Cloud Networking Pace Drives Stellar Revenue

and Record EPS

Arista Networks, Inc. (NYSE: ANET), an industry leader in

software-driven cloud networking solutions for large data center

and computing environments, today announced financial results for

its fourth quarter and year ended December 31, 2016.

Fourth Quarter Financial Highlights

- Revenue of $328.0 million, an increase

of 33.6% compared to the fourth quarter of 2015, and an increase of

13.0% from the third quarter of 2016.

- GAAP gross margin of 64.1%, compared to

GAAP gross margin of 63.6% in the fourth quarter of 2015 and 64.2%

in the third quarter of 2016.

- Non-GAAP gross margin of 64.4%,

compared to non-GAAP gross margin of 64.0% in the fourth quarter of

2015 and 64.6% in the third quarter of 2016.

- GAAP net income of $58.8 million, or

$0.79 per diluted share, compared to GAAP net income of $43.9

million, or $0.60 per diluted share, in the fourth quarter of

2015.

- Non-GAAP net income of $77.5 million,

or $1.04 per diluted share, compared to non-GAAP net income of

$57.5 million, or $0.80 per diluted share, in the fourth quarter of

2015.

"2016 was indeed a historic year for Arista, as we exceeded one

billion dollars in annual sales within two years of becoming a

public company,” stated Jayshree Ullal, Arista President and CEO.

“Our customers are adopting cloud networking at an unprecedented

pace.”

Full Year Financial Highlights

- Revenue of $1.1 billion, an increase of

34.8% compared to fiscal year 2015.

- GAAP gross margin of 64.0%, compared to

GAAP gross margin of 64.9% in fiscal year 2015.

- Non-GAAP gross margin of 64.4%,

compared to non-GAAP gross margin of 65.3% in fiscal year

2015.

- GAAP net income of $184.2 million, or

$2.50 per diluted share, compared to GAAP net income of $121.1

million, or $1.67 per diluted share, in fiscal year 2015.

- Non-GAAP net income of $241.4 million

or $3.30 per diluted share, compared to non-GAAP net income of

$174.2 million, or $2.44 per diluted share, in fiscal year

2015.

Commenting on the company's financial results for the quarter,

Ita Brennan, Arista’s CFO, said, “We are pleased with our

outstanding financial performance in the fourth quarter, reflecting

strong customer demand and consistent execution.”

Fourth Quarter Company Highlights

- Introduced Arista AlgoMatch™, an

innovation that delivers advanced network policy enforcement for

modern cloud networking along with the new Arista 7160

Series 25/100GbE programmable platforms. Arista AlgoMatch

provides customers with more flexible and scalable solutions for

access control, telemetry and secure cloud networking. The Arista

7160 Series utilizes new merchant silicon from Cavium to provide a

programmable platform that lowers operational costs by supporting

Flexible Profiles to reduce network complexity and delivers native

25GbE interfaces that support the new IEEE standard.

2016 Company Highlights

- Delivered the Arista 7500R Universal

Spine and Arista 7280R Universal Leaf platforms.

- Introduced the Arista FlexRoute™

Engine, which provides support for the full internet routing table,

in hardware, and scales to more than one million routes on the

Arista 7500R Universal Spine and Arista 7280R Universal Leaf

platforms.

- Positioned by Gartner, Inc. in the

“Leaders” quadrant of the 16 May 2016 Magic Quadrant for Data

Center Networking.

- Announced next-generation,

real-time telemetry and analytics capabilities that

leverage Arista EOS® and CloudVision®.

- Initiated a strategic partnership with

Hewlett Packard Enterprise ("HPE") to deliver on a common vision of

secure Hybrid IT solutions.

- Unveiled the next phase of Arista EOS

(Extensible Operating System) enabling network-wide state with

NetDB™.

Financial Outlook

For the first quarter of 2017, we expect:

- Revenue between $320 and $330

million.

- Non-GAAP gross margin between 61% to

64%, and

- Non-GAAP operating margin of

approximately 27%.

Guidance for non-GAAP financial measures excludes legal expenses

of approximately $12 million associated with the OptumSoft and

Cisco litigation, stock-based compensation and other non-recurring

expenses. A reconciliation of non-GAAP guidance measures to

corresponding GAAP measures is not available on a forward-looking

basis (see further explanation below).

Prepared Materials and Conference Call Information

Arista executives will discuss fourth quarter and fiscal 2016

financial results on a conference call at 1:30 p.m. Pacific time

today. To listen to the call via telephone, dial 1-877-201-0168 in

the United States or 1-647-788-4901 from outside the US. The

Conference ID is 49206884.

