UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2017

Commission File Number: 001-34985

Globus

Maritime Limited

(Translation

of registrant’s name into English)

128 Vouliagmenis

Avenue, 3rd Floor, Glyfada, Athens, Greece, 166 74

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form

40-F

o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Information Contained in this Report on Form 6-K

On February 8, 2017, Globus Maritime Limited (the “Company”),

entered into a Share and Warrant Purchase Agreement (the “Purchase Agreement”) pursuant to which it sold for $5 million

an aggregate of 5,000,000 shares of common stock, par value $0.004 per share, of the Company (the “Shares”) and warrants

to purchase 25,000,000 shares of common stock of the Company at a price of $1.60 per share (subject to adjustment) (the “Warrants”,

together with the Shares, the “Purchased Securities”) to a number of investors (the “Purchasers”) in a

private placement. The Company intends to use the net proceeds from the private placement for general corporate purposes and working

capital including repayment of debt.

On February 9, the Company entered into a registration rights

agreement with the Purchasers providing them with certain rights relating to registration under the Securities Act of the Shares

and the shares of common stock underlying the Warrants.

In addition, in connection with the closing of the private placement,

the Company entered into two loan amendment agreements (each, a “Loan Amendment Agreement”) with each of two lenders

of the Company.

One loan amendment agreement was entered into by the Company

with Firment Trading Limited, a Marshall Islands corporation (“Firment”), a related party to the Company through common

control and the lender of the outstanding loan in the principal amount of $18,535,787 to the Company (the “Firment Credit

Facility”), pursuant to which Firment released (the “Firment Loan Amendment”) an amount equal to $16,885,000

(but to have an amount equal to $1,650,787 remain outstanding, and to continue to accrue under the Firment Credit Facility as though

it were principal) of the Firment Credit Facility and the Company issued to a nominee of Firment 16,885,000 shares of common stock

of the Company (the “Firment Shares”) and a warrant to purchase 6,230,580 shares of common stock of the Company at

a price of $1.60 per share (subject to adjustment) (the “Firment Warrant”, together with Firment Shares, the “Firment

Securities”). To preclude any doubt, the Firment Loan Amendment provides that the prior Amendment No. 1 to the Firment Loan

Agreement, dated November 27, 2016, and which never went into effect, is of no further force and effect.

The other loan amendment agreement was entered into by the Company

with Silaner Investments Limited, a Cyprus company (“Silaner”), a related party to the Company through common control

and the lender of the outstanding loan in the principal amount of $3,189,048 to the Company (the “Silaner Credit Facility”),

pursuant to which Silaner agreed to release (the “Silaner Loan Amendment”) an amount equal to the outstanding principal

of $3,115,000 (but to have an amount equal to the accrued and unpaid interest of $74,048 remain outstanding, and to continue to

accrue under the Silaner Credit Facility as though it were principal) of the Silaner Credit Facility and the Company issued to

a nominee of Silaner 3,115,000 shares of common stock (the “Silaner Shares”) and a warrant to purchase 1,149,437 shares

of common stock of the Company at a price of $1.60 per share (subject to adjustment) (the “Silaner Warrant”, together

with Silaner Shares, the “Silaner Securities”). To preclude any doubt, the Silaner Loan Amendment provides that the

prior Amendment No. 1 to the Silaner Loan Agreement, dated November 27, 2016, and which never went into effect, is of no further

force and effect.

The Firment Loan Amendment, the Silaner Loan Amendment, and

the related issuances all closed on February 8, 2017. The private placement with the Purchasers closed on February 9, 2017. The

Warrants, the Firment Warrant and the Silaner Warrant will each be exercisable for a period of 24 months from their respective

issuance.

The Purchased Securities, the shares of common stock issuable

upon the exercise of the Warrants, the Firment Warrant and the Silaner Warrant (the “Exercisable Shares”), the Firment

Securities and the Silaner Securities (together, the “Securities”) have not been registered under the Securities Act

of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States or to a U.S. person

absent a registration statement or exemption from registration.

