanged, rising to

$23.1 billion last year from $23 billion a year ago.

Anglo's net debt fell to $8.5 billion by year-end from $12.9

billion at the end of 2015, as higher commodity prices and asset

sales brought some relief to the mining giant's balance sheet.

The rebound brings a reprieve to Anglo American Chief Executive

Mark Cutifani, who a year ago unveiled a plan to sharply reduce the

mining giant's assets and cut its workforce by more than half.

-Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

February 21, 2017 02:34 ET (07:34 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

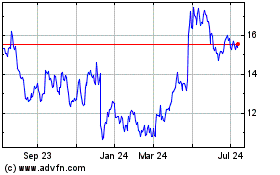

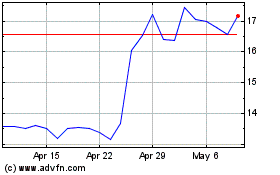

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024