The financial results conference call will also be available via

live webcast on our investor relations website at

investors.arista.com. Shortly after the conclusion of the

conference call, a replay of the audio webcast will be available on

Arista’s Investor Relations website.

Forward-Looking Statements

This press release contains “forward-looking statements”

regarding our future performance, including statements in the

section entitled “Financial Outlook,” such as estimates regarding

revenue, non-GAAP gross margin and non-GAAP operating margin for

the first quarter of fiscal 2017, statements regarding the adoption

of cloud networking by our customers at an unprecedented pace, and

statements regarding the benefits from the introduction of Arista

AlgoMatch™ and the Arista 7160 Series platforms. Forward-looking

statements are subject to a number of uncertainties and risks that

could cause actual results to differ materially from those

anticipated in the forward-looking statements including risks

associated with: Arista Networks’ limited operating history; risks

associated with Arista Networks’ rapid growth; Arista Networks’

customer concentration; Arista Networks’ dispute with Cisco

Systems, Inc. including Arista Networks’ ability to obtain a

determination that alternative product implementations are not

covered by remedial orders and our ability to manage our

manufacturing and supply chain including the sourcing of components

on commercially reasonable terms, if at all; risks associated with

our customer’s adoption of our redesigned products and services and

requests for more favorable terms and conditions; declines in the

sales prices of our products and services; changes in customer

order patterns or customer mix; increased competition in our

products and service markets, including the data center market;

dependence on the introduction and market acceptance of new product

offerings and standards; rapid technological and market change; the

evolution of the cloud networking market and the adoption by end

customers of Arista Networks’ cloud networking solutions; Arista’s

dispute with OptumSoft; and general market, political, economic and

business conditions. Additional risks and uncertainties that could

affect Arista Networks can be found in Arista’s Quarterly Reporting

on Form 10-Q filed with the SEC on November 3, 2016, and other

filings that the company makes to the SEC from time to time. You

can locate these reports through our website at http://investors.arista.com and on the SEC’s

website at www.sec.gov. All

forward-looking statements in this press release are based on

information available to the company as of the date hereof and

Arista Networks disclaims any obligation to publicly update or

revise any forward-looking statement to reflect events that occur

or circumstances that exist after the date on which they were

made.

Non-GAAP Financial Measures

The company reports certain non-GAAP financial measures that

exclude stock-based compensation expense, expenses associated with

the OptumSoft and Cisco litigation, and other non-recurring

charges. The company uses these non-GAAP financial measures

internally in analyzing its financial results and believes that the

use of these non-GAAP financial measures is useful to investors as

an additional tool to evaluate ongoing operating results and

trends. In addition, these measures are the primary indicators

management uses as a basis for its planning and forecasting for

future periods.

Non-GAAP financial measures are not meant to be considered in

isolation or as a substitute for comparable GAAP net income, net

income per diluted share, gross margin, or operating margin.

Non-GAAP financial measures are subject to limitations, and should

be read only in conjunction with the company's consolidated

financial statements prepared in accordance with GAAP. A

description of these non-GAAP financial measures and a

reconciliation of the company’s non-GAAP financial measures to

their most directly comparable GAAP measures has been provided in

the financial statement tables included in this press release, and

investors are encouraged to review the reconciliation.

The Company’s guidance for non-GAAP financial measures excludes

stock-based compensation, expenses associated with the OptumSoft

and Cisco litigation, and other non-recurring charges. The Company

has not reconciled its non-GAAP gross margin or its non-GAAP

operating margin guidance to GAAP gross margin or GAAP operating

margin, because we do not provide guidance on GAAP gross margin or

GAAP operating margin or the various reconciling cash and non-cash

items between GAAP gross margin and GAAP operating margin and

non-GAAP gross margin and non-GAAP operating margin. Stock-based

compensation expense is impacted by the Company’s future hiring and

retention needs, as well as the future fair market value of the

Company’s common stock, all of which is difficult to predict and

subject to constant change. The actual amount of stock-based

compensation in the fiscal first quarter of 2017 will have a

significant impact on the Company’s GAAP gross margin and GAAP

operating margin. Accordingly, a reconciliation of the non-GAAP

financial measure guidance to the corresponding GAAP measure is not

available without unreasonable effort.

About Arista Networks

Arista Networks was founded to pioneer and deliver

software-driven cloud networking solutions for large datacenter

storage and computing environments. Arista’s award-winning

platforms, ranging in Ethernet speeds from 10 to 100 gigabits per

second, redefine scalability, agility and resilience. Arista has

shipped more than ten million cloud networking ports worldwide with

CloudVision and EOS, an advanced network operating system.

Committed to open standards, Arista is a founding member of the

25/50GbE consortium. Arista Networks products are available

worldwide directly and through partners.

