Anthem Countersues After Cigna Ends Deal -- WSJ

February 16 2017 - 3:02AM

Dow Jones News

By Anna Wilde Mathews

Anthem Inc. responded to a suit by Cigna Corp. with its own suit

against its merger partner, escalating the hostilities between the

two health insurers in the wake of a judge's decision that their

$48 billion deal violated antitrust law.

In its suit, filed like Cigna's in the Delaware Court of

Chancery, Anthem said it sought a temporary restraining order to

block Cigna from ending their pact. It also sought to force Cigna

to adhere to the terms of their deal and requested damages. Anthem

said it was reacting to "Cigna's campaign to sabotage the merger

and to try to deflect attention from its repeated willful breaches

of the merger agreement."

Anthem's move is a fast response to Cigna's announcement Tuesday

that it was terminating their agreement and pursuing litigation

seeking a $1.85 billion breakup fee plus more than $13 billion in

damages from its deal partner. Cigna had said that Anthem violated

the terms of their agreement, and that its strategy had led to the

rejection of the deal.

Anthem argued Cigna doesn't have the right to end their

agreement, which it said it has extended to April 30.

The twin suits come after months of growing discord between the

two companies, which had originally announced they would combine in

2015 amid an industry merger frenzy. Both had previously accused

the other of breaches of their agreement.

Last week, U.S. District Judge Amy Berman Jackson blocked their

combination on antitrust grounds, saying it would create an

unacceptable reduction in the number of companies able to serve

large multistate employers that insure their workers.

The decision followed a similar one by a different judge

regarding the $34 billion acquisition of Humana Inc. by Aetna Inc.

Those two health insurers said Tuesday they were calling it quits,

jointly agreeing to end their merger. That, combined with Cigna's

announcement that it wanted out of its Anthem pact, all but quashed

a deal boom that would have reshaped the industry and marked a

triumph for the Obama administration's antitrust enforcers, which

sued to halt both deals last July.

Anthem is appealing the judge's antitrust ruling against its

acquisition, an effort that faces an uphill battle. Even if it is

able to keep Cigna in the fold until the end of April, that is

almost certainly not enough time to clear the various legal and

regulatory hurdles the insurer must overcome to complete a

deal.

Cigna said Tuesday that the merger "cannot and will not achieve

regulatory approval" and that "terminating the agreement is in the

best interest of Cigna's shareholders."

But Anthem said Wednesday that it "believes that there is still

sufficient time and a viable path forward potentially to complete

the transaction" and it is "committed to completing this

value-creating merger either through a successful appeal or through

settlement with the new leadership at the Department of

Justice."

Merging parties don't often appeal adverse court rulings because

of the time, money and uncertainty involved in trying to keep a

deal together during prolonged litigation. It could be weeks or

months before a new Trump administration Justice Department

antitrust team is fully in place. Even if such talks did unfold,

Anthem would have to overcome the court ruling that says

unequivocally the deal violates federal antitrust law.

Tim Greaney, a professor at Saint Louis University School of

Law, said that Anthem's appeal was very unlikely to be resolved

before the end of April. "I don't see how that could be done," he

said, because even if an appeals court disagreed with the antitrust

decision, it would likely remand the matter back to Judge

Jackson.

In her ruling, Judge Jackson called the rift between the two

partners "the elephant in the courtroom." Analysts have long said

litigation between the two appeared likely if a judge blocked their

merger. For months, the two companies waged battles over strategy,

direction and leadership that have become increasingly public.

During antitrust trial proceedings that began in November,

Anthem mounted a legal defense of the merger single-handedly. Cigna

lawyers said very little during the proceedings, and when they did,

it usually didn't help Anthem's position.

In its statement Wednesday, Anthem offered a detailed timeline

of what it said were Cigna's actions that had led to the rejection

of their combination, going back to their efforts to win Justice

Department approval. During the antitrust trial, Anthem had sought

to minimize differences between the two companies, as it argued

that they could still successfully forge a unified insurer.

For its part, Cigna said Tuesday that Anthem had breached their

agreement by not using its "reasonable best efforts" to win

regulatory approval for the deal.

Write to Anna Wilde Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

February 16, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

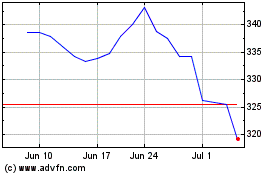

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

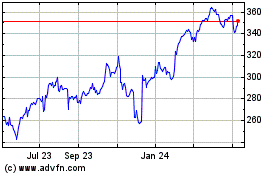

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024