UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

Check the appropriate box:

|

x

|

Preliminary Information Statement

|

|

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

¨

|

Definitive Information Statement

|

|

COOL TECHNOLOGIES, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g)

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

Amount previously paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule, or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

COOL TECHNOLOGIES, INC.

8875 Hidden River Parkway

Tampa, Florida 33637

February __, 2017

Dear Stockholders:

The enclosed Information Statement is being furnished to the holders of record of the shares of the common stock (the “

Common Stock

”) of Cool Technologies, Inc., a Nevada corporation (the “

Company)

, as of the close of business on the record date, February 24, 2017 (the “

Record Date

”). The purpose of the Information Statement is to notify our stockholders that on February 10, 2017, the Company received a joint written consent in lieu of a meeting (the “

Joint Written Consent

”) from the members of the Board of Directors (the “

Board

”) and the holders of all of the issued and outstanding shares of Series B preferred stock representing 66 2/3% of the voting stock of the Company (the “

Consenting Stockholders”)

. The Joint Written Consent adopted resolutions which authorized the Company to act on a proposal to amend the Articles of Incorporation of the Company from 140,000,000 to 350,000,000 shares of Common Stock of the Company.

You are urged to read the Information Statement in its entirety for a description of the action taken by the Consenting Stockholders of the Company. The action will become effective on a date that is not earlier than twenty-one (21) calendar days after this Information Statement is first mailed to our stockholders.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The enclosed Information Statement is being furnished to you to inform you that the foregoing action has been approved by the Consenting Stockholders. Because the Consenting Stockholders have voted in favor of the foregoing actions, and have sufficient voting power to approve such actions through their ownership of Common Stock, no other stockholder consents will be solicited in connection with the transactions described in this Information Statement. The Board is not soliciting your proxy in connection with the adoption of the resolution, and proxies are not requested from stockholders.

This Information Statement is being mailed on or about February 24, 2017 to stockholders of record on the Record Date.

|

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

|

/s/ Timothy Hassett

|

|

|

|

|

Timothy Hassett

|

|

|

|

|

Chairman and Chief Executive Officer

|

|

COOL TECHNOLOGIES, INC.

8875 Hidden River Parkway

Tampa, Florida 33637

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

_____________________________________

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being furnished to the holders of record of the shares of the common stock (the “Common Stock”) of Cool Technologies, Inc., a Nevada corporation (the “

Company”

), as of the close of business on the record date, February 24, 2017 (the “

Record Date

”). The purpose of the Information Statement is to notify our stockholders that on February 10, 2017, the Company received a joint written consent in lieu of a meeting (the “

Joint Written Consent

”) from the members of the Board of Directors (the “

Board

”) and the holders of all of the issued and outstanding shares of Series B preferred stock (the “

Series B Stock”)

of the Company representing 66 2/3% of the voting stock of the Company (the “

Consenting Stockholders”)

. The Joint Written Consent adopted resolutions which authorized the Company to act on a proposal to amend its Articles of Incorporation to increase the amount of authorized shares of Common Stock from 140,000,000 to 350,000,000 shares of common stock.

The Board believes that the amendment to the Articles of Incorporation (the “Amendment”) is beneficial to the Company. The full text of the Amendment is attached as

Appendix A

to this Information Statement.

The action will become effective on a date that is not earlier than twenty one (21) calendar days after this Information Statement is first mailed to our stockholders.

Because the Consenting Stockholders have voted in favor of the foregoing action, and have sufficient voting power to approve such actions through their ownership of Common Stock, no other stockholder consents will be solicited in connection with the transactions described in this Information Statement. The Board is not soliciting proxies in connection with the adoption of these resolutions, and proxies are not requested from stockholders.

In accordance with our bylaws, our Board has fixed the close of business on February 24, 2017 as the record date for determining the stockholders entitled to notice of the above noted actions. This Information Statement is being mailed on or about February 24, 2017 to stockholders of record on the Record Date.

Under Nevada law, stockholders have no appraisal or dissenters’ rights in connection with the proposed amendment.

DISTRIBUTION AND COSTS

We will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. In addition, we will only deliver one Information Statement to multiple security holders sharing an address, unless we have received contrary instructions from one or more of the security holders. Also, we will promptly deliver a separate copy of this Information Statement and future stockholder communication documents to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and future stockholder communication documents to any security holder or holders sharing an address to which multiple copies are now delivered, upon written request to us at our address noted above.

Security holders may also address future requests regarding delivery of information statements by contacting us at the address noted above.