ARISTA, EOS, CloudVision, and AlgoMatch are among the registered

and unregistered trademarks of Arista Networks, Inc. in

jurisdictions around the world. Other company names or product

names may be trademarks of their respective owners.

Additional information and resources can be found at:

http://www.arista.com

ARISTA NETWORKS, INC.

Consolidated Statements of

Income

(Unaudited in thousands, except per

share amounts)

Three Months Ended December 31, Year Ended

December 31, 2016 2015 2016

2015 Revenue: Product $ 289,008 $ 217,325 $ 991,337 $

744,877 Service 38,961 28,121 137,830 92,714

Total revenue 327,969 245,446 1,129,167

837,591 Cost of revenue: Product 108,057 81,142 369,768

263,585 Service 9,757 8,136 36,283 30,446

Total cost of revenue 117,814 89,278 406,051

294,031 Gross profit 210,155 156,168 723,116 543,560

Operating expenses: Research and development 71,398 57,413 273,581

209,448 Sales and marketing 38,321 31,308 130,887 109,084 General

and administrative 22,941 18,050 75,239 75,720

Total operating expenses 132,660 106,771

479,707 394,252 Income from operations 77,495 49,397

243,409 149,308 Other income (expense), net: Interest expense (918

) (746 ) (3,136 ) (3,152 ) Other income (expense), net 560

(109 ) 1,952 (147 ) Total other income (expense), net (358 )

(855 ) (1,184 ) (3,299 ) Income before provision for income taxes

77,137 48,542 242,225 146,009 Provision for income taxes 18,354

4,618 58,036 24,907 Net income $ 58,783

$ 43,924 $ 184,189 $ 121,102 Net income

attributable to common stockholders: Basic $ 58,527 $ 43,431

$ 182,965 $ 119,115 Diluted $ 58,542 $

43,464 $ 183,039 $ 119,264 Net income per

share attributable to common stockholders: Basic $ 0.84 $

0.65 $ 2.66 $ 1.81 Diluted $ 0.79 $

0.60 $ 2.50 $ 1.67 Weighted-average shares

used in computing net income per share attributable to common

stockholders: Basic 69,980 67,111 68,771

65,964 Diluted 74,384 72,062 73,222

71,411

ARISTA NETWORKS, INC.

Reconciliation of Selected GAAP to

Non-GAAP Financial Measures

(Unaudited in thousands, except

percentages and per share amounts)

Three Months Ended December 31, Year Ended

December 31, 2016 2015 2016

2015 GAAP gross profit $ 210,155 $ 156,168 $ 723,116 $

543,560 GAAP gross margin 64.1 % 63.6 % 64.0 % 64.9 % Stock-based

compensation expense 1,004 842 3,620 3,048

Non-GAAP gross profit $ 211,159 $ 157,010 $

726,736 $ 546,608 Non-GAAP gross margin 64.4 % 64.0 %

64.4 % 65.3 % GAAP income from operations $ 77,495 $ 49,397

$ 243,409 $ 149,308 Stock-based compensation expense 16,324 12,978

59,032 45,303 Litigation expense 12,209 8,956 35,833

41,424 Non-GAAP income from operations $ 106,028

$ 71,331 $ 338,274 $ 236,035 Non-GAAP

operating margin 32.3 % 29.1 % 30.0 % 28.2 % GAAP net income

$ 58,783 $ 43,924 $ 184,189 $ 121,102 Stock-based compensation

expense 16,324 12,978 59,032 45,303 Litigation expense 12,209 8,956

35,833 41,424 Release of income tax reserve — (968 ) (6,293 )

(7,344 ) Income tax effect on non-GAAP exclusions (9,836 ) (7,424 )

(31,340 ) (26,292 ) Non-GAAP net income $ 77,480 $ 57,466

$ 241,421 $ 174,193

Weighted average shares used in computing GAAP diluted

income per share attributable to common stockholders 74,384

72,062 73,222 71,411 GAAP diluted net

income per share attributable to common stockholders $ 0.79 $ 0.60

$ 2.50 $ 1.67 Net income attributable to participating securities —

0.01 0.02 0.03 Non-GAAP adjustments to net income 0.25 0.19

0.78 0.74 Non-GAAP diluted net income per

share $ 1.04 $ 0.80 $ 3.30 $ 2.44

Summary of Stock-Based Compensation Expense Cost of revenue

$ 1,004 $ 842 $ 3,620 $ 3,048 Research and development 8,830 7,171

31,892 25,515 Sales and marketing 4,292 3,316 15,666 11,454 General

and administrative 2,198 1,649 7,854 5,286

Total $ 16,324 $ 12,978 $ 59,032 $

45,303

ARISTA NETWORKS, INC.

