Use these links to rapidly review the document

TABLE OF CONTENTS

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON FEBRUARY 17, 2017.

REGISTRATION NO. 333-215992

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM F-10 and FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

|

|

|

|

Form F-10

BROOKFIELD ASSET MANAGEMENT INC.

BROOKFIELD FINANCE INC.

(Exact name of Registrant as specified in its charter)

|

|

Form F-3

BROOKFIELD FINANCE LLC

(Exact name of Registrant as specified in its charter)

|

|

ONTARIO

(Province or other Jurisdiction of

Incorporation or Organization)

|

|

DELAWARE

(State or other Jurisdiction of

Incorporation or Organization)

|

|

6512

(Primary Standard Industrial Classification

Code Number, if applicable)

|

|

6512

(Primary Standard Industrial Classification

Code Number, if applicable)

|

|

NOT APPLICABLE

(I.R.S. Employer Identification

Number, if applicable)

|

|

NOT APPLICABLE

(I.R.S. Employer Identification

Number, if applicable)

|

|

BROOKFIELD PLACE, 181 BAY STREET

SUITE 300, P.O. BOX 762

TORONTO, ONTARIO M5J 2T3

(416) 363-9491

(Address and telephone number of Registrant's principal

executive offices)

|

|

BROOKFIELD PLACE

250 VESEY STREET, 15th FLOOR

NEW YORK, NEW YORK 10281-1023

(212) 417-7000

(Address and telephone number of Registrant's principal

executive offices)

|

TORYS LLP

1114 AVENUE OF THE AMERICAS

NEW YORK, NY 10036

ATTENTION: ANDREW J. BECK & MILE T. KURTA

(212) 880-6000

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

TORYS LLP

1114 AVENUE OF THE AMERICAS

NEW YORK, NY 10036

ATTENTION: ANDREW J. BECK & MILE T. KURTA

(212) 880-6000

Approximate date of commencement of proposed sale to the public:

From time to time after

the effective date of this

Registration Statement.

|

|

|

|

|

|

|

Form F-10

|

|

Province of Ontario, Canada

(Principal jurisdiction regulating this offering)

|

|

It is proposed that this filing shall become effective (check appropriate box below):

|

|

A.

|

|

o

|

|

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously

in the United States and Canada).

|

|

B.

|

|

ý

|

|

at some future date (check appropriate box below)

|

|

1.

|

|

o

|

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than

seven calendar days after filing).

|

|

2.

|

|

o

|

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time seven calendar

days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ).

|

|

3.

|

|

ý

|

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of

clearance has been issued with respect hereto.

|

|

4.

|

|

o

|

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

|

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to the home

jurisdiction's shelf prospectus offering procedures, check the following box.

ý

|

Form F-3

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with

the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount to

be Registered

(2)

|

|

Proposed Maximum

Aggregate Offering Price

(3)(4)

|

|

Amount of

Registration Fee

(5)

|

|

|

|

Debt Securities of Brookfield Asset Management Inc.

|

|

|

|

|

|

|

|

|

|

Guarantees by Brookfield Asset Management Inc. of Debt Securities of Brookfield Finance Inc.

(1)

|

|

|

|

|

|

|

|

|

|

Guarantees by Brookfield Asset Management Inc. of Debt Securities of Brookfield Finance LLC

(1)

|

|

|

|

|

|

|

|

|

|

Class A Preference Shares

|

|

|

|

|

|

|

|

|

|

Class A Limited Voting Shares

|

|

|

|

|

|

|

|

|

|

Debt Securities of Brookfield Finance Inc.

|

|

|

|

|

|

|

|

|

|

Debt Securities of Brookfield Finance LLC

|

|

|

|

|

|

|

|

|

Total

|

|

US$2,500,000,000

|

|

US$2,500,000,000

|

|

US$289,750

|

|

|

-

(1)

-

The guarantees issued by Brookfield Asset Management Inc. being registered hereon are being sold without

separate consideration. Pursuant to Rule 457(n) under the Securities Act, no separate fee for the guarantees is payable.

-

(2)

-

There

are being registered under this Registration Statement such indeterminate number of securities of the Registrants as shall have an aggregate initial

offering price not to exceed US$2,500,000,000. Any securities registered by this Registration Statement may be sold separately or as units with other securities registered under this Registration

Statement. The proposed maximum initial offering price per security will be determined, from time to time, by the Registrant in connection with the sale of the securities under this Registration

Statement.

-

(3)

-

In

United States dollars or the equivalent thereof in Canadian dollars.

-

(4)

-

Estimated

solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as

amended (the "

Securities Act

").

-

(5)

-

Previously

paid.

The Registrants hereby amend the Registration Statement on such date or dates as may be necessary to delay its effective date until the registration statement

shall become effective as provided in Rule 467 under the Securities Act of 1933 or on such date as the Commission, acting pursuant to Section 8(a) of the Act,

may determine.

Table of Contents

PART I

Base Shelf Prospectus

A registration statement relating to these securities has been filed with the U.S. Securities and Exchange Commission,

and the prospectus contained herein is not complete and may be

changed. These securities may not be offered or sold prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell in any U.S. state

where the offer or sale is not permitted.

|

|

|

|

|

New Issue

|

|

February 17, 2017

|

SHORT FORM BASE SHELF PROSPECTUS

US$2,500,000,000

|

|

|

|

|

|

|

BROOKFIELD ASSET MANAGEMENT INC.

|

|

BROOKFIELD FINANCE INC.

|

|

BROOKFIELD FINANCE LLC

|

|

Debt Securities

Class A Preference Shares

Class A Limited Voting

Shares

|

|

Debt Securities

Unconditionally guaranteed as to payment of principal, premium, if any, and interest by Brookfield Asset Management Inc.

|

|

Debt Securities

Unconditionally guaranteed as to payment of principal, premium, if any, and interest by Brookfield Asset Management Inc.

|

During the 25-month period that this short form base shelf prospectus, including any amendments hereto (this "

Prospectus

"), remains

effective, (i) each of Brookfield Asset Management Inc. (the "

Company

"), Brookfield Finance Inc.

("

BFI

") and Brookfield Finance LLC ("

US LLC

", and together with the Company and BFI, the

"

Issuers

" and each an "

Issuer

") may from time to time offer and issue (i) unsecured debt securities

(the "

BAM Debt Securities

", "

BFI Debt Securities

" and "

US LLC Debt

Securities

", respectively, and collectively the "

Debt Securities

") and (ii) the Company may from time to time offer and

issue Class A Preference Shares ("

Preference Shares

") and Class A Limited Voting Shares ("

Class A

Shares

", and together with the Preference Shares and Debt Securities, the "

Securities

"). The BFI Debt Securities and the

US LLC Debt Securities will be fully and unconditionally guaranteed as to payment of principal, premium (if any) and interest and certain other amounts by the Company.

The Company and BFI are permitted, under a multijurisdictional disclosure system adopted by the United States and Canada, to prepare this Prospectus in accordance with

the Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. The financial statements included or

incorporated herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS") and thus may not be comparable

to financial statements of U.S. companies.

