CUSIP NO. 828336107 13G Page 1 of 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. )*

SILVER WHEATON CORP.

(Name of Issuer)

Common Shares, no par value

[1]

(Title of Class of Securities)

828336107

(CUSIP Number)

December 31, 2016

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule is filed:

[X] Rule 13d‑1(b)

[ ] Rule 13d‑1(c)

[ ] Rule 13d‑1(d)

*The remainder of this cover page shall be filled out for a reporting person's

initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter the

disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed

to be "filed" for the purpose of Section 18 of the Securities Exchange Act of

1934 ("Act") or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the

Notes).

[1]

These securities are traded in the U.S. and Canada. Their title in the U.S. is

"common shares" and in Canada is "ordinary shares." The title reported in this

Schedule 13G is the title used in the U.S. as listed on the New York Stock

Exchange, Inc. (the "NYSE").

CUSIP NO. 828336107 13G Page 2 of 14

1. NAMES OF REPORTING PERSONS.

Franklin Resources, Inc.

2. CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

(b) X

3. SEC USE ONLY

4. CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

5. SOLE VOTING POWER

(See Item 4)

6. SHARED VOTING POWER

(See Item 4)

7. SOLE DISPOSITIVE POWER

(See Item 4)

8. SHARED DISPOSITIVE POWER

(See Item 4)

9. AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,839,562

10. CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES [ ]

11. PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

5.6%

12. TYPE OF REPORTING PERSON

HC, CO (See Item 4)

CUSIP NO. 828336107 13G Page 3 of 14

1. NAMES OF REPORTING PERSONS.

Charles B. Johnson

2. CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

(b) X

3. SEC USE ONLY

4. CITIZENSHIP OR PLACE OF ORGANIZATION

USA

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

5. SOLE VOTING POWER

(See Item 4)

6. SHARED VOTING POWER

(See Item 4)

7. SOLE DISPOSITIVE POWER

(See Item 4)

8. SHARED DISPOSITIVE POWER

(See Item 4)

9. AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,839,562

10. CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES [ ]

11. PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

5.6%

12. TYPE OF REPORTING PERSON

HC, IN (See Item 4)

CUSIP NO. 828336107 13G Page 4 of 14

1. NAMES OF REPORTING PERSONS.

Rupert H. Johnson, Jr.

2. CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

(b) X

3. SEC USE ONLY

4. CITIZENSHIP OR PLACE OF ORGANIZATION

USA

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

5. SOLE VOTING POWER

(See Item 4)

6. SHARED VOTING POWER

(See Item 4)

7. SOLE DISPOSITIVE POWER

(See Item 4)

8. SHARED DISPOSITIVE POWER

(See Item 4)

9. AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,839,562

10. CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES

CERTAIN SHARES [ ]

11. PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

5.6%

12. TYPE OF REPORTING PERSON

HC, IN (See Item 4)

CUSIP NO. 828336107 13G Page 5 of 14

Item 1.

(a) Name of Issuer

SILVER WHEATON CORP.

(b) Address of Issuer's Principal Executive Offices

3500 – 1021 West Hastings Street

Vancouver, BC

Canada V6E 0C3

Item 2.

(a) Name of Person Filing

(i): Franklin Resources, Inc.

(ii): Charles B. Johnson

(iii): Rupert H. Johnson, Jr.

(b) Address of Principal Business Office or, if none, Residence

(i), (ii), and (iii):

One Franklin Parkway

San Mateo, CA 94403‑1906

(c) Citizenship

(i): Delaware

(ii) and (iii): USA

(d) Title of Class of Securities

Common Shares, no par value

(e) CUSIP Number

828336107

CUSIP NO. 828336107 13G Page 6 of 14

Item 3. If this statement is filed pursuant to §§240.13d‑1(b) or 240.13d‑2(b) or (c),

check whether the person filing is a:

(a) [ ] Broker or dealer registered under section 15 of the Act (15 U.S.C. 78o).

(b) [ ] Bank as defined in section 3(a)(6) of the Act (15 U.S.C. 78c).

(c) [ ] Insurance company as defined in section 3(a)(19) of the Act (15 U.S.C. 78c)

(d) [ ] Investment company registered under section 8 of the Investment Company Act

of 1940 (15 U.S.C 80a‑8).

