Current Report Filing (8-k)

February 17 2017 - 7:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

February 15, 2017

BLOOMIN’ BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

001-35625

|

20-8023465

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code

(813) 282-1225

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

Item 2.02

|

Results of Operations and Financial Condition

|

On

February 17, 2017

, the Company issued a press release reporting its financial results for the thirteen weeks and fiscal year ended December 25, 2016. A copy of the release is attached as Exhibit 99.1.

Based on a review of our non-GAAP presentations, we have determined that, commencing with our results for the first fiscal quarter of 2017, when presenting the non-GAAP measures Adjusted income from operations and the corresponding margins, Adjusted net income and Adjusted diluted earnings per share, we will no longer adjust for expenses incurred in connection with our remodel program or intangible amortization recorded as a result of the 2013 acquisition of our Brazil operations.

Our fourth quarter and fiscal year 2016 results announced in today’s earnings release, attached as Exhibit 99.1, are reported in accordance with our existing methodology. However, the adjusted measures included in our

Fiscal 2017 Financial Outlook

in today’s earnings release are estimated based on the revised methodology. In order to assist investors in understanding the impact of this change and for comparability purposes, attached as Exhibit 99.2 is a recasting of the impacted non-GAAP measures to conform to the revised methodology for fiscal years 2016, 2015 and 2014.

The information contained in Item 2.02 of this report, and the exhibits attached hereto, are being furnished and shall not be deemed “filed” for any purpose, and shall not be deemed incorporated by reference in any document whether or not filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, regardless of any general incorporation language in any such document.

|

|

|

|

Item 2.05

|

Costs Associated with Exit or Disposal Activities

|

On

February 15, 2017

, the Company decided to close

43

underperforming restaurants (the “2017 Closure Initiative”). Most of these restaurants will close in 2017, with the balance closing as leases and certain operating covenants expire or are amended or waived. In connection with the 2017 Closure Initiative, the Company reassessed the future undiscounted cash flows of the impacted restaurants, and as a result, the Company recognized pre-tax asset impairments and closing costs of

$46.5 million

during the thirteen weeks and fiscal year ended December 25, 2016, which includes three restaurants that closed in the fourth quarter.

The Company currently expects to incur additional charges of approximately

$19.5 million

to

$23.5 million

over the next

three years

related to the closures. Such costs include lease obligations, employee terminations and other closure related obligations. Total future undiscounted cash expenditures of

$31.5 million

to

$37.0 million

, primarily related to lease liabilities, are expected to occur over the remaining lease term with the final terms ending in

January 2029

.

The amounts and timing of all estimates are subject to a number of assumptions and actual results may differ.

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits.

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

|

|

99.1

|

|

Press Release of Bloomin’ Brands, Inc. dated February 17, 2017

|

|

|

99.2

|

|

Recast of Non-GAAP Measures to Conform to the Revised Methodology

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

BLOOMIN’ BRANDS, INC.

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date:

|

February 17, 2017

|

By:

|

/s/ David J. Deno

|

|

|

|

|

David J. Deno

|

|

|

|

|

Executive Vice President and Chief Financial and Administrative Officer

(Principal Financial and Accounting Officer)

|

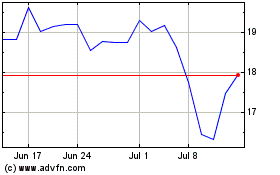

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

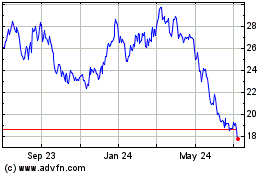

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Apr 2023 to Apr 2024