Prospective investors should be aware that the acquisition of the Securities may have tax consequences both in the United States and in Canada. Such consequences for

investors who are residents in Canada or are residents in, or citizens of, the United States may not be described fully herein or in a Prospectus Supplement. Prospective investors should

consult their own tax advisors with respect to their particular circumstances.

The enforcement by investors of civil liabilities under the U.S. federal securities laws may be affected adversely by the fact that the Company and BFI are incorporated

or organized under the laws of the Province of Ontario, that some or all of their officers and directors may be residents of Canada, that some or all of the underwriters or experts named in the

registration statement may be residents of Canada and that all or a substantial portion of the assets of such Issuers and such persons may be located outside the

United States.

See "Cautionary Note Regarding Forward-Looking Information" and "Risk Factors" beginning on pages iii and 2 for a discussion of certain risks that you should

consider in connection with an investment in these Securities.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE "COMMISSION"), ANY U.S. STATE SECURITIES COMMISSION, OR ANY

CANADIAN REGULATORY AUTHORITY, NOR HAS THE COMMISSION, ANY U.S. STATE SECURITIES COMMISSION OR ANY CANADIAN SECURITIES REGULATORY AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THIS

PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Collectively,

the Issuers may offer and issue Securities either separately or together, in one or more series in an aggregate principal amount of up to US$2,500,000,000 (or the equivalent in

other currencies or currency units) or, if any Debt Securities are offered at an original issue discount, such greater amount as shall result in an aggregate offering price of US$2,500,000,000.

Securities of any series may be offered in such amount and with such terms as may be determined in light of market conditions. The specific terms of the Securities in respect of which this Prospectus

is being

delivered will be set forth in one or more prospectus supplements (each a "

Prospectus Supplement

") to be delivered to purchasers together with this

Prospectus, and may include, where applicable (i) in the case of Debt Securities, the specific designation, aggregate principal amount, denomination (which may be in United States

dollars,

Table of Contents

in

any other currency or in units based on or relating to foreign currencies), maturity, interest rate (which may be fixed or variable) and time of payment of interest, if any, any terms for

redemption at the option of the Issuer or the holders, any terms for sinking fund payments, any listing on a securities exchange, the initial public offering price (or the manner of

determination thereof if offered on a non-fixed price basis) and any other specific terms, (ii) in the case of the Preference Shares, the designation of the particular class, series, aggregate

principal amount, the number of shares offered, the issue price, the dividend rate, the dividend payment dates, any terms for redemption at the option of the Company or the holder, any exchange or

conversion terms and any other specific terms, and (iii) in the case of Class A Shares, the number of shares offered, the issue price and any other specific terms. Each such Prospectus

Supplement will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of each such Prospectus Supplement and only for the purposes of the

distribution of the Securities to which such Prospectus Supplement pertains. The Issuers have filed an undertaking with the securities regulatory authorities in each of the provinces of Canada that

they will not distribute, under this Prospectus, Securities that, at the time of distribution, are novel without pre-clearing the disclosure to be contained in the Prospectus Supplement, pertaining to

the distribution of such Securities, with the applicable regulator.

The

Company's and BFI's head and registered offices are at Suite 300, Brookfield Place, 181 Bay Street, P.O. Box 762, Toronto, Ontario, M5J 2T3. The US LLC's

head and registered office is at Brookfield Place, 250 Vesey Street, 15th Floor, New York, New York, United States 10281-1023.

The

Issuers may sell the Securities to or through underwriters or dealers or directly to investors or through agents. The Prospectus Supplement relating to each series of offered Securities will

identify each person who may be deemed to be an underwriter with respect to such series and will set forth the terms of the offering of such series, including, to the extent applicable, the initial

public offering price, the proceeds to the applicable Issuer, the underwriting commissions and any other concessions to be allowed or reallowed to dealers. The managing underwriter or underwriters

with respect to each series sold to or through underwriters will be named in the related Prospectus Supplement.

In

connection with any underwritten offering of Securities, the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at a

level above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. See "Plan of Distribution".

The

outstanding Class A Preference Shares, Series 2, Series 4, Series 8, Series 9, Series 13, Series 17, Series 18, Series 24,

Series 25, Series 26, Series 28, Series 30, Series 32, Series 34, Series 36, Series 37, Series 38, Series 40, Series 42,

Series 44 and Series 46 are listed on the Toronto Stock Exchange. The outstanding Class A Shares are listed for trading on the New York, Toronto and NYSE Euronext stock

exchanges.

US LLC,

certain directors of the Company and certain managers of US LLC (collectively, the "

Non-Residents

") are incorporated, continued or

otherwise organized under the laws of a non-Canadian jurisdiction or reside outside of Canada. Although each of the Non-Residents has appointed the Company, Suite 300, Brookfield Place,

181 Bay Street,

Toronto, Ontario, Canada, M5J 2T3, as its agent for service of process in Ontario, it may not be possible for investors to enforce judgments obtained in Canada against any person or company

that is incorporated, continued or otherwise organized under the laws of a non-Canadian jurisdiction or resides outside of Canada, even if the Non-Resident has appointed an agent for service of

process. See "Agent for Service of Process".

There is no market through which the Debt Securities or the Preference Shares may be sold and purchasers may not be able to resell Debt Securities or Preference Shares purchased

under this Prospectus. This may affect the pricing of the Debt Securities or the Preference Shares in the secondary market, the transparency and availability of trading prices, the liquidity of the

Debt Securities or the Preference Shares, and the extent of issuer regulation. See "Risk Factors".

Table of Contents

TABLE OF CONTENTS

In

this Prospectus, unless the context otherwise indicates, references to the "

Company

" refer to Brookfield Asset Management Inc.

and references to "

we

", "

us

", "

our

" and

"

Brookfield

" refer to the Company and its direct and indirect subsidiaries including BFI and US LLC. All dollar amounts set forth in this

Prospectus and any Prospectus Supplement are in U.S. dollars, except where otherwise indicated.

This short form base shelf prospectus has been filed under legislation in each of the provinces of Canada that permits certain information about these securities

to be determined after this prospectus has become final and that permits the omission from this prospectus of that information. The legislation requires the delivery to purchasers of a prospectus

supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form base shelf prospectus

constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated

by reference in this prospectus from documents filed with securities commissions or similar authorities in Canada.