(e) [ ] An investment adviser in accordance with §240.13d‑1(b)(1)(ii)(E);

(f) [ ] An employee benefit plan or endowment fund in accordance with §240.13d‑1(b)

(1)(ii)(F);

(g) [X] A parent holding company or control person in accordance with §240.13d‑1(b)

(1)(ii)(G);

(h) [ ] A savings associations as defined in Section 3(b) of the Federal Deposit

Insurance Act (12 U.S.C. 1813);

(i) [ ] A church plan that is excluded from the definition of an investment company

under section 3(c)(14) of the Investment Company Act of 1940 (15 U.S.C.

80a‑3);

(j) [ ] A non‑U.S. institution in accordance with §240.13d‑1(b)(ii)(J);

(k) [ ] Group, in accordance with §240.13d‑1(b)(1)(ii)(K).

If filing as a non‑U.S. institution in accordance with §240.13d‑1(b)(1)(ii)(J),

please specify the type of institution:

Item 4. Ownership

The securities reported herein are beneficially owned by one or more open ‑ or closed ‑

end investment companies or other managed accounts that are investment management clients

of investment managers that are direct and indirect subsidiaries (each, an “Investment

Management Subsidiary” and, collectively, the “Investment Management Subsidiaries”) of

Franklin Resources, Inc.(“FRI”), including the Investment Management Subsidiaries listed

in this Item 4. When an investment management contract (including a sub‑advisory

agreement) delegates to an Investment Management Subsidiary investment discretion or

voting power over the securities held in the investment advisory accounts that are subject

to that agreement, FRI treats the Investment Management Subsidiary as having sole

investment discretion or voting authority, as the case may be, unless the agreement

specifies otherwise. Accordingly, each Investment Management Subsidiary reports on

Schedule 13G that it has sole investment discretion and voting authority over the

securities covered by any such investment management agreement, unless otherwise noted in

this Item 4. As a result, for purposes of Rule 13d‑3 under the Act, the Investment

Management Subsidiaries listed in this Item 4 may be deemed to be the beneficial owners of

the securities reported in this Schedule 13G.

Beneficial ownership by Investment Management Subsidiaries and other FRI affiliates is

being reported in conformity with the guidelines articulated by the SEC staff in Release

No. 34‑39538 (January 12, 1998) relating to organizations, such as FRI, where related

entities exercise voting and investment powers over the securities being reported

independently from each other. The voting and investment powers held by Franklin Mutual

Advisers, LLC (“FMA”), an indirect wholly‑owned Investment Management Subsidiary, are

exercised independently from FRI and from all other Investment Management Subsidiaries

(FRI, its affiliates and the Investment Management Subsidiaries other than FMA are

collectively, “FRI affiliates”). Furthermore, internal policies and procedures of FMA and

FRI establish informational barriers that prevent the flow between FMA and the FRI

affiliates of information that relates to the voting and investment powers over the

securities owned by their respective investment management clients. Consequently, FMA and

the FRI affiliates report the securities over which they hold investment and voting power

separately from each other for purposes of Section 13 of the Act.

CUSIP NO. 828336107 13G Page 7 of 14

Charles B. Johnson and Rupert H. Johnson, Jr. (the “Principal Shareholders”) each own in

excess of 10% of the outstanding common stock of FRI and are the principal stockholders of

FRI. FRI and the Principal Shareholders may be deemed to be, for purposes of Rule 13d‑3

under the Act, the beneficial owners of securities held by persons and entities for whom

or for which FRI subsidiaries provide investment management services. The number of

shares that may be deemed to be beneficially owned and the percentage of the class of

which such shares are a part are reported in Items 9 and 11 of the cover pages for FRI and

each of the Principal Shareholders. FRI, the Principal Shareholders and each of the

Investment Management Subsidiaries disclaim any pecuniary interest in any of such

securities. In addition, the filing of this Schedule 13G on behalf of the Principal

Shareholders, FRI and the FRI affiliates, as applicable, should not be construed as an

admission that any of them is, and each of them disclaims that it is, the beneficial

owner, as defined in Rule 13d‑3, of any of the securities reported in this Schedule 13G.