VOTE REQUIRED; MANNER OF APPROVAL

Approval to implement the amendment to the Articles requires the affirmative vote of the holders of a majority of the voting power of the Company. There are currently 113,238,236 shares of Common Stock outstanding, and each share of Common Stock is entitled to one vote. Based on information and belief, there are currently 100 shares of Series A preferred stock (“

Series A Stock

”) outstanding. Each share of Series A Stock has the voting right of 50,000 shares of Common Stock. There are currently 3,636,360 shares of Series B Stock outstanding. For so long as the Series B Stock is issued and outstanding, the holders of Series B Stock shall vote together as a single class with the holders of the Common Stock and the holders of any other class or series of shares entitled to vote with the Common Stock, with the holders of Series B Stock being entitled to 66 2/3% of the total votes on all such matters. Because all of holders of the Series B Stock having 66 2/3% of the voting rights of the Company have voted in favor of the foregoing action, and have sufficient voting power to approve such actions through their ownership of Series B Stock, no other stockholder consents will be solicited in connection with the transaction described in this Information Statement. The Board is not soliciting proxies in connection with the adoption of these proposals, and proxies are not requested from stockholders.

In addition, the Nevada Revised Statutes (the “

NRS

”) provide in substance that stockholders may take action without a meeting of the stockholders and without prior notice if a consent or consents in writing, setting forth the action so taken, is signed by the holders of the outstanding voting shares holding not less than the minimum number of votes that would be necessary to approve such action at a stockholders meeting. The action is effective when written consents from holders of record of a majority of the outstanding shares of voting stock are executed and delivered to the Company.

Written consent was received from the holders of all of the issued and outstanding holders of the Series B Stock having 66 2/3% voting power. Accordingly, the necessary majority of votes necessary to implement the proposed amendment to the Articles was received. In accordance with our bylaws, the Board has fixed the close of business on February 24, 2017 as the record date for determining the stockholders entitled to vote or give written consent.

On February 10, 2017, the Board and the Consenting Stockholders executed and delivered to the Company the Joint Written Consent. Accordingly, in compliance with the NRS, at least a majority of the total voting stock of the Company have approved the amendment. As a result, no vote or proxy is required by the stockholders to approve the adoption of the foregoing actions.

REASON FOR THE AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK FROM 140,000,000 SHARES TO 350,000,000 SHARES OF COMMON STOCK.

The Company’s current Articles of Incorporation authorizes the issuance of 140,000,000 shares of Common Stock. As of February 12, 2017, there were 113,238,236 shares of Common Stock issued and outstanding.

The purpose of the proposed increase in authorized share capital is to make available additional shares of Common Stock for issuance of all the current outstanding convertible securities and for general corporate purposes without the requirement of further action by the stockholders of the Company. We currently have outstanding convertible debentures which will require the issuance of 22,083,933 shares of common stock if all such indebtedness would convert (assuming individual conversion rates which range from $0.025 to $0.08 per share). Also, we currently have 650,000 shares due to be issued as part of a private placement agreement with an accredited investor and 150,000 inducement shares to be issued as part of an agreement to sell a promissory note. Also, we currently have 4,000,000 options and 53,201,091 warrants issued and outstanding, which would require the issuance of 57,201,091 shares of common stock if all such options and warrants would be exercised. Finally, an investor to whom we have a debt obligation has a call right to require the Company to sell him 4,000,000 shares at $0.05 per share. We also hope to be able to require Bellridge Capital LP to purchase shares of our common stock pursuant to the terms and provisions of the Securities Purchase Agreement. See the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission on December 12, 2016 for a description of our arrangement with Bellridge Capital.

The Company recently informed its shareholders that it will be effectuating a 1:15 reverse stock split. See the Schedule 14C Information Statement filed by the Company with the Securities and Exchange Commission on November 23, 2016. As a result of such reverse stock split, the current amount of issued and outstanding shares will be decreased but the number of authorized shares of common stock would remain the same, i.e., 140,000,000. It was the expectation of the Company that upon the effectiveness of the reverse stock split the Company would have sufficient shares of common stock to issue to the holders of the outstanding convertible debentures, options and warrants as well any other contractual obligations to issue shares. However, since FINRA has not yet declared the reverse stock split effective, the Company will need to increase the number of authorized shares of common stock by amending its Articles of Incorporation.

In addition, the Company will need additional authorized shares in connection with establishing additional employee or director equity compensation plans or arrangements or for other general corporate purposes, including without limitation raising capital. There is currently no formal agreement or arrangement with respect to any of the foregoing other than as described above. Increasing the authorized number of shares of the Common Stock of the Company will provide the Company with greater flexibility and allow the issuance of additional shares of Common Stock in most cases without the expense or delay of seeking further approval from the stockholders.

