Filed Pursuant to Rule 424(b)(2)

File No. 333-202840

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing

supplement and the accompanying prospectus supplement and prospectus are not an offer to sell these notes and we are not soliciting an offer to buy these notes in any jurisdiction where the offer or sale is not permitted.

|

|

|

|

|

Subject To Completion, dated February 16, 2017

PRICING SUPPLEMENT No. 4 dated February , 2017

(To Prospectus Supplement dated January 30, 2017

and Prospectus dated March 18, 2015)

|

|

|

Wells Fargo & Company

Medium–Term Notes, Series P

$

Capped Fixed to Floating Rate Notes

Notes Linked to the Consumer Price Index due February 24, 2027

The notes have a term of 10 years. The notes pay interest monthly at a rate that will be fixed at 3.00% per annum for the first two years

and thereafter at a floating rate that will be reset each month and will be equal to the lagging year-over-year percentage change in the Consumer Price Index plus 1.00%, subject to the maximum interest rate and minimum interest rate, as set forth

below. Because the Consumer Price Index is one measure of price inflation in the United States, the return on your notes after the first two years will depend on U.S. inflation levels, as measured by the Consumer Price Index. All payments on the

notes are subject to the credit risk of Wells Fargo & Company. If Wells Fargo & Company defaults on its obligations, you could lose some or all of your investment. The notes will not be listed on any exchange and are designed to be

held to maturity.

|

|

|

|

|

Issuer:

|

|

Wells Fargo & Company (“

Wells Fargo

”)

|

|

Consumer Price Index or

CPI:

|

|

The “

Consumer Price Index

” or “

CPI

” means the All Items Consumer Price Index for All Urban

Consumers (CPI-U) U.S. City Average before seasonal adjustment published by the Bureau of Labor Statistics of the U.S. Department of Labor (the “

BLS

”) (Bloomberg: CPURNSA), as determined by the calculation agent in accordance with

the procedures set forth under “Description of Notes—Floating Rate Notes—Base Rates—CPI Rate Notes” in the accompanying prospectus supplement.

|

|

Original Offering Price:

|

|

$1,000 per note. References in this pricing supplement to a “

note

” are to a note with a principal amount of

$1,000.

|

|

Pricing Date:

|

|

February 22, 2017.*

|

|

Issue Date:

|

|

February 24, 2017.* (T+2)

|

|

Stated Maturity Date:

|

|

February 24, 2027.* The notes are not subject to redemption by Wells Fargo or repayment at the option of any holder of the

notes prior to the stated maturity date.

|

|

Payment at Maturity:

|

|

A holder will be entitled to receive on the stated maturity date a cash payment in U.S. dollars equal to $1,000 per note, plus

any accrued and unpaid interest.

|

|

Interest Payment Dates:

|

|

Monthly, on the 24

th

day of each month, commencing March 24, 2017, and at

maturity.* Except as described below for the first interest period, on each interest payment date, interest will be paid for the period commencing on and including the immediately preceding interest payment date and ending on and including the day

immediately preceding that interest payment date. This period is referred to as an “

interest period

.” The first interest period will commence on and include the issue date and end on and include March 23, 2017. Interest payable with

respect to an interest period will be computed on the basis of a 360-day year of twelve 30-day months. If a scheduled interest payment date is not a business day, interest will be paid on the next business day, and interest on that payment will not

accrue during the period from and after the scheduled interest payment date.

|

|

Interest Rate:

|

|

The interest rate that will apply during the first 24 interest periods (up to and including the interest period ending

February 23, 2019) will be equal to 3.00% per annum. For all interest periods commencing on or after February 24, 2019, the interest rate that will apply during an interest period will be equal to the CPI Rate on the interest determination date for

such interest period plus 1.00%, subject to the maximum interest rate and the minimum interest rate.

|

|

CPI Rate:

|

|

The CPI Rate, on any interest determination date, will be equal to the lagging year-over-year percentage change in the CPI,

calculated as set forth under “Additional Terms of the Notes” on the next page.

|

|

Interest Determination

Date:

|

|

The “

interest determination date

” for an interest period commencing on or after February 24, 2019 is the

first day of such interest period.

|

|

Maximum Interest Rate:

|

|

5.00% per annum

|

|

Minimum Interest Rate:

|

|

0.00% per annum

|

|

Calculation Agent:

|

|

Wells Fargo Securities, LLC

|

|

Listing:

|

|

The notes will not be listed on any securities exchange or automated quotation system.

|

|

Denominations:

|

|

$1,000 and any integral multiples of $1,000

|

|

CUSIP Number:

|

|

95000N2D0

|

|

* To the extent that we make any change to the expected

pricing date or expected issue date, the interest payment dates and stated maturity date may also be changed in our discretion to ensure that the term of the notes remains the same.

|

On the date of this preliminary pricing supplement, the estimated value of the notes is

approximately $972.45 per note. While the estimated value of the notes on the pricing date may differ from the estimated value set forth above, we do not expect it to differ significantly absent a material change in market conditions or other

relevant factors. In no event will the estimated value of the notes on the pricing date be less than $942.45 per note. The estimated value of the notes was determined for us by Wells Fargo Securities, LLC using its proprietary pricing models. It is

not an indication of actual profit to us or to Wells Fargo Securities, LLC or any of our other affiliates, nor is it an indication of the price, if any, at which Wells Fargo Securities, LLC or any other person may be willing to buy the notes from

you at any time after issuance. See “Investment Description” in this pricing supplement.

The notes have

complex features and investing in the notes involves risks not associated with an investment in conventional debt securities. See “Risk Factors” on page PRS-6.

The notes are unsecured obligations of Wells Fargo & Company and all payments on the notes are subject to the credit

risk of Wells Fargo & Company. If Wells Fargo & Company defaults on its obligations, you could lose some or all of your investment. The notes are not deposits or other obligations of a depository institution and are not insured by

the Federal Deposit Insurance Corporation, the Deposit Insurance Fund or any other governmental agency of the United States or any other jurisdiction.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes

or determined if this pricing supplement or the accompanying prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

Original Offering Price

|

|

Agent Discount

(1)

|

|

Proceeds to Wells Fargo

|

|

Per Note

|

|

$1,000.00

|

|

$17.50

|

|

$982.50

|

|

Total

|

|

|

|

|

|

|

|

|

(1)

|

The agent discount will not be more than $17.50 per note. Wells Fargo Securities, LLC, a wholly owned

subsidiary of Wells Fargo & Company, is the agent for the distribution of the notes and is acting as principal. See “Investment Description” in this pricing supplement for further information.

|

Wells Fargo Securities

ADDITIONAL TERMS OF THE NOTES

The “

CPI rate

” means, for any interest determination date, the lagging year-over-year percentage change in the CPI (which may

be negative), calculated as follows:

Ref CPI

t

– Ref CPI

t-12

Ref CPI

t-12

where,

|

|

•

|

|

the

“Ref CPI

t

” is the level of the CPI for the third

calendar month prior to the calendar month of such interest determination date (the “

reference month

”) and

|

|

|

•

|

|

the “

Ref CPI

t-12

” is the level of the CPI for the

twelfth calendar month prior to such reference month.

|

For example, with respect to the interest determination date

occurring on February 24, 2019 (i.e., the interest determination date for the interest period commencing on and including February 24, 2019 and ending on and including March 23, 2019), the Ref CPI

t

is the level of the CPI for

November 2018 and the Ref CPI

t-12

is the level of the CPI for November 2017.

