The Female Health Company / Veru Healthcare (NASDAQ:FHCO) (the

Company) today reported its financial results for the fiscal 2017

first quarter ended December 31, 2016. The Company’s fiscal 2017

first-quarter financial results include the operations of Aspen

Park Pharmaceuticals, Inc. since the acquisition date, October 31,

2016.

“We are excited about the progress we are making to advance our

multiple drug candidates and the incredible growth opportunities

they represent,” said Mitchell Steiner, MD, President and Chief

Executive Officer of The Female Health Company / Veru Healthcare.

“Given the size of our company, to have this many high quality

shots on goal is quite unique. In recent weeks, we have

strengthened our leadership team and, with guidance from our board

of directors, refocused our strategy to rapidly move our drug

portfolio forward.”

“With regard to our proprietary Tamsulosin DRS (Delayed Release

Sachet) product, a slow release granule formulation that addresses

the large patient population of men with benign prostatic

hyperplasia (BPH), we plan to initiate the formulation selection,

single dose bioequivalence clinical trial next month. Our

sales and marketing team is working to add new revenues from FC2

available as a prescription product for reimbursement, by

capitalizing on existing Federal and State laws that mandate

coverage of female condoms. As we are facing a sexually transmitted

disease (STD) epidemic in the US and FC2 provides dual protection

against unwanted pregnancies and STDs, we believe FC2 is without

equal as a contraception product for women who want to take control

of their sexual health and protect themselves from STDs.”

“Building on the positive momentum from our recent meeting with

the FDA Advisory Committee held on December 6, 2016, we are

preparing an Investigational New Drug (IND) application for

MSS-722, our proprietary oral drug candidate for the treatment of

male infertility. We believe our product has the potential to

improve sperm count and sperm quality in infertile men thereby

potentially avoiding more intrusive and expensive alternatives for

couples trying to have children. And finally, we have requested a

pre-IND meeting with the FDA for APP-944, our product for the

treatment of hot flashes in men with advanced prostate cancer who

are receiving hormonal therapies.”

Commenting on the Company’s financial results, Dr. Steiner

added, “Last year’s first quarter included extraordinarily large

tender shipments of FC2 to the Brazilian Ministry of Health.

Excluding this unusual Brazilian tender, FC2 unit sales were the

same in the current year first quarter compared with the prior-year

first quarter. Our fiscal 2017 first quarter financial performance

was impacted by non-recurring acquisition-related costs, as well as

fees associated with securing our intellectual property. We

received a $2.8 million payment related to a past due obligation

from Brazil, strengthening our balance sheet and providing

additional financial flexibility, and we are optimistic that we

will receive additional payments related to past due obligations in

2017. Nonetheless, these financial results continue to support the

rationale for the Company’s recent merger as a revenue

diversification and growth strategy. We are now positioned for

financial growth from multiple new near-term sources of revenue

that will add to our inconsistent global public health sector

business. We anticipate immediate and near term revenues from FC2

commercial business and Tamsulosin DRS, respectively.”

Recent Highlights

- Unit sales of FC2 were 6.3 million in the fiscal 2017 first

quarter. This compares with the prior year first quarter unit sales

of 15.4 million, which included an unusually large tender of 9.1

million units to the Brazil Ministry of Health as well as 6.3

million from other customers. Excluding the Brazilian order, unit

sales were the same in the fiscal 2017 first quarter compared with

the same period last year.

- In January, 2017, established a dedicated sales and marketing

team, with the goal of coordinating prelaunch, launch, and sales

and marketing activities to gain market share and drive business

growth for the Company’s currently marketed products, as well as

its drug development candidates.

- On January 4, 2017, announced that, through its exclusive

distributor in Brazil, Semina Indústria e Comércio Ltda (Semina),

the Company received a payment of $2.8 million related to past due

obligations from the Brazilian Ministry of Health. The payment

represents the full amount owed on the two oldest open invoices and

reduces the amount owed on 2015 invoices from $8.0 million to $5.2

million. The amount owed for 2016 invoices is $7.8 million, for a

total outstanding balance of $13.1 million after the payment.

Semina has informed the company that additional payments are

expected in 2017.

- On December 7, 2016, announced its plan for a Phase 2 clinical

trial for MSS-722, the company’s proprietary oral drug candidate

for the treatment of male infertility, following the company’s

presentation and FDA guidance resulting from the Bone, Reproductive

and Urologic Drugs Advisory Committee of FDA on December 6,

2016.

