Fourth-Quarter Revenue Grows 86% Year on

Year

Fourth-Quarter Gross Merchandise Volume

(GMV) Grows 94% Year on Year

Shopify reports in U.S. dollars and in accordance with U.S.

GAAP

Shopify Inc. (NYSE:SHOP)(TSX:SHOP), the leading cloud-based,

multi-channel commerce platform designed for small and medium-sized

businesses, today announced strong financial results for the

quarter and full year ended December 31, 2016.

“Our work at Shopify is to help entrepreneurs thrive in a space

that’s changing all the time, and we did our job especially well

this past holiday season,” stated Tobi Lütke, founder and CEO of

Shopify. “That eight of our ten top sellers over the Black Friday

Cyber Monday weekend were merchants that had upgraded from

lower-priced plans reminds us that today’s startups become

tomorrow’s superstars, at a velocity that appears to be increasing

all the time. As the engine powering the growth of these merchants,

Shopify has an opportunity that stretches years into the

future.”

“That we grew revenue by 90% and GMV by 99% for the full year

2016 speaks to the enormous opportunity in retail right now and our

strategic position within it,” commented Russ Jones, Shopify’s CFO.

“Throughout 2017 we will continue to build out our ability to seize

this opportunity by expanding not only our existing features, such

as channels, payments, shipping and capital, but also our

facilities and infrastructure. These investments are timely, as we

expect the number of merchants on Shopify to continue expanding

rapidly and their collective sales volumes to continue to grow at a

rate several times that of overall retail.”

Fourth-Quarter Financial Highlights

- Total revenue in the fourth quarter was

$130.4 million, an 86% increase from the comparable quarter in

2015. Within this, Subscription Solutions revenue grew 63% to $56.4

million. This increase was driven by the continued rapid growth in

Monthly Recurring Revenue1 (“MRR”). The number of merchants on the

Shopify platform surpassed 375,000 in the fourth quarter, as a

record number of merchants joined the platform in the period.

Merchant Solutions revenue grew 108% to $74.0 million, driven

primarily by the growth of Gross Merchandise Volume2 (“GMV”).

- MRR as of December 31, 2016 was

$18.5 million, up 63% compared with $11.3 million as of

December 31, 2015.

- GMV for the fourth quarter was $5.5

billion, an increase of 94% over the fourth quarter of 2015. Gross

Payments Volume ("GPV"), which is the amount of GMV processed

through Shopify Payments, grew to $2.2 billion, which accounted for

39% of GMV processed in the quarter, versus $1.0 billion, or 37%,

for the fourth quarter of 2015.

- Gross profit dollars grew 87% to $68.1

million as compared with the $36.5 million recorded for the fourth

quarter of 2015.

- Operating loss for the fourth quarter

of 2016 was $9.3 million, or 7% of revenue, versus $6.5 million, or

9% of revenue, for the comparable period a year ago.

- Adjusted operating loss3 for the fourth

quarter of 2016 was 1% of revenue, or $0.8 million; adjusted

operating loss for the fourth quarter of 2015 was 2% of revenue, or

$1.3 million.

- Net loss for the fourth quarter of 2016

was $8.9 million, or $0.10 per share, compared with $6.3 million,

or $0.08 per share, for the fourth quarter of 2015.

- Adjusted net loss3 for the fourth

quarter of 2016 was $0.4 million, or $0.00 per share, compared with

an adjusted net loss of $1.1 million, or $0.01 per share, for the

fourth quarter of 2015.

- At December 31, 2016, Shopify had

$392.4 million in cash, cash equivalents and marketable securities,

compared with $190.2 million on December 31, 2015.

Fourth-Quarter Business Highlights

- GMV during the holiday shopping weekend

spanning Black Friday through Cyber Monday more than doubled over

the comparable period last year as the level of activity on the

Shopify platform reached a peak of nearly 3 million requests per

minute.

- Multi-channel continued to prove to be

an effective strategy to support merchants, as percentage growth of

GMV over social channels far outpaced that of our more traditional

retail channels, such as point of sale and the online store.