We refer to the twelve-month period from Ref CPI

t-12

to Ref CPI

t

as the “

year-over-year reference

period

.”

See “Description of Notes—Floating Rate Notes—Base Rates—CPI Rate Notes” in the

accompanying prospectus supplement for further information about the manner in which the CPI Rate will be determined on each interest determination date.

PRS-2

INVESTMENT DESCRIPTION

The Notes Linked to the Consumer Price Index due February 24, 2027 are senior unsecured debt securities of Wells Fargo & Company

and are part of a series entitled “Medium-Term Notes, Series P.”

All payments on the notes are subject to the credit risk of

Wells Fargo.

You should read this pricing supplement together with the prospectus supplement dated January 30, 2017 and the

prospectus dated March 18, 2015 for additional information about the notes. Information included in this pricing supplement supersedes information in the prospectus supplement and prospectus to the extent it is different from that information.

Certain defined terms used but not defined herein have the meanings set forth in the prospectus supplement.

You may access the prospectus

supplement and prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

The original offering price of each note of $1,000 includes certain costs that are borne by you. Because of these costs, the estimated value

of the notes on the pricing date will be less than the original offering price. The costs included in the original offering price relate to selling, structuring, hedging and issuing the notes, as well as to our funding considerations for debt of

this type.

The costs related to selling, structuring, hedging and issuing the notes include (i) the agent discount (if any),

(ii) the projected profit that our hedge counterparty (which may be one of our affiliates) expects to realize for assuming risks inherent in hedging our obligations under the notes and (iii) hedging and other costs relating to the offering

of the notes.

Our funding considerations take into account the higher issuance, operational and ongoing management costs of market-linked

debt such as the notes as compared to our conventional debt of the same maturity, as well as our liquidity needs and preferences. Our funding considerations are reflected in the fact that we determine the economic terms of the notes based on an

assumed funding rate that is generally lower than the interest rates implied by secondary market prices for our debt obligations and/or by other traded instruments referencing our debt obligations, which we refer to as our “

secondary market

rates

.” As discussed below, our secondary market rates are used in determining the estimated value of the notes.

If the costs

relating to selling, structuring, hedging and issuing the notes were lower, or if the assumed funding rate we use to determine the economic terms of the notes were higher, the economic terms of the notes would be more favorable to you and the

estimated value would be higher. The estimated value of the notes as of the pricing date will be set forth in the final pricing supplement.

Determining the estimated value

Our

affiliate, Wells Fargo Securities, LLC (“

WFS

”), calculated the estimated value of the notes set forth on the cover page of this pricing supplement based on its proprietary pricing models. Based on these pricing models and related

market inputs and assumptions referred to in this section below, WFS determined an estimated value for the notes by estimating the value of the combination of hypothetical financial instruments that would replicate the payout on the notes, which

combination consists of a non-interest bearing, fixed-income bond (the “

debt component

”) and one or more derivative instruments underlying the economic terms of the notes (the “

derivative component

”).

The estimated value of the debt component is based on a reference interest rate, determined by WFS as of a recent date, that generally tracks

our secondary market rates. Because WFS does not continuously calculate our reference interest rate, the reference interest rate used in the calculation of the estimated value of the debt component may be higher or lower than our secondary market

rates at the time of that calculation. As noted above, we determine the economic terms of the notes based upon an assumed funding rate that is generally lower than our secondary market rates. In contrast, in determining the estimated value of the

notes, we value the debt component using a reference interest rate that generally tracks our secondary market rates. Because the reference interest rate is generally higher than the assumed funding rate, using the reference interest rate to value

the debt

PRS-3

component generally results in a lower estimated value for the debt component, which we believe more closely approximates a market valuation of the debt component than if we had used the assumed

funding rate.

WFS calculated the estimated value of the derivative component based on a proprietary derivative-pricing model, which

generated a theoretical price for the derivative instruments that constitute the derivative component based on various inputs, including the “derivative component factors” identified in “Risk Factors—The Value Of The Notes Prior

To Stated Maturity Will Be Affected By Numerous Factors, Some Of Which Are Related In Complex Ways.” These inputs may be market-observable or may be based on assumptions made by WFS in its discretion.

The estimated value of the notes determined by WFS is subject to important limitations. See “Risk Factors—The Estimated Value Of The

Notes Is Determined By Our Affiliate’s Pricing Models, Which May Differ From Those Of Other Dealers” and “—Our Economic Interests And Those Of Any Dealer Participating In The Offering Are Potentially Adverse To Your

Interests.”

Valuation of the notes after issuance

The estimated value of the notes is not an indication of the price, if any, at which WFS or any other person may be willing to buy the notes

from you in the secondary market. The price, if any, at which WFS or any of its affiliates may purchase the notes in the secondary market will be based upon WFS’s proprietary pricing models and will fluctuate over the term of the notes due to

changes in market conditions and other relevant factors. However, absent changes in these market conditions and other relevant factors, except as otherwise described in the following paragraph, any secondary market price will be lower than the

estimated value on the pricing date because the secondary market price will be reduced by a bid-offer spread, which may vary depending on the aggregate principal amount of the notes to be purchased in the secondary market transaction, and the

expected cost of unwinding any related hedging transactions. Accordingly, unless market conditions and other relevant factors change significantly in your favor, any secondary market price for the notes is likely to be less than the original

offering price.

If WFS or any of its affiliates makes a secondary market in the notes at any time up to the issue date or during the

6-month period following the issue date, the secondary market price offered by WFS or any of its affiliates will be increased by an amount reflecting a portion of the costs associated with selling, structuring, hedging and issuing the notes that are

included in the original offering price. Because this portion of the costs is not fully deducted upon issuance, any secondary market price offered by WFS or any of its affiliates during this period will be higher than it would be if it were based

solely on WFS’s proprietary pricing models less the bid-offer spread and hedging unwind costs described above. The amount of this increase in the secondary market price will decline steadily to zero over this 6-month period. If you hold the

notes through an account at WFS or any of its affiliates, we expect that this increase will also be reflected in the value indicated for the notes on your brokerage account statement.

If WFS or any of its affiliates makes a secondary market in the notes, WFS expects to provide those secondary market prices to any

unaffiliated broker-dealers through which the notes are held and to commercial pricing vendors. If you hold your notes through an account at a broker-dealer other than WFS or any of its affiliates, that broker-dealer may obtain market prices for the

notes from WFS (directly or indirectly), but could also obtain such market prices from other sources, and may be willing to purchase the notes at any given time at a price that differs from the price at which WFS or any of its affiliates is willing

to purchase the notes. As a result, if you hold your notes through an account at a broker-dealer other than WFS or any of its affiliates, the value of the notes on your brokerage account statement may be different than if you held your notes at WFS

or any of its affiliates.

The notes will not be listed or displayed on any securities exchange or any automated quotation system.

Although WFS and/or its affiliates may buy the notes from investors, they are not obligated to do so and are not required to make a market for the notes. There can be no assurance that a secondary market will develop.