Copies of the documents incorporated herein by reference may be obtained on request without charge from

the office of the Corporate Secretary of the Company at

Suite 300, Brookfield Place, 181 Bay Street, Toronto, Ontario, Canada, M5J 2T3, Telephone: (416) 363-9491, and are also available electronically at the Canadian Securities

Administrators' Website at

www.sedar.com

.

i

Table of Contents

DOCUMENTS INCORPORATED BY REFERENCE

The following documents, filed with the securities regulatory authorities in each of the provinces and territories of Canada, and filed

with, or furnished to, the Commission, are specifically incorporated by reference in this Prospectus:

-

(a)

-

the

Company's annual information form for the financial year ended December 31, 2015, dated March 30, 2016

(the "

AIF

");

-

(b)

-

the

Company's audited comparative consolidated financial statements and the notes thereto for the fiscal years ended December 31, 2015 and 2014,

together with the accompanying auditor's report thereon;

-

(c)

-

the

management's discussion and analysis for the audited comparative consolidated financial statements referred to in paragraph (b) above

(the "

MD&A

");

-

(d)

-

the

Company's unaudited comparative interim consolidated financial statements for the three and nine months ended September 30, 2016 and 2015;

-

(e)

-

the

management's discussion and analysis for the unaudited comparative interim consolidated financial statements referred to in

paragraph (d) above;

-

(f)

-

the

Company's management information circular dated May 2, 2016;

-

(g)

-

the

Company's press release dated February 9, 2017 in respect of the Company's unaudited financial results for the fourth quarter and year ended

December 31, 2016; and

-

(h)

-

the

Company's unaudited comparative interim consolidated financial statements for the three and nine months ended September 30, 2016 and 2015, as

supplemented on February 10, 2017 (adding note 12 to the notes thereto).

The

Company has supplemented the financial statements referred to in paragraph (h) above to include an additional note to the financial statements providing information regarding

US LLC, its debt securities and the guarantee by the Company in accordance with Rule 3-10(b) of Regulation S-X promulgated by the Commission.

Any

documents of the Company, and if applicable, BFI and US LLC, of the type described in item 11.1 of

Form 44-101F1 —

Short Form Prospectus

, and any "template version" of "marketing materials" (each as defined

in National Instrument 41-101 —

Distribution Requirements

("

NI 41-101

")), that are required to be filed by the Company, and if applicable, BFI and US LLC, with the securities regulatory

authorities in Canada, after the date of this Prospectus and prior to the termination of the offering shall be deemed to be incorporated by reference into this Prospectus. In addition, any report on

Form 6-K or Form 40-F filed by the Company with the Commission after the date of this Prospectus shall be deemed to be incorporated by reference into this Prospectus if and to the extent

expressly provided in such report. The Company's reports on Form 6-K and its annual report on Form 40-F are available at the Commission's website

at

www.sec.gov

.

Any statement contained in this Prospectus or in a document incorporated or deemed to be incorporated by reference in this Prospectus shall be deemed to be

modified or superseded for the purposes of this Prospectus to the extent that a statement contained in this Prospectus or in any other subsequently filed document that also is or is deemed to be

incorporated by reference in this Prospectus modifies or supersedes that statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or

includes any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the

modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is

necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to

constitute a part of this Prospectus.

Upon

a new annual information form and new interim or annual financial statements being filed with and, where required, accepted by the applicable securities regulatory authorities

during the currency of this Prospectus, the previous annual information form, the previous interim or annual financial statements and all

ii

Table of Contents

material

change reports filed prior to the commencement of the then current fiscal year will be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and

sales of Securities hereunder. Upon a new management information circular in connection with an annual meeting being filed with the applicable securities regulatory authorities during the currency of

this Prospectus, the management information circular filed in connection with the previous annual meeting (unless such management information circular also related to a special meeting) will be deemed

no longer to be incorporated by reference in this Prospectus for purposes of future offers and sales of Securities hereunder.

A

Prospectus Supplement containing the specific terms of an offering of Securities will be delivered to purchasers of such Securities together with this Prospectus and will be deemed to

be incorporated into this Prospectus as of the date of such Prospectus Supplement but only for purposes of the offering of Securities covered by that Prospectus Supplement.

Prospective

investors should rely only on the information incorporated by reference or contained in this Prospectus or any Prospectus Supplement and on the other information included in

the Registration Statement on Forms F-10 and F-3 relating to the Securities and of which this Prospectus is a part. The Company has not authorized anyone to provide different or

additional information.

Copies

of the documents incorporated herein by reference may be obtained on request without charge from the office of the Corporate Secretary of the Company at Suite 300,

Brookfield Place, 181 Bay Street, Toronto, Ontario, Canada, M5J 2T3 telephone: (416) 363-9491, and are also available electronically on System for Electronic Document Analysis and

Retrieval ("

SEDAR

") at

www.sedar.com

.

AVAILABLE INFORMATION

The Issuers have filed with the Commission under the Securities Act of 1933, as amended (the "

Securities

Act

"), a Registration Statement on Forms F-10 and F-3 relating to the Securities and of which this Prospectus is a part. This Prospectus does not contain all of

the information set forth in such Registration Statement, to which reference is made for further information.

The

Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the "

Exchange Act

"),

and, in accordance therewith, files reports and other information with the Commission. Under a multijurisdictional disclosure system adopted by the United States and Canada, such reports and

other information may be prepared in accordance with the disclosure requirements of Canada, which requirements are different from those of the United States. Such reports and other information

concerning the Company can be inspected and copied at the public reference facilities maintained by the Commission at: 100 F Street, N.E., Washington, D.C. 20549. Copies of these

materials can be obtained from the Public Reference Section of the Commission at 100 F Street, N.E., Washington, D.C. 20549, at prescribed

rates. Please call the Commission at l-800-SEC-0330 for further information on the public reference room. Certain of the Company's filings are also electronically available from the

Commission's Electronic Document Gathering and Retrieval System, which is commonly known by the acronym EDGAR, and which may be accessed at

www.sec.gov

, as well as from

commercial document retrieval services.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This Prospectus and the documents incorporated by reference herein contain forward-looking information and other "forward-looking

statements" within the meaning of Canadian and United States securities laws, including the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include

statements that are predictive in nature, depend upon or refer to future events or conditions, include statements regarding the operations, business, financial condition, expected financial results,

performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook of the Company and its subsidiaries, as well as the outlook for North American and

international economies for the current fiscal year and subsequent periods.

The

words "expects," "anticipates," "plans," "believes," "estimates," "seeks," "intends," "targets," "projects," "forecasts" or negative versions thereof and other similar expressions,

or future or conditional verbs such as "may," "will," "should," "would" and "could", which are predictions of or indicate future events, trends

iii

Table of Contents

or

prospects, and which do not relate to historical matters identify forward-looking statements. Although we believe that the anticipated future results, performance or achievements expressed or

implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and

information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause our actual results, performance or achievements to

differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.

Factors

that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to: the impact or unanticipated

impact of general economic, political and market factors in the countries in which we do business; the behaviour of financial markets, including fluctuations in interest and foreign exchange rates;

global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; strategic actions including dispositions; the ability to complete and

effectively integrate acquisitions into existing operations and the ability to attain expected benefits; changes in accounting policies and methods used to report financial condition (including

uncertainties associated with critical accounting assumptions and estimates); the ability to appropriately manage human capital; the effect of applying future accounting changes; business competition;

operational and reputational risks; technological change; changes in government regulation and legislation within the countries in which we operate; governmental investigations; litigation; changes in

tax

laws; ability to collect amounts owed; catastrophic events, such as earthquakes and hurricanes; the possible impact of international conflicts and other developments including terrorist acts and

cyberterrorism; and other risks and factors detailed in this Prospectus under the heading "Risk Factors" as well as in the AIF under the heading "Business Environment and Risks" and the MD&A under the

heading "Business Environment and Risks", each incorporated by reference in this Prospectus, as well as in other documents filed by the Issuers from time to time with the securities regulators in

Canada and the United States.

