Civitas Solutions, Inc. (NYSE:CIVI) today reported financial

results for the fiscal first quarter ended December 31, 2016.

First Quarter Fiscal 2017 Highlights

- First quarter net revenue increased

3.9% to $359.4 million; excluding at-risk youth ("ARY") divested

operations, first quarter net revenue increased by 6.1%

- First quarter net income was $4.2

million, compared to a net loss of $5.6 million in the first

quarter of fiscal 2016

- First quarter Adjusted EBITDA increased

3.3% to $37.5 million

“Our first quarter growth reflects increases in volumes and

rates in our I/DD, SRS and ADH service lines, and includes a very

strong operating performance from our SRS service line, in which

gross revenue increased 9.7%. In addition, gross revenue from our

newest service line—adult day health—doubled from the year earlier

period, and we continued to reduce leverage. At the same time, we

maintained our elevated level of new start investment and, while

the first quarter was quiet with regard to the closing of M&A

deals, we are poised to leverage a robust acquisition

pipeline.”

First Quarter Fiscal 2017 Financial Results

Net revenue for the first quarter was $359.4 million, an

increase of $13.6 million, or 3.9%, over net revenue for the same

period of the prior year. The growth in net revenue was negatively

impacted by the divestiture of our ARY operations in six states

during fiscal 2015 and the first half of fiscal 2016, which

resulted in a decrease in net revenue of $6.9 million as compared

to the first quarter of the prior year. Excluding these operations,

net revenue increased by $20.5 million, or 6.1%, of which $11.5

million was from acquisitions that closed during and after the

quarter ended December 31, 2015, and $9.0 million was from organic

growth.

Net revenue consisted of:

- Intellectual and Developmental

Disabilities ("I/DD") services net revenue of $238.2 million, an

increase of 3.6% compared to the first quarter of fiscal 2016.

- Post-Acute Specialty Rehabilitation

Services ("SRS") services net revenue of $74.3 million, an increase

of 9.2% compared to the first quarter of fiscal 2016.

- ARY service net revenue of $35.8

million, a decrease of 15.3% compared to the first quarter of

fiscal 2016. Excluding the ARY divestitures, ARY services net

revenue increased by 1.2%.

- Adult Day Health ("ADH") services net

revenue of $11.1 million, an increase of approximately 100%

compared to the first quarter of fiscal 2016.

Income from operations for the first quarter was $15.5 million,

or 4.3% of net revenue, compared to $7.2 million, or 2.1% of net

revenue, for the first quarter of the prior year. The increase in

our operating margin was driven by a decrease in general and

administrative expenses compared to the first quarter of fiscal

2016. This decrease was primarily due to cost containment efforts

and a $9.6 million reduction in stock based compensation resulting

from a $10.5 million stock based compensation charge recorded

during the first quarter of the prior year related to awards under

our former equity plan. The increase in our operating margin was

partially offset by an increase in direct labor costs, due to

higher amounts of overtime in some markets and increased health

insurance costs, and an increase in occupancy costs due to higher

open occupancy rates primarily within our I/DD business. The

increase was also partially offset by a $2.9 million favorable

adjustment to acquisition related contingent consideration recorded

during the first quarter of the prior year.

Net income for the first quarter was $4.2 million compared to a

net loss of $5.6 million for the same period of the prior year. Net

loss during the first quarter of fiscal 2016 was negatively

affected by the tax impact of the stock compensation charge

described above, which was not deductible for tax purposes.

Basic and diluted net income per common share from continuing

operations was $0.11 for the first quarter ended December 31, 2016,

compared to basic and diluted net loss per common share from

continuing operations of $0.15 for the same period of the prior

year.

Adjusted EBITDA for the first quarter was $37.5 million, or

10.4% of net revenue, compared to Adjusted EBITDA of $36.3 million,

or 10.5% of net revenue, for the first quarter of the prior year.

The increase in our Adjusted EBITDA was primarily due to cost

containment efforts in administrative staffing, business and office

related costs and the positive impact of divesting lower margin ARY

businesses during the first half of fiscal 2016. The increase was

partially offset by the increases in direct labor and occupancy

costs described above.