Fiscal First Quarter Results: 2017 vs. 2016

For the first quarter of fiscal 2017, net revenues were $3.2

million. This compares with the near record net revenues for the

first quarter of fiscal 2016 of $8.2 million, which included net

revenues of $4.8 million from Brazil. Gross profit was $1.7

million, or 51% of net revenues, compared with $5.4 million, or 66%

of net revenues, for the first quarter of fiscal 2016. Operating

expenses were $3.5 million, which includes non-recurring

acquisition-related expenses of $826,000 and amortization of

intangible assets of $27,000, as well as increased employee

compensation expense, legal expense and costs associated with

intellectual property rights. The $826,000 of non-recurring

acquisition-related expenses includes warrant expense of $543,000

for warrants to the Company’s outside financial advisor, Torreya,

as part of the acquisition. This compares with operating expenses

of $3.0 million for the prior year first quarter. Net loss was $1.4

million, or $0.04 per share, versus net income of $1.5 million, or

$0.05 per diluted share, for the first quarter of fiscal 2016.

Significant quarter-to-quarter variations in the

Company’s results have historically resulted from the timing and

shipment of large orders rather than from any fundamental changes

in the business or the underlying demand for female condoms. Two of

the largest customers for FC2 operate in markets where the

government health ministries are either still under a multi-year

tender or have had a multi-year tender recently expire, and as a

result significant orders from these customers during the remainder

of fiscal 2017 are unlikely. The Company is also currently seeing

pressure on spending for FC2 by large global agencies and donor

governments in the developed world. As a result, the Company may

continue to experience challenges for unit sales of FC2 in the

global public sector for the remainder of fiscal 2017.

The Company expects to host a conference call in early to

mid-March to update investors on the Company’s product

commercialization and drug development progress. Shareholders and

other interested parties with questions may contact Kevin Gilbert

at 312-366-2633 or KGilbert@veruhealthcare.com.

About The Female Health Company / Veru

HealthcareThe Female Health Company / Veru Healthcare is a

pharmaceutical and medical device company, with a focus on the

development and commercialization of pharmaceuticals that qualify

for the FDA's 505(b)(2) accelerated regulatory approval pathway as

well as the 505(b)(1) pathway. The Company does business both as

"Veru Healthcare" and as "The Female Health Company" and is

organized as follows:

- Veru Healthcare manages the Pharmaceuticals Division, which

develops and commercializes pharmaceutical products for men's and

women's health and oncology.

- Veru Healthcare manages the Consumer Health / Medical Devices

Division, which is focused on commercializing sexual healthcare

products and devices for the consumer market, including the

Company's FC2 Female Condom® in the consumer health products sector

and PREBOOST® medicated individual wipes, which are a male genital

desensitizing drug product that helps in the prevention of

premature ejaculation.

- The Female Health Company manages the Global Public Health

Division, which is focused on the global public health sector FC2

business. This division markets the Company’s Female Condom (FC2)

to entities, including ministries of health, government health

agencies, U.N. agencies, nonprofit organizations and commercial

partners, that work to support and improve the lives, health and

well-being of women around the world.

More information about the Female Health Company/ Veru

Healthcare and its products can be found at www.femalehealth.com,

www.veruhealthcare.com and www.femalecondom.org. For corporate and

investor-related information about the Company, please visit

www.FHCinvestor.com.

"Safe Harbor" statement under the Private Securities

Litigation Reform Act of 1995:The statements in this

release which are not historical fact are "forward-looking

statements" as that term is defined in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements in this

release include statements relating to the regulatory pathway to

secure FDA approval of the Company's drug candidates, the impact of

FHC's strategies on operating results, long-term demand for female

condoms, PREBOOST®, Tamsulosin DRS and MSS-722, the expectation of

additional payments from the Brazilian Ministry of Health in 2017,

and anticipated immediate and near-term revenues. These statements

are based upon the Company's current plans and strategies, and

reflect the Company's current assessment of the risks and

uncertainties related to its business, and are made as of the date

of this release. The Company assumes no obligation to update any

forward-looking statements contained in this release as a result of

new information or future events, developments or circumstances.