We

caution that the foregoing list of important factors that may affect future results is not exhaustive. Nonetheless, all of the forward-looking statements contained in this Prospectus

or in documents incorporated by reference herein are qualified by these cautionary statements. When relying on our forward-looking statements, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events. Except as required by law, the Issuers undertake no obligation to publicly update or revise any forward-looking statements or

information, whether written or oral, that may need to be updated as a result of new information, future events or otherwise.

iv

Table of Contents

SUMMARY

The Company

The Company is a global alternative asset manager with approximately US$250 billion in assets under management. Brookfield has

more than a 100-year history of owning and operating assets with a focus on property, renewable power, infrastructure and private equity. Brookfield offers a range of public and private investment

products and services. The Company's Class A Shares are co-listed on the New York Stock Exchange, the TSX and the NYSE Euronext under the symbols "BAM", "BAM.A" and "BAMA", respectively.

Brookfield Finance Inc.

BFI was incorporated on March 31, 2015 under the

Business Corporations Act

(Ontario) and is an indirect 100% owned subsidiary of the Company. BFI issued US$500 million aggregate principal amount of BFI Debt Securities in June 2016

(the "

Existing Debt Securities

"), which Existing Debt Securities are fully and unconditionally guaranteed by the Company. BFI has no significant

assets or liabilities, no subsidiaries and no ongoing business operations of its own, other than the Existing Debt Securities, the issuance of BFI Debt Securities and the investments it makes

with the net proceeds of such BFI Debt Securities.

Brookfield Finance LLC

US LLC was formed on February 6, 2017 under the

Delaware Limited Liability Company

Act

and is an indirect 100% owned subsidiary of the Company. US LLC has no significant assets or liabilities, no subsidiaries and no ongoing business operations of its

own, other than the issuance of US LLC Debt Securities and the investments it makes with the net proceeds of such US LLC Debt Securities.

The Offering

The Securities described herein may be offered from time to time in one or more offerings utilizing a "shelf" process under Canadian

and U.S. securities laws. Under this shelf process, this Prospectus provides you with a general description of the Securities that we may offer. Each time we sell Securities, we will provide a

Prospectus Supplement that will contain specific information about the terms of that offering. The Prospectus Supplement may also add, update or change information contained in this Prospectus. You

should read both this Prospectus and any Prospectus Supplement together with additional information described under the heading "Available Information."

1

Table of Contents

RISK FACTORS

An investment in the Securities is subject to a number of risks. Before deciding whether to invest in the Securities, investors should

consider carefully the risks described below, the risk factors set forth in the relevant Prospectus Supplement and the information incorporated by reference in this Prospectus. Specific reference is

made to the sections entitled "Business Environment and Risks" in the MD&A, which is incorporated by reference in this Prospectus.

No Existing Trading Market

There is currently no market through which the Debt Securities or the Preference Shares may be sold and purchasers of Debt Securities

or Preference Shares may not be able to resell such Debt Securities or Preference Shares purchased under this Prospectus. There can be no assurance that an active trading market will develop for the

Debt Securities or the Preference Shares after an offering or, if developed, that such market will be sustained. This may affect the pricing of the Debt Securities or the Preference Shares in the

secondary market, the transparency and availability of trading prices, the liquidity of the Debt Securities or the Preference Shares and the extent of issuer regulation.

The

public offering prices of the Securities may be determined by negotiation between the Issuers and underwriters based on several factors and may bear no relationship to the prices at

which the Securities will trade in the public market subsequent to such offering. See "Plan of Distribution".

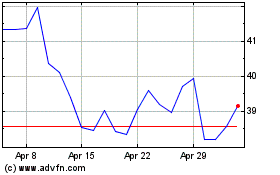

Stock Exchange Prices

The trading price of the Class A Shares in the open market is subject to volatility and cannot be predicted. Holders of

Class A Shares may not be able to resell their Class A Shares at or above the price at which they purchased their Class A Shares due to such trading price fluctuations. The

trading price could fluctuate significantly in response to factors both related and unrelated to Brookfield's operating performance and/or future prospects, including, but not limited to:

(i) variations in Brookfield's quarterly or annual operating results and financial condition; (ii) changes in government laws, rules or regulations affecting Brookfield's businesses;

(iii) material announcements by Brookfield's competitors; (iv) market conditions and events specific to the industries in which Brookfield operates; (v) changes in general

economic conditions; (vi) differences between Brookfield's actual financial and operating results and those expected by investors and analysts; (vii) changes in analysts' recommendations

or earnings projections; (viii) changes in the extent of analysts' interest in covering the Company and its publicly-traded affiliates; (ix) the depth and liquidity of the market for the

Class A Shares; (x) dilution from the issuance of additional equity; (xi) investor perception of Brookfield's businesses and industries; (xii) investment restrictions;

(xiii) Brookfield's dividend policy; (xiv) the departure of key executives; (xv) sales of Class A Shares by senior management or significant shareholders; and

(xvi) the materialization of other risks described in the MD&A.

Reliance on Subsidiaries

The Company conducts a significant amount of its operations through subsidiaries. Although the Debt Securities are senior obligations

of the Company (either directly or pursuant to its guarantee), they are effectively subordinated to all existing and future liabilities of the Company's consolidated subsidiaries and operating

companies. The Indentures (as defined herein) do not restrict the ability of the Company's subsidiaries to incur additional indebtedness. Because the Company conducts a

significant amount of its operations through subsidiaries, the Company's ability to pay the indebtedness and dividends owing by it under or in respect of the Securities is dependent on dividends and

other distributions it receives from subsidiaries and major investments. Certain of the instruments governing the indebtedness of the companies in which the Company has an investment may restrict the

ability of such companies to pay dividends or make other payments on investments under certain circumstances.

Foreign Currency Risks

In addition, Securities denominated or payable in foreign currencies may entail significant risks, and the extent and nature of such

risks change continuously. These risks include, without limitation, the possibility of

2

Table of Contents

significant

fluctuations in the foreign currency market, the imposition or modification of foreign exchange controls and potential illiquidity in the secondary market. These risks will vary depending

on the currency or currencies involved. Prospective purchasers should consult their own financial and legal advisors as to the risks entailed in an investment in Securities denominated in currencies

other than Canadian dollars. Such Securities are not an appropriate investment for investors who are unsophisticated with respect to foreign currency transactions.

Credit Ratings

There is no assurance that any credit rating, if any, assigned to Securities issued hereunder will remain in effect for any given

period of time or that any rating will not be lowered or withdrawn entirely by the relevant rating agency. A lowering or withdrawal of such rating may have an adverse effect on the market value of

the Securities.

Interest Rate Risks

Prevailing interest rates will affect the market price or value of the Debt Securities and the Preference Shares. The market price or

value of the Debt Securities and the Preference

Shares will decline as prevailing interest rates for comparable debt instruments rise, and increase as prevailing interest rates for comparable debt instruments decline.