PRS-4

INVESTOR CONSIDERATIONS

We have designed the notes for investors who:

|

¾

|

|

seek current income at a fixed rate of interest of 3.00% per annum for the first two years and are

willing to accept a floating rate of interest thereafter based on lagging year-over-year percentage changes in the CPI;

|

|

¾

|

|

seek an investment with a per annum interest rate that will be reset monthly after the first two years and

will be equal to the CPI Rate plus 1.00%, subject to the maximum interest rate and the minimum interest rate, for any monthly interest period;

|

|

¾

|

|

understand that during periods of deflation, as measured by the CPI, the interest rate on the notes after the

first two years may be less than 1.00% per annum and may be as low as 0.00%;

|

|

¾

|

|

understand that the interest rate on the notes for any monthly interest period after the second year will

never be higher than the maximum interest rate regardless of the percentage changes in the CPI; and

|

|

¾

|

|

are willing to hold the notes until maturity.

|

The notes are not designed for, and may not be a suitable investment for, investors who:

|

¾

|

|

seek a liquid investment or are unable or unwilling to hold the notes to maturity;

|

|

¾

|

|

are unwilling to purchase notes with an estimated value as of the pricing date that is lower than the original

offering price and that may be as low as the lower estimated value set forth on the cover page;

|

|

¾

|

|

expect deflation, as measured by the CPI, during the term of the notes;

|

|

¾

|

|

expect interest rates to increase beyond the rates provided by the notes;

|

|

¾

|

|

are unwilling to accept the credit risk of Wells Fargo; or

|

|

¾

|

|

prefer the certainty of investments with fixed coupons for the entire term of the investment and with

comparable maturities issued by companies with comparable credit ratings.

|

PRS-5

RISK FACTORS

The notes have complex features and investing in the notes will involve risks. You should carefully consider the risk factors set forth below

as well as the other information contained in the prospectus supplement and prospectus, including the documents they incorporate by reference. You should reach an investment decision only after you have carefully considered with your advisors the

suitability of an investment in the notes in light of your particular circumstances.

In Periods Of Little Or No Inflation, The

Interest Rate After The First Two Years Will Be Approximately Equal To 1.00% Per Annum, And In Periods Of Deflation, The Interest Rate After The First Two Years Will Be Less Than 1.00% Per Annum And Could Be As Low As Zero.

Interest payable on the notes after the first two years is linked to year-over-year changes in the level of the CPI for the lagging

year-over-year reference period relating to each interest determination date. If the CPI remains approximately constant over a particular year-over-year reference period, which is likely to occur when there is little or no inflation, investors in

the notes will receive an interest payment for the related interest payment date at a rate of approximately 1.00% per annum. If the CPI decreases in a particular year-over-year reference period, which is likely to occur when there is deflation,

investors in the notes will receive an interest payment for the related interest payment date at a rate that is less than 1.00% per annum. If the CPI declines by a percentage equal to or greater than 1.00% in a particular year-over-year

reference period, investors in the notes will not receive any interest on the related interest payment date.

The Interest Rate On The

Notes May Be Lower Than The Rate Otherwise Payable On Conventional Debt Securities Issued By Us With Similar Maturities.

If there are

only minimal increases, no changes or decreases in the CPI measured monthly on a year-over-year basis, the interest rate on the notes after the first two years will be below what we would currently expect to pay as of the date of this pricing

supplement if we issued a conventional debt security with the same maturity as the notes. The Board of Governors of the Federal Reserve System (the “

FRB

”) currently targets an inflation rate of 2.00% per year, as measured by

“core” inflation measures (excluding items that tend to fluctuate often or dramatically, such as food and energy items). You should understand that if the FRB is successful in reaching and maintaining a stable target rate, and if changes

in the level of the CPI correspond to this target rate, the effective yield on your notes will be less than that which we would be pay on a conventional fixed-rate non-redeemable note of comparable maturity.

The Amount Of Interest Payable On The Notes In Any Month Is Capped.

The interest rate on the notes for each monthly interest period after the first two years is subject to the maximum interest rate of

5.00% per annum. Accordingly, if inflation, as measured by the CPI, exceeds 4.00% in the year-over year reference period relating to any interest determination date, you will not receive the full benefit of the year-over-year increase in the

CPI for that interest period due to the maximum interest rate.

The Notes Are Subject To The Credit Risk Of Wells Fargo.

The notes are our obligations and are not, either directly or indirectly, an obligation of any third party. Any amounts payable under the

notes are subject to our creditworthiness. As a result, our actual and perceived creditworthiness may affect the value of the notes and, in the event we were to default on our obligations, you may not receive any amounts owed to you under the terms

of the notes.

Holders Of The Notes Have Limited Rights Of Acceleration.

Payment of principal on the notes may be accelerated only in the case of payment defaults that continue for a period of 30 days or certain

events of bankruptcy or insolvency, whether voluntary or involuntary. If you purchase the notes, you will have no right to accelerate the payment of principal on the notes if we fail in the performance of any of our obligations under the notes,

other than the obligations to pay principal and interest on the notes. See “Description of the Notes—Events of Default and Acceleration Rights” in the accompanying prospectus supplement.

PRS-6

Holders Of The Notes Could Be At Greater Risk For Being Structurally Subordinated If We

Convey, Transfer Or Lease All Or Substantially All Of Our Assets To One Or More Of Our Subsidiaries.

Under the indenture, we may

convey, transfer or lease all or substantially all of our assets to one or more of our subsidiaries. In that event, third-party creditors of our subsidiaries would have additional assets from which to recover on their claims while holders of the

notes would be structurally subordinated to creditors of our subsidiaries with respect to such assets. See “Description of the Notes—Consolidation, Merger or Sale” in the accompanying prospectus supplement.

The Estimated Value Of The Notes On The Pricing Date, Based On WFS’s Proprietary Pricing Models, Will Be Less Than The Original

Offering Price.

The original offering price of the notes includes certain costs that are borne by you. Because of these costs, the

estimated value of the notes on the pricing date will be less than the original offering price. The costs included in the original offering price relate to selling, structuring, hedging and issuing the notes, as well as to our funding considerations

for debt of this type. The costs related to selling, structuring, hedging and issuing the notes include (i) the agent discount (if any), (ii) the projected profit that our hedge counterparty (which may be one of our affiliates) expects to

realize for assuming risks inherent in hedging our obligations under the notes and (iii) hedging and other costs relating to the offering of the notes. Our funding considerations are reflected in the fact that we determine the economic terms of

the notes based on an assumed funding rate that is generally lower than our secondary market rates. If the costs relating to selling, structuring, hedging and issuing the notes were lower, or if the assumed funding rate we use to determine the

economic terms of the notes were higher, the economic terms of the notes would be more favorable to you and the estimated value would be higher.

The Estimated Value Of The Notes Is Determined By Our Affiliate’s Pricing Models, Which May Differ From Those Of Other Dealers.

The estimated value of the notes was determined for us by WFS using its proprietary pricing models and related market inputs and

assumptions referred to above under “Investment Description—Determining the estimated value.” Certain inputs to these models may be determined by WFS in its discretion. WFS’s views on these inputs may differ from other

dealers’ views, and WFS’s estimated value of the notes may be higher, and perhaps materially higher, than the estimated value of the notes that would be determined by other dealers in the market. WFS’s models and its inputs and

related assumptions may prove to be wrong and therefore not an accurate reflection of the value of the notes.