Such forward-looking statements are inherently subject to known and

unknown risks and uncertainties. The Company's actual results and

future developments could differ materially from the results or

developments expressed in, or implied by, these forward-looking

statements. Factors that may cause actual results to differ

materially from those contemplated by such forward-looking

statements include, but are not limited to, the following: product

demand and market acceptance; competition in the Company's markets

and the risk of new competitors and new competitive product

introductions; risks relating to the ability of the Company to

obtain sufficient financing on acceptable terms when needed to fund

development and operations; risks related to the development of the

Company's product portfolio, including clinical trials, regulatory

approvals and time and cost to bring to market; many of the

Company's products are at an early stage of development and the

Company may fail to successfully commercialize such products; risks

related to intellectual property, including licensing risks;

government contracting risks, including the appropriations process

and funding priorities, potential bureaucratic delays in awarding

contracts, process errors, politics or other pressures, and the

risk that government tenders and contracts may be subject to

cancellation, delay or restructuring; a governmental tender award

indicates acceptance of the bidder's price rather than an order or

guarantee of the purchase of any minimum number of units, and as a

result government ministries or other public sector customers may

order and purchase fewer units than the full maximum tender amount;

the Company's reliance on its international partners in the

consumer sector and on the level of spending on the female condom

by country governments, global donors and other public health

organizations in the global public sector; the economic and

business environment and the impact of government pressures; risks

involved in doing business on an international level, including

currency risks, regulatory requirements, political risks, export

restrictions and other trade barriers; the Company's production

capacity, efficiency and supply constraints; risks related to the

costs and other effects of litigation; the Company’s ability to

identify, successfully negotiate and complete suitable acquisitions

or other strategic initiatives; the Company’s ability to

successfully integrate acquired businesses, technologies or

products; and other risks detailed in the Company's press releases,

shareholder communications and Securities and Exchange Commission

filings, including the Company's Form 10-K for the year ended

September 30, 2016. These documents are available on the "SEC

Filings" section of our website at

www.veruhealthcare.com/investors.

FINANCIAL SCHEDULES FOLLOW

| The Female Health Company |

| Unaudited Condensed Consolidated Balance

Sheets |

| |

|

|

|

|

|

December 31, |

|

September 30, |

|

|

|

2016 |

|

|

2016 |

| Cash |

$ |

3,485,424 |

|

$ |

2,385,082 |

| Accounts receivable,

net |

|

8,390,949 |

|

|

10,775,200 |

| Income tax

receivable |

|

2,196 |

|

|

2,387 |

| Inventory, net |

|

2,522,281 |

|

|

2,492,644 |

| Prepaid expenses and

other current assets |

|

720,944 |

|

|

634,588 |

| Total current

assets |

|

15,121,794 |

|

|

16,289,901 |

| |

|

|

|

| Other trade

receivables |

|

7,837,500 |

|

|

7,837,500 |

| Other non-current

assets |

|

178,579 |

|

|

189,219 |

| Plant and equipment,

net |

|

798,247 |

|

|

825,087 |

| Deferred income

taxes |

|

8,872,764 |

|

|

13,482,000 |

| Intangible assets,

net |

|

20,873,271 |

|

|

0 |

| Goodwill |

|

6,878,932 |

|

|

0 |

| Total assets |

$ |

60,561,087 |

|

$ |

38,623,707 |

| |

|

|

|

| Accounts payable |

$ |

1,266,122 |

|

$ |

701,035 |

| Accrued expenses and

other current liabilities |

|

3,046,439 |

|

|

2,380,571 |

| Accrued

compensation |

|

61,182 |

|

|

264,871 |

| Total current

liabilities |

|

4,373,743 |

|

|

3,346,477 |

| |

|

|

|

| Other liabilities |

|

1,233,750 |

|

|

1,233,750 |

| Deferred rent |

|

22,424 |

|

|

0 |

| Deferred income

taxes |

|

1,709,260 |

|

|

110,069 |

| Total liabilities |

|

7,339,177 |

|

|

4,690,296 |

| |

|

|

|

| Series 4 preferred

stock |

|

17,981,883 |

|

|

0 |

| Total stockholders'

equity |

|

35,240,027 |

|

|

33,933,411 |

| Total liabilities and

stockholders’ equity |

$ |

60,561,087 |

|

$ |

38,623,707 |

| |

|

|

|

|

|

| The Female Health Company |

| Unaudited Condensed Consolidated Statements of

Operations |

| |

|

| |

Three Months Ended |

| |

December 31, |

| |

2016 |

|

|

|

2015 |

|

| |

|

|

|

|

|

|

| Net revenues |

$ |

3,243,599 |

|

|

|

$ |

8,230,659 |

|

| |

|

|

|

|

|

|

| Cost of sales |

|

1,591,315 |

|

|

|

|

2,828,322 |

|

| |

|

|

|

|

|

|

| Gross profit |

|

1,652,284 |

|

|

|

|

5,402,337 |

|

| |

|

|

|

|

|

|

| Operating expenses |

|

3,526,974 |

|

|

|

|

3,009,782 |

|

| |

|

|

|

|

|

|

| Operating (loss)

