Deere Gives Upbeat Outlook as Earnings Fall

February 17 2017 - 8:25AM

Dow Jones News

By Imani Moise

Farm-equipment supplier Deere & Co. said its earnings and

sales fell in the most recent quarter as the company continued to

cope with soft demand.

Lower prices for farm commodities and a glut of used equipment

have made farmers cautious of buying new equipment, but the company

said the market is turning around.

"We are seeing signs that after several years of steep declines

key agricultural markets may be stabilizing," said Chief Executive

Samuel Allen.

Although the Moline, Ill.-based company still expects

agriculture and construction sales to be down industry wide, Deere

projected 3% revenue growth for its agriculture & turf segment

and 7% growth in its construction and forestry business for the

fiscal year.

Both segments were hurt by lower volumes during the quarter.

Agriculture and turf sales were flat and construction and forestry

sales dropped 6%.

In all for the first quarter, Deere reported a profit of $193.8

million, or 61 cents a share, down from $254.4 million, or 80

cents, a year earlier. The most recent quarter included a $94

million pretax charge related to employee separation programs.

Net sales fell 1.5% to $4.69 billion. Revenue including

financial services and other items rose 1.8% to $5.63 billion

Analysts polled by Thomson Reuters had forecast earnings of 55

cents on $4.68 billion in revenue.

Shares rose 2.7% to $112.15 premarket and have risen 19% over

the past three months through Thursday's close.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

February 17, 2017 08:10 ET (13:10 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

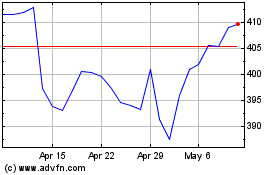

Deere (NYSE:DE)

Historical Stock Chart

From Mar 2024 to Apr 2024

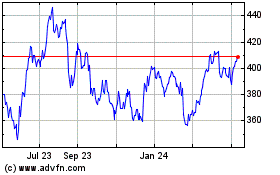

Deere (NYSE:DE)

Historical Stock Chart

From Apr 2023 to Apr 2024