Current Report Filing (8-k)

February 10 2017 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 10, 2017

ANTERO MIDSTREAM PARTNERS LP

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36719

|

|

46-4109058

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

1615 Wynkoop Street

Denver, Colorado 80202

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code:

(303) 357-7310

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Introductory Note

As previously reported, on February 6, 2017, Antero Midstream Partners LP (the “Partnership”) and Antero Resources Midstream Management LLC, its general partner, entered into an Underwriting Agreement with Barclays Capital Inc. and Wells Fargo Securities, LLC, relating to the upsized offer and sale (the “Offering”) of up to 6,900,000 common units representing limited partner interests in the Partnership (the “Common Units”), including up to 900,000 Common Units to be issued pursuant to the exercise of the underwriters’ option to purchase additional Common Units (the “Option”). On February 10, 2017, in connection with the closing of the Offering, we issued and sold 6,900,000 Common Units pursuant to the underwriting agreement, including 900,000 Common Units issued in connection with the exercise of the underwriters' Option in full.

This Current Report on Form 8-K is being filed for the purpose of filing Exhibit 5.1, which reflects the upsized number of Common Units issued in connection with the Offering and the exercise of the Option in full.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits.

|

EXHIBIT

|

|

DESCRIPTION

|

|

5.1

|

|

Opinion of Latham & Watkins LLP as to the legality of the securities being registered

|

|

23.1

|

|

Consent of Latham & Watkins LLP (contained in Exhibit 5.1)

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ANTERO MIDSTREAM PARTNERS LP

|

|

|

|

|

|

|

By:

|

Antero Resources Midstream Management LLC,

|

|

|

|

its general partner

|

|

|

|

|

|

|

By:

|

/s/ Glen C. Warren, Jr.

|

|

|

|

Glen C. Warren, Jr.

|

|

|

|

President

|

Dated: February 10, 2017

3

EXHIBIT INDEX

|

EXHIBIT

|

|

DESCRIPTION

|

|

5.1

|

|

Opinion of Latham & Watkins LLP as to the legality of the securities being registered

|

|

23.1

|

|

Consent of Latham & Watkins LLP (contained in Exhibit 5.1)

|

4

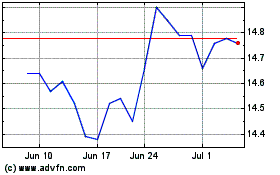

Antero Midstream (NYSE:AM)

Historical Stock Chart

From Mar 2024 to Apr 2024

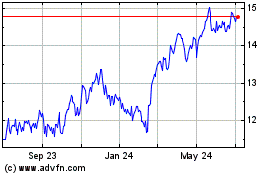

Antero Midstream (NYSE:AM)

Historical Stock Chart

From Apr 2023 to Apr 2024