Consolidated Balance Sheets

(Unaudited in thousands)

December 31, 2016 2015

ASSETS CURRENT ASSETS: Cash and cash equivalents $ 567,923 $

687,326 Marketable securities 299,910 — Accounts receivable 253,119

144,263 Inventories 236,490 92,129 Prepaid expenses and other

current assets 168,684 50,610 Total current assets

1,526,126 974,328 Property and equipment, net 76,961 79,706

Investments 36,136 36,636 Deferred tax assets 70,960 48,429 Other

assets 18,824 20,791 TOTAL ASSETS $ 1,729,007

$ 1,159,890

LIABILITIES AND STOCKHOLDERS’ EQUITY

CURRENT LIABILITIES: Accounts payable $ 79,457 $ 43,966 Accrued

liabilities 90,951 60,971 Deferred revenue 273,350 122,049 Other

current liabilities 15,795 8,025 Total current

liabilities 459,553 235,011 Income taxes payable 14,498 14,060

Lease financing obligations, non-current 39,593 41,210 Deferred

revenue, non-current 99,585 74,759 Other long-term liabilities

7,958 6,698 TOTAL LIABILITIES 621,187 371,738

Commitments and contingencies STOCKHOLDERS’ EQUITY: Common

stock 7 7 Additional paid-in capital 674,183 537,904 Retained

earnings 435,105 250,916 Accumulated other comprehensive loss

(1,475 ) (675 ) TOTAL STOCKHOLDERS’ EQUITY 1,107,820 788,152

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 1,729,007

$ 1,159,890

ARISTA NETWORKS, INC.

Consolidated Statements of Cash

Flows

(Unaudited in thousands)

Year Ended December 31, 2016

2015 CASH FLOWS FROM OPERATING ACTIVITIES: Net income

$ 184,189 $ 121,102 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

19,749 13,671 Stock-based compensation 59,032 45,303 Deferred

income taxes (21,720 ) (24,409 ) Excess tax benefit on stock

based-compensation (42,855 ) (37,251 ) Amortization of investment

premiums 1,493 1,471 Changes in operating assets and liabilities:

Accounts receivable (108,856 ) (47,281 ) Inventories (144,361 )

(14,123 ) Prepaid expenses and other current assets (115,074 )

(7,827 ) Other assets 2,866 (3,087 ) Accounts payable 38,678 9,037

Accrued liabilities 30,629 20,398 Deferred revenue 176,126 90,340

Income taxes payable 42,650 32,018 Other liabilities 8,894

1,171 Net cash provided by operating activities 131,440

200,533

CASH FLOWS FROM INVESTING ACTIVITIES:

Proceeds from marketable securities 137,855 208,200 Purchases of

marketable securities (439,711 ) — Purchases of property and

equipment (21,419 ) (19,989 ) Other investing activities (2,500 ) —

Change in restricted cash (204 ) (4,041 ) Net cash provided by

(used) in investing activities (325,979 ) 184,170

CASH

FLOWS FROM FINANCING ACTIVITIES: Principal payments of lease

financing obligations (1,336 ) (1,086 ) Proceeds from issuance of

common stock upon exercising options, net of repurchases 24,855

17,835 Minimum tax withholding paid on behalf of employees for net

share settlement (1,100 ) — Proceeds from issuance of common stock,

employee stock purchase plan 10,326 9,366 Excess tax benefit on

stock-based compensation 42,855 37,251 Issuance costs from initial

public offering — (261 ) Net cash provided by financing

activities 75,600 63,105 Effect of exchange rate

changes (464 ) (513 ) NET INCREASE/(DECREASE) IN CASH AND CASH

EQUIVALENTS (119,403 ) 447,295 CASH AND CASH EQUIVALENTS—Beginning

of year 687,326 240,031 CASH AND CASH EQUIVALENTS—End

of year $ 567,923 $ 687,326

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170216006185/en/

Arista Networks, Inc.Investor Contact:Chuck Elliott,

408-547-5549Business and Investor Developmentelliott@arista.comorCharles Yager,

408-547-5892Product and Investor Advocacycyager@arista.com

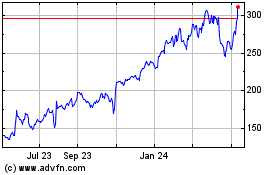

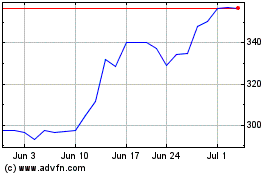

Arista Networks (NYSE:ANET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arista Networks (NYSE:ANET)

Historical Stock Chart

From Apr 2023 to Apr 2024