Current Report Filing (8-k)

February 14 2017 - 5:47PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

Current

Report

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE

OF REPORT (DATE OF EARLIEST EVENT REPORTED):

February

9, 2017

SUPERIOR

DRILLING PRODUCTS, INC.

(Exact

name of registrant as specified in its charter)

|

Utah

(State

of

Incorporation)

|

|

46-4341605

(I.R.S.

Employer

Identification

No.)

|

|

|

|

|

|

1583

South 1700 East

|

|

|

|

Vernal,

Utah

(Address

of principal executive offices)

|

|

84078

(Zip

code)

|

Commission

File Number:

001-36453

Registrant’s

telephone number, including area code:

(435) 789-0594

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

1.01. Entry into a Material Definitive Agreement.

On

February 9, 2017, Meier Properties, Series LLC, a Utah limited liability company (“MPS”), and a wholly-owned subsidiary

of Superior Drilling Products, Inc. (the “Company”), sold to Superior Auto Body and Paint, LLC, a Utah limited liability

company (“SABP”), certain real estate located at 3978 West 12600 South, Riverton, Utah 84096 (the “Real Property”)

pursuant to the terms and conditions of a special warranty deed between SABP and MPS (the “Deed”). Prior to the sale,

MPS leased the Real Property to SABP pursuant to that certain lease dated May 25, 2012 (the “Lease”). The Lease was

terminated in connection with closing of the transactions contemplated by the Deed (the “Lease Termination”). The

purchase price for the Real Property was approximately $2.5 million, which is substantially equal to the appraised value of the

Real Property, plus any prepayment fees and accrued interest associated with the Existing Loans Balance, as such term is defined

below. The purchase price for the purchase was financed by Zions First National Bank (the “Zion’s Loan”). The

proceeds of the sale were utilized by MPS to repay in full the outstanding balance for the loans of MPS outstanding on the Real

Property with a cumulative payoff balance of approximately $2.5 million. In connection with the repayment in full of such loans,

the guaranty of the Company of such loans was released.

As

part of the transaction, Troy Meier, the Company’s Chief Executive Officer, and Annette Meier, the Company’s Chief

Operating Officer, were required to pledge 547,000 of their shares of the Company’s common stock to partially collateralize

the Zion’s Loan, as the Meiers have a direct ownership interest in SABP. These shares were previously held as a portion

of the collateral for that certain amended and restated promissory note dated December 31, 2015 in the original principal amount

of approximately $8.3 million issued to the Company by Tronco Energy Corporation, which the Company refers to in its SEC filings

as the Tronco loan. Zions has agreed to transfer the stock pledge back to the Company for security under the Tronco loan after

repayment in full of the Zion’s Loan.

The

foregoing descriptions of the Lease, the Lease Termination, the Zion’s Loan and the Deed are qualified in their entirety

by reference to the text of the Lease, the Lease Termination, the Zion’s Loan and the Deed, which are filed or included,

as applicable, as Exhibits 10.1 through 10.4, respectively, to this Form 8-K and are incorporated herein by reference.

Item

1.02 Termination of a Material Definitive Agreement.

The

text set forth in Item 1.01 regarding the Lease Termination is incorporated into this section by reference.

Item

8.01 Other Events.

On

February 14, 2017, the Company issued a press release announcing the execution of the Deed and the related transactions, along

with preliminary revenue for the fourth calendar quarter of 2016. A copy of the press release is filed herewith as Exhibit 99.1.

Item

9.01 Financial Statements and Exhibits.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Lease,

dated May 25, 2012, between MPS, as lessor, and SABP, as lessee (incorporated by reference to Exhibit 10.56 to the Registrant’s

Registration Statement on Form S-1 (Registration No. 333-195085) filed with the SEC on April 7, 2014).

|

|

|

|

|

|

10.2

|

|

Loan

Agreement, dated April 3, 2012, between MPS and SABP as co-borrowers, and Mountain West Small Business Finance, as lender;

Change in Terms Agreement dated March 19, 2012, between SABP, as borrower and Mountain America Credit Union, as Lender; and

Change in Terms Agreement dated March 19, 2012, between SABP, as borrower and Mountain America Credit Union, as Lender (incorporated

by reference to Exhibit 10.50 to Amendment No. 1 to the Registrant’s Registration Statement on Form S-1 (Registration

No. 333-195085) filed with the SEC on April 30, 2014).

|

|

|

|

|

|

10.3

|

|

Loan

Agreement, dated May 25, 2012, between MPS and SABP, as co-borrowers and Mountain West Small Business Finance, as lender (incorporated

by reference to Exhibit 10.52 to the Registrant’s Registration Statement on Form S-1 (Registration No. 333-195085) filed

with the SEC on April 7, 2014).

|

|

|

|

|

|

10.4

|

|

Special

Warranty Deed between MPS and SABP dated February 9, 2017.*

|

|

|

|

|

|

10.5

|

|

Termination

of Real Property Lease between MPS and SABP dated February 9, 2017.*

|

|

|

|

|

|

99.1

|

|

Press

release issued on February 14, 2017 regarding the Purchase Agreement and preliminary revenue for the fourth calendar quarter

of 2016.*

|

*

Filed herewith.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Date:

February 14, 2017

|

|

SUPERIOR

DRILLING PRODUCTS, INC.

|

|

|

|

|

|

/s/

Christopher D. Cashion

|

|

|

Christopher

D. Cashion

|

|

|

Chief

Financial Officer

|

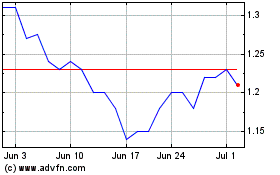

Superior Drilling Products (AMEX:SDPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Superior Drilling Products (AMEX:SDPI)

Historical Stock Chart

From Apr 2023 to Apr 2024