The Estimated Value Of

The Notes Is Not An Indication Of The Price, If Any, At Which WFS Or Any Other Person May Be Willing To Buy The Notes From You In The Secondary Market.

The price, if any, at which WFS or any of its affiliates may purchase the notes in the secondary market will be based on WFS’s

proprietary pricing models and will fluctuate over the term of the notes as a result of changes in the market and other factors described in the next risk factor. Any such secondary market price for the notes will also be reduced by a bid-offer

spread, which may vary depending on the aggregate principal amount of the notes to be purchased in the secondary market transaction, and the expected cost of unwinding any related hedging transactions. Unless the factors described in the next risk

factor change significantly in your favor, any such secondary market price for the notes is likely to be less than the original offering price.

If WFS or any of its affiliates makes a secondary market in the notes at any time up to the issue date or during the 6-month period following

the issue date, the secondary market price offered by WFS or any of its affiliates will be increased by an amount reflecting a portion of the costs associated with selling, structuring, hedging and issuing the notes that are included in the original

offering price. Because this portion of the costs is not fully deducted upon issuance, any secondary market price offered by WFS or any of its affiliates during this period will be higher than it would be if it were based solely on WFS’s

proprietary pricing models less the bid-offer spread and hedging unwind costs described above. The amount of this increase in the secondary market price will decline steadily to zero over this 6-month period. If you hold through an account at WFS or

any of its affiliates, we expect that this increase will also be reflected in the value indicated for the notes on your brokerage account statement. If you hold your notes through an account at a broker-dealer other than WFS or any of its

affiliates, the value of the notes on your brokerage account statement may be different than if you held your notes at WFS or any of its affiliates, as discussed above under “Investment Description.”

PRS-7

The Value Of The Notes Prior To Stated Maturity Will Be Affected By Numerous Factors, Some Of

Which Are Related In Complex Ways.

The value of the notes prior to stated maturity will be affected by the performance of the CPI and

a number of other factors, some of which are interrelated in complex ways. The effect of any one factor may be offset or magnified by the effect of another factor. The following factors, which we refer to as the “derivative component

factors,” are expected to affect the value of the notes. When we refer to the “

value

” of your note, we mean the value that you could receive for your note if you are able to sell it in the open market before the stated maturity

date.

|

|

•

|

|

The CPI.

The value of the notes prior to maturity will be influenced by the current and projected

year-over-year changes in the level of the CPI.

|

|

|

•

|

|

Interest Rates.

The value of the notes may be affected by changes in the interest rates and in the

yield curve in the U.S. markets.

|

|

|

•

|

|

Time Remaining To Maturity.

The value of the notes at any given time prior to maturity will likely be

different from that which would be expected based on the then-current level of the CPI. This difference will most likely reflect a discount due to expectations and uncertainty concerning the level of the CPI during the period of time still remaining

to the maturity date. In general, as the time remaining to maturity decreases, the value of the notes will approach the amount payable at maturity.

|

|

|

•

|

|

Volatility of The CPI.

Volatility is the term used to describe the size and frequency of fluctuations

in the level of the CPI. The value of the notes may be affected if the volatility of the CPI changes.

|

In addition to

the derivative component factors, the value of the notes will be affected by actual or anticipated changes in our creditworthiness, as reflected in our secondary market rates. You should understand that the impact of one of the factors specified

above, such as a change in interest rates, may offset some or all of any change in the value of the notes attributable to another factor, such as a change in the level of the CPI. Because several factors are expected to affect the value of the

notes, changes in the level of the CMI may not result in a comparable change in the value of the notes.

Many Factors, Including United

States Monetary Policy, May Influence U.S. Inflation Rates, And Could Materially And Adversely Affect The Value Of The Notes.

The FRB

uses the tools of monetary policy, including conducting open market operations, imposing reserve requirements, permitting depository institutions to hold contractual clearing balances and extending credit through its discount window facility, to

alter the federal funds rate, which in turn affects the U.S. money supply, interest rates and rates of inflation. One way that the FRB might foster price stability and reduce inflation is to raise the target federal funds rate. If the FRB employs

monetary policy to reduce inflation, the level of the CPI may decrease or experience a lower rate of change, which would adversely affect the amount of one or more interest payments to you.

Although we expect U.S. monetary policy to influence the rate of inflation and, accordingly, the level of the CPI, inflation is influenced by

a number of unpredictable factors and there can be no assurance that the FRB’s policies or actions will be effective. For example, in 2009, despite multiple measures taken by the FRB to provide liquidity to the economy, inflation rates remained

extremely low. Other factors that influence interest rates or inflation rates generally may include sentiment regarding underlying strength in the U.S., European and global economies, expectations regarding the level of price inflation, sentiment

regarding credit quality in U.S., European and global credit markets, supply and demand of various consumer goods, services and energy resources and the performance of capital markets generally.

The Manner In Which The BLS Calculates The CPI May Change In The Future And Any Such Change May Affect The Value Of The Notes.

There can be no assurance that the BLS will not change the method by which it calculates the CPI. In addition, changes in the way the CPI is

calculated could reduce the level of the CPI and lower the interest payments with respect to the notes. Accordingly, the amount of interest, if any, payable on the notes after the first two years, and therefore the value of the notes, may be

significantly reduced. If the CPI is substantially altered or discontinued, a modified or substitute index may be employed to calculate the interest payable on the notes, and any such modification or substitution may adversely affect the value of

the notes.

PRS-8

The Manner In Which Inflation Is Measured For Purposes Of The Notes May Differ From Other

Measures Of Inflation In Important Ways.

The year-over-year percentage change in the level of the CPI is just one measure of price

inflation in the United States. This measure may not reflect the actual levels of inflation affecting holders of the notes. Moreover, this measure may be more volatile than other measures of inflation. The CPI includes prices of all items measured

by the BLS, including items that may be particularly volatile such as energy and food items. Significant fluctuations in the prices of these items may have a significant effect on changes in the CPI and may cause the CPI to be more volatile than

similar indices excluding these items. Moreover, measuring the year-over-year percentage change in the level of the CPI each month may result in a more volatile measure of inflation than alternative measures, such as the percentage change in the

average level of the CPI from one year to the next.

An Investment In The Notes May Be More Risky Than An Investment In Notes With A

Shorter Term.

The notes have a term of ten years. By purchasing notes with a longer term, you will bear greater exposure to

fluctuations in interest rates than if you purchased a note with a shorter term. In particular, you may be negatively affected if interest rates begin to rise because the interest rate applicable to your notes during a particular interest period may

be less than the amount of interest you could earn on other investments available at such time. In addition, if you tried to sell your notes at such time, the value of your notes in any secondary market transaction would also be adversely affected.

The Historical Levels Of The CPI Are Not An Indication Of The Future Levels Of The CPI.

The historical levels of the CPI are not an indication of the future levels of the CPI during the term of the notes. In the past, the CPI has

experienced periods of volatility and such volatility may occur in the future. Fluctuations and trends in the CPI that have occurred in the past are not necessarily indicative, however, of fluctuations that may occur in the future. Holders of the

notes will receive interest payments that will be affected by changes in the CPI. Changes in the CPI are a function of the changes in specified consumer prices over time, which result from the interaction of many factors over which we have no

control.