The shares of Common Stock do not carry any pre-emptive rights. The adoption of the Amendment will not of itself cause any changes in the Company’s capital accounts.

The increase in authorized share capital will not have any immediate effect on the rights of existing holders of the Company’s Common Stock. However, the Board of Directors will have the authority to issue authorized shares of Common Stock without requiring future approval from the stockholders of such issuances, except as may be required by applicable law. To the extent that additional authorized shares of Common Stock are issued in the future, they will decrease the existing stockholders’ percentage equity ownership interests and, depending upon the price at which such shares of common stock are issued, could be dilutive to the existing stockholders. Any such issuance of additional shares of Common Stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of Common Stock of the Company.

One of the effects of the increase in authorized share capital, if adopted, however, may be to enable the Board to render it more difficult to or discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of present management. The Board would, unless prohibited by applicable law, have additional shares of Common Stock available to effect transactions (including private placements) in which the number of the Company’s outstanding shares would be increased and would thereby dilute the interest of any party attempting to gain control of the Company. Such action, however, could discourage an acquisition of the Company which the stockholders of the Company might view as desirable.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table lists, as of February 7, 2017, the number shares of common stock beneficially owned by (i) each person or entity known to the Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each executive officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership of common stock by our principal stockholders and management is based upon information furnished by each person using “beneficial ownership” concepts under the rules of the SEC. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power. Unless otherwise indicated, the business address of each such person is c/o Cool Technologies, Inc., 8875 Hidden River Parkway, Suite 300, Tampa, Florida 33637.

The percentages below are calculated based on 113,238,236 issued and outstanding shares of common stock and 100 issued and outstanding shares of Series A Stock (each such share of Series A Stock has the voting right of 50,000 shares of Common Stock) as of February 7, 2017.

|

Name of Beneficial Owner

|

|

Number of Shares Beneficially

Owned

|

|

|

Percentage

|

|

|

|

|

|

|

|

|

|

|

5% or Greater Stockholders

Spirit Bear Limited (1)

1470 First Avenue, No. 4a

New York, NY 10075

|

|

|

11,074,854

|

(2)

|

|

8.97

|

%

|

|

|

|

|

|

|

|

|

|

|

Gemini Master Fund, Ltd. (3)

% Gemini Strategies Inc.

619 Vulcan Avenue, Suite 203

Encinitas, California 92024

|

|

|

13,116,229

|

|

|

11.58

|

%

|

|

|

|

|

|

|

|

|

|

|

Mark Hodowanec

|

|

|

7,100,000

|

(4)

|

|

6.26

|

%

|

|

|

|

|

|

|

|

|

|

|

Eric Paul Brown

1877 S. Wiesbrook Road

Wheaton, Illinois 60189

|

|

|

1,969,998

|

(5)

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

Christopher J. Jones

1314 E. Forest Avenue

Wheaton, Illinois 60189

|

|

|

2,425,452

|

(7)

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

Inverom Corporation (8)

16W235 83

rd

Street, Suite A

Burr Ridge, Illinois 60527

|

|

|

1,818,180

|

(9)

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

KHIC, LLC(10)

120 West 45

th

Street

New York, New York 10036

|

|

|

24,444,914

|

(11)

|

|

17.75

|

%

|

|

|

|

|

|

|

|

|

|

|

Directors and executive officers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Timothy Hassett

|

|

|

8,001,500

|

(12)

|

|

7.00

|

%

|

|

|

|

|

|

|

|

|

|

|

Quentin Ponder

|

|

|

2,800,000

|

(13)

|

|

2.46

|

%

|

|

|

|

|

|

|

|

|

|

|

Judson Bibb

|

|

|

3,868,300

|

(14)

|

|

3.34

|

%

|

|

|

|

|

|

|

|

|

|

|

Christopher McKee

|

|

|

744,444

|

(15)

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

Richard J. "Dick" Schul

|

|

|

500,000

|

(16)

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

Donald Bowman

|

|

|

250,000

|

(17)

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

Daniel C. Ustian

|

|

|

4,562,624

|

(18)

|

|

66.33

|

%(6)

|

|

|

|

|

|

|

|

|

|

|

All executive officers and directors as a group (8 persons)(19)

|

|

|

27,575,568

|

|

|

22.32

|

%

|

____________

* less than 1%

|

(1)

|

Jay Palmer, President of Spirit Bear Limited, has sole voting and disposition power over shares held by Spirit Bear.