- Mobile traffic to merchants’ stores

continued to grow, reaching 69% of traffic and 55% of orders at the

end of 2016, versus 61% and 46%, respectively, at the end of

2015.

- Shopify’s Sell on Amazon integration

was made generally available to merchants in December. Designed to

seamlessly connect Shopify store owners to the millions of

customers searching for products to buy on Amazon, merchants can

now conveniently manage their product catalog for their ecommerce

website, retail store, Amazon store, and other sales channels all

in one place.

Since the start of the year, Shopify launched its inaugural

Build a Bigger Business competition.

The new competition, which augments Shopify’s Build a Business

competition, aims to equip established small and medium-sized

businesses and trend-setting entrepreneurs with the tools and

mentorship needed to achieve their ultimate growth objectives.

Winners in each category will take a once-in-a-lifetime

entrepreneurial getaway at the Namale Resort and Spa in Fiji with

Tony Robbins and other business mentors.

Full-Year Financial Highlights

- Total revenue for the full year grew

90% to $389.3 million, compared with $205.2 million in 2015. Within

this, Subscription Solutions revenue grew 68% to $188.6 million and

Merchant Solutions revenue grew 115% to $200.7 million.

- GMV for 2016 was $15.4 billion, an

increase of 99% over 2015. GPV grew to $5.9 billion in 2016, or 39%

of GMV, versus $2.7 billion, or 35% of GMV, for 2015.

- Gross profit dollars grew 85% over 2015

to $209.5 million, versus $113.3 million for 2015.

- Operating loss for 2016 was $37.2

million, or 10% of revenue, versus $17.8 million, or 9% of revenue,

for 2015.

- Adjusted operating loss3 for 2016 was

3% of revenue, or $12.1 million; adjusted operating loss for 2015

was 3% of revenue, or $6.7 million.

- Net loss was $35.4 million, or $0.42

per share, compared with $18.8 million, or $0.30 per share, for

2015.

- Adjusted net loss3 for 2016 was $10.3

million, or $0.12 per share, compared with an adjusted net loss of

$7.7 million, or $0.13 per share, for 2015.

2016 Business Highlights

Shopify expanded considerably in 2016, adding new merchants,

channels, partners, and functionality. Over the past twelve

months:

- More than 133,000 net new merchants

began selling on Shopify, which ended the year with approximately

377,500 merchants on the platform.

- Merchants on average became more

successful on Shopify, as GMV per merchant grew by 25% over last

year.

- MRR per merchant expanded over 2015,

primarily due to strong growth in the number of merchants joining

at higher subscription levels.

- Average Revenue Per User (ARPU)

expanded 15% to $1,243, versus $1,077 for 2015, driven by higher

GMV per merchant, increased penetration of Shopify Payments, higher

MRR per merchant, and the introduction of new merchant

services.

- The number of partners referring at

least one new merchant to Shopify in 2016 grew to more than 11,000,

compared with more than 8,500 in 2015.

- Shopify integrated a number of new

sales channels for merchants in 2016, including Facebook Messenger

and Amazon. Shopify also launched a software development kit for

third parties looking to make their sites natively available to

Shopify merchants. The addition of Houzz, Wanelo, eBates and others

has driven the number of channels over which a merchant can sell to

more than a dozen.

- Shopify Capital successfully launched,

providing merchants with more than $30 million in aggregate in cash

advances to help fuel their businesses by providing working capital

for growth, such as securing inventory, hiring employees or

marketing activities.

- Shopify launched Apple Pay for the web,

and by year end, more than 150,000 of Shopify’s merchants had

elected to offer Apple Pay as a means for checkout. These merchants

saw conversion rates approximately double by shoppers who have

enabled Apple Pay.

- Canada Post joined the US Postal

Service as a partner on Shopify Shipping, bringing integrated

shipping and tracking to more merchants in North America.

- Shopify completed three acquisitions

with the aim of expanding its breadth and depth of capabilities for

merchants. All are founder-led teams where a focus on merchants,

entrepreneurial cultures and product development talent make them

strong additions to Shopify.

