Today's Top Supply Chain and Logistics News From WSJ

February 16 2017 - 7:11AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

U.S. agriculture exporters may be concerned about tough talk on

trade, but they're not seeing the impact in overseas markets. The

chief executive of Bunge Ltd., one of the world's big commodities

traders, tells the WSJ's Jacob Bunge the balance between price and

supply remains the major factor that purchasers of U.S.-grown crops

consider in moving goods around the world. Agricultural traders

have watched warily as Mr. Trump ratcheted up criticism of trade

policies, and some are looking at the risks to their supply chains.

Archer Daniels Midland Co. says it is prepared to adjust its

grain-processing operations in the event of new trade waves. Recent

figures from U.S. ports suggest exports are steaming ahead: the

ports of Los Angeles and Long Beach reported a combined 20.5%

year-over-year increase in outbound flows in January. Still, the

volume was down from the previous three months, a slowdown that may

get the attention of some exporters.

Manufacturers of pickup trucks have special reasons to be

worried if the U.S. scuttles the North American Free Trade

Agreement. Companies including General Motors Co., Toyota Motor

Corp. and Fiat Chrysler Automobiles NV could see the immediate end

to an exemption from a 25% duty the U.S. imposes on all pickup

trucks and some work vans produced outside the country, the WSJ's

Robbie Whelan reports. The exemption to what's known colorfully as

the "chicken tax" is included in Nafta, and trade experts say it

would disappear if the trade agreement is gutted -- highlighting

the way Nafta's many provisions have been embedded into the costs

of products. The tax originated in a trade dispute between the U.S.

and West Germany back I the 1960s over American poultry exports.

For pickup truck makers and buyers, dropping it would amount to

more than chicken feed: Last year through November, the U.S.

imported $18.5 billion worth of vehicles from Mexico that would be

subject to the tax.

The U.S. business community in China is starting to line up

behind calls for a tit-for-tat approach with Beijing on trade and

investment. After years of caution, the WSJ's Mark Magnier and Josh

Chin report, the companies are embracing some of the Trump

administration's tough talk in hopes of gaining better access to

China's markets. Shipping and logistics companies would certainly

like better access. Many Western freight operators that once sought

big returns in China have tamped down investment and expectations

as they've grown frustrated along with other companies at the

country's restrictive industrial and economic policies. Now, the

American businesses say they want reciprocity. Some point as an

example to Chinese e-commerce giant Alibaba Group Holding Ltd.,

which is able to run its own data center in Silicon Valley while

rival Amazon.com Inc. and other U.S. companies are only allowed to

invest in Chinese cloud businesses with local partners.

ECONOMY & TRADE

U.S. consumers and factories are doing their part to match the

growing shipping demand. New reports this week point to more goods

moving through the economy, the WSj's Ben Leubsdorf reports,

suggesting solid momentum to start the year. Retail sales expanded

5.6% year-over-year in January and even picked up from December,

growth that came as retailers maintained imports at a healthy pace

following the holidays in an apparent display of confidence in the

consumer economy. The sales expansion comes as retailers seem to

have exerted greater discipline in stocking -- the industry's

inventory-to-sales ratio has been at relatively low levels after

store owners piled up goods far beyond demand earlier last year.

The economic growth isn't changing some bigger underlying trends

however: department store sales fell last month from a year ago

while sales at "non-store retailers," including e-commerce

companies, saw sales grow 12%.

A battle over online payments in the European Union is a fresh

reminder that e-commerce regulation remains a work in progress.

Business groups are slamming a European Union proposal that would

require customers to enter extra security information for online

purchases above a nominal amount, the WSJ's Todd Buell reports,

saying tighter controls could cut online sales by more than $11

billion a year. Credit-card companies and e-commerce associations

worry customers will abandon online purchases if they become too

cumbersome, while consumer groups insist there shouldn't be

tradeoff in protections against fraud. The battle comes as retail

groups in the U.S. are still seeking changes that would make it

easier for states to collect sales taxes on online purchases. With

forecasts of strong growth in cross-border e-commerce demand, those

questions will only grow larger as more consumers shop beyond their

home countries.

QUOTABLE

IN OTHER NEWS

Japan's SoftBank Group is buying Fortress Investment Group LLC,

which owns regional railroads Florida East Coast Railway and

RailAmerica. (WSJ)

Retail-industry executives told President Donald Trump at a

White House meeting a proposed import tax would have "profound

implications" as it raises prices for consumers. (WSJ)

European Union lawmakers approved a preferential trade deal with

Canada. (WSJ)

The eurozone recorded its largest annual trade surplus since the

euro currency was established in 1999, helped by expanding exports

late last year. (WSJ)

Canadian factory sales surged at a surprising 2.3% pace in

December. (WSJ)

U.S. motor-vehicle fatalities rose 6% last year to the highest

level since 2007, as vehicle miles traveled rose 3%. (WSJ)

U.S. Steel Corp. is withdrawing a legal claim that hackers in

China stole a key recipe for high-tech steel. (WSJ)

The European Parliament voted to include international shipping

in Europe's emissions trading system. (Ship & Bunker)

CMA CGM SA joined Maersk Line in agreeing to sell container

shipping space through Alibaba Group Holding Ltd. (The

Loadstar)

Mediterranean Shipping Co. is in talks to acquire a stake in

Italy-based cargo vessel operator Linea Messina. (Reuters)

Japan Post is planning job cuts at the Toll Group amid reports

the freight business it acquired in 2015 is foundering. (

Australian Financial Review)

Wal-Mart Stores Inc. denies a report in the Korea Times that the

retailer has terminated contracts with South Korean ocean carriers.

(American Shipper)

Amazon.com Inc. is opening a bookstore in Walnut Creek, Calif.,

its first move into the San Francisco Bay area. (San Francisco

Chronicle)

Amazon will lease a 1 million-square-foot distribution center in

Eastvale, Calif., in the state's Inland Empire due to open next

year. (Chain Store Age)

Roll-on/roll-off cargo, which includes farm and construction

equipment, fell nearly 8% at the Port of Baltimore last year.

(Baltimore Sun)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

February 16, 2017 06:56 ET (11:56 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

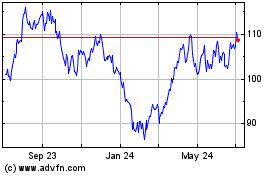

Bunge Global (NYSE:BG)

Historical Stock Chart

From Mar 2024 to Apr 2024

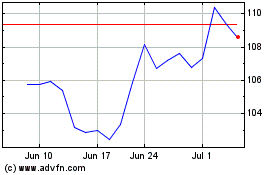

Bunge Global (NYSE:BG)

Historical Stock Chart

From Apr 2023 to Apr 2024