Fiscal 2017 Outlook and Guidance

The Company is confirming its fiscal year 2017 net revenue and

Adjusted EBITDA guidance that it originally communicated on

December 14, 2016 during the release of fiscal 2016 fourth quarter

and full year

For fiscal 2017, we are maintaining our guidance for net revenue

with a range of $1.48 billion to $1.52 billion and Adjusted EBITDA

with a range of $162.0 million to $166.0 million.

A reconciliation of the low-end and high-end of the Adjusted

EBITDA guidance to net income is as follows:

Fiscal Year Ending September 30,

2017

(In millions)

Low-end High-end Net income $

26.7 $ 29.1 Provision for income taxes 17.8 19.4 Interest

expense, net 32.7 32.7 Depreciation and amortization 73.0 73.0

Stock-based compensation 10.0 10.0 Contingent consideration

adjustment 0.4 0.4 Expense reduction project costs 1.4

1.4 Adjusted EBITDA $ 162.0 $ 166.0 Modeling

guidelines for the current fiscal year assume the following:

Average basic and diluted shares

outstanding for the year: 38 million

Capital expenditures: 3.3% of net

revenue

Annual tax rate: 40%

Net income as presented in the reconciliation of Adjusted EBITDA

guidance to net income may be further impacted by potential future

non-operating charges that would impact net income without

affecting Adjusted EBITDA.

Conference Call

This afternoon, Thursday, February 9, 2017, Civitas Solutions

management will host a conference call at 5:00 p.m. (Eastern Time)

to discuss the fiscal 2017 first quarter operating results.

Conference Call Dial-in #: Domestic U.S. Toll

Free: 877-255-4315 International: 412-317-5467

Replay Details (available 1 hour after conclusion of the

conference call through 5/9/2017):

Domestic U.S. Toll Free: 877-344-7529

International: 412-317-0088 Canada Toll Free: 855-669-9658 Replay

Access Code: 10101091

A live webcast of the conference call will be available via the

investor relations section of the Company’s website:

www.civitas-solutions.com. Following the call, an archived replay

of the webcast will be available on this website through May 9,

2017.

Non-GAAP Financial Information

This earnings release includes a discussion of Adjusted EBITDA,

net revenue excluding ARY divested operations, and net debt, which

are non-GAAP financial measures. Adjusted EBITDA is presented

because it is an important measure used by management to assess

financial performance, and management believes it provides a more

transparent view of the Company’s underlying operating performance

and operating trends. In addition, the Company believes this

measurement is important because securities analysts, investors and

lenders use this measurement to compare the Company’s performance

to other companies in our industry. Net revenue excluding ARY

divested operations is presented to enhance investors’

understanding of the financial performance and operating trends of

the continuing operations. Net debt is presented because it is

useful for lenders, securities analysts, and investors in

determining the Company's net debt leverage ratio.

The non-GAAP financial measures are not determined in accordance

with GAAP and should not be considered in isolation or as

alternatives to net income, revenues or total debt or other

financial statement data presented as indicators of financial

performance or liquidity, each as presented in accordance with

GAAP. Adjusted EBITDA should not be considered as a measure of

discretionary cash available to us to invest in the growth of our

business. While we and other companies in our industry frequently

use Adjusted EBITDA as a measure of operating performance and the

ability to meet debt service requirements, it is not necessarily

comparable to other similarly titled captions of other companies

due to potential inconsistencies in the methods of calculation. All

non-GAAP financial measures should be reviewed in conjunction with

the Company’s financial statements filed with the SEC.

For a reconciliation of each non-GAAP financial measure to the

most directly comparable GAAP financial measure, please see

“Reconciliation of non-GAAP Financial Measures” on page 7 of this

press release.

Forward-Looking Statements

This press release contains statements about future events and

expectations that constitute forward-looking statements, including

our guidance, outlook and statements about our expectations for

future financial performance. Forward-looking statements are based

on our beliefs, assumptions and expectations of industry trends,

our future financial and operating performance and our growth,

taking into account the information currently available to us.