- The percentage of Shopify merchants

using Shopify Payments grew every quarter throughout 2016, with 85%

of merchants at year end using Shopify Payments in geographies

where it is available compared with 76% in the fourth quarter of

2015. This equates to 68% of our global merchant base compared with

62% in the fourth quarter of 2015.

Financial Outlook

The financial outlook that follows constitutes forward-looking

information within the meaning of applicable securities laws and is

based on a number of assumptions and subject to a number of risks.

Actual results could vary materially as a result of numerous

factors, including certain risk factors, many of which are beyond

Shopify’s control. Please see “Forward-looking Statements”

below.

In addition to the other assumptions and factors described in

this press release, Shopify’s outlook assumes the continuation of

growth trends in our industry, our ability to manage our growth

effectively and the absence of material changes in our industry or

the global economy. The following statements supersede all prior

statements made by Shopify. All numbers provided in this section

are approximate.

For the full year 2017, Shopify currently expects:

- Revenues in the range of $580 million

to $600 million

- GAAP operating loss in the range of $73

million to $77 million

- Adjusted operating loss3 in the range

of $18 million to $22 million, which excludes stock-based

compensation expenses and related payroll taxes of $55 million

For the first quarter of 2017, Shopify currently expects:

- Revenues in the range of $120 million

to $122 million

- GAAP operating loss in the range of $20

million to $22 million

- Adjusted operating loss3 in the range

of $9 million to $11 million, which excludes stock-based

compensation expenses and related payroll taxes of $11 million

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss

its fourth-quarter and full-year results today, February 15, 2017,

at 8:30 a.m. ET. The conference call will be webcast on the

investor relations section of Shopify’s website at https://investors.shopify.com/events/Events-Presentations/default.aspx.

An archived replay of the webcast will be available following the

conclusion of the call.

Shopify’s Audited Consolidated Financial Statements and

accompanying Notes, Management’s Discussion and Analysis, and

Annual Information Form for the year ended December 31, 2016 are

available on Shopify’s website at www.shopify.com, and will be filed on SEDAR at

www.sedar.com and on EDGAR at

www.sec.gov. Shareholders may, upon

request, receive a hard copy of the complete audited financial

statements free of charge.

About Shopify

Shopify is the leading cloud-based, multi-channel commerce

platform designed for small and medium-sized businesses. Merchants

can use the software to design, set up, and manage their stores

across multiple sales channels, including web, mobile, social

media, marketplaces and physical retail locations. The platform

also provides merchants with a powerful back-office and a single

view of their business. The Shopify platform was engineered for

reliability and scale, making enterprise-level technology available

to businesses of all sizes. Shopify currently powers hundreds of

thousands of businesses in approximately 175 countries and is

trusted by brands such as Tesla, Nestle, GE, Red Bull, Kylie

Cosmetics, and many more.

Non-GAAP Financial Measures

To supplement its consolidated financial statements, which are

prepared and presented in accordance with United States generally

accepted accounting principles (GAAP), Shopify uses certain

non-GAAP financial measures to provide additional information in

order to assist investors in understanding its financial and

operating performance.

Adjusted operating loss, non-GAAP operating expenses, adjusted

net loss and adjusted net loss per share are non-GAAP financial

measures that exclude the effect of share-based compensation

expenses and related payroll taxes as well as sales and use

tax.

Management uses non-GAAP financial measures internally for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. Shopify believes that these

non-GAAP measures provide useful information about operating

results, enhance the overall understanding of past financial

performance and future prospects, and allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision making. Non-GAAP financial

measures are not recognized measures for financial statement

presentation under U.S. GAAP and do not have standardized meanings,

and may not be comparable to similar measures presented by other

public companies. Such non-GAAP financial measures should be

considered as a supplement to, and not as a substitute for, or

superior to, the corresponding measures calculated in accordance

with GAAP. See the financial tables below for a reconciliation of

the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements

within the meaning of applicable securities laws, including

statements regarding Shopify’s financial outlook and future

financial performance. Words such as “expects”, “anticipates” and

“intends” or similar expressions are intended to identify

forward-looking statements.