FRI, the Principal Shareholders, and each of the Investment Management Subsidiaries

believe that they are not a “group” within the meaning of Rule 13d‑5 under the Act and

that they are not otherwise required to attribute to each other the beneficial ownership

of the securities held by any of them or by any persons or entities for whom or for which

the Investment Management Subsidiaries provide investment management services.

(a) Amount beneficially owned:

24,839,562

(b) Percent of class:

5.6%

(c) Number of shares as to which the person has:

(i) Sole power to vote or to direct the vote

Franklin Resources, Inc.: 0

Charles B. Johnson: 0

Rupert H. Johnson, Jr.: 0

Templeton Global Advisors Limited: 12,084,292

Templeton Investment Counsel, LLC: 8,142,726

Franklin Templeton Investments Corp.: 590,763

Franklin Templeton Investments Australia Limited: 323,400

Templeton Asset Management Ltd.: 320,545

Franklin Templeton Investment Management Limited: 155,400

Franklin Templeton Investments (Asia) Ltd.: 76,000

Franklin Templeton Investment Trust Management Co., Ltd: 13,200

Fiduciary Trust Company International: 11,600

Franklin Advisers, Inc.: 6,000

(ii) Shared power to vote or to direct the vote

Templeton Asset Management Ltd.: 144,900

Templeton Global Advisors Limited: 136,777

CUSIP NO. 828336107 13G Page 8 of 14

(iii) Sole power to dispose or to direct the disposition of

Franklin Resources, Inc.: 0

Charles B. Johnson: 0

Rupert H. Johnson, Jr.: 0

Templeton Global Advisors Limited: 12,246,269

Templeton Investment Counsel, LLC: 9,120,826

Templeton Asset Management Ltd.: 1,255,345

Franklin Templeton Investments Corp.: 590,763

Franklin Templeton Investments Australia Limited: 323,400

Franklin Templeton Investment Management Limited: 189,300

Franklin Templeton Investments (Asia) Ltd.: 76,000

Franklin Templeton Investment Trust Management Co., 13,200

Ltd:

Fiduciary Trust Company International: 11,600

Franklin Advisers, Inc.: 6,000

(iv) Shared power to dispose or to direct the disposition of

[2]

Templeton Global Advisors Limited: 861,959

Templeton Asset Management Ltd.: 144,900

[2]

One of the investment management contracts that relates to these securities provides that the

applicable FRI affiliate share investment power over the securities held in the client’s account

with another unaffiliated entity. The issuer's securities held in such account are less than

5% of the outstanding shares of the class. In addition, FRI does not believe that such contract

causes such client or unaffiliated entity to be part of a group with FRI or any FRI affiliate

within the meaning of Rule 13d‑5 under the Act.

CUSIP NO. 828336107 13G Page 9 of 14

Item 5. Ownership of Five Percent or Less of a Class

If this statement is being filed to report the fact that as of the date hereof

the reporting person has ceased to be the beneficial owner of more than five

percent of the class of securities, check the following [ ].

Item 6. Ownership of More than Five Percent on Behalf of Another Person

The clients of the Investment Management Subsidiaries, including investment

companies registered under the Investment Company Act of 1940 and other

managed accounts, have the right to receive or power to direct the receipt of

dividends from, and the proceeds from the sale of, the securities reported

herein.

Item 7. Identification and Classification of the Subsidiary Which Acquired the

Security Being Reported on By the Parent Holding Company

See Attached Exhibit C

Item 8. Identification and Classification of Members of the Group

Not Applicable

Item 9. Notice of Dissolution of Group

Not Applicable

CUSIP NO. 828336107 13G Page 10 of 14

Item 10. Certification

By signing below I certify that, to the best of my knowledge and belief, the

securities referred to above were acquired and are held in the ordinary course of

business and were not acquired and are not held for the purpose of or with the

effect of changing or influencing the control of the issuer of the securities and

were not acquired and are not held in connection with or as a participant in any

transaction having that purpose or effect.

Exhibits

Exhibit A ‑ Joint Filing Agreement

Exhibit B ‑ Limited Powers of Attorney for Section 13 Reporting Obligations

Exhibit C ‑ Item 7 Identification and Classification of Subsidiaries

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that

the information set forth in this statement is true, complete and correct.

Dated: January 26, 2017

Franklin Resources, Inc.

By:

/s/LORI A. WEBER

‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑

Lori A. Weber

Assistant Secretary of Franklin Resources, Inc.

Charles B. Johnson

Rupert H. Johnson, Jr.

By: /s/ROBERT C. ROSSELOT

‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑

Robert C. Rosselot

Attorney‑in‑Fact for Charles B. Johnson pursuant to Power of Attorney

attached to this Schedule 13G

Attorney‑in‑Fact for Rupert H. Johnson, Jr. pursuant to Power of Attorney

attached to this Schedule 13G

CUSIP NO. 828336107 13G Page 11 of 14

EXHIBIT A

JOINT FILING AGREEMENT

In accordance with Rule 13d‑1(k) under the Securities Exchange Act of 1934, as amended,

the undersigned hereby agree to the joint filing with each other of the attached

statement on Schedule 13G and to all amendments to such statement and that such

statement and all amendments to such statement are made on behalf of each of them.

IN WITNESS WHEREOF, the undersigned have executed this agreement on January 26, 2017.

Franklin Resources, Inc.

By: /s/LORI A. WEBER

‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑

Lori A. Weber

Assistant Secretary of Franklin Resources, Inc.

Charles B. Johnson

Rupert H. Johnson, Jr.

By:

/s/ROBERT C. ROSSELOT

‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑

Robert C. Rosselot

Attorney‑in‑Fact for Charles B. Johnson pursuant to Power of Attorney

attached to this Schedule 13G

Attorney‑in‑Fact for Rupert H. Johnson, Jr. pursuant to Power of Attorney

attached to this Schedule 13G

CUSIP NO. 828336107 13G Page 12 of 14

EXHIBIT B

LIMITED POWER OF ATTORNEY

FOR

SECTION 13 REPORTING OBLIGATIONS

Know all by these presents, that the undersigned hereby makes, constitutes and appoints

each of Robert Rosselot and Maria Gray, each acting individually, as the undersigned’s

true and lawful attorney‑in‑fact, with full power and authority as hereinafter described

on behalf of and in the name, place and stead of the undersigned to:

(1) prepare, execute, acknowledge, deliver and file Schedules 13D and 13G (including

any amendments thereto or any related documentation) with the United States Securities and

Exchange Commission, any national securities exchanges and Franklin Resources, Inc., a

Delaware corporation (the “Reporting Entity”), as considered necessary or advisable under

Section 13 of the Securities Exchange Act of 1934 and the rules and regulations

promulgated thereunder, as amended from time to time (the “Exchange Act”); and

(2) perform any and all other acts which in the discretion of such attorney‑in‑fact

are necessary or desirable for and on behalf of the undersigned in connection with the

foregoing.

The undersigned acknowledges that:

(1) this Limited Power of Attorney authorizes, but does not require, each such

attorney‑in‑fact to act in their discretion on information provided to such

attorney‑in‑fact without independent verification of such information;

(2) any documents prepared and/or executed by either such attorney‑in‑fact on behalf of

the undersigned pursuant to this Limited Power of Attorney will be in such form and will

contain such information and disclosure as such attorney‑in‑fact, in his or her

discretion, deems necessary or desirable;

(3) neither the Reporting Entity nor either of such attorneys‑in‑fact assumes (i) any

liability for the undersigned’s responsibility to comply with the requirements of the

Exchange Act or (ii) any liability of the undersigned for any failure to comply with such

requirements; and

(4) this Limited Power of Attorney does not relieve the undersigned from responsibility

for compliance with the undersigned’s obligations under the Exchange Act, including

without limitation the reporting requirements under Section 13 of the Exchange Act.

The undersigned hereby gives and grants each of the foregoing attorneys‑in‑fact full

power and authority to do and perform all and every act and thing whatsoever requisite,

necessary or appropriate to be done in and about the foregoing matters as fully to all

intents and purposes as the undersigned might or could do if present, hereby ratifying all

that each such attorney‑in‑fact of, for and on behalf of the undersigned, shall lawfully

do or cause to be done by virtue of this Limited Power of Attorney.

This Limited Power of Attorney shall remain in full force and effect until revoked by

the undersigned in a signed writing delivered to each such attorney‑in‑fact.

