UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 13, 2017

McEWEN MINING INC.

(Exact name of registrant as specified in its charter)

|

Colorado

(State or other jurisdiction of

incorporation or organization)

|

|

001-33190

(Commission File

Number)

|

|

84-0796160

(I.R.S. Employer

Identification No.)

|

150 King Street West, Suite 2800

Toronto, Ontario, Canada M5H 1J9

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number including area code:

(866) 441-0690

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01

Entry into a Material Definitive Agreement

On February 13, 2017, McEwen Mining Inc. (the “Company”) entered into an Arrangement Agreement (the “Arrangement Agreement”) with Lexam VG Gold Inc., a corporation existing under the laws of the Province of Ontario, Canada (“Lexam”), pursuant to which the Company will acquire all of the issued and outstanding common shares of Lexam (the “Arrangement”). The Arrangement will be implemented by way of the plan of arrangement attached as Schedule A to the Arrangement Agreement (the “Plan of Arrangement”) and is subject to approval by the Ontario Superior Court of Justice (Commercial List) (the “Court”). The effect of the Arrangement will result in Lexam becoming a wholly-owned subsidiary of the Company.

The Board of Directors of the Company has unanimously determined, upon the recommendation of a special committee of independent and disinterested directors, that the Arrangement Agreement and the Arrangement are advisable and fair to, and in the best interests of, the Company and its shareholders, and unanimously approved the Arrangement Agreement. Robert R. McEwen, Chairman and Chief Executive Officer of each of the Company and Lexam, and Richard Brissenden, a director of each of the Company and Lexam, both abstained from voting on the Arrangement and Arrangement Agreement because of their interests in Lexam.

Pursuant to, and subject to the terms and conditions of, the Arrangement Agreement and the Plan of Arrangement, the Company will acquire all of the issued and outstanding shares of Lexam’s common shares (the “Lexam Shares”) in exchange for shares of common stock of the Company at a ratio of 0.056 of a share of the Company’s common stock for each Lexam Share. In addition, all issued and outstanding options to acquire Lexam Shares will be converted into options to purchase shares of common stock of the Company at a ratio of 0.056 of a share of the Company’s common stock for each Lexam Share underlying each such Lexam option. The exchange ratio of 0.056 will not be adjusted for any subsequent changes in market prices of the Lexam Shares or the Company’s common stock prior to the closing of the Arrangement.

Consummation of the Arrangement is subject to various conditions, including, among others: (i) the approval of Lexam’s shareholders of the Arrangement and any other necessary actions related thereto; (ii) approval of the Court; (iii) approval of the listing of the shares of the Company’s common stock issuable to holders of Lexam Shares on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange; (iv) holders of not more than five percent of the issued and outstanding Lexam Shares exercising rights of dissent in respect of the Arrangement; (v) the accuracy of each party’s representations and warranties (subject to certain materiality qualifiers); and (vi) the absence of a material adverse effect in respect of each party.

The Arrangement Agreement includes customary representations, warranties, and covenants by the parties, including, among others, a covenant of Lexam not to solicit competing or alternative transactions, subject to certain exceptions to permit Lexam’s Board of Directors to comply with its fiduciary duties, including the right of Lexam to enter into a “Superior Proposal” (as defined in the Arrangement Agreement).

The Arrangement Agreement contains certain termination rights for both the Company and Lexam. Lexam has agreed to pay a termination fee of $2,100,000 in certain circumstances, including if the Arrangement Agreement is terminated because (i) Lexam is in material breach or in default of any of its obligations or covenants set forth in the Arrangement Agreement; (ii) the meeting of Lexam shareholders to approve the Arrangement has not occurred on or before April 17, 2017; (iii) Lexam’s Board of Directors accepts, approves, recommends, or enters into a legally binding agreement that constitutes a Superior Proposal or an “Acquisition Proposal” (as defined in the Arrangement Agreement); or (iv) an

2

Acquisition Proposal was announced prior to the Lexam shareholders meeting, Lexam shareholders do not approve the Arrangement Agreement, and Lexam enters into a transaction resulting in the merger, business combination, or similar transaction, including the sale or acquisition of a material portion of Lexam’s assets within 12 months of the termination of the Arrangement Agreement.

The Company has agreed to pay a termination fee of $2,100,000 in certain circumstances, including if the Arrangement Agreement is terminated because (i) the Company fails to complete the Arrangement on or prior to May 23, 2017 when all other closing conditions have been met or (ii) the Company materially breaches its representations, warranties or covenants such that closing conditions would not be met.

In order to comply with NYSE rules, Mr. McEwen will not be entitled to receive shares of the Company’s common stock in exchange for his Lexam Shares in an amount representing more than 1% of the currently issued and outstanding shares of the Company without obtaining the prior approval of the Company’s shareholders. The Company will seek such shareholder approval at its 2017 Annual Meeting of Shareholders. If such shareholder approval is not obtained, the Company will pay for such excess shares in cash.

