Mine Disputes Boost Copper

February 20 2017 - 7:31AM

Dow Jones News

By Katherine Dunn and Sara Schonhardt

LONDON--Copper prices edged higher in London on Monday, as a

contract dispute between mining giant Freeport-McMoRan Inc. and the

Indonesian government continued to stoke supply worries.

The three-month London Metal Exchange copper price was up 0.78%

at $6,016.50 per metric ton in midmorning European trade, chipping

back a decline on Friday.

"Metals prices are beginning the new week of trading with a

positive undertone and are recouping some of the losses they

suffered at the end of last week," Commerzbank said in a note.

On Monday, Arizona-based Freeport said it was considering

entering arbitration with the government if it can't resolve the

dispute over the terms of the company's operating rights in the

next 120 days.

A spokesman for the company said Freeport needed "long-term

certainty about our operating rights" to make the investments in

the mine and new smelting facilities the government now

requires.

The two sides have been locked in negotiations over the license,

which has prevented Freeport from obtaining a permit needed to

restart exports. Following a strike at its smelting facility

earlier this year, Freeport was forced to stop production at

Grasberg earlier this month, and has warned of other cuts.

Freeport is pursuing plans to invest another $15 billion in its

Grasberg mine, the largest copper producer in Indonesia, and one of

the largest mines in the world.

The negotiations come amid a backdrop of supply disruptions in

Chile, home to the world's largest copper mine, where union workers

have been on strike since Feb. 9.

The Escondida mine, located in the Atacama Desert of northern

Chile, is majority-owned by BHP Billiton Ltd. Last week, the union

said it would enter another round of negotiations with the

management.

Those supply concerns have helped push up sentiment in the

copper market, with the market now up nearly 9% for the year.

Traders in the U.S. are out on Monday for the President's Day

holiday.

The other base metals were largely higher on Monday. Lead was up

1.02% at $2,276 per ton, zinc was up 0.98% at $2,383.50 per ton,

nickel was flat at $11,070 per ton, and tin was up 0.35% at $19,845

per ton. Aluminum shed 0.03% to $1,884 per ton.

Write to Katherine Dunn at katherine.dunn@wsj.com and Sara

Schonhardt at sara.schonhardt@wsj.com.

(END) Dow Jones Newswires

February 20, 2017 07:16 ET (12:16 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

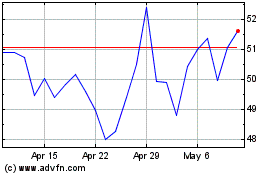

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024