The Purchase Agreement and the Loan Amendment Agreements contain

representations and warranties that are typical for private placements by public companies.

The representations, warranties and covenants contained in the

Purchase Agreement, registration rights agreement and Loan Amendment Agreements were made solely for the benefit of the parties

to those agreements and may be subject to limitations agreed upon by the contracting parties. Accordingly, the Purchase Agreement,

registration rights agreement and Loan Amendment Agreements are incorporated herein by reference only to provide investors with

information regarding the terms of the Purchase Agreement, registration rights agreement and Loan Amendment Agreements, and not

to provide investors with any other factual information regarding the Company or its business, and should be read in conjunction

with the disclosures in the Company’s periodic reports and other filings with the Securities and Exchange Commission.

The foregoing description of the Purchase Agreement, registration

rights agreement, Loan Amendment Agreements, Warrants, Firment Warrant and Silaner Warrant does not purport to be complete and

is qualified in its entirety by reference to the full text of those agreements, which are filed as Exhibit 10.1, 10.2, 10.3, 10.4,

10.5, 10.6 and 10.7 to this Current Report on Form 6-K and incorporated herein by reference.

The issuances of the Purchased Securities, the Firment Securities

and the Silaner Securities were each made in accordance with the Purchase Agreement and applicable Loan Amendment Agreement, respectively,

and pursuant to one or more exemptions from registration under the Securities Act provided by Section 4(a)(2) of the Securities

Act and certain rules and regulations promulgated under that section and/or Regulation D and Regulation S promulgated under the

Securities Act. Each Purchaser represented in the Purchase Agreement that it acquired the Purchased Securities, and Firment and

Silaner have each represented in applicable Loan Amendment Agreement that it acquired the Firment Securities or Silaner Securities,

for its own account and not with a view to or for distributing or reselling such Securities or any part thereof. In addition, the

Purchasers, Firment and Silaner have each agreed not to sell or otherwise dispose of all or any part of its Securities except pursuant

to an effective registration statement under the Securities Act or under an exemption from such registration and in compliance

with applicable federal and state securities laws. The Purchasers, Firment and Silaner each represented that they were not solicited

nor did they execute the Purchase Agreement or applicable Loan Termination Agreement in the United States.

Exhibits

The following exhibit is filed as part of this Report on Form

6-K:

|

10.1*

|

Share and Warrant Purchase Agreement dated February 8, 2017 between Globus Maritime Limited and the Purchasers listed on Schedule A thereto

|

|

10.2*

|

Registration Rights Agreement between Globus Maritime

Limited and the Purchasers dated February 9, 2017

|

|

10.3*

|

Amendment to Loan Agreement dated February 8, 2017 between Globus

Maritime Limited and Firment Trading Limited

|

|

10.4*

|

Amendment to Loan Agreement dated February 8, 2017 between Globus Maritime Limited and Silaner Investments Limited

|

|

10.5*

|

Form of Warrant issued to each Purchaser

|

|

10.6*

|

Warrant dated February 8, 2017 issued to nominee of Firment Trading Limited

|

|

10.7*

|

Warrant dated February 8, 2017 issued to nominee of Silaner Investments Limited

|

|

10.8*

|

Schedule to Exhibit 10.5 (Regarding Material Differences in Issued Warrants)

|

|

99.1*

|

A copy of an announcement of Globus Maritime Limited

|

*Filed herewith

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: February 9, 2017

|

|

|

|

|

|

GLOBUS MARITIME LIMITED

|

|

|

|

|

|

|

By:

|

/s/ Athanasios Feidakis

|

|

|

|

Name:

|

Athanasios Feidakis

|

|

|

Title:

|

President, Chief Executive Officer and Chief Financial Officer

|

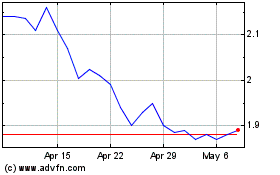

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Apr 2023 to Apr 2024