The Arrangement Agreement has been included to provide investors and shareholders with information regarding its terms. It is not intended to provide any other factual information about the Company. The representations, warranties and covenants contained in the Arrangement Agreement were made only for purposes of that agreement and as of specific dates, were solely for the benefit of the parties to the Arrangement Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Arrangement Agreement instead of establishing these matters as facts and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Shareholders are not third-party beneficiaries under the Arrangement Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or Lexam or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Arrangement Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

A copy of the Arrangement Agreement is attached to this report as Exhibit 2.1. The foregoing description of the Arrangement Agreement is qualified in its entirety by reference to the Arrangement Agreement.

Item 3.02

Unregistered Sales of Equity Securities

As described in Item 1.01 of this report, the Company has agreed in the Arrangement Agreement that, if the Plan of Arrangement becomes effective and its acquisition of the issued and outstanding common shares of Lexam is thereby completed, the Company will issue 0.056 of a share of the Company’s common stock for each issued and outstanding Lexam Share, or approximately 12,689,709 shares of the Company’s common stock. If issued, such shares will represent approximately 4% of the total number of shares of common stock of the Company.

Section 3(a)(10) of the Securities Act of 1933, as amended (the “Securities Act”), exempts from the registration requirements under that Act the issuance of securities which have been approved, after a hearing upon the fairness of the terms and conditions on which all persons to whom it is proposed the securities will be issued shall have the right to appear, by any court expressly authorized by law to grant such approval. Under the Arrangement Agreement, Lexam will submit the Plan of Arrangement to the

3

Court for interim order permitting notice to all persons to which the shares of the Company’s common stock will potentially be issuable. Following the requisite approval by the Lexam shareholders and a hearing at which such persons will have the right to appear, Lexam will seek a final order from the Court as to the fairness of the Plan of Arrangement. Such final order is a condition to the consummation of the Plan of Arrangement and the issuance of the Company’s shares of common stock. The Company therefore anticipates that, if the Plan of Arrangement becomes effective under the terms and conditions described in the Arrangement (including the receipt of such final order from the Court), the issuance of up to 12,689,709 shares of the Company’s common stock to the Lexam shareholders will be exempt from the registration requirements under the Securities Act pursuant to Section 3(a)(10) thereof.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this report:

|

2.1

|

|

Arrangement Agreement, dated as of February 13, 2017, between McEwen Mining Inc. and Lexam VG Gold Inc.

|

Additional Information About the Arrangement

As discussed above, in connection with the Arrangement, the Company intends to seek approval from its shareholders at the Company’s 2017 Annual Meeting of Shareholders to issue shares to Robert R. McEwen, Chairman and Chief Executive Officer of the Company, as required by the rules of the New York Stock Exchange. The Company intends to file a preliminary proxy statement and a definitive proxy statement with the SEC to seek such approval. SHAREHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT MATERIALS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE ARRANGEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE ARRANGEMENT AND THE PARTIES THERETO.

The definitive proxy statement will be mailed to the Company’s shareholders seeking, among other things, their

approval to issue shares exceeding 1% of the currently issued and outstanding shares of the Company’s common stock to Mr. McEwen in consideration for his shares of Lexam, in accordance with the terms of the Arrangement. The Company’s shareholders may also obtain a copy of the definitive proxy statement free of charge once it is available by directing a request to: McEwen Mining Inc. at (647) 258-0395, at 150 King Street West, Suite 2800, Toronto, Ontario, Canada M5H 1J9. In addition, the preliminary proxy statement, the definitive proxy statement and other relevant materials that will be filed with the SEC will be available free of charge at the SEC’s website at www.sec.gov or shareholders may access copies of such documentation filed with the SEC by visiting the “Investor Relations” section of the Company’s website at http://www.mcewenmining.com.

The Company and its respective directors, executive officers and other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies in connection with the Arrangement. Information regarding the names, affiliations and interests of certain of the Company’s

executive officers and directors in the solicitation will be available in the preliminary proxy statement and definitive proxy statement relating to the Arrangement to be filed with the SEC. Information about the Company’s executive officers and directors is also available in the Company’s definitive proxy statement relating to its 2016 Annual Meeting of Shareholders filed with the SEC on April 20, 2016.

4

SIGNATURE

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

McEWEN MINING INC.

|

|

|

|

|

|

|

|

Date: February 17, 2017

|

By:

|

/s/

Carmen Diges

|

|

|

|

Carmen Diges, General Counsel

|

5

Exhibit Index

The following is a list of the Exhibits filed herewith:

|

Exhibit

|

|

|

|

Number

|

|

Description of Exhibit

|

|

|

|

|

|

2.1

|

|

Arrangement Agreement, dated as of February 13, 2017, between McEwen Mining Inc. and Lexam VG Gold Inc.

|

6

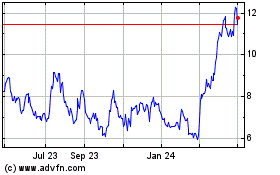

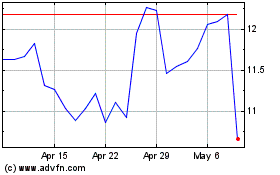

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Apr 2023 to Apr 2024