SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 13G

(Rule 13d-102)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO § 240.13d-1 (b), (c) AND (d) AND AMENDMENTS THERETO FILED PURSUANT TO § 240.13d-2

(Amendment No. 3)*

|

Perion Network Ltd.

|

|

(Name of Issuer)

|

|

|

|

Ordinary Shares, par value NIS 0.01 per share

|

|

(Title of Class of Securities)

|

|

|

|

M78673106

|

|

(CUSIP Number)

|

|

|

|

December 31, 2016

|

|

(Date of Event Which Requires Filing of this Statement)

|

Check the appropriate box to designate the rule pursuant to which

this Schedule is filed:

*The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

(Continued on following pages)

Page

1

of 12 Pages

Exhibit Index Contained on Page 11

|

CUSIP NO. M78673106

|

13G

|

Page 2 of 12 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

Benchmark Israel II, L.P. (“BI”)

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(SEE INSTRUCTIONS)

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

9,293,742 shares, except that BCPI Partners II, L.P. (“BCPI-P”),

the general partner of BI, may be deemed to have sole power to vote these shares, BCPI Corporation II (“BCPI-C”), the

general partner of BCPI-P, may be deemed to have sole power to vote these shares and Michael A. Eisenberg (“Eisenberg”)

and Arad Naveh (“Naveh”), the directors of BCPI-C, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

9,293,742 shares, except that BCPI-P, the general partner of BI,

may be deemed to have sole power to dispose of these shares, BCPI-C, the general partner of BCPI-P, may be deemed to have sole

power to dispose of these shares and Eisenberg and Naveh, the directors of BCPI-C, may be deemed to have shared power to dispose

of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON

|

9,293,742

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

12.0%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

PN

|

|

CUSIP NO. M78673106

|

13G

|

Page 3 of 12 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

BCPI Partners II, L.P.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(SEE INSTRUCTIONS)

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

9,576,772 shares, of which 9,293,742 are directly owned by BI and

283,030 are held in nominee form for the benefit of persons associated with BCPI-C. BCPI-P, the general partner of BI, may be deemed

to have sole power to vote these shares, BCPI-C, the general partner of BCPI-P, may be deemed to have sole power to vote these

shares and Eisenberg and Naveh, the directors of BCPI-C, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

9,576,772 shares, of which 9,293,742 are directly owned by BI and

283,030 are held in nominee form for the benefit of persons associated with BCPI-C. BCPI-P, the general partner of BI, may be deemed

to have sole power to dispose of these shares, BCPI-C, the general partner of BCPI-P, may be deemed to have sole power to dispose

of these shares and Eisenberg and Naveh, the directors of BCPI-C, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON

|

9,576,772

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

12.4%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

PN

|

|

CUSIP NO. M78673106

|

13G

|

Page 4 of 12 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

BCPI Corporation II

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(SEE INSTRUCTIONS)

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

9,576,772 shares, of which 9,293,742 are directly owned by BI and

283,030 are held in nominee form for the benefit of persons associated with BCPI-C. BCPI-P, the general partner of BI, may be deemed

to have sole power to vote these shares, BCPI-C, the general partner of BCPI-P, may be deemed to have sole power to vote these

shares and Eisenberg and Naveh, the directors of BCPI-C, may be deemed to have shared power to vote these shares.

|

|

6

|

SHARED VOTING POWER

See response to row 5.

|

|

7

|

SOLE DISPOSITIVE POWER

9,576,772 shares, of which 9,293,742 are directly owned by BI and

283,030 are held in nominee form for the benefit of persons associated with BCPI-C. BCPI-P, the general partner of BI, may be deemed

to have sole power to dispose of these shares, BCPI-C, the general partner of BCPI-P, may be deemed to have sole power to dispose

of these shares and Eisenberg and Naveh, the directors of BCPI-C, may be deemed to have shared power to dispose of these shares.

|

|

8

|

SHARED DISPOSITIVE POWER

See response to row 7.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON

|

9,576,772

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

12.4%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

CO

|

|

CUSIP NO. M78673106

|

13G

|

Page 5 of 12 Pages

|

|

1

|

NAMES OF REPORTING PERSON

Michael A. Eisenberg

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(SEE INSTRUCTIONS)

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Dual citizen of the United States and Israel

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

See response to row 6.

|

|

6

|

SHARED VOTING POWER

9,576,772 shares, of which 9,293,742 are directly owned by BI and

283,030 are held in nominee form for the benefit of persons associated with BCPI-C. BCPI-P, the general partner of BI, may be deemed

to have sole power to vote these shares, BCPI-C, the general partner of BCPI-P, may be deemed to have sole power to vote these

shares and Eisenberg, a director of BCPI-C, may be deemed to have shared power to vote these shares.

|

|

7

|

SOLE DISPOSITIVE POWER

See response to row 8.

|

|

8

|

SHARED DISPOSITIVE POWER

9,576,772 shares, of which 9,293,742 are directly owned by BI and

283,030 are held in nominee form for the benefit of persons associated with BCPI-C. BCPI-P, the general partner of BI, may be deemed

to have sole power to dispose of these shares, BCPI-C, the general partner of BCPI-P, may be deemed to have sole power to dispose

of these shares and Eisenberg, a director of BCPI-C, may be deemed to have shared power to dispose of these shares.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON

|

9,576,772

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

12.4%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

IN

|

|

CUSIP NO. M78673106

|

13G

|

Page 6 of 12 Pages

|

|

1

|

NAMES OF REPORTING PERSON

Arad Naveh

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(SEE INSTRUCTIONS)

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Dual citizen of the United States and Israel

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

See response to row 6.

|

|

6

|

SHARED VOTING POWER

9,576,772 shares, of which 9,293,742 are directly owned by BI and

283,030 are held in nominee form for the benefit of persons associated with BCPI-C. BCPI-P, the general partner of BI, may be deemed

to have sole power to vote these shares, BCPI-C, the general partner of BCPI-P, may be deemed to have sole power to vote these

shares and Naveh, a director of BCPI-C, may be deemed to have shared power to vote these shares.

|

|

7

|

SOLE DISPOSITIVE POWER

See response to row 8.

|

|

8

|

SHARED DISPOSITIVE POWER

9,576,772 shares, of which 9,293,742 are directly owned by BI and

283,030 are held in nominee form for the benefit of persons associated with BCPI-C. BCPI-P, the general partner of BI, may be deemed

to have sole power to dispose of these shares, BCPI-C, the general partner of BCPI-P, may be deemed to have sole power to dispose

of these shares and Naveh, a director of BCPI-C, may be deemed to have shared power to dispose of these shares.

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON

|

9,576,772

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

|

12.4%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

IN

|

|

CUSIP NO. M78673106

|

13G

|

Page 7 of 12 Pages

|

This Amendment No. 3 amends and restates in its entirety the Schedule

13G previously filed by Benchmark Israel II, L.P., a Delaware limited partnership (“BI”), BCPI Partners II, L.P., a

Delaware limited partnership (“BCPI-P”), BCPI Corporation II, a Delaware corporation (“BCPI-C”), and Michael

A. Eisenberg (“Eisenberg”) and Arad Naveh (“Naveh”) (together will all prior and current amendments thereto,

this “Schedule 13G”).

|

|

Item 1(a)

|

Name of Issuer:

|

Perion Network Ltd. (the “Issuer”)

|

|

Item 1(b)

|

Address of issuer's principal executive offices:

|

1 Azrieli Center, Building A, 4

th

Floor

26 HaRokmim Street, Holon, Israel 5885849

|

|

Items 2(a)

|

Name of person filing:

|

This Statement is filed by BI, BCPI-P,

BCPI-C, and Eisenberg and Naveh. The foregoing entities and individuals are collectively referred to as the “Reporting Persons.”

BCPI-P, the general partner of BI, may

be deemed to have sole power to vote and sole power to dispose of shares of the Issuer directly owned by BI. BCPI-C, the general

partner BCPI-P, may be deemed to have sole power to vote and sole power to dispose of shares of the Issuer directly owned by BI.

Eisenberg and Naveh are the directors of BCPI-C and may be deemed to have shared power to vote and shared power to dispose of shares

of the Issuer directly owned by BI.

|

|

Item 2(b)

|

Address or principal business office or, if none, residence:

|

The address for each of the Reporting Persons is:

Benchmark Capital

2965 Woodside Road

Woodside, California 94062

BI and BCPI-P are Delaware limited partnerships. BCPI-C

is a Delaware corporation. Eisenberg and Naveh are dual citizens of the United States and Israel.

|

|

Item 2(d)

|

Title of class of securities:

|

Ordinary Shares

M78673106

|

|

Item 3

|

If this statement is filed pursuant to §§

240.13d-1(b), or 240.13d-2(b) or (c), check whether the person filings is a:

|

Not applicable.

|

CUSIP NO. M78673106

|

13G

|

Page 8 of 12 Pages

|

Provide the following information regarding

the aggregate number and percentage of the class of securities of the issuer identified in Item 1.

The following information with respect

to the ownership of the Ordinary Shares of the issuer by the persons filing this Statement is provided as of December 31, 2016

(based on 77,455,588 Ordinary Shares of the issuer outstanding as of December 31, 2016 as reported by the issuer to the Reporting

Persons).

|

|

(a)

|

Amount beneficially owned

:

|

See Row 9 of cover page for each Reporting

Person.

See Row 11 of cover page for each Reporting

Person.

|

|

(c)

|

Number of shares as to which such person has

:

|

|

|

(i)

|

Sole power to vote or to direct the vote

:

|

See Row 5 of cover page for each Reporting

Person.

|

|

(ii)

|

Shared power to vote or to direct the vote

:

|

See Row 6 of cover page for each Reporting

Person.

|

|

(iii)

|

Sole power to dispose or to direct the disposition of

:

|

See Row 7 of cover page for each Reporting

Person.

|

|

(iv)

|

Shared power to dispose or to direct the disposition of

:

|

See Row 8 of cover page for each Reporting

Person.

|

|

Item 5

|

Ownership of 5 Percent or Less of a Class

|

Not applicable.

|

|

Item 6

|

Ownership of More than 5 Percent on Behalf of Another

Person

|

Under certain circumstances set forth

in the limited partnership agreements of BI and BCPI-P, and the certificate of incorporation of BCPI-C, the general and limited

partners or shareholders, as the case may be, of each of such entities may be deemed to have the right to receive dividends from,

or the proceeds from, the sale of shares of the issuer owned by each such entity of which they are a partner or shareholder.

|

CUSIP NO. M78673106

|

13G

|

Page 9 of 12 Pages

|

|

|

Item 7

|

Identification and Classification of the Subsidiary

Which Acquired the Security Being Reported on by the Parent Holding Company or Control Person

|

Not applicable.

|

|

Item 8

|

Identification and Classification of Members of the

Group

|

Not applicable.

|

|

Item 9

|

Notice of Dissolution of Group

|

Not applicable.

By signing below I certify that, to the

best of my knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with

the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection

with or as a participant in any transaction having that purpose or effect.

|

CUSIP NO. M78673106

|

13G

|

Page 10 of 12 Pages

|

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: February 10, 2017

|

|

BENCHMARK ISRAEL II, L.P., a Delaware limited partnership

|

|

|

|

|

|

|

By:

|

BCPI PARTNERS II, L.P., a Delaware limited partnership

|

|

|

Its:

|

General Partner

|

|

|

|

|

|

|

By:

|

BCPI Corporation II, a Delaware corporation

|

|

|

Its:

|

General Partner

|

|

|

|

|

|

|

By:

|

/s/ Steven M. Spurlock

|

|

|

|

Steven M. Spurlock

|

|

|

|

Officer

|

|

|

|

|

|

|

BCPI PARTNERS II, L.P., a Delaware limited partnership

|

|

|

|

|

|

|

By:

|

BCPI Corporation II, a Delaware corporation

|

|

|

Its:

|

General Partner

|

|

|

|

|

|

|

By:

|

/s/ Steven M. Spurlock

|

|

|

|

Steven M. Spurlock

|

|

|

|

Officer

|

|

|

|

|

|

|

BCPI CORPORATION II, a Delaware corporation

|

|

|

|

|

|

|

By:

|

/s/ Steven M. Spurlock

|

|

|

|

Steven M. Spurlock

|

|

|

|

Officer

|

|

|

|

|

|

|

MICHAEL EISENBERG

|

|

|

ARAD NAVEH

|

|

|

|

|

|

|

By:

|

/s/ Steven M. Spurlock

|

|

|

|

Steven M. Spurlock

|

|

|

|

Attorney-in-Fact*

|

*Signed pursuant to a Power of Attorney already on file with the

appropriate agencies.

|

CUSIP NO. M78673106

|

13G

|

Page

11 of 12 Pages

|

EXHIBIT INDEX

|

|

|

Found on

Sequentially

|

|

Exhibit

|

|

Numbered Page

|

|

|

|

|

|

Exhibit A: Agreement of Joint Filing

|

|

12

|

|

CUSIP NO. M78673106

|

13G

|

Page 12 of 12 Pages

|

exhibit A

Agreement of Joint Filing

The Reporting Persons agree that a single Schedule

13G (or any amendment thereto) relating to the Ordinary Shares of Perion Network Ltd. shall be filed on behalf of each of the Reporting

Persons. Note that copies of the applicable Agreement of Joint Filings are already on file with the appropriate agencies.

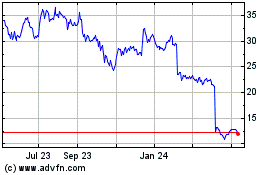

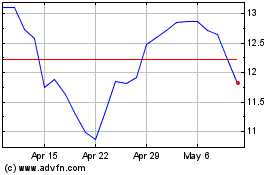

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Apr 2023 to Apr 2024