|

|

(2)

|

Represents (i) 4,850,000 shares of Common Stock underlying 97 shares of Series A Stock (having voting rights to 50,000 shares of Common Stock for each share of Series A Stock), (ii) currently exercisable warrants to purchase an aggregate of 5,400,000 shares of Common Stock and (iii) 324,854 shares of Common Stock.

|

|

(3)

|

Steven Winters, President of Gemini Strategies Inc., investment manager of Gemini Master Fund, Ltd. has sole voting and dispositive power over shares held by Gemini Master Fund, Ltd.

|

|

(4)

|

Includes options to purchase 1,000,000 shares of Common Stock at $2.00 per share. Excludes 80,000 shares held by Mr. Hodowanec’s minor children and 110,000 shares held by his spouse.

|

|

(5)

|

Includes (i) 909,090 shares of Series B Stock which are convertible by the Series B stockholder into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Common Stock trades in excess of $2.25 for any consecutive 20-day period, (ii) a warrant to purchase 909,090 shares of Common Stock at $0.07 per share and (iii) a warrant to purchase 60,909 shares of Common Stock at $0.75 per share.

|

|

(6)

|

The Series B Stock votes together as a single class with the holders of the Common Stock, with the holders of Series B Stock being entitled to 66 2/3% of the total votes.

|

|

(7)

|

Includes (i) 909,090 shares of Series B Stock which are convertible by the Series B stockholder into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Common Stock trades in excess of $2.25 for any consecutive 20-day period, (ii) a warrant to purchase 909,090 shares of Common Stock at $0.07 per share and (iii) a warrant to purchase 243,636 shares of Common Stock at $0.75 per share

|

|

(8)

|

Roman Kuropas, President of Inverom Corporation, has sole voting and dispositive power over the shares held by Inverom Corporation.

|

|

(9)

|

Includes (i) 909,090 shares of Series B Stock which are convertible into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Common Stock trades in excess of $2.25 for any consecutive 20-day period and (ii) a warrant to purchase 909,090 shares of Common Stock at $0.07 per share. Excludes warrants to purchase 200,000 shares of Common Stock at $0.80 per share held by Roman Kuropas, President of Inverom.

|

|

(10)

|

Eric Hess, member and Secretary of KHIC, LLC, has sole voting and dispositive power over the shares held by KHIC, LLC.

|

|

(11)

|

Represents (i) 150,000 shares of common stock underlying 3 shares of Series A Preferred Stock (having voting rights to 50,000 shares of common stock for each share of Series A Stock), (ii) a currently exercisable warrant to purchase 4,000,000 shares of common stock at $0.06 per share , (iii)14,994,914 shares of Common Stock issuable upon the conversion of a convertible promissory note at a conversion price of $0.025 per share , (iv) a currently exercisable warrant to purchase 650,000 shares of common stock at $0.15 per share , (v) a currently exercisable warrant to purchase 650,000 shares of common stock at $0.12 per share , and (vi) the call right to purchase 4,000,000 shares of common stock until May 8, 2017.

|

|

(12)

|

Includes (i) an option to purchase 1,000,000 shares of Common Stock at $2.00 per share and (ii) a currently exercisable warrant to purchase 625,000 shares of Common Stock at $0.22 per share. Does not include an aggregate of 90,000 shares held by Mr. Hassett’s minor children.

|

|

(13)

|

Includes a currently exercisable warrant to purchase 400,000 shares of Common Stock at $0.22 per share

|

|

(14)

|

Includes (i) options to purchase 2,000,000 shares of Common Stock at $2.00 per share, and (ii) a currently exercisable warrant to purchase 750,000 shares of Common Stock at $0.22 per share.

|

|

(15)

|

Includes (i) a currently exercisable warrant to purchase 222,222 shares of Common Stock at $0.45 per share, (ii) a currently exercisable warrant to purchase 200,000 shares of Common Stock at $0.80, and (iii) currently exercisable warrant to purchase 100,000 shares of Common Stock at $0.27 per share.

|

|

(16)

|

Includes a currently exercisable warrant to purchase 200,000 shares of common stock at $0.50 per share, (ii) a currently exercisable warrant to purchase 100,000 shares of common stock at $0.27 per share, and (iii) a currently exercisable warrant to purchase 100,000 shares of common stock at $0.22.

|

|

(17)

|

Represents a currently exercisable warrant to purchase 250,000 shares of Common Stock at $0.60 per share.

