CSX, Railroad Veteran Hunter Harrison Have Discussed Three-Year CEO Contract--Update

February 10 2017 - 1:01PM

Dow Jones News

By Jacquie McNish and David Benoit

CSX Corp. on Friday pushed off a board fight with an activist

investor, buying more time to reach an agreement to install

railroad veteran Hunter Harrison as its chief executive.

The company extended the deadline for board nominations until

Feb. 24, giving Mr. Harrison and his partner, activist investor

Paul Hilal, until that date to nominate directors as they negotiate

a deal to gain board seats and replace CSX's long-serving Chairman

and CEO Michael Ward.

Mr. Harrison and CSX have discussed a three-year contract for

the 72-year-old to run the Jacksonville, Fla.-based railroad, but

Mr. Hilal's request for as many as six board seats has become a

sticking point in the talks, according to people familiar with the

matter.

The director discussions are still fluid, the people said. A

deal isn't a sure thing, as Messrs. Harrison and Hilal are seen as

a package deal, they added.

Mr. Hilal told CSX directors at meetings in Atlanta last week

that his goal is to avoid a board fight, the people said. His fund,

Mantle Ridge LP, raised more than $1 billion for its CSX

investment.

CSX is expected to announce a succession plan for Mr. Ward even

if the company doesn't reach a deal with Mr. Harrison, some of the

people said.

Mr. Ward, who took over as CEO in 2003, has spent nearly four

decades with CSX, and investors had previously questioned the

company's succession plan. His retirement was delayed two years ago

when CSX lost its No. 2 executive, Oscar Munoz, to United

Continental Holdings Inc., where he is now CEO.

CSX is under pressure to settle in part because its stock has

surged by roughly 30% since Mr. Harrison stepped down from CP's

board and The Wall Street Journal reported that he and Mantle Ridge

would mount a campaign at CSX. Mr. Harrison's track record of

improving efficiency at other railroads helps explain investor

enthusiasm for the prospect of a shakeup at CSX.

The move put a spotlight on the profitability of CSX, which

operates one of two major rail networks east of the Mississippi.

CSX has for years aimed to reach an operating ratio, a measure of

costs as a percentage of revenue, in the mid-60s. In its last

fiscal year, its ratio was just under 70%.

--Paul Ziobro contributed to this article.

Write to Jacquie McNish at Jacquie.McNish@wsj.com and David

Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

February 10, 2017 12:46 ET (17:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

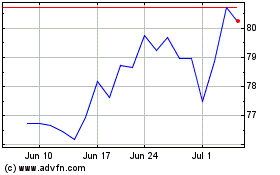

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

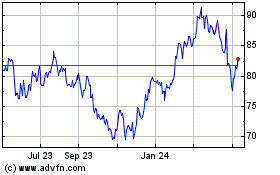

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024