The Notes Will Not Be Listed On Any Securities Exchange And We Do Not Expect A Trading Market For The Notes To Develop.

The notes will not be listed or displayed on any securities exchange or any automated quotation system. Although the agent and/or its

affiliates may purchase the notes from holders, they are not obligated to do so and are not required to make a market for the notes. There can be no assurance that a secondary market will develop. Because we do not expect that any market makers will

participate in a secondary market for the notes, the price at which you may be able to sell your notes is likely to depend on the price, if any, at which the agent is willing to buy your notes.

If a secondary market does exist, it may be limited. Accordingly, there may be a limited number of buyers if you decide to sell your notes

prior to stated maturity. This may affect the price you receive upon such sale. Consequently, you should be willing to hold the notes to stated maturity.

Our Economic Interests And Those Of Any Dealer Participating In The Offering Are Potentially Adverse To Your Interests.

You should be aware of the following ways in which our economic interests and those of any dealer participating in the distribution of the

notes, which we refer to as a “

participating dealer

,” are potentially adverse to your interests as an investor in the notes. In engaging in certain of the activities described below, our affiliates or any participating dealer or its

affiliates may take actions that may adversely affect the value of and your return on the notes, and in so doing they will have no obligation to consider your interests as an investor in the notes. Our affiliates or any participating dealer or its

affiliates may realize a profit from these activities even if investors do not receive a favorable investment return on the notes.

|

|

•

|

|

The calculation agent is our affiliate and may be required to make discretionary judgments that affect

the return you receive on the notes.

WFS, which is our affiliate, will be the calculation agent for the notes. As calculation agent, WFS will determine the level of the CPI on any date of determination and may be required to make other

determinations that affect the return on the notes. In making these determinations, the calculation agent may be required to make discretionary

|

PRS-9

|

|

judgments, including determining the level of the CPI if not published on Bloomberg screen CPURNSA; if the CPI is discontinued or substantially altered, as determined by the calculation agent,

selecting a successor index or, if no successor index is available, determining the interest rate payable on the notes. In making these discretionary judgments, the fact that WFS is our affiliate may cause it to have economic interests that are

adverse to your interests as an investor in the notes, and WFS’s determinations as calculation agent may adversely affect your return on the notes.

|

|

|

•

|

|

The estimated value of the notes was calculated by our affiliate and is therefore not an independent

third-party valuation.

WFS calculated the estimated value of the notes set forth on the cover page of this pricing supplement, which involved discretionary judgments by WFS, as described under “Risk Factors—The Estimated Value Of

The Notes Is Determined By Our Affiliate’s Pricing Models, Which May Differ From Those Of Other Dealers” above. Accordingly, the estimated value of the notes set forth on the cover page of this pricing supplement is not an independent

third-party valuation.

|

|

|

•

|

|

A participating dealer or its affiliates may realize hedging profits projected by its proprietary

pricing models in addition to any selling concession, creating a further incentive for the participating dealer to sell the notes to you.

If any participating dealer or any of its affiliates conducts hedging activities for us in connection

with the notes, that participating dealer or its affiliates will expect to realize a projected profit from such hedging activities and this projected profit will be in addition to any concession that the participating dealer realizes for the sale of

the notes to you. This additional projected profit may create a further incentive for the participating dealer to sell the notes to you.

|

The Resolution Of Wells Fargo Under The Orderly Liquidation Authority Could Result In Greater Losses For Holders Of The Notes, Particularly

If A Single-Point-Of-Entry Strategy Is Used.

Your ability to recover the full amount that would otherwise be payable on the notes in

a proceeding under the U.S. Bankruptcy Code may be impaired by the exercise by the Federal Deposit Insurance Corporation (the “

FDIC

”) of its powers under the “orderly liquidation authority” under Title II of the

Dodd-Frank Wall Street Reform and Consumer Protection Act (the “

Dodd-Frank Act

”). In particular, the single point of entry strategy described below is intended to impose losses at the top-tier holding company level in the resolution

of a Global Systemically Important Bank (“

G-SIB

”) such as Wells Fargo.

Title II of the Dodd-Frank Act created a new

resolution regime known as the “orderly liquidation authority” to which financial companies, including bank holding companies such as Wells Fargo, can be subjected. Under the orderly liquidation authority, the FDIC may be appointed as

receiver for a financial company for purposes of liquidating the entity if, upon the recommendation of applicable regulators, the United States Secretary of the Treasury determines, among other things, that the entity is in severe financial

distress, that the entity’s failure would have serious adverse effects on the U.S. financial system and that resolution under the orderly liquidation authority would avoid or mitigate those effects. Absent such determinations, Wells Fargo, as a

bank holding company, would remain subject to the U.S. Bankruptcy Code.

If the FDIC is appointed as receiver under the orderly

liquidation authority, then the orderly liquidation authority, rather than the U.S. Bankruptcy Code, would determine the powers of the receiver and the rights and obligations of creditors and other parties who have transacted with Wells Fargo. There

are substantial differences between the rights available to creditors in the orderly liquidation authority and under the U.S. Bankruptcy Code, including the right of the FDIC under the orderly liquidation authority to disregard the strict priority

of creditor claims in some circumstances (which would otherwise be respected by a bankruptcy court) and the use of an administrative claims procedure to determine creditors’ claims (as opposed to the judicial procedure utilized in bankruptcy

proceedings). In certain circumstances under the orderly liquidation authority, the FDIC could elevate the priority of claims if it determines that doing so is necessary to facilitate a smooth and orderly liquidation without the need to obtain the

consent of other creditors or prior court review. In addition, under the orderly liquidation authority, the FDIC has the right to transfer assets or liabilities of the failed company to a third party or “bridge” entity.

The FDIC has announced that a “single point of entry” strategy may be a desirable strategy to resolve a large financial institution

such as Wells Fargo in a manner that would, among other things, impose losses on shareholders, unsecured debt holders (including, in our case, holders of the notes) and other creditors of the top-tier holding company (in our case, Wells Fargo),

while permitting the holding company’s subsidiaries to continue to operate. In addition, in December 2016, the FRB finalized rules requiring U.S. G-SIBs, including Wells Fargo, to maintain minimum amounts of long-term debt and total

loss-absorbing capacity (TLAC). It is possible that the application of the single point of entry strategy—in which Wells Fargo would be the only legal entity to enter resolution proceedings—could result in greater losses to holders of the

notes than the losses that would result

PRS-10

from the application of a bankruptcy proceeding or a different resolution strategy for Wells Fargo. Assuming Wells Fargo entered resolution proceedings and that support from Wells Fargo to its

subsidiaries was sufficient to enable the subsidiaries to remain solvent, losses at the subsidiary level could be transferred to Wells Fargo and ultimately borne by Wells Fargo’s security holders (including holders of the notes and our other

unsecured debt securities), with the result that third-party creditors of Wells Fargo’s subsidiaries would receive full recoveries on their claims, while Wells Fargo’s security holders (including holders of the notes) and other unsecured

creditors could face significant losses. In that case, Wells Fargo’s security holders could face significant losses while the third-party creditors of Wells Fargo’s subsidiaries would incur no losses because the subsidiaries would continue

to operate and would not enter resolution or bankruptcy proceedings. In addition, holders of the notes and other debt securities of Wells Fargo could face losses ahead of our other similarly situated creditors in a resolution under the orderly

liquidation authority if the FDIC exercised its right, described above, to disregard the strict priority of creditor claims.