These statements are not statements of historical fact.

Forward-looking statements involve risks and uncertainties that may

cause our actual results to differ materially from the expectations

of future results we express or imply in any forward-looking

statements and you should not place undue reliance on such

statements. Factors that could contribute to these differences

include, but are not limited to: reductions or changes in Medicaid

or other funding; changes in budgetary priorities by federal, state

and local governments; substantial claims, litigation and

governmental proceedings; reductions in reimbursement rates or

changes in policies or payment practices by the Company’s payors;

increases in labor costs; matters involving employees that may

expose the Company to potential liability; the Company’s

substantial amount of debt; the Company’s ability to comply with

billing and collection rules and regulations; changes in economic

conditions; increases in insurance costs; increases in workers

compensation-related liability; the Company’s ability to maintain

relationships with government agencies and advocacy groups;

negative publicity; the Company’s ability to maintain existing

service contracts and licenses; the Company’s ability to implement

its growth strategies successfully; the Company’s financial

performance; and other factors described in “Risk Factors” in

Civitas’ Form 10-K. Words such as “anticipates”, “believes”,

“continues”, "positions", “estimates”, “expects”, “goal”,

"aspiration", “objectives”, “intends”, “may”, “hope”,

“opportunity”, “plans”, “potential”, “near-term”, “long-term”,

“projections”, “assumptions”, “projects”, “guidance”, “forecasts”,

“outlook”, “target”, “trends”, “should”, “could”, “would”, “will”

and similar expressions are intended to identify such

forward-looking statements. We qualify any forward-looking

statements entirely by these cautionary factors. We assume no

obligation to update or revise any forward-looking statements for

any reason, or to update the reasons actual results could differ

materially from those anticipated in these forward-looking

statements, even if new information becomes available in the

future. Comparisons of results for current and any prior periods

are not intended to express any future trends or indications of

future performance, unless expressed as such, and should only be

viewed as historical data.

Select Financial Highlights

($ in thousands, except share and per

share data)

(unaudited)

Three Months Ended

December 31,

2016

2015

Gross revenue $ 364,441 $ 349,736 Sales adjustments (5,047 )

(3,989 ) Net revenue 359,394 345,747 Cost of revenue 283,976

271,012 Operating expenses: General and administrative expenses

41,792 49,542 Depreciation and amortization 18,155

17,987 Total operating expenses 59,947

67,529 Income from operations 15,471 7,206 Other

income (expense): Other income (expense), net 56 (815 ) Interest

expense (8,485 ) (8,573 ) Income (loss) from

continuing operations before income taxes 7,042 (2,182 ) Provision

for income taxes 2,863 3,392 Income

(loss) from continuing operations 4,179 (5,574 ) Loss from

discontinued operations, net of tax — (30 )

Net income (loss) $ 4,179 $ (5,604 ) Income (loss) per

common share, basic and diluted Income (loss) from continuing

operations $ 0.11 $ (0.15 ) Loss from discontinued operations

— — Net income (loss) $ 0.11 $

(0.15 ) Weighted average number of common shares outstanding, basic

37,231,067 37,095,279 Weighted average number of common shares

outstanding, diluted 37,328,638 37,095,279

Selected Balance Sheet and Cash Flow

Highlights

($ in thousands)

(unaudited)

As of

December 31, 2016

September 30, 2016

Cash and cash equivalents

$

53,725

$ 50,683 Working capital (a) $ 87,879 $ 77,354 Total assets

$ 1,067,921 $ 1,086,158 Total debt (b) $ 642,820 $ 644,591 Net debt

(c) $ 539,095 $ 543,908 Stockholders' equity $ 154,496 $ 145,590

Three Months Ended December 31,

2016 2015 Cash

flows provided by (used in): Operating activities $ 15,797 $ 6,617

Investing activities $ (10,571 ) $ (13,073 ) Financing activities $

(2,184 ) $ (1,040 ) Purchases of property and equipment $ (11,327 )

$ (9,122 ) Acquisition of businesses, net of cash acquired $ — $

(4,156 ) (a) Calculated as current assets minus

current liabilities. (b) Includes obligations under capital leases.

(c) Represents net debt as defined in our senior credit agreement

(total debt, net of cash and cash equivalents and restricted cash).

See Reconciliation of non-GAAP Financial Measures for a

reconciliation of total debt to net debt.

Reconciliation of Non-GAAP Financial

Measures

($ in thousands)

(unaudited)

Three Months Ended December

31,

2016

2015

Net income $ 4,179 $ (5,604 ) Loss from discontinued

operations, net of tax — 30 Provision for income taxes 2,863 3,392

Interest expense, net 8,481 8,349 Depreciation and amortization

18,155 17,987

Adjustments: Stock-based compensation (a)

2,079 11,719 Exit costs(b) — 2,140 Contingent consideration

adjustment (c) 375 (2,945 ) Sale of business(d) — 1,250 Expense

reduction project costs(e) 1,375 —

Adjusted EBITDA $ 37,507 $ 36,318 (a)

Represents non-cash stock-based compensation expense. For the three

months ended December 31, 2015, stock- based compensation includes

$10.5 million of expense related to certain awards under our former

equity compensation plan that vested in connection with our

secondary offering and the distribution of our shares held by NMH

Investment, LLC in October 2015. The vesting of these awards

impacted the allocation of the shares of Civitas that were

distributed from NMH Investment, LLC to our private equity sponsor

and management and not the number of shares outstanding. (b)

Represents severance and lease terminations costs associated with

our ARY divestitures. (c) Represents the fair value adjustment

associated with acquisition related contingent consideration

liabilities. (d) Represents the loss recorded on the sale of our

North Carolina ARY business. (e) Represents consulting and

severance costs incurred in connection with the Company's project

to optimize business operations and reduce company-wide expenses.

Reconciliation of Non-GAAP Financial

Measures (continued)($ in thousands)(unaudited)

Reconciliations of net revenue to net revenue excluding ARY

divested operations, for the three months ended December 31, 2016

and 2015 are as follows:

Three Months Ended December

31,

2016 2015

$ Change

% Change Net revenue $ 359,394 $ 345,747

$

13,647

3.9 % Less net revenue from ARY divested operations 17

6,889 (6,872 ) Net revenue excluding ARY divested

operations $ 359,377 $ 338,858 $ 20,519 6.1 %

Three Months Ended December

31,

2016 2015

$ Change

% Change ARY net revenue $ 35,757 $ 42,194 $ (6,437 )

(15.3 )% Less net revenue from ARY divested operations 17 6,889

(6,872 ) Human Services net revenue excluding ARY divested

operations $ 35,740 $ 35,305 $ 435 1.2 %

A reconciliation of total debt to net debt

is as follows:

As of

December 31, 2016

September 30, 2016

Total debt

$

642,820

$

644,591

Cash and cash equivalents

53,725

50,683

Restricted cash

50,000

50,000

Net debt

$

539,095

$

543,908

About Civitas

Civitas Solutions, Inc. is the leading national provider of

home- and community-based health and human services to must-serve

individuals with intellectual, developmental, physical or

behavioral disabilities and other special needs. Since our founding

in 1980, we have evolved from a single residential program to a

diversified national network offering an array of quality services

in 35 states.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170209006295/en/

Civitas Solutions, Inc.Dwight Robson, 617-790-4800Chief Public

Strategy and Marketing

Officerdwight.robson@civitas-solutions.com

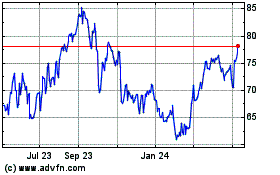

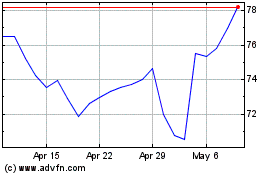

Civitas Resources (NYSE:CIVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Civitas Resources (NYSE:CIVI)

Historical Stock Chart

From Apr 2023 to Apr 2024