Dilution

The Company may undertake additional offerings of Class A Shares and of securities convertible into Class A Shares in the

future. The increase in the number of Class A Shares issued and outstanding and the possibility of sales of such Class A Shares may depress the price of the Class A Shares. In

addition, as a result of the issuance such additional Class A Shares, the voting power of the Company's existing holders of Class A Shares will be diluted.

Ranking of the Debt Securities

The Debt Securities will not be secured by any assets of the Company, BFI or US LLC. Therefore, holders of secured indebtedness

of the Company, BFI or US LLC would have a claim on the assets securing such indebtedness that effectively ranks prior to the claim of holders of the Debt Securities and would have a claim that

ranks equal with the claim of holders of Debt Securities to the extent that such security did not satisfy the secured indebtedness. Furthermore, although covenants given by the Company in various

agreements may restrict incurring secured indebtedness, such indebtedness may, subject to certain conditions, be incurred.

BFI's and US LLC's Reliance on the Company

Neither BFI nor US LLC will have assets, property or operations other than the Debt Securities they issue and the investments

each of them makes with the net proceeds of such Debt Securities. Neither BFI nor US LLC will be restricted in their ability to make investments or incur debt. Therefore, the holders of the BFI

Debt Securities and US LLC Debt Securities are relying principally on the unconditional guarantee of the BFI Debt Securities and US LLC Debt Securities provided by the Company and the

financial position and creditworthiness of the Company in order to receive the repayment of the amounts owing under and in respect of the BFI Debt Securities and US LLC Debt Securities. The

financial position and creditworthiness of the Company is subject to the risks noted above.

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our ratio of earnings to fixed charges for the periods indicated. The ratio of earnings to fixed charges

was calculated by dividing earnings by fixed charges. Earnings were calculated by adding (a) earnings from continuing operations before income taxes, (b) fixed charges (as defined

below) and (c) dividend income of equity investees; and then subtracting (a) interest capitalized and (b) preferred stock dividend requirements of subsidiaries.

3

Table of Contents

Fixed

charges were calculated by adding (a) interest expensed and capitalized and (b) preferred stock dividend requirements of subsidiaries.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months

Ended

September 30,

2016

|

|

Year Ended December 31,

|

|

|

|

2015

|

|

2014

|

|

2013

|

|

2012

|

|

2011

|

|

|

|

1.7x

|

|

|

2.0x

|

|

|

2.9x

|

|

|

2.5x

|

|

|

1.8x

|

|

|

1.7x

|

|

USE OF PROCEEDS

Unless otherwise indicated in a Prospectus Supplement, the net proceeds from the sale of Securities will be used for general corporate

purposes.

DESCRIPTION OF CAPITAL STRUCTURE OF THE ISSUERS

The Company's authorized share capital consists of an unlimited number of preference shares designated as Class A Preference

Shares, issuable in series, an unlimited number of preference shares designated as Class AA Preference Shares, issuable in series, an unlimited number of Class A Shares,

and 85,120 Class B Limited Voting Shares ("

Class B Shares

"). As of the date of this Prospectus, the Company had

10,465,100 Class A Preference Shares, Series 2; 4,000,000 Class A Preference Shares, Series 4; 2,479,585 Class A Preference Shares,

Series 8; 5,519,115 Class A Preference Shares, Series 9; 9,647,700 Class A Preference Shares, Series 13; 7,966,604 Class A Preference

Shares, Series 17; 7,977,135 Class A Preference Shares, Series 18; 9,394,250 Class A Preference Shares, Series 24; 1,533,133 Class A

Preference

Shares, Series 25; 9,903,348 Class A Preference Shares, Series 26; 9,394,373 Class A Preference Shares, Series 28; 9,936,637 Class A

Preference Shares, Series 30; 11,982,568 Class A Preference Shares, Series 32; 9,977,889 Class A Preference Shares, Series 34;

7,963,892 Class A Preference Shares, Series 36; 7,963,057 Class A Preference Shares, Series 37; 8,000,000 Class A Preference Shares,

Series 38; 12,000,000 Class A Preference Shares, Series 40; 12,000,000 Class A Preference Shares, Series 42; 10,000,000 Class A

Preference Shares, Series 44; 12,000,000 Class A Preference Shares, Series 46; 986,367,192 Class A Shares; and 85,120 Class B Shares issued and

outstanding.

BFI

is authorized to issue an unlimited number of common shares. As of the date of this Prospectus, one common share of BFI held directly by Brookfield US Holdings Inc., an

indirect wholly-owned subsidiary of the Company, is issued and outstanding.

US LLC

is authorized to issue an unlimited number of common shares. As of the date of this Prospectus, one common share of US LLC held directly by Brookfield US

Corporation, an indirect wholly-owned subsidiary of the Company, is issued and outstanding.

DESCRIPTION OF THE PREFERENCE SHARES

The following description sets forth certain general terms and provisions of the Preference Shares. The particular terms and provisions

of a series of Preference Shares offered by a Prospectus Supplement, and the extent to which the general terms and provisions described below may apply thereto, will be described in such Prospectus

Supplement.

Series

The Preference Shares may be issued from time to time in one or more series. The board of directors of the Company will fix the number

of shares in each series and the provisions attached to each series before issue.

Priority

The Preference Shares rank senior to the Class AA Preference Shares, the Class A Shares, the Class B Shares and

other shares ranking junior to the Preference Shares with respect to priority in the payment of dividends and in the distribution of assets in the event of the liquidation,

dissolution or winding-up of the Company, whether voluntary or involuntary, or in the event of any other distribution of assets of the Company

4

Table of Contents

among

its shareholders for the purpose of winding-up its affairs. Each series of Preference Shares ranks on a parity with every other series of Preference Shares with respect to priority in the

payment of dividends and in the distribution of assets in the event of the liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, or in the event of any other

distribution of assets of the Company among its shareholders for the purpose of winding-up its affairs.

Shareholder Approvals

The Company shall not delete or vary any preference, right, condition, restriction, limitation or prohibition attaching to the

Preference Shares as a class or create preference shares ranking in priority to or on parity with the Preference Shares except by special resolution passed by at least 66

2

/

3

% of the

votes cast at a meeting of the holders of the Preference Shares duly called for that purpose, in accordance with the provisions of the articles of the Company. Each holder of Preference Shares

entitled to vote at a class meeting of holders of Preference Shares, or at a joint meeting of the holders of two or more series of Preference Shares, has one vote in respect of each C$25.00 of the

issue price of each Preference Share held by such holder.

DESCRIPTION OF THE CLASS A SHARES

The following description sets forth certain general terms and provisions of the Class A Shares. The particular terms and

provisions of Class A Shares offered by a Prospectus Supplement, and the extent to which the general terms and provisions described below may apply thereto, will be described in such Prospectus

Supplement.