The orderly

liquidation authority also requires that creditors and shareholders of the financial company in receivership must bear all losses before taxpayers are exposed to any losses, and amounts owed by the financial company or the receivership to the U.S.

government would generally receive a statutory payment priority over the claims of private creditors, including senior creditors such as claims in respect of the notes. In addition, under the orderly liquidation authority, claims of creditors

(including holders of the notes) could be satisfied through the issuance of equity or other securities in a bridge entity to which Wells Fargo’s assets are transferred. If securities were to be delivered in satisfaction of claims, there can be

no assurance that the value of the securities of the bridge entity would be sufficient to repay all or any part of the creditor claims for which the securities were exchanged.

While the FDIC has issued regulations to implement the orderly liquidation authority, not all aspects of how the FDIC might exercise this

authority are known and additional rulemaking is possible.

The Resolution Of Wells Fargo In A Bankruptcy Proceeding Could Also Result

in Greater Losses For Holders Of Our Debt Securities, Including The Notes.

As required by the Dodd-Frank Act and regulations issued

by the FRB and the FDIC, we are required to provide to the FRB and the FDIC a plan for our rapid and orderly resolution in the event of material financial distress affecting Wells Fargo or the failure of Wells Fargo. The strategy described in our

most recently filed resolution plan is a “multiple point of entry” strategy, in which Wells Fargo, Wells Fargo Bank, National Association (“

WFBNA

”) and Wells Fargo Securities, LLC (“

WFS

”) would each

undergo separate resolution proceedings under the U.S. Bankruptcy Code, the Federal Deposit Insurance Act, and the Securities Investor Protection Act, respectively. To further the orderly resolution of its businesses and those of its

subsidiaries, Wells Fargo may provide capital and liquidity resources to certain of its major subsidiaries (such as WFBNA and WFS) during any period of distress, including through the forgiveness of intercompany indebtedness, the making of

additional intercompany loans and by other means. These subsidiaries may enter into separate resolution proceedings even after receiving capital and liquidity resources from Wells Fargo. It is possible that creditors of some or all of Wells

Fargo’s major subsidiaries would receive significant, or even full, recoveries on their claims while holders of Wells Fargo’s debt securities (including holders of the notes) could face significant or complete losses. It is also possible

that holders of Wells Fargo’s debt securities (including holders of the notes) could face greater losses than if the multiple point of entry strategy had not been implemented and Wells Fargo had not provided capital and liquidity resources to

major subsidiaries that enter separate resolution proceedings because assets and other resources provided to those subsidiaries would not be available to pay Wells Fargo’s creditors (including holders of the notes and Wells Fargo’s other

debt securities).

It may also be possible for Wells Fargo to be resolved under the U.S. Bankruptcy Code using a strategy in which only

Wells Fargo itself enters proceedings while some or all of its operating subsidiaries are maintained as going concerns. In this case, the effects on creditors of Wells Fargo would likely be similar to those arising under the orderly liquidation

authority, as described above. To carry out such a strategy, Wells Fargo may seek to recapitalize its subsidiaries or provide them with liquidity in order to preserve them as going concerns prior to the commencement of Wells Fargo’s bankruptcy

proceeding. Moreover, Wells Fargo could seek to elevate the priority of its guarantee obligations relating to its major subsidiaries’ derivatives contracts over its other obligations, so that cross-default and early termination rights under

derivatives contracts at its subsidiaries would be stayed under the ISDA Resolution Stay Protocol. This elevation would result in holders of our debt securities (including the notes) incurring losses ahead of the beneficiaries of those guarantee

obligations. It is also possible that holders of our debt securities (including the notes) could incur losses ahead of other similarly situated creditors.

PRS-11

If either resolution strategy proved to be unsuccessful, holders of our debt securities

(including the notes) may as a consequence be in a worse position than if the strategy had not been implemented. In all cases, any payments to holders of our debt securities are dependent on our ability to make such payments and are therefore

subject to our credit risk.

PRS-12

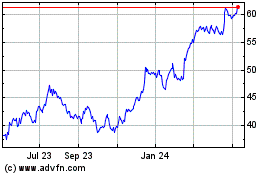

HYPOTHETICAL INTEREST RATE ILLUSTRATION BASED ON HISTORICAL CPI LEVELS

The chart below sets forth the historical levels of the CPI from January 2007 to January 2017. We obtained the historical information included

below from Bloomberg Financial Markets, without independent verification. After the chart below is a hypothetical illustration of the interest rate that would have resulted with respect to a hypothetical interest payment date occurring on

January 24, 2017 based on the historical levels of CPI. This example is for purposes of illustration only and the values used in the example may have been rounded for ease of analysis. This example is intended to illustrate the effect of

general trends in the CPI on the amount of interest payable to you on the notes after the first two years. Fluctuations and trends in the CPI that have occurred in the past are not necessarily indicative, however, of fluctuations that may occur in

the future. See “Risk Factors—The Historical Levels Of The CPI Are Not An Indication Of The Future Levels Of The CPI.” As a result, this hypothetical illustration should not be taken as an indication of any actual interest

rates that may be payable on the notes after the first two years.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month

