Current Report Filing (8-k)

February 15 2017 - 7:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2017 (February 14, 2017)

MBIA INC.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Connecticut

|

|

1-9583

|

|

06-1185706

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

1 Manhattanville Road, Suite 301

Purchase, New York

|

|

10577

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

914-273-4545

Not

Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

MBIA Inc. (the “Company”) announced today that the Compensation and Governance Committee of the Board of Directors (the “Committee”) has

approved an amendment (the “Amendment”) to the Amended and Restated MBIA Inc. 2005 Deferred Compensation and Excess Benefit Plan (the “Plan”). The Plan was last amended in 2009, when a cap of $1.5 million on the amount of

eligible annual compensation considered for computing the annual pension contribution under the Plan was introduced. Pursuant to the Amendment, and beginning in 2018 for compensation awarded for the 2017 year, the cap will be increased from $1.5

million to $2.0 million. As a result, the maximum contribution from the Company towards any employee’s pension will rise from $150,000 to $200,000, based on the Company’s payment under the Plan of 10% of eligible annual compensation, which

the Committee considered to be a reasonable cap relative to target annual compensation for senior executives.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

MBIA INC.

|

|

|

|

|

By:

|

|

/s/ Ram D. Wertheim

|

|

|

|

|

|

|

|

Ram D. Wertheim

|

|

|

|

Chief Legal Officer

|

Date: February 15, 2017

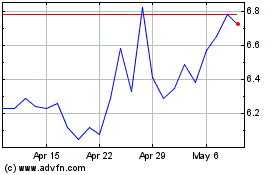

MBIA (NYSE:MBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MBIA (NYSE:MBI)

Historical Stock Chart

From Apr 2023 to Apr 2024