Dividend Rights and Rights Upon Dissolution or Winding-Up

The Class A Shares rank on parity with the Class B Shares and rank after the Class A Preference Shares, the

Class AA Preference Shares and any other senior-ranking shares outstanding

from time to time with respect to the payment of dividends (if, as and when declared by the board of directors of the Company) and return of capital on the liquidation, dissolution or winding-up of

the Company or any other distribution of the assets of the Company among its shareholders for the purpose of winding up its affairs.

Voting Rights

Except as set out below under "Election of Directors", each holder of a Class A Share and Class B Shares is entitled to

notice of, and to attend and vote at, all meetings of the Company's shareholders (except meetings at which only holders of another specified class or series of shares are entitled to vote) and is

entitled to cast one vote per share held, which results in the Class A Shares and Class B Shares each controlling 50% of the aggregate voting rights of the Company. Subject to applicable

law and in addition to any other required shareholder approvals, all matters approved by shareholders (other than the election of directors), must be approved by: (i) a majority or, in the case

of matters that require approval by a special resolution of shareholders, at least 66

2

/

3

%, of the votes cast by holders of Class A Shares who vote in respect of the resolution or

special resolution, as the case may be, and (ii) a majority or, in the case of matters that require approval by a special resolution of shareholders, at least 66

2

/

3

%, of the

votes cast by holders of Class B Shares who vote in respect of the resolution or special resolution, as the case may be.

Election of Directors

In the election of directors, holders of Class A Shares, together, in certain circumstances, with the holders of certain series

of Class A Preference Shares, are entitled to elect one-half of the board of directors of the Company, provided that if the holders of Class A Preference Shares, Series 1,

Series 2 or Series 3 become entitled to elect two or three directors, as the case may be, the numbers of directors to be elected by holders of Class A Shares, together, in certain

circumstances with the holders of Class A Preference Shares, shall be reduced by the number of directors to be elected by holders of Class A Preference Shares, Series 1,

Series 2 and Series 3. Holders of Class B Shares are entitled to elect the other one-half of the board of directors of the Company.

5

Table of Contents

Each

holder of Class A Shares has the right to cast a number of votes equal to the number of Class A Shares held by the holder multiplied by the number of directors to be

elected by the holder and the holders of shares of the classes or series of shares entitled to vote with the holder of Class A Shares in the election of directors. A holder of Class A

Shares may cast all such votes in favour of one candidate or distribute such votes among its candidates in any manner the holder of Class A Shares sees fit. Where a holder of Class A

Shares has voted for more than one candidate without specifying the distribution of votes among such

candidates, the holder of Class A Shares will be deemed to have divided the holder's votes equally among the candidates for whom the holder of Class A Shares voted.

DESCRIPTION OF DEBT SECURITIES

The following description sets forth certain general terms and provisions of the Debt Securities. The particular terms and provisions

of the series of Debt Securities offered by a Prospectus Supplement, and the extent to which the general terms and provisions described below may apply thereto, will be described in such Prospectus

Supplement.

The

BAM Debt Securities will be issued under an indenture dated as of September 20, 1995, as amended, restated, supplemented or replaced from time to time,

(the "

BAM Indenture

") between the Company, as issuer, and Computershare Trust Company of Canada (formerly, Montreal Trust Company of Canada)

("

Computershare

"), as trustee (the "

BAM Trustee

"). The BFI Debt Securities will be issued under

an indenture dated as of June 2, 2016, as amended, restated, supplemented or replaced from time to time, (the "

BFI Indenture

") between

BFI, as issuer, the Company, as guarantor, and Computershare, as trustee (the "

BFI Trustee

"). The US LLC Debt Securities will be issued

under an indenture (the "

US LLC Indenture

" and together with the BAM Indenture and the BFI Indenture, the

"

Indentures

" and each an "

Indenture

") to be entered into between US LLC, as issuer, the Company,

as guarantor, Computershare Trust Company, N.A., as U.S. trustee and Computershare, as Canadian trustee (together, the "

US LLC Trustees

").

The BAM Indenture and the BFI Indenture are subject to the provisions of the

Business Corporations Act

(Ontario) and, consequently, are exempt from the

operation of certain provisions of the

Trust Indenture Act of 1939

pursuant to Rule 4d-9 thereunder. The US LLC Indenture is subject to

the

Trust Indenture Act of 1939

. Copies of the BAM Indenture and the BFI Indenture and a copy of the form of the US LLC Indenture have been filed

with the Commission as an exhibit to the Registration Statement on Forms F-10 and F-3 of which this Prospectus is a part. The BAM Indenture is also available on the Company's SEDAR

profile at

www.sedar.com

and the BFI Indenture is available on BFI's SEDAR profile at

www.sedar.com.

The

following statements with respect to the Indentures and the Debt Securities issued thereunder are brief summaries of certain provisions of the Indentures and do not purport to be

complete; such statements are subject to the detailed referenced provisions of the applicable Indenture, including the definition of capitalized terms used under this caption. Wherever a particular

section or defined term of an Indenture is referred to, the statement is qualified in its entirety by such section or term. References to the "

Issuer

"

and "

Indenture Securities

" refer to the Company, BFI or US LLC, as issuer, and the Debt Securities issued by it under the BAM Indenture, the BFI

Indenture or the US LLC Indenture, respectively. References to the "

Trustee

" or "

Trustees

" and

any particular Indenture or Debt Securities refer to the BAM Trustee, the BFI Trustee or the US LLC Trustees, as trustee or trustees under the applicable Indenture.

General

The Indentures do not limit the aggregate principal amount of Indenture Securities (which may include debentures, notes and other

unsecured evidences of indebtedness) which may be issued thereunder, and Indenture Securities may be issued under each Indenture from time to time in one or more series and may be denominated and

payable in foreign currencies or units based on or relating to foreign currencies, including European currency units. Special Canadian and United States federal income tax considerations

applicable to any Indenture Securities so denominated will be described in the Prospectus Supplement relating thereto. Unless otherwise indicated in the applicable Prospectus Supplement, each

Indenture permits the Company, BFI or US LLC, as applicable, to increase the principal amount of any series of Indenture Securities previously issued by it and to issue such increased principal

amount. (Section 301 of the BAM Indenture, Section 3.1 of the BFI Indenture and Section 3.1 of the US LLC Indenture). In the case of additional Debt Securities of a series

6

Table of Contents

under

the US LLC Indenture, issued after the date of original issuance of Debt Securities of such series, if they are not fungible with the original Debt Securities of such series for

U.S. federal income tax purposes, then such additional Debt Securities will be issued with a separate CUSIP or ISIN number so that they are distinguishable from the original Debt Securities of

such series.

All

Debt Securities issued by BFI and US LLC will be fully and unconditionally guaranteed by the Company.

