Big Food Looks to Startups for Ideas, Innovation -- Update

February 17 2017 - 5:25PM

Dow Jones News

By Annie Gasparro

When General Mills Inc. and Kellogg Co. couldn't beat the

startups appearing on store shelves next to their Yoplait yogurt

and Froot Loops cereal, they decided to invest in them.

Food giants are starting venture capital funds to invest in

startups focused on healthier and less-processed foods, betting the

younger companies can teach them to be more entrepreneurial and

innovative. Slow to recognize consumers' shift toward those

products, global titans have found themselves stuck in a rut.

This week, Kraft Heinz Co., which has struggled with sales

declines in the U.S. and Europe, said it made a $143 billion

approach to take over UnileverPLC, but the U.K. consumer-products

giant declined. If a deal were to occur, it would quickly reignite

sales growth by bringing Kraft cheese, Heinz condiments and

Planters nuts to more countries where Unilever sells its Hellmann's

mayonnaise and Lipton teas.

Meanwhile, Nestlé SA, the world's largest packaged-food company,

General Mills, J.M. Smucker Co. and Campbell Soup Co. each revealed

disappointing sales trends, further highlighting the challenges

these American mainstays face.

Nestlé, the world's largest packaged-food company, dropped its

long-running sales-growth target for the next three years, saying

it needs time to adapt to these fundamental changes in the

industry.

"It's hard for consumer companies to step out of what they've

been locked into for 60 or 80 years," said Ryan Caldbeck, founder

and chief executive of CircleUp, a business that connects

private-equity firms with food startups. CircleUp says large

consumer-goods companies lost $18 billion in market share to

smaller competitors between 2011 and 2015.

In January Kellogg's fund, Eighteen94 Capital led a $4.2 million

investment in Kuli Kuli, which makes snacks with moringa, a leafy

green tree common in Asia, Latin America and Africa. A week later,

General Mills' venture-capital fund, 301 Inc., led a second

investment of $6 million in Rhythm Superfoods, maker of "zesty

nacho" kale chips.

Campbell Soup Co. and Tyson Foods Inc. dedicated $125 million

and $150 million, respectively, toward their in-house venture funds

last year.

In total, venture capital funds made 66

food-and-beverage-related deals last year, up 20% from 2015. About

a fifth were backed by big food companies, according to Dow Jones

VentureSource.

The shift in tastes toward food consumers view as fresher and

more natural also is a factor prompting big food companies to seek

larger deals. Kraft Heinz Co., which has struggled with sales

declines in the U.S. and Europe, Friday said it made a $143 billion

approach to take over Unilever PLC, a move the U.K.

consumer-products giant declined. If a deal were to materialize, it

would bring together brands such as Kraft Heinz's namesakes and

Oscar Meyer hot dogs with Unilever's Hellmann's mayonnaise and

Lipton teas.

Because food giants and emerging brands are also competitors,

some entrepreneurs have been wary of entreaties from these

investors.

"If I tell you all our trade secrets, what's going to stop

Kellogg from making their own moringa bar?" Kuli Kuli founder Lisa

Curtis recalls asking Simon Burton, the head of Kellogg's venture

capital fund.

Mr. Burton said Kellogg is looking for marketing and recipe

ideas that can help improve the performance of its older brands

like Nutri-Grain bars, in addition to a return on its investment in

Kuli Kuli.

Ms. Curtis said access to Kellogg's resources made that

partnership worth it. "The deal gave us validation" with grocery

store buyers, according to the 29-year-old former Peace Corps

volunteer.

Rhythm Superfoods Chief Executive Scott Jensen said many of his

peers are more open to a minority investment than a full

acquisition. Some have heard cautionary tales of startups that

slipped after teaming with big food makers, like Kellogg's rocky

pairing with cereal-maker Kashi. A few years into its ownership,

Kellogg merged Kashi with its broader operations, and the once

ahead-of-the-curve brand began falling behind on innovation.

Mr. Jensen, who met General Mills executives in 2015, said his

kale chip company has benefited from the food giant's array of

specialists, like an engineer who works only on bagging

machines.

Rhythm's sales rose 30% in 2016. Mr. Jensen expects sales to

rise another 40% this year to more than $20 million. But General

Mills isn't "telling us how to run our business. And now that other

people can see that, I have a lot of people who come to me and say,

'Can you introduce me to them?'"

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

February 17, 2017 17:10 ET (22:10 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

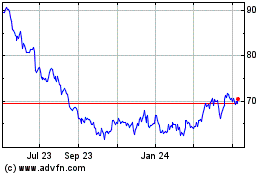

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

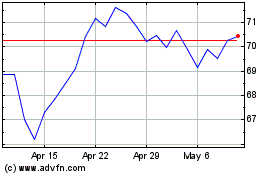

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024