income |

|

(1,874,690 |

) |

|

|

|

2,392,555 |

|

| |

|

|

|

|

|

|

| Interest and other

expense, net |

|

(9,621 |

) |

|

|

|

(27,795 |

) |

| Foreign currency

transaction loss |

|

(11,939 |

) |

|

|

|

(44,944 |

) |

| |

|

|

|

|

|

|

| (Loss) income before

income taxes |

|

(1,896,250 |

) |

|

|

|

2,319,816 |

|

| |

|

|

|

|

|

|

| Income tax (benefit)

expense |

|

(530,069 |

) |

|

|

|

829,453 |

|

| Net (loss) income |

$ |

(1,366,181 |

) |

|

|

$ |

1,490,363 |

|

| |

|

|

|

|

|

|

| Net (loss) income per

basic common share outstanding |

$ |

(0.04 |

) |

|

|

$ |

0.05 |

|

| |

|

|

|

|

|

|

| Basic weighted average

common shares outstanding |

|

30,976,140 |

|

|

|

|

28,633,372 |

|

| |

|

|

|

|

|

|

| Net (loss) income per

diluted common share outstanding |

$ |

(0.04 |

) |

|

|

$ |

0.05 |

|

| |

|

|

|

|

|

|

| Diluted weighted

average common shares outstanding |

|

30,976,140 |

|

|

|

|

28,993,943 |

|

| |

|

|

|

|

|

|

| The Female Health Company |

| Unaudited Condensed Consolidated Statements of

Cash Flows |

| |

|

|

|

|

|

Three Months Ended |

| |

|

December 31, |

| |

|

2016 |

|

|

2015 |

|

| Net (loss) income |

$ |

(1,366,181 |

) |

$ |

1,490,363 |

|

| |

|

|

|

|

| Adjustments

to reconcile net (loss) income to net cash provided by (used in)

operating activities: |

| |

|

Depreciation and amortization |

|

89,284 |

|

|

114,406 |

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

26,729 |

|

|

0 |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

317,311 |

|

|

123,344 |

|

|

|

|

|

|

|

| Warrants

issued |

|

542,930 |

|

|

0 |

|

|

|

|

|

|

|

|

|

| Deferred

income taxes |

|

(591,573 |

) |

|

746,452 |

|

|

|

|

|

|

|

| Loss on

disposal of fixed assets |

|

4,469 |

|

|

111 |

|

| |

|

|

|

|

| Changes

in current assets and liabilities, net of effects of acquisition of

a business |

|

2,142,996 |

|

|

(2,905,907 |

) |

|

|

|

|

|

|

|

|

| Net cash provided by

(used in) operating activities |

|

1,165,965 |

|

|

(431,231 |

) |

| |

|

|

|

|

|

|

| Net cash used in

investing activities |

|

(65,623 |

) |

|

(2,942 |

) |

| |

|

|

|

|

|

|

| Net increase (decrease)

in cash |

|

1,100,342 |

|

|

(434,173 |

) |

| |

|

|

|

|

|

|

| Cash at beginning of

period |

|

2,385,082 |

|

|

4,105,814 |

|

| |

|

|

|

|

|

|

| Cash at end of

period |

$ |

3,485,424 |

|

$ |

3,671,641 |

|

| |

|

|

|

|

|

|

Contact:

Kevin Gilbert: 312-366-2633

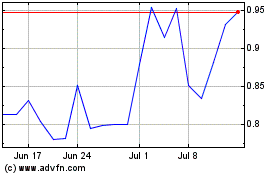

Veru (NASDAQ:VERU)

Historical Stock Chart

From Mar 2024 to Apr 2024

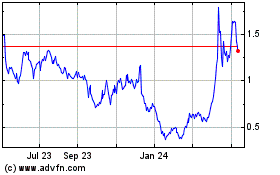

Veru (NASDAQ:VERU)

Historical Stock Chart

From Apr 2023 to Apr 2024