The

applicable Prospectus Supplement will set forth the following terms relating to the particular offered Debt Securities: (1) the specific designation of the offered Debt

Securities and the Indenture under which they are issued; (2) any limit on the aggregate principal amount of the offered Debt Securities; (3) the date or dates, if any, on which the

offered Debt Securities will mature and the portion (if less than all of the principal amount) of the offered Debt Securities to be payable upon declaration of acceleration of maturity;

(4) the rate or rates per annum (which may be fixed or variable) at which the offered Debt Securities will bear interest, if any, the date or dates from which any such interest will accrue and

on which any such interest will be payable and the Regular Record Dates for any interest payable on the offered Debt Securities which are in registered form ("

Registered Debt

Securities

"); (5) any mandatory or optional redemption or sinking fund provisions, including the period or periods within which the price or prices at which and the

terms and conditions upon which the offered Debt Securities may be redeemed or purchased at the option of the Issuer or otherwise; (6) whether the offered Debt Securities will be issuable in

registered form or bearer form or both and, if issuable in bearer form, the restrictions as to the offer, sale and delivery of the offered Debt Securities in bearer form and as to exchanges between

registered and bearer form; (7) whether the offered Debt Securities will be issuable in the form of one or more registered global securities ("

Registered Global

Securities

") and, if so, the identity of the Depositary for such Registered Global Securities; (8) the denominations in which any of the offered Debt Securities will be

issuable if in other than denominations of $1,000 and any multiple thereof; (9) each office or agency where the principal of, and any premium and interest on, the offered Debt Securities will

be payable and each office or agency where the offered Debt Securities may be presented for registration of transfer or exchange; (10) if other

than U.S. dollars, the foreign currency or the units based on or relating to foreign currencies in which the offered Debt Securities are denominated and/or in which the payment of the principal

of, and any premium and interest on, the offered Debt Securities will or may be payable; and (11) any other terms of the offered Debt Securities, including covenants and additional Events of

Default. Special Canadian and United States federal income tax considerations applicable to the offered Debt Securities, the amount of principal thereof and any premium and interest thereon

will be described in the Prospectus Supplement relating thereto. Unless otherwise indicated in the applicable Prospectus Supplement, no Indenture affords the Holders the right to tender Indenture

Securities to the Issuer for repurchase, or provides for any increase in the rate or rates of interest per annum at which the Indenture Securities will bear interest, in the event the Company, BFI or

US LLC should become involved in a highly leveraged transaction or in the event of a change in control of the Company, BFI or US LLC. (Section 301 of the BAM Indenture,

Section 3.1 of the BFI Indenture and Section 3.1 of the US LLC Indenture)

Indenture

Securities may be issued bearing no interest or interest at a rate below the prevailing market rate at the time of issuance, to be offered and sold at a discount below their

stated principal amount. The Canadian and United States federal income tax consequences and other special considerations applicable to any such discounted Indenture Securities or other

Indenture Securities offered and sold at par which are treated as having been issued at a discount for Canadian and/or United States federal income tax purposes will be described in the

Prospectus Supplement relating thereto. (Section 301 of the BAM Indenture, Section 3.1 of the BFI Indenture and Section 3.1 of the US LLC Indenture)

The

Indenture Securities issued pursuant to any Indenture and any coupons appertaining thereto will be unsecured and will rank

pari passu

with each other and with all other unsecured and unsubordinated

indebtedness for borrowed money of the Issuer and the Company.

(Section 301 of the BAM Indenture, Section 3.1 of the BFI Indenture and Section 3.1 of the US LLC Indenture)

The

Company's guarantee of the Indenture Securities issued by BFI and US LLC will be unsecured and will rank

pari passu

with

all other unsecured and unsubordinated indebtedness of the Company, including the Company's obligations under the Indenture Securities issued under the BAM Indenture.

7

Table of Contents

Form, Denomination, Exchange and Transfer

Unless otherwise indicated in the applicable Prospectus Supplement, Indenture Securities will be issued only in fully registered form

without coupons and in denominations of $1,000 or any integral multiple thereof. (Section 302 of the BAM Indenture, Section 3.2 of the BFI Indenture and Section 3.2 of the

US LLC Indenture) Indenture Securities may be presented for exchange and Registered Debt Securities may be presented for registration of transfer in the manner, at the places and, subject to

the restrictions set forth in the applicable Indenture and in the applicable Prospectus Supplement, without service charge, but upon payment of any taxes or the governmental charges due in connection

therewith. The Company has appointed the BAM Trustee as Security Registrar under the BAM Indenture, BFI has appointed the BFI Trustee as Security Registrar under the BFI Indenture and either

US LLC Trustee shall act as Security Registrar under the US LLC Indenture. (Section 305 of the BAM Indenture, Section 3.5 of the BFI Indenture and Section 3.5 of the

US LLC Indenture)

Payment

Unless otherwise indicated in the applicable Prospectus Supplement, payment of the principal of, and any premium and interest on,

Registered Debt Securities (other than a Registered Global Security) will be made at the office or agency of the applicable Trustee, in its capacity as paying agent, in Toronto, Canada (in the

case of the BAM Indenture) or New York, New York (in the case of the BFI Indenture and the US LLC Indenture), except that, at the option of the particular Issuer, payment

of any interest may be made (i) by check mailed to the address of the Person entitled thereto at such address as shall appear in the applicable Security Register or (ii) by wire transfer

to an account maintained by the Person entitled thereto as specified in the applicable Security Register. (Sections 305, 307 and 1002 of the BAM Indenture, Sections 3.5, 3.7

and 11.2 of the BFI Indenture and Sections 3.5, 3.7 and 11.2 of the US LLC Indenture) Unless otherwise indicated in the applicable Prospectus Supplement, payment of any

interest due on Registered Debt Securities will be made to the Persons in whose name such Registered Debt Securities are registered at the close of business on the Regular Record Date for such

interest payment. (Section 307 of the BAM Indenture, Section 3.7 of the BFI Indenture and Section 3.7 of the US LLC Indenture)

Registered Global Securities

The Registered Debt Securities of a particular series may be issued in the form of one or more Registered Global Securities which will

be registered in the name of, and deposited with, one or more Depositories or nominees, each of which will be identified in the Prospectus Supplement relating to such series. Unless and until

exchanged, in whole or in part, for Indenture Securities in definitive registered form, a Registered Global Security may not be transferred except as a whole by the Depositary for such Registered

Global Security to a nominee of such Depositary, by a nominee of such Depositary to such Depositary or another nominee of such Depositary or by such Depositary or any such nominee to a successor of

such Depositary or a nominee of such successor. (Section 305 of the BAM Indenture, Section 3.5 of the BFI Indenture and Section 3.5 of the US LLC Indenture)

The

specific terms of the depositary arrangement with respect to any portion of a particular series of Indenture Securities to be represented by a Registered Global Security will be

described in the Prospectus Supplement relating to such series. We anticipate that the following provisions will apply to all depositary arrangements.

