Ventas In Talks to Buy Part or All of Brookdale Senior Living -- Update

February 16 2017 - 5:13PM

Dow Jones News

By Dana Mattioli and Dana Cimilluca

Healthcare-facility owner Ventas Inc. is in talks to acquire

part or all of Brookdale Senior Living Inc. after another big

suitor cooled on its bid for the nation's largest operator of

senior-living centers.

Ventas is vying for Brookdale after another leading contender to

make a deal with the company, private-equity firm Blackstone Group

LP, lost interest, according to people familiar with the matter.

Brookdale had a market value of nearly $3 billion Thursday

afternoon as well as nearly $6 billion in long-term debt and lease

obligations as of the end of last year.

In January, The Wall Street Journal reported that Brentwood,

Tenn.-based Brookdale was holding talks with Blackstone and others

about a sale. When Brookdale reported earnings this week, the

company confirmed that it's exploring a possible deal. "I can

report that our board and management team working together with our

legal and financial advisers are in a process of exploring options

and alternatives to create and enhance shareholder value,"

Executive Chairman Dan Decker said on a conference call with

analysts and investors.

It isn't clear if there are other suitors, and Blackstone could

still re-enter the fray. The talks are complicated by the fact that

much of Brookdale's real estate is owned by other parties,

including Ventas, who may need to sign off on a deal, and it's

possible there won't be any transaction.

Ventas, based in Chicago, is one of the biggest U.S. health

care-focused real-estate investment trusts, with almost 1,300

senior housing and health-care properties in the U.S. Canada and

U.K. It had a market value of a $22 billion Thursday.

Brookdale is a big tenant of Ventas, with 140 properties leased

or managed as of the end of last year, representing about 5% of

revenue, according to Ventas's annual report. That could help put

Ventas in a better position to do a deal with Brookdale.

Ventas is an acquisitive company. Last year, it bought $1.5

billion worth of properties from Blackstone. In 2015, it paid $1.75

billion to buy a hospital operator known as Ardent Medical

Services, spinning off most of the post-acute and skilled-nursing

properties into Care Capital Properties Inc.

Brookdale has been under pressure from two separate activist

hedge funds in the past two years that have urged it to take steps

including selling or spinning off its real-estate portfolio to

reverse a decline in the shares.

In the fourth quarter, Brookdale reported revenue of $1.21

billion, a 2.4% decrease from the year-earlier period. The company

reported a net loss of $268.6 million compared with a net loss of

$174.3 million in the fourth quarter of 2015. "We are operating in

a difficult environment with intense supply pressure and a

competitive labor market," Brookdale's chief executive said in the

company's earnings release.

Even after rebounding lately amid deal speculation, Brookdale

shares closed Thursday at $15.38, down from nearly $40 two years

ago. Shares of Brookdale fell 2.5% after hours on Thursday.

Brookdale was founded in 1986 and has grown through a number of

mergers, including its $1.4 billion purchase in 2014 of Emeritus

Corp., which has weighed on the company's performance. It has more

than 1,000 communities spread across the U.S., with more than

100,000 residents. It also offers services such as outpatient

therapy, hospice care and assisted living.

Brookdale's property alone could be worth as much as $7 billion,

one of the hedge funds, Land and Buildings Investment Management

LLC, has said in a letter urging a sale of the real estate. In

2015, Sandell Asset Management launched a proxy fight and urged

Brookdale to spin off its real-estate portfolio. It settled for a

seat on the board. Sandell has since sold its stake.

David Benoit contributed to this article

Write to Dana Mattioli at dana.mattioli@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

February 16, 2017 16:58 ET (21:58 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

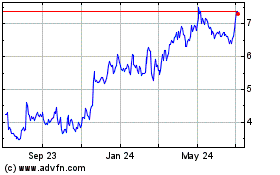

Brookdale Senior Living (NYSE:BKD)

Historical Stock Chart

From Mar 2024 to Apr 2024

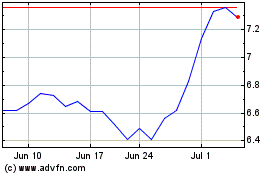

Brookdale Senior Living (NYSE:BKD)

Historical Stock Chart

From Apr 2023 to Apr 2024