Innovative Solutions & Support, Inc. (“IS&S” or the

“Company”) (ISSC) today announced its financial results for the

first quarter of fiscal 2017 ended December 31, 2016.

For the first quarter of fiscal 2017, the Company reported gross

sales of $3.8 million and net sales of $3.4 million, reflecting a

return of certain equipment previously sold to a customer to

provide them a more cost effective solution and for other future

installations. The Company had first quarter fiscal 2016 net sales

of $6.6 million. The Company reported a net loss of $1.2 million,

or ($0.07) per share, for the first quarter of fiscal 2017. In the

first quarter a year ago, the Company reported a net loss of $0.2

million, or ($0.01) per share.

Geoffrey Hedrick, Chairman and Chief Executive Officer of

IS&S, said, “Our disappointment in program delays with the

resulting revenue impact is partially mitigated by a pick-up in new

orders and continued progress with the new products we are

developing in anticipation of the implementation of NextGen

mandates. The timing of orders also weighed on our financial

performance. Since adopting our strategy to internally fund new

product development, we have been focused on getting ahead of the

NextGen mandates with innovative new technologies that address

large market opportunities. We continue to progress, with an STC

anticