Current Report Filing (8-k)

February 16 2017 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2017 (February 7, 2017)

EDUCATIONAL DEVELOPMENT CORPORATION

(

Exact name of registrant as specified in its charter

)

|

Delaware

|

|

000-04957

|

|

73-0750007

|

|

(

State or other jurisdiction of

incorporation or organization

)

|

|

(Commission file number)

|

|

(I.R.S. Employer

Identification No.

)

|

5402 South 122nd East Avenue, Tulsa, Oklahoma

74146

(

Address of principal executive offices and Zip Code

)

(918) 622-4522

(

Registrant’s telephone number, including area code

)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On February 7 2017, Educational Development Corporation (“the Company”) and MidFirst Bank (“the Lender”) entered into a Fourth Amendment Loan Agreement. This amendment granted a waiver related to the “Debt to Worth Ratio” of our Loan Agreement with which we were in violation of at the time our financial statements dated November 30, 2016 were filed. In addition, the agreement deleted the “Debt to Worth Ratio” provision and substituted a new covenant “Minimum Tangible Net Worth” calculation, along with a modification in the “Funded Debt to EBITDA Ratio” to an "Adjusted Debt to EBITDA Ratio”. Management believes these changes in covenants have a favorable impact on covenant compliance and management does not expect to be out of compliance in the foreseeable future. Finally, the amendment suspends dividends and stock buybacks.

The Company has experienced extraordinary growth the past two years. Net revenues in Fiscal Year 2015 were $33 million, Fiscal Year 2016 $64 million, and Fiscal Year ending February 2017 projected to reach $109 million. This growth has required the Company to invest in additional inventory, warehouse fulfillment equipment and software upgrades. Management believes it is in the best interest of the shareholders to suspend the dividend and focus all resources and cash requirements toward financing future growth.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Educational Development Corporation

By:

/s/ Randall W. White

Randall W. White

President and Chief Executive Officer

Date: February 15, 2017

EXHIBIT INDEX

Exhibit

Description of Exhibit

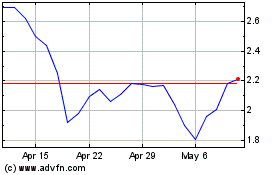

Educational Development (NASDAQ:EDUC)

Historical Stock Chart

From Mar 2024 to Apr 2024

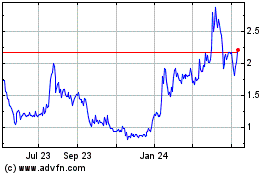

Educational Development (NASDAQ:EDUC)

Historical Stock Chart

From Apr 2023 to Apr 2024