Current Report Filing (8-k)

February 15 2017 - 7:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 14, 2017

(February 8, 2017)

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35666

|

|

45-5200503

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

1790 Hughes Landing Blvd

Suite 500

The Woodlands, TX 77380

(Address of principal executive offices) (Zip Code)

Registrants’ telephone number, including area code:

(832) 413-4770

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

Underwriting Agreement

On February 8, 2017, Summit Midstream Holdings, LLC (“Summit Holdings”), Summit Midstream Finance Corp. (“Finance Corp.” and, together with Summit Holdings, the “Issuers”), Summit Midstream GP, LLC (the “General Partner”), and Summit Midstream Partners, LP (“SMLP”) and certain subsidiary guarantors (collectively, the “Subsidiary Guarantors” and, together with SMLP, the “Guarantors”) entered into an underwriting agreement (the “Underwriting Agreement”) with Merrill Lynch, Pierce, Fenner & Smith Incorporated, as representative of the several underwriters named therein (collectively, the “Underwriters”), to sell $500.0 million aggregate principal amount of the Issuers’ 5.75% Senior Notes due 2025 (the “Notes”). The offering of the Notes (the “Offering”) was registered with the Securities and Exchange Commission (the “Commission”) pursuant to a Registration Statement on Form S-3 (File No. 333-197311), filed by SMLP and the Issuers on July 8, 2014 and as amended on February 8, 2017 (the “Registration Statement”), as supplemented by a prospectus supplement, dated February 8, 2017 (the “Prospectus Supplement”), filed by SMLP and the Issuers with the Commission on February 10, 2017 pursuant to Rule 424(b)(5) under the Securities Act of 1933, as amended.

The Underwriting Agreement contains customary representations, warranties and agreements of the Issuers, the General Partner and the Guarantors, and customary indemnification rights and obligations of the parties.

The Offering is anticipated to close on February 15, 2017 and Summit Holdings intends to use the net proceeds to (i) fund the consideration payable in the concurrent tender offer described in the Prospectus Supplement, and, if necessary, fund the redemption price payable in connection with the redemption of the Issuers' 7.5% Senior Notes due 2021 that remain outstanding following the consummation of the tender offer and (ii) repay a portion of the indebtedness outstanding under Summit Holdings' revolving credit facility.

The foregoing description of the Underwriting Agreement does not purport to be complete and is qualified in its entirety by reference to the Underwriting Agreement, a copy of which is filed as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Relationships

Certain of the Underwriters and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory, investment banking and commercial banking services for the Partnership and its respective affiliates, for which they have received or will receive customary fees and expense reimbursements. In particular, certain of the Underwriters and their affiliates are lenders under Summit Holdings’ revolving credit facility and, therefore, are expected to receive a portion of the net proceeds from the Offering.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

1.1

|

|

Underwriting Agreement, dated as of February 8, 2017, by and among Summit Midstream Holdings, LLC, Summit Midstream Finance Corp., Summit Midstream GP, LLC, the Guarantors named therein and the Underwriters named therein.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Midstream Partners, LP

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

By:

|

Summit Midstream GP, LLC (its general partner)

|

|

|

|

|

|

|

Date:

|

February 14, 2017

|

|

/s/ Matthew S. Harrison

|

|

|

|

|

Matthew S. Harrison, Executive Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

1.1

|

|

Underwriting Agreement, dated as of February 8, 2017, by and among Summit Midstream Holdings, LLC, Summit Midstream Finance Corp., Summit Midstream GP, LLC, the Guarantors named therein and the Underwriters named therein.

|

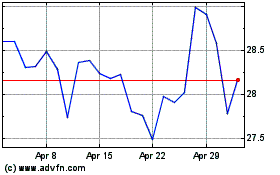

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

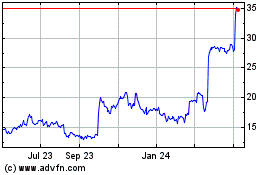

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024