Virgin Media Secured Finance PLC Announces a Supplement to the Offering Memorandum Containing Virgin Media Inc.’s Prelimina...

February 16 2017 - 3:00AM

Business Wire

Virgin Media Secured Finance PLC (the “Issuer”) today

announced that it has published a supplement dated February 16,

2017 (the “Supplement”) to the offering memorandum dated

February 8, 2017 (the “Offering Memorandum”) relating to (i)

its offer to exchange (the “Exchange Offer”) any and all of

its outstanding sterling denominated 5.5% senior secured notes due

2021 (the “Original Sterling Notes”) for new

sterling-denominated 6.0% senior secured notes due 2025 (the

“New Notes”) and (ii) its solicitation (the “Consent

Solicitation” and, together with the Exchange Offer, the

“Offer”) of consents (the “Consents”) from Eligible

Holders participating in the Exchange Offer to make certain

proposed amendments to the indenture governing the Original

Sterling Notes (the “Proposed Amendments”). The

information in the Supplement supplements and amends the Offering

Memorandum and supersedes the information in the Offering

Memorandum to the extent inconsistent with the information in the

Offering Memorandum. Capitalized terms used herein and not

otherwise defined have the meanings ascribed to them in the

Offering Memorandum, as supplemented by the Supplement.

On February 15, 2016, Liberty Global plc (“Liberty

Global”) provided selected, preliminary unaudited financial and

operating information for certain of its fixed-income borrowing

groups, including Virgin Media Inc. and its subsidiaries (the

“Virgin Media Group”), for the three and twelve months ended

December 31, 2016 by posting a press release to its website. The

Supplement contains selected preliminary unaudited financial and

operating information of the Virgin Media Group for the three and

twelve months ended December 31, 2016.

The Offer is being made solely pursuant to the Offering

Memorandum (as supplemented by the Supplement).The terms and

conditions of the Offer, how to tender Original Sterling Notes in

the Offer and deliver Consents thereby, and certain conditions to

the Offer are set forth in the Offering Memorandum, as supplemented

by the Supplement. The Offering Memorandum and the Supplement

contain important information that should be read carefully before

any decision is made with respect to the Offer. The Exchange Offer

and Consent Solicitation will expire at 11:59 p.m., New York time,

on March 9, 2017, (as it may be extended, the “Expiration

Time”). Tendered Original Sterling Notes may be validly

withdrawn at any time prior to the earlier of (i) the Early

Exchange Deadline and (ii) the date on which the requisite consents

to the Proposed Amendments are received, but not thereafter.

Copies of the Offering Memorandum and Supplement can be obtained

by Eligible Holders of the Original Sterling Notes from the

Exchange Agent and Information Agent at the telephone number

below.

Virgin Media Secured Finance PLCMedia HouseBartley Wood Business

ParkHook, Hampshire RG27 9UPUnited Kingdom Vani Bassi, Head of

Investor Relations, +44 1256 752347Issued by: Virgin Media Secured

Finance PLC

About Virgin Media

Virgin Media offers four multi award-winning services across the

UK and Ireland: broadband, TV, mobile phone and landline. The

company’s dedicated, ultrafast network delivers the fastest widely

available broadband speeds to homes and businesses. We’re expanding

this through our £3bn Project Lightning programme to pass an

incremental 4 million premises. Our interactive TV service brings

live programmes, thousands of hours of on-demand programming and

the best apps and games in a set-top box, as well as on-the-go

services for tablets and smartphones. We launched the world’s first

virtual mobile network, offering fantastic value and services. We

are also one of the largest fixed-line phone providers in the UK

and Ireland. Through Virgin Media Business, we support

entrepreneurs, businesses and the public sector, delivering the

fastest speeds and tailor-made services. Virgin Media is part of

Liberty Global, the world’s largest international cable company,

with operations in more than 30 countries.

Disclaimer

None of the Issuer, Credit Suisse Securities (Europe) Limited

(the “Dealer Manager”), the trustee of the New Notes, the

trustee of the Original Sterling Notes, the Information Agent, or

the Exchange Agent (or their respective directors, employees or

affiliates) makes any recommendation as to whether or not Eligible

Holders of the Original Sterling Notes should submit Original

Sterling Notes for exchange and deliver Consents with respect to

such notes thereby. This announcement does not constitute the

solicitation of an offer to buy or an offer to sell Original

Sterling Notes or New Notes, as applicable, or a solicitation of

Consents, in any jurisdiction in which such offer, sale or

solicitation would be unlawful. The Offer is only being made (1) to

“qualified institutional buyers” as defined in Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”),

in a private transaction in reliance upon the exemption from the

registration requirements of the Securities Act provided by Section

4(a)(2) thereof and (2) outside the United States to persons that

are not “U.S. persons,” as such term is defined in Rule 902 of

Regulation S (“Regulation S”) under the Securities Act and

who would be participating in any transaction in accordance with

Regulation S. Holders of the Original Sterling Notes who have

certified to the Issuer that they are eligible to participate in

the Offer pursuant to at least one of the foregoing conditions are

referred to as “Eligible Holders”. The New Notes to be

offered have not been, and will not be, registered under the

Securities Act and may not be offered or sold in the United States

absent an applicable exemption from registration requirements.

This announcement does not describe all the material terms of

the Offer and no decision should be made by any holder of the

Original Sterling Notes on the basis of this announcement. The

complete terms and conditions of the Offer are described in the

Offering Memorandum and the Supplement. This announcement must be

read in conjunction with the Offering Memorandum and the

Supplement. The Offering Memorandum and the Supplement contain

important information which should be read carefully before any

decision is made with respect to the Offer. Additionally, the

Offering Memorandum and the Supplement contain forward-looking

statements and information that is necessarily subject to risks,

uncertainties and assumptions. No assurance can be given that the

Offer described herein will be consummated. The Issuer assumes no

obligations to update or correct the information contained in this

announcement. See “Forward-Looking Statements” and “Risk Factors”

in the Offering Memorandum for a more complete discussion of

certain factors that could affect Virgin Media Inc.’s future

performance and results of operation. If any holder is in any doubt

as to the contents of this announcement or the Offer or the action

it should take, it is recommended to seek its own financial and

legal advice, including in respect of any tax consequences,

immediately from its stockbroker, bank manager, solicitor,

accountant or other independent financial, tax or legal adviser.

Any individual or company whose Original Sterling Notes are held on

its behalf by a broker, dealer, bank, custodian, trust company or

other nominee must contact such entity if it wishes to exchange

such Original Sterling Notes and deliver its Consent thereby

pursuant to the Offer.

The information contained in this announcement does not

constitute an invitation or inducement to engage in investment

activity within the meaning of the United Kingdom Financial

Services and Markets Act 2000. In the United Kingdom, this

announcement is being distributed only to, and is directed only to

persons who (i) are investment professionals, as such term is

defined in Article 19(5) of the Financial Services and Markets Act

2000 (Financial Promotion) Order 2005 (as amended, the

“Financial Promotion Order”), (ii) are persons falling

within Article 49(2)(a) to (d) (“high net worth companies,

unincorporated associations, etc.”) of the Financial Promotion

Order, (iii) are outside the United Kingdom, or (iv) are

persons to whom an invitation or inducement to engage in investment

activity (within the meaning of section 21 of the Financial

Services and Markets Act 2000 (“FSMA”)) in connection with

the issue or sale of any New Notes may otherwise lawfully be

communicated or caused to be communicated (all such persons

together being referred to as “Relevant Persons”).The

information contained in this announcement must not be acted on or

relied on in the United Kingdom by persons who are not Relevant

Persons. In the United Kingdom, the New Notes are and any

investment or investment activity to which this announcement

relates, is available only to Relevant Persons, and will be engaged

in only with such persons. Any person who is not a Relevant Person

should not act or rely on the information contained in this

announcement.

Holders of Original Sterling Notes with questions regarding

the Offer procedures should contact the Exchange Agent and/or

Information Agent for further information. All other questions

concerning the Offer should be directed to the Dealer

Manager.

Disclosure of inside information by Virgin Media Secured Finance

plc under Article 17(1) of Regulation (EU) 596/2014.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170216005455/en/

Dealer ManagerCredit Suisse

Securities (Europe) LimitedOne Cabot SquareLondon E14 4QJUnited

KingdomTelephone: +44 (0)207 883 8763Attention: The Liability

Management DeskEmail:

liability.management@credit-suisse.comorExchange Agent and Information AgentLucid

Issuer Services LimitedAttention: Sunjeeve Patel / Paul

KammingaTel: +44 (0)20 7704 0880Email: virginmedia@lucid-is.com

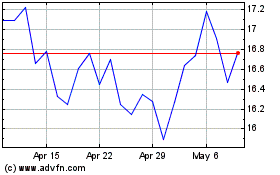

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

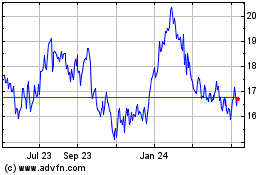

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024