Upon

the issuance of a Registered Global Security, the Depositary therefor or its nominee will credit, on its book entry and registration system, the respective principal amounts of the

Indenture Securities represented by such Registered Global Security to the accounts of such persons having accounts with such Depositary or its nominee

("

participants

") as shall be designated by the underwriters, investment dealers or agents participating in the distribution of such Indenture Securities

or by the particular Issuer if such Indenture Securities are offered and sold directly by the Issuer. Ownership of beneficial interests in a Registered Global Security will be limited to participants

or persons that may hold beneficial interests through participants. Ownership of beneficial interests in a Registered Global Security will be shown on, and the transfer of such ownership will be

effected only through, records maintained by the Depositary therefor or its

nominee (with respect to beneficial interests of participants) or by participants or persons that hold through participants (with respect to interests of

8

Table of Contents

persons

other than participants). The laws of some states in the United States require certain purchasers of securities to take physical delivery thereof in definitive form. Such depositary

arrangements and such laws may impair the ability to transfer beneficial interests in a Registered Global Security.

So

long as the Depositary for a Registered Global Security or its nominee is the registered owner thereof, such Depositary or such nominee, as the case may be, will be considered the

sole owner or Holder of the Indenture Securities represented by such Registered Global Security for all purposes under the applicable Indenture. Except as provided below, owners of beneficial

interests in a Registered Global Security will not be entitled to have Indenture Securities of the series represented by such Registered Global Security registered in their names, will not receive or

be entitled to receive physical delivery of Indenture Securities of such series in definitive form and will not be considered the owners or Holders thereof under the applicable Indenture.

Principal,

premium, if any, and interest payments on a Registered Global Security registered in the name of a Depositary or its nominee will be made to such Depositary or nominee, as the

case may be, as the registered owner of such Registered Global Security. None of the particular Issuer or Trustee or any paying agent for Indenture Securities of the series represented by such

Registered Global Security will have any responsibility or liability for any aspect of the records relating to, or payments made on account of, beneficial interests in such Registered Global Security

or for maintaining, supervising or reviewing any records relating to such beneficial interests.

We

expect that the Depositary for a Registered Global Security or its nominee, upon receipt of any payment of principal, premium or interest, will immediately credit participants'

accounts with payments in amounts proportionate to their respective beneficial interests in the principal amount of such Registered Global Security as shown on the records of such Depositary or its

nominee. We also expect that payments by participants to owners of beneficial interests in a Registered Global Security held through such participants will be governed by standing instructions and

customary practices, as is now the case with securities held for the accounts of customers registered in "street name", and will be the responsibility of such participants.

No

Registered Global Security may be exchanged in whole or in part for Securities registered, and no transfer of a Registered Global Security in whole or in part may be registered, in

the name of any Person other than the Depositary for such Registered Global Security or a nominee thereof unless (A) such Depositary (i) has notified the particular Issuer that it is

unwilling or unable to continue as Depositary for such Registered Global Security or (ii) has ceased to be a clearing agency registered under the Exchange Act, and a successor securities

Depositary is not obtained, (B) there shall have occurred and be continuing an Event of Default with respect to such Registered Global Security, (C) the particular Issuer determines, in

its sole discretion, that the Securities of such series shall no longer be represented by such Registered Global Security and executes and delivers to the applicable Trustee(s) an Issuer order that

such Registered Global

Security shall be so exchangeable and the transfer thereof so registerable or (D) there shall exist such circumstances, if any, in addition to or in lieu of the foregoing as have been specified

for this purpose as contemplated in the applicable Indenture. (Section 305 of the BAM Indenture, Section 3.5.2 of the BFI Indenture and Section 3.5.2 of the

US LLC Indenture)

Consolidation, Merger, Amalgamation and Sale of Assets

The Company shall not enter into any transaction (whether by way of reorganization, reconstruction, consolidation, amalgamation,

merger, transfer, sale or otherwise) whereby all or substantially all of its undertaking, property and assets would become the property of any other Person

(the "

Successor Corporation

") unless: (a) the Company and the Successor Corporation shall execute, prior to or contemporaneously with the

consummation of such transaction, such instruments and do such things as, in the opinion of counsel, shall be necessary or advisable to establish that, upon the consummation of such transaction,

(i) the Successor Corporation will have assumed all the covenants and obligations of the Company under each Indenture in respect of the Indenture Securities of every series issued thereunder,

and (ii) the obligations of the Company under and in respect of the Indenture Securities of every series issued under each Indenture will be valid and binding obligations of the Successor

Corporation entitling the Holders thereof, as against the Successor Corporation, to all the rights of Holders of Indenture Securities thereunder; and (b) such transaction shall be on such terms

and shall be carried out at such times and otherwise in such manner as shall not be prejudicial to the interests of the Holders of the Indenture Securities of each and every series or to the rights

and powers of the

9

Table of Contents

Trustees

under the Indentures. (Section 801 of the BAM Indenture, Section 9.1 of the BFI Indenture and Section 9.1 of the US LLC Indenture)

Pursuant

to the BFI Indenture, BFI shall not enter into any transaction (whether by way of reorganization, reconstruction, consolidation, amalgamation, merger, transfer, sale or

otherwise) whereby all or substantially all of its undertaking, property and assets would become the property of any other Person (the "

BFI

Successor

") unless: (a) BFI, the BFI Successor and the Company shall execute, prior to or contemporaneously with the consummation of such transaction, such instruments

and do such things as, in the opinion of counsel, shall be necessary or advisable to establish that, upon the consummation of such transaction, (i) the BFI Successor will have assumed all the

covenants and obligations of BFI under the BFI Indenture in respect of the Indenture Securities of every series issued thereunder, (ii) the Indenture Securities of every series issued by BFI

will be valid and binding obligations of the BFI Successor, entitling the Holders thereof, as against the BFI Successor, to all the rights of Holders of Indenture Securities under the BFI Indenture,

and (iii) the guarantee obligations of the Company in respect of the Indenture Securities of every series issued under the BFI Indenture continue in full force and effect; and (b) such

transaction shall be on such terms and shall be carried out at such times and otherwise in such manner as shall not be prejudicial to the interests of the Holders of the Indenture Securities issued by

BFI of each and every series or to the rights and powers of the BFI Trustee under the BFI Indenture; provided, however, that such

restrictions are not applicable to any sale or transfer by BFI or the Company to any one or more of their subsidiaries. (Section 9.1 of the BFI Indenture)

Pursuant

to the US LLC Indenture, US LLC shall not enter into any transaction (whether by way of reorganization, reconstruction, consolidation, amalgamation, merger,

transfer, sale or otherwise) whereby all or substantially all of its undertaking, property and assets would become the property of any other Person (the "

US LLC

Successor

") unless: (a) US LLC, the US LLC Successor and the Company shall execute, prior to or contemporaneously with the consummation of such

transaction, such instruments and do such things as, in the opinion of counsel, shall be necessary or advisable to establish that, upon the consummation of such transaction, (i) the

US LLC Successor will have assumed all the covenants and obligations of US LLC under the US LLC Indenture in respect of the Indenture Securities of every series issued thereunder,

(ii) the Indenture Securities of every series issued by US LLC will be valid and binding obligations of the US LLC Successor, entitling the Holders thereof, as against the

US LLC Successor, to all the rights of Holders of Indenture Securities under the US LLC Indenture, and (iii) the guarantee obligations of the Company in respect of the Indenture

Securities of every series issued under the US LLC Indenture continue in full force and effect; and (b) such transaction shall be on such terms and shall be carried out at such times and