By Anna Wilde Mathews and Brent Kendall

Two health-insurance mergers worth a combined $82 billion are

unraveling in the wake of court rulings that found the transactions

violated federal antitrust law, all but quashing a deal boom that

would have reshaped the industry.

Aetna Inc. and Humana Inc. said Tuesday they would terminate

their $34 billion merger agreement instead of attempting to appeal

a judge's decision last month that their combination would harm

senior citizens.

Just hours later, Cigna Corp. said it was calling off its $48

billion merger agreement with Anthem Inc. and pursuing litigation

seeking a $1.85 billion breakup fee plus more than $13 billion in

damages from its deal partner.

Cigna's announcement escalated a monthslong fight in which the

two companies have accused each other of violating their merger

agreement. Anthem immediately disputed Cigna's authority to nix the

deal.

"Anthem will continue to enforce its rights under the merger

agreement and remains committed to closing the transaction," an

Anthem spokeswoman said.

Anthem has said it unilaterally extended the merger agreement

through April 30 and is appealing the antitrust decision, but it

faces numerous obstacles to salvaging the transaction.

The fate of both deals represents a victory for the Obama

administration's antitrust officials, who were able to win the

cases despite major differences between the two transactions.

In the Aetna case, a judge in January said the merger could harm

seniors who buy the private Medicare plans known as Medicare

Advantage. The Anthem antitrust decision by a different judge last

week focused closely on that acquisition's potential impact on

large, multistate employers that offer health coverage to their

workers.

Both acquisitions came together amid an insurance-industry

merger frenzy in 2015, but the dynamics in each have been

different.

Aetna and Humana presented a more united public front. The

companies' tandem announcements of the termination Tuesday said it

was a mutual decision, and both said Aetna will now owe Humana a $1

billion breakup fee.

Aetna Chief Executive Mark T. Bertolini said Tuesday "both

companies need to move forward with their respective strategies in

order to continue to meet member expectations."

Though the decision allows the two insurers to avoid what had

been widely seen as an uphill battle to preserve the deal, it also

leaves them with challenges as they move ahead as stand-alone

companies.

Aetna will now need to find new engines for growth, and it has

highlighted hopes for Medicare, Medicaid and its core commercial

franchise. The Humana deal would have vaulted it to the top

position in the growing Medicare Advantage business.

Humana said Tuesday that the breakup fee is worth about $630

million after taxes. In a call with analysts to discuss its 2017

financial guidance, Humana Chief Executive Bruce Broussard said his

company was "confident in our future."

The company is seen as an attractive takeover target once again,

and Mr. Broussard said Humana was "always oriented toward the most

effective shareholder value, and we would obviously review any kind

of interest into the organization."

Humana, which had retreated somewhat from the Affordable Care

Act's exchanges this year after losses, also said it would fully

withdraw from the business in 2018. Mr. Broussard said the insurer

was "seeing signs of an unbalanced risk pool" in its 2017

enrollment.

That decision is an early difficult sign for the Trump

administration, which, while critical of the Affordable Care Act,

is expected to issue a regulation that includes efforts to

stabilize the law's insurance marketplaces into 2018.

For its part, Anthem faces challenges in its solo effort to

appeal the antitrust ruling. Even if it is able to keep Cigna in

the fold until the end of April, that is almost certainly not

enough time to clear the various legal and regulatory hurdles the

insurer must overcome to complete a deal.

Cigna said in a statement Tuesday that the merger "cannot and

will not achieve regulatory approval" and that "terminating the

agreement is in the best interest of Cigna's shareholders."

The insurer said its lawsuit seeking billions of dollars in

damages from Anthem includes "the amount of premium that Cigna

shareholders did not realize as a result of the failed merger

process." Cigna said it filed the lawsuit in the Delaware Court of

Chancery.

Cigna's move is the latest twist in the increasingly discordant

relationship between the two merger partners, including battles

over strategy, direction and leadership that have become

increasingly public over the past several months.

Analysts have long said litigation between the two appeared

likely in the event of a negative antitrust ruling. During trial

proceedings that began in November, Anthem mounted a legal defense

of the merger single-handedly. Cigna lawyers said very little

during the proceedings, and when they did, it usually didn't help

Anthem's position.

Cigna said Tuesday that Anthem had breached their agreement by

not using its "reasonable best efforts" to win regulatory approval

for the deal.

Anthem declined to comment Tuesday beyond its statement

disputing Cigna's right to break off the merger of the two

insurers.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Brent

Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

February 15, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

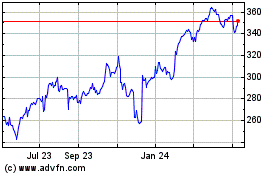

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

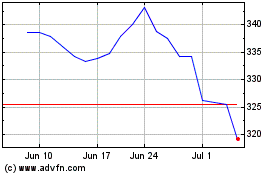

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024