|

|

(18)

|

Includes (i)909,090 shares of Series B Stock which are convertible by Mr. Ustian into Common Stock on a one-to-one basis and automatically convert into Common Stock on a one-to-one basis if the Company’s common stock trades in excess of $2.25 for any consecutive 20-day period, (ii) a currently exercisable warrant to purchase 909,090 shares of Common Stock at $0.07 per share, (iii) a currently exercisable warrant to purchase 222,222 shares of Common Stock at $0.45 per share; (iv) a currently exercisable warrant to purchase 200,000 shares of Common Stock at $0.80 per share, (v) a currently exercisable warrant to purchase 100,000 shares of Common Stock at $0.27, and (vi) a currently exercisable warrant to purchase 1,000,000 shares of Common Stock at $0.22 per share.

|

|

(19)

|

Includes Mark Hodowanec, Chief Technology Officer.

|

INTEREST OF CERTAIN PERSONS IN OR IN

OPPOSITION TO MATTERS TO BE ACTED UPON

No director, executive officer, associate of any officer or director or executive officer, or any other person has any interest, direct or indirect, by security holdings or otherwise, in the increase in the authorized shares of common stock from 140,000,000 to 350,000,000 shares which is not shared by all other stockholders, other than Daniel Ustian, a director of the Company, who is also a holder of 909,090 shares of Series B Stock, and Roman Kuropas, a member of the Company’s Advisory Board, who is the President of Inverom Corporation, a holder of 909,090 shares of Series B Stock. Both Messrs. Ustian and Kuropas consented to the proposed amendment to the increase in the authorized number of shares of common stock.

ADDITIONAL INFORMATION

For more detailed information about the Company, including financial statements, you may refer to our:

Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on March 30, 2016, which contains our audited financial statements;

Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2016 filed with the SEC on May 19, 2016;

Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2016 filed with the SEC on August 22, 2016; and

Quarterly Report on Form 10-Q/A for the quarterly period ended June 30, 2016 filed with the SEC on August 30, 2016.

The reports we file with the SEC and the accompanying exhibits may be inspected without charge at the Public Reference Section of the Commission at 100 F Street, N.E., Washington, DC 20549. Copies of such materials may also be obtained from the SEC at prescribed rates. The SEC also maintains a Web site that contains reports, proxy and information statements and other information regarding public companies that file reports with the SEC. Copies of the Reports may be obtained from the SEC’s EDGAR archives at http://www.sec.gov. We will also mail copies of our prior reports to any stockholder upon written request.

Upon written request, we will furnish without charge to record and beneficial holders of our common stock a copy of any and all of the documents referred to in this Information Statement. These documents will be provided by first class mail. Please make your request to the address or telephone number below.

OTHER MATTERS

The Board knows of no other matters other than those described in this Information Statement which have been approved or considered by the holders of a majority of the shares of the Company’s voting stock.

IF YOU HAVE ANY QUESTIONS REGARDING THIS INFORMATION STATEMENT, PLEASE CONTACT:

Cool Technologies, Inc.

8875 Hidden River Parkway

Tampa, Florida 33637

(813) 975-7467

|

|

|

By Order of the Board,

|

|

|

|

|

|

|

|

|

|

/s/ Timothy Hassett

|

|

|

|

|

Chairman and Chief Executive Officer

|

|

AMENDMENT TO ARTICLES OF INCORPORATION

OF

COOL TECHNOLOGIES, INC.

Cool Technologies, Inc., a corporation organized and existing under the laws of the State of Nevada, hereby certifies as follows:

|

1.

|

The name of the corporation is Cool Technologies, Inc. The date of filing of its original Articles of Incorporation with the Secretary of State was July 21, 2002.

|

|

|

|

|

2.

|

This Amended Articles of Incorporation amends Article II of the Articles of Incorporation of this corporation by increasing the number to shares of common stock the Corporation is authorized from 140,000,000 to 350,000,000.

|

The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in a case of a vote of classes or series or may be required by the provisions of the articles of incorporation in favor of the amendment, is 66%.

|

Signed on this __ day of February, 2017

|

|

|

|

|

|

|

|

|

|

By

|

|

|

|

|

Name:

|

Timothy Hassett

|

|

|

|

Title:

|

Chairman and Chief Executive Officer

|

|

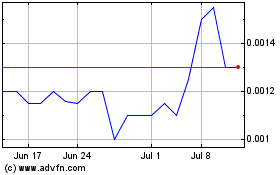

Cool Technologies (PK) (USOTC:WARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cool Technologies (PK) (USOTC:WARM)

Historical Stock Chart

From Apr 2023 to Apr 2024