IN WITNESS WHEREOF, the undersigned has caused this Limited Power of Attorney to be

executed as of this

30th

day of

April

, 2007

/s/Charles B. Johnson

Signature

Charles B. Johnson

Print Name

CUSIP NO. 828336107 13G Page 13 of 14

LIMITED POWER OF ATTORNEY

FOR

SECTION 13 REPORTING OBLIGATIONS

Know all by these presents, that the undersigned hereby makes, constitutes and

appoints each of Robert Rosselot and Maria Gray, each acting individually, as the

undersigned’s true and lawful attorney‑in‑fact, with full power and authority as

hereinafter described on behalf of and in the name, place and stead of the undersigned to:

(1) prepare, execute, acknowledge, deliver and file Schedules 13D and 13G (including

any amendments thereto or any related documentation) with the United States Securities and

Exchange Commission, any national securities exchanges and Franklin Resources, Inc., a

Delaware corporation (the “Reporting Entity”), as considered necessary or advisable under

Section 13 of the Securities Exchange Act of 1934 and the rules and regulations

promulgated thereunder, as amended from time to time (the “Exchange Act”); and

(2) perform any and all other acts which in the discretion of such attorney‑in‑fact

are necessary or desirable for and on behalf of the undersigned in connection with the

foregoing.

The undersigned acknowledges that:

(1) this Limited Power of Attorney authorizes, but does not require, each such

attorney‑in‑fact to act in their discretion on information provided to such

attorney‑in‑fact without independent verification of such information;

(2) any documents prepared and/or executed by either such attorney‑in‑fact on behalf of

the undersigned pursuant to this Limited Power of Attorney will be in such form and will

contain such information and disclosure as such attorney‑in‑fact, in his or her

discretion, deems necessary or desirable;

(3) neither the Reporting Entity nor either of such attorneys‑in‑fact assumes (i) any

liability for the undersigned’s responsibility to comply with the requirements of the

Exchange Act or (ii) any liability of the undersigned for any failure to comply with such

requirements; and

(4) this Limited Power of Attorney does not relieve the undersigned from responsibility

for compliance with the undersigned’s obligations under the Exchange Act, including

without limitation the reporting requirements under Section 13 of the Exchange Act.

The undersigned hereby gives and grants each of the foregoing attorneys‑in‑fact full

power and authority to do and perform all and every act and thing whatsoever requisite,

necessary or appropriate to be done in and about the foregoing matters as fully to all

intents and purposes as the undersigned might or could do if present, hereby ratifying all

that each such attorney‑in‑fact of, for and on behalf of the undersigned, shall lawfully

do or cause to be done by virtue of this Limited Power of Attorney.

This Limited Power of Attorney shall remain in full force and effect until revoked by

the undersigned in a signed writing delivered to each such attorney‑in‑fact.

IN WITNESS WHEREOF, the undersigned has caused this Limited Power of Attorney to be

executed as

of this

25th

day of

April

, 2007

/s/ Rupert H. Johnson, Jr.

Signature

Rupert H. Johnson, Jr.

Print Name

CUSIP NO. 828336107 13G Page 14 of 14

EXHIBIT C

Franklin Advisers, Inc. Item 3 Classification: 3(e)

Franklin Templeton Investment Management Limited Item 3 Classification: 3(e)

Franklin Templeton Investments (Asia) Ltd. Item 3 Classification: 3(e)

Franklin Templeton Investments Corp. Item 3 Classification: 3(e)

Franklin Templeton Investment Trust Management Co., Ltd Item 3 Classification: 3(e)

Templeton Asset Management Ltd. Item 3 Classification: 3(e)

Templeton Global Advisors Limited Item 3 Classification: 3(e)

Templeton Investment Counsel, LLC Item 3 Classification: 3(e)

Fiduciary Trust Company International Item 3 Classification: 3(b)

Franklin Templeton Investments Australia Limited Item 3 Classification: 3(j)

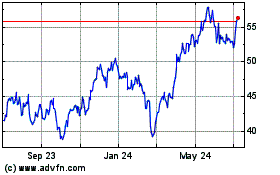

Wheaton Precious Metals (NYSE:WPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

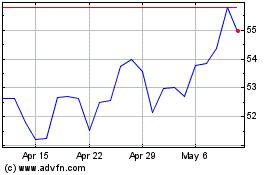

Wheaton Precious Metals (NYSE:WPM)

Historical Stock Chart

From Apr 2023 to Apr 2024