These forward-looking statements are based on Shopify’s current

projections and expectations about future events and financial

trends that management believes might affect its financial

condition, results of operations, business strategy and financial

needs, and on certain assumptions and analysis made by Shopify in

light of the experience and perception of historical trends,

current conditions and expected future developments and other

factors management believes are appropriate. These projections,

expectations, assumptions and analyses are subject to known and

unknown risks, uncertainties, assumptions and other factors that

could cause actual results, performance, events and achievements to

differ materially from those anticipated in these forward-looking

statements. Although Shopify believes that the assumptions

underlying these forward-looking statements are reasonable, they

may prove to be incorrect, and readers cannot be assured that

actual results will be consistent with these forward-looking

statements. Actual results could differ materially from those

projected in the forward-looking statements as a result of numerous

factors, including certain risk factors, many of which are beyond

Shopify’s control, including but not limited to: (i) merchant

acquisition and retention; (ii) managing our growth; (iii) our

history of losses; (iv) our limited operating history; (v) our

ability to innovate; (vi) a disruption of service or security

breach; (vii) payments processed through Shopify Payments; (viii)

our reliance on a single supplier to provide the technology we

offer through Shopify Payments; (ix) a breach involving personally

identifiable information; (x) serious software errors or defects;

(xi) exchange rate fluctuations; (xii) achieving or maintaining

data transmission capacity; and (xiii) other one-time events and

other important factors disclosed previously and from time to time

in Shopify’s filings with the U.S. Securities and Exchange

Commission and the securities commissions or similar securities

regulatory authorities in each of the provinces or territories of

Canada. The forward-looking statements contained in this news

release represent Shopify’s expectations as of the date of this

news release, or as of the date they are otherwise stated to be

made, and subsequent events may cause these expectations to change.

Shopify undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by law.

1.

Monthly Recurring Revenue, or MRR, is

calculated by multiplying the number of merchants by the average

monthly subscription plan fee in effect on the last day of that

period and is used by management as a directional indicator of

subscription solutions revenue going forward assuming merchants

maintain their subscription plan the following month.

2.

Gross Merchandise Volume, or GMV,

represents the total dollar value of orders processed on the

Shopify platform in the period, net of refunds, and inclusive of

shipping and handling, duty and value-added taxes.

3.

Please refer to "Non-GAAP Financial

Measures" in this press release.

Shopify Inc.

Consolidated Statements of Operations

and Comprehensive Loss

(Expressed in US $000’s, except share and

per share amounts, unaudited)

Three months ended Years ended

December 31, 2016

December 31, 2015

December 31, 2016

December 31, 2015

$ $ $ $ Revenues Subscription

solutions 56,387 34,608 188,606 111,979 Merchant solutions 73,996

35,565 200,724 93,254 130,383

70,173 389,330 205,233

Cost of revenues

Subscription solutions 11,593 7,662 39,478 24,531 Merchant

solutions 50,655 26,044 140,357 67,447

62,248 33,706 179,835 91,978

Gross profit 68,135 36,467 209,495

113,255

Operating expenses Sales and marketing 39,016

22,527 129,214 70,374 Research and development 24,472 13,541 74,336

39,722 General and administrative 13,952 6,918 43,110

20,915 Total operating expenses 77,440 42,986

246,660 131,011

Loss from operations

(9,305 ) (6,519 ) (37,165 ) (17,756 )

Other income (expense) 438 212 1,810

(1,034 )

Net loss (8,867 ) (6,307 ) (35,355 ) (18,790 )

Other comprehensive loss, net of tax (1,342 ) —

(1,818 ) —

Comprehensive loss (10,209 ) (6,307 )

(37,173 ) (18,790 ) Basic and diluted net loss per share

attributable to shareholders (0.10 ) (0.08 ) (0.42 ) (0.30 )

Weighted average shares used to compute basic and diluted net loss

per share attributable to shareholders 89,137,155 77,996,629

83,988,597 61,716,065

Shopify Inc.

Consolidated Balance Sheets

(Expressed in US $000’s, except share and

per share amounts, unaudited)

As at December 31, 2016 December 31,

2015 $ $ Assets Current assets Cash

and cash equivalents 84,013 110,070 Marketable securities 308,401

80,103 Trade and other receivables 9,599 6,089 Merchant cash

advances receivable, net 11,896 — Other current assets 8,989

6,203 422,898 202,465

Long term assets

Property and equipment 45,719 33,048 Intangible assets 6,437 5,826

Goodwill 15,504 2,373 67,660 41,247

Total assets 490,558 243,712

Liabilities

and shareholders’ equity Current liabilities Accounts

payable and accrued liabilities 45,057 23,689 Current portion of

deferred revenue 20,164 12,726 Current portion of lease incentives

1,311 822 66,532 37,237

Long term

liabilities Deferred revenue 922 661 Lease incentives 12,628

10,497 13,550 11,158

Shareholders’

equity Common stock, unlimited Class A subordinate voting

shares authorized, 77,030,952 and 56,877,089 issued and

outstanding; unlimited Class B multiple voting shares authorized,

12,374,528 and 23,212,769 issued and outstanding 468,494 231,452

Additional paid-in capital 27,009 11,719 Accumulated other

comprehensive loss (1,818 ) — Accumulated deficit (83,209 ) (47,854

)

Total shareholders’ equity 410,476 195,317

Total liabilities and shareholders’ equity 490,558

243,712

Shopify Inc.

Consolidated Statements of Cash

Flows

(Expressed in US $000’s, except share and

per share amounts, unaudited)

Years ended December 31, 2016

December 31, 2015 $ $ Cash

flows from operating activities Net loss for the year (35,355 )

(18,790 ) Adjustments to reconcile net loss to net cash provided by

operating activities: Amortization and depreciation 13,967 7,236

Stock-based compensation 22,896 7,805 Vesting of restricted shares

202 353 Unrealized foreign exchange (gain) loss (969 ) 1,828

Changes in operating assets and liabilities: Trade and other

receivables (2,356 ) 1,176 Merchant cash advances receivable, net

(11,896 ) — Other current assets (2,604 ) (4,708 ) Accounts payable

and accrued liabilities 19,813 11,097 Deferred revenue 7,699 6,218

Lease incentives 2,620 3,541 Net cash provided by

operating activities 14,017 15,756

Cash flows from

investing activities Purchase of marketable securities (369,208

) (111,154 ) Maturity of marketable securities 139,872 48,350

Acquisitions of property and equipment (23,773 ) (16,525 )

Acquisitions of intangible assets (2,463 ) (4,511 ) Acquisition of

business (net of cash acquired) (14,114 ) — Net cash used in

investing activities (269,686 ) (83,840 )

Cash flows from

financing activities Proceeds from initial public offering, net

of issuance costs — 136,251 Proceeds from the exercise of stock

options 4,162 1,604 Proceeds from follow-on public offering, net of

issuance costs 224,423

—

Net cash provided by financing activities 228,585

137,855 Effect of foreign exchange on cash and cash

equivalents 1,027 (1,654 )

Net increase (decrease) in

cash and cash equivalents (26,057 ) 68,117

Cash and cash

equivalents – Beginning of Year 110,070 41,953

Cash and cash equivalents – End of Year 84,013

110,070

Shopify Inc.

Reconciliation from GAAP to Non-GAAP

Results

(Expressed in US $000’s, except share and

per share amounts, unaudited)

Three months ended Years ended

December 31, 2016

December 31, 2015

December 31, 2016

December 31, 2015

$ $ $ $ GAAP Gross profit 68,135 36,467

209,495 113,255 % of Revenue 52 % 52 % 54 % 55 % add: stock-based

compensation 206 84 629 282 add: payroll taxes related to

stock-based compensation 10 63 89 63

Non-GAAP Gross profit 68,351 36,614 210,213

113,600 % of Revenue 52 % 52 % 54 % 55 % GAAP Sales

and marketing 39,016 22,527 129,214 70,374 % of Revenue 30 % 32 %

33 % 34 % less: stock-based compensation 1,300 418 3,951 1,099

less: payroll taxes related to stock-based compensation 124

252 493 252 Non-GAAP Sales and marketing

37,592 21,857 124,770 69,023 % of

Revenue 29 % 31 % 32 % 34 % GAAP Research and development

24,472 13,541 74,336 39,722 % of Revenue 19 % 19 % 19 % 19 % less:

stock-based compensation 5,232 1,656 14,318 4,509 less: payroll

taxes related to stock-based compensation 230 1,864

1,046 1,864 Non-GAAP Research and development 19,010

10,021 58,972 33,349 % of Revenue 15 %

14 % 15 % 16 % GAAP General and administrative 13,952 6,918

43,110 20,915 % of Revenue 11 % 10 % 11 % 10 % less: stock-based

compensation 1,324 721 4,200 2,268 less: payroll taxes related to

stock-based compensation 72 151 295 151 less: sales and use tax —

— — 566 Non-GAAP General and

administrative 12,556 6,046 38,615 17,930

% of Revenue 10 % 9 % 10 % 9 % GAAP Operating

expenses 77,440 42,986 246,660 131,011 % of Revenue 59 % 61 % 63 %

64 % less: stock-based compensation 7,856 2,795 22,469 7,876 less:

payroll taxes related to stock-based compensation 426 2,267 1,834

2,267 less: sales and use tax — — — 566

Non-GAAP Operating Expenses 69,158 37,924 222,357

120,302 % of Revenue 53 % 54 % 57 % 59 %

Shopify Inc.

Reconciliation from GAAP to Non-GAAP

Results (continued)

(Expressed in US $000’s, except share and

per share amounts, unaudited)

Three months ended Years ended

December 31, 2016

December 31, 2015

December 31, 2016

December 31, 2015

$ $ $ $ GAAP Operating loss (9,305 )

(6,519 ) (37,165 ) (17,756 ) % of Revenue (7 )% (9 )% (10 )% (9 )%

add: stock-based compensation 8,062 2,879 23,098 8,158 add: payroll

taxes related to stock-based compensation 436 2,330 1,923 2,330

add: sales and use tax — — — 566

Adjusted Operating loss (807 ) (1,310 ) (12,144 ) (6,702 ) % of

Revenue (1 )% (2 )% (3 )% (3 )% GAAP Net loss (8,867 )

(6,307 ) (35,355 ) (18,790 ) % of Revenue (7 )% (9 )% (9 )% (9 )%

add: stock-based compensation 8,062 2,879 23,098 8,158 add: payroll

taxes related to stock-based compensation 436 2,330 1,923 2,330

add: sales and use tax — — — 566

Adjusted Net loss and comprehensive loss (369 ) (1,098 ) (10,334 )

(7,736 ) % of Revenue — % (2 )% (3 )% (4 )% GAAP net loss

per share attributable to shareholders (0.10 ) (0.08 ) (0.42 )

(0.30 ) add: stock-based compensation 0.09 0.04 0.28 0.13 add:

payroll taxes related to stock-based compensation 0.00 0.03 0.02

0.04 add: sales and use tax 0.00 0.00 0.00

0.01 Adjusted net loss per share attributable to

shareholders(1) 0.00 (0.01 ) (0.12 ) (0.13 ) Weighted

average shares used to compute GAAP and non-GAAP net loss per share

attributable to shareholders 89,137,155 77,996,629 83,988,597

61,716,065

(1) Totals may not foot due to rounding differences.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170215005375/en/

ShopifyINVESTORS:Katie Keita, 613-241-2828Director,

Investor RelationsIR@shopify.comorMEDIA:Sheryl So, 416-238-6705 x

302Public Relations Managerpress@shopify.com

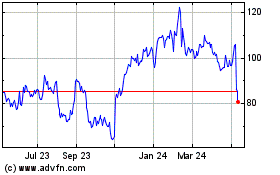

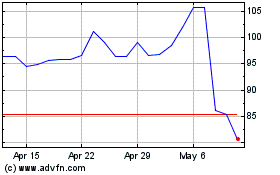

Shopify (TSX:SHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shopify (TSX:SHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024