|

|

2007

|

|

|

2008

|

|

|

2009

|

|

|

2010

|

|

|

2011

|

|

|

2012

|

|

|

2013

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

2017

|

|

|

January

|

|

|

202.416

|

|

|

|

211.08

|

|

|

|

211.143

|

|

|

|

216.687

|

|

|

|

220.223

|

|

|

|

226.665

|

|

|

|

230.28

|

|

|

|

233.916

|

|

|

|

233.707

|

|

|

|

236.916

|

|

|

|

242.839

|

|

|

February

|

|

|

203.499

|

|

|

|

211.693

|

|

|

|

212.193

|

|

|

|

216.741

|

|

|

|

221.309

|

|

|

|

227.663

|

|

|

|

232.166

|

|

|

|

234.781

|

|

|

|

234.722

|

|

|

|

237.111

|

|

|

|

|

|

|

March

|

|

|

205.352

|

|

|

|

213.528

|

|

|

|

212.709

|

|

|

|

217.631

|

|

|

|

223.467

|

|

|

|

229.392

|

|

|

|

232.773

|

|

|

|

236.293

|

|

|

|

236.119

|

|

|

|

238.132

|

|

|

|

|

|

|

April

|

|

|

206.686

|

|

|

|

214.823

|

|

|

|

213.240

|

|

|

|

218.009

|

|

|

|

224.906

|

|

|

|

230.085

|

|

|

|

232.531

|

|

|

|

237.072

|

|

|

|

236.599

|

|

|

|

239.261

|

|

|

|

|

|

|

May

|

|

|

207.949

|

|

|

|

216.632

|

|

|

|

213.856

|

|

|

|

218.178

|

|

|

|

225.964

|

|

|

|

229.815

|

|

|

|

232.945

|

|

|

|

237.900

|

|

|

|

237.805

|

|

|

|

240.229

|

|

|

|

|

|

|

June

|

|

|

208.352

|

|

|

|

218.815

|

|

|

|

215.693

|

|

|

|

217.965

|

|

|

|

225.722

|

|

|

|

229.478

|

|

|

|

233.504

|

|

|

|

238.343

|

|

|

|

238.638

|

|

|

|

241.018

|

|

|

|

|

|

|

July

|

|

|

208.299

|

|

|

|

219.964

|

|

|

|

215.351

|

|

|

|

218.011

|

|

|

|

225.922

|

|

|

|

229.104

|

|

|

|

233.596

|

|

|

|

238.250

|

|

|

|

238.654

|

|

|

|

240.628

|

|

|

|

|

|

|

August

|

|

|

207.917

|

|

|

|

219.086

|

|

|

|

215.834

|

|

|

|

218.312

|

|

|

|

226.545

|

|

|

|

230.379

|

|

|

|

233.877

|

|

|

|

237.852

|

|

|

|

238.316

|

|

|

|

240.849

|

|

|

|

|

|

|

September

|

|

|

208.490

|

|

|

|

218.783

|

|

|

|

215.969

|

|

|

|

218.439

|

|

|

|

226.889

|

|

|

|

231.407

|

|

|

|

234.149

|

|

|

|

238.031

|

|

|

|

237.945

|

|

|

|

241.428

|

|

|

|

|

|

|

October

|

|

|

208.936

|

|

|

|

216.573

|

|

|

|

216.177

|

|

|

|

218.711

|

|

|

|

226.421

|

|

|

|

231.317

|

|

|

|

233.546

|

|

|

|

237.433

|

|

|

|

237.838

|

|

|

|

241.729

|

|

|

|

|

|

|

November

|

|

|

210.177

|

|

|

|

212.425

|

|

|

|

216.330

|

|

|

|

218.803

|

|

|

|

226.23

|

|

|

|

230.221

|

|

|

|

233.069

|

|

|

|

236.151

|

|

|

|

237.336

|

|

|

|

241.353

|

|

|

|

|

|

|

December

|

|

|

210.036

|

|

|

|

210.228

|

|

|

|

215.949

|

|

|

|

219.179

|

|

|

|

225.672

|

|

|

|

229.601

|

|

|

|

233.049

|

|

|

|

234.812

|

|

|

|

236.525

|

|

|

|

241.432

|

|

|

|

|

|

Hypothetical Illustration of Interest Payment for January 24, 2017 Hypothetical Interest Payment Date.

A January 24, 2017 hypothetical interest payment date would relate to a hypothetical interest period commencing on and including

December 24, 2016 and ending on and including January 23, 2016, and a hypothetical interest determination date of December 24, 2016 (i.e., the first day of the interest period). Assuming January 24, 2017 was an interest payment

date occurring after the 2-year fixed interest period, the hypothetical interest rate on the notes payable on such hypothetical interest payment date would be calculated as follows:

Step 1:

Calculate the CPI Rate for the applicable interest determination date:

|

|

|

|

|

|

|

CPI Rate =

|

|

Ref CPI

t

– Ref CPI

t-12

|

|

|

|

|

|

Ref CPI

t-12

|

|

|

Ref CPI

t

is 241.428, which is the level of the CPI for September 2016, the third calendar month prior to the calendar month of the December 24, 2016 hypothetical interest determination date, which is

the hypothetical reference month; and

Ref

CPI

t-12

is 237.945, which is the level of the CPI for September 2015, the twelfth calendar month prior to such

hypothetical reference month.

|

|

|

|

|

|

|

CPI Rate =

|

|

241.428 – 237.945

|

|

|

|

|

|

237.945

|

|

|

CPI Rate = 1.46378%

Step 2:

Calculate the Interest Rate for the applicable interest determination date:

Interest Rate = CPI Rate + 1.00%, subject to maximum interest rate and minimum interest rate

Interest Rate = 1.46378% + 1.00%

Interest Rate = 2.46378%

Therefore, on the January 24, 2017 hypothetical interest payment date, you would receive an interest payment equal to $2.05 per note,

i.e., $1,000 × 2.46378% × (30/360), rounded to the nearest cent.

PRS-13

THE CONSUMER PRICE INDEX

The CPI is a measure of the average change over time in the prices paid by urban consumers for a market basket of goods and services, including

food and beverages, housing, apparel, transportation, medical care, recreation, education and communication, and other goods and services. The CPI is a market-accepted measure of inflation. For more information about the CPI, including the manner in

which the calculation agent will calculate the CPI for purposes of the notes, see “Description of Notes—Floating Rate Notes—Base Rates—CPI Rate Notes” in the accompanying prospectus supplement.

Historical Information

We

obtained the levels of the CPI provided below from Bloomberg Financial Markets, without independent verification. The historical performance of the CPI should not be taken as an indication of the future performance of the CPI during the term of the

notes.

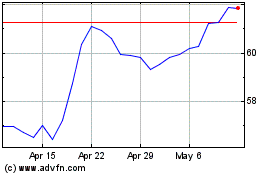

The following graph sets forth the levels of the CPI for each month in the period from January 2007 through January 2017. The

level of the CPI for January 2017 was 242.839.

The following graph sets forth the levels of the CPI as a percentage change on a rolling twelve-month basis

from January 2007 through February 2017.

PRS-14

UNITED STATES FEDERAL TAX CONSIDERATIONS

The following is a discussion of the material U.S. federal income and certain estate tax consequences of the ownership and disposition of the

notes. It applies to you only if you purchase a note for cash in the initial offering at the “

issue price

,” which is the first price at which a substantial amount of the notes is sold to the public, and hold the note as a capital

asset within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended (the “

Code

”). It does not address all of the tax consequences that may be relevant to you in light of your particular circumstances or if

you are an investor subject to special rules, such as:

|

|

•

|

|

a financial institution;

|

|

|

•

|

|

a “regulated investment company”;

|

|

|

•

|

|

a “real estate investment trust”;

|

|

|

•

|

|

a tax-exempt entity, including an “individual retirement account” or “Roth IRA”;

|

|

|

•

|

|

a dealer or trader subject to a mark-to-market method of tax accounting with respect to the notes;

|

|

|

•

|

|

a person holding a note as part of a “straddle” or conversion transaction or who has entered into a

“constructive sale” with respect to a note;

|

|

|

•

|

|

a U.S. holder (as defined below) whose functional currency is not the U.S. dollar; or

|

|

|

•

|

|

an entity classified as a partnership for U.S. federal income tax purposes.

|

If an entity that is classified as a partnership for U.S. federal income tax purposes holds the notes, the U.S. federal income tax treatment

of a partner will generally depend on the status of the partner and the activities of the partnership. If you are a partnership holding the notes or a partner in such a partnership, you should consult your tax adviser as to the particular U.S.

federal tax consequences of holding and disposing of the notes to you.

This discussion is based on the Code, administrative

pronouncements, judicial decisions and final, temporary and proposed Treasury regulations, all as of the date hereof, changes to any of which subsequent to the date of this pricing supplement may affect the tax consequences described herein,

possibly with retroactive effect. This discussion does not address the effects of any applicable state, local or non-U.S. tax laws or the potential application of the alternative minimum tax or the Medicare tax on net investment income. You should

consult your tax adviser concerning the application of the U.S. federal income and estate tax laws to your particular situation, as well as any tax consequences arising under the laws of any state, local or non-U.S. jurisdiction.

Tax Treatment of the Notes

In the opinion of our counsel, Davis Polk & Wardwell LLP, the notes will be treated as “

contingent payment debt

instruments

” for U.S. federal income tax purposes, and the discussion herein is based on this treatment.

Tax Consequences to

U.S. Holders

This section applies only to U.S. holders. You are a “

U.S. holder

” if you are a beneficial owner of a

note that is, for U.S. federal income tax purposes:

|

|

•

|

|

a citizen or individual resident of the United States;

|

|

|

•

|

|

a corporation created or organized in or under the laws of the United States, any state therein or the

District of Columbia; or

|

|

|

•

|

|

an estate or trust the income of which is subject to U.S. federal income taxation regardless of its source.

|

Interest Accruals on the Notes.

Pursuant to rules governing the tax treatment of contingent payment debt

instruments (the “

contingent debt regulations

”), you will be required to accrue interest income on the notes on a constant yield basis based on a comparable yield, as described below, regardless of whether you use the cash or

accrual method of accounting for U.S. federal income tax purposes. Accordingly, you may be required to include

PRS-15

interest in your taxable income in a particular year in excess of any stated interest payments actually received in that year.

Under the contingent debt regulations you must accrue an amount of ordinary interest income, as original issue discount

(“

OID

”) for U.S. federal income tax purposes, for each accrual period prior to and including the maturity date of the notes that equals the product of:

|

|

•

|

|

the adjusted issue price (as defined below) of the notes as of the beginning of the accrual period,

|

|

|

•

|

|

the comparable yield (as defined below) of the notes, adjusted for the length of the accrual period, and

|

|

|

•

|

|

a fraction, the numerator of which is the number of days during the accrual period that you held the notes and

the denominator of which is the number of days in the accrual period.

|

The “

adjusted issue price

” of a

note is its issue price increased by any interest income previously accrued, determined without regard to any adjustments to interest accruals described below, and decreased by the projected amount of any payments (in accordance with the projected

payment schedule described below) previously made with respect to the notes.

As used in the contingent debt regulations, the term

“

comparable yield

” means the greater of (i) the annual yield we would pay, as of the issue date, on a fixed-rate, nonconvertible debt instrument with no contingent payments, but with terms and conditions otherwise comparable to

those of the notes, and (ii) the applicable federal rate.

The contingent debt regulations require that we provide to U.S. holders,

solely for U.S. federal income tax purposes, a schedule of the projected amounts of payments (the “

projected payment schedule

”) on the notes. This schedule must produce a yield to maturity that equals the comparable yield. U.S.

holders may obtain the comparable yield and projected payment schedule by submitting a written request for this information to us at: Wells Fargo Securities, LLC, Investment Solutions Group, 375 Park Avenue, New York, NY 10152.

For U.S. federal income tax purposes, you are required under the contingent debt regulations to use the comparable yield and the projected

payment schedule established by us in determining interest accruals and adjustments in respect of a note, unless you timely disclose and justify the use of a different comparable yield and projected payment schedule to the Internal Revenue Service

(the “

IRS

”).

The comparable yield and the projected payment schedule will not be used for any purpose other than

to determine your interest accruals and adjustments thereto in respect of a note for U.S. federal income tax purposes. They will not constitute a projection or representation by us regarding the actual amounts that will be paid on a note.

Adjustments to Interest Accruals on the Notes

. If, during any taxable year, you receive actual payments with respect to a note that, in

the aggregate, exceed the total amount of projected payments for that taxable year, you will incur a ‘‘

net positive adjustment

’’ under the contingent debt regulations equal to the amount of such excess. This net positive

adjustment is treated as additional interest income in that taxable year. If you receive in a taxable year actual payments with respect to a note that, in the aggregate, are less than the amount of projected payments for that taxable year, you will

incur a ‘‘

net negative adjustment

’’ under the contingent debt regulations equal to the amount of such deficit. This net negative adjustment:

|

|

•

|

|

will first reduce your interest income on the note for that taxable year;

|

|

|

•

|

|

to the extent of any excess, will give rise to an ordinary loss to the extent of your interest income on the

note during prior taxable years, reduced to the extent such interest was offset by prior net negative adjustments; and

|

|

|

•

|

|

to the extent of any excess after the application of the previous two bullet points, will be carried forward

as a negative adjustment to offset future interest income with respect to the note or to reduce the amount realized on a sale, exchange or retirement of the note.

|

If you are a U.S. holder who is an individual, a net negative adjustment is not subject to the two percent floor limitation on

miscellaneous itemized deductions.

PRS-16

Sale, Exchange or Retirement of Notes

. You will recognize taxable gain or loss on the

sale, exchange or retirement of a note equal to the difference between the amount received and your adjusted tax basis in the note. The amount of gain or loss on a sale, exchange or retirement of a note will be equal to the difference between

(a) the amount received by you (the “

amount realized

”) and (b) your adjusted tax basis in the note. As discussed above, to the extent that you have any net negative adjustment carryforward, you may use such net negative

adjustment carryforward from a previous year to reduce the amount realized on the sale, exchange or retirement of the notes.

Your

adjusted tax basis in a note generally will be equal to your original purchase price for the note, increased by any interest income you previously accrued (determined without regard to any adjustments to interest accruals described above) and

decreased by the amount of any projected payments that previously have been scheduled to be made in respect of the notes (without regard to the actual amount paid).

Any gain recognized upon a sale, exchange or retirement of a note generally will be treated as ordinary interest income. Any loss will be

ordinary loss to the extent of the excess of previous interest inclusions over the total net negative adjustments previously taken into account as ordinary losses in respect of the note, and thereafter capital loss (which will be long-term capital

loss if the note has been held for more than one year). The deductibility of capital losses is subject to limitations. If you recognize a loss upon a sale or other disposition of a note and such loss is above certain thresholds, you may be required

to file a disclosure statement with the IRS.

Tax Consequences to Non-U.S. Holders

This section applies only to non-U.S. holders. You are a “

non-U.S. holder

” if you are a beneficial owner of a note that is,

for U.S. federal income tax purposes:

|

|

•

|

|

an individual who is classified as a nonresident alien;

|

|

|

•

|

|

a foreign corporation; or

|

|

|

•

|

|

a foreign estate or trust.

|

You are not a non-U.S. holder for purposes of this discussion if you are (i) an individual who is present in the United States for

183 days or more in the taxable year of disposition, (ii) a former citizen or resident of the United States or (iii) a person for whom income or gain in respect of the notes is effectively connected with the conduct of a trade or

business in the United States. If you are or may become such a person during the period in which you hold a note, you should consult your tax adviser regarding the U.S. federal tax consequences of an investment in the notes.

Treatment of Income and Gain on the Notes

. Subject to the discussion below concerning FATCA, you generally will not be subject to U.S.

federal income or withholding tax in respect of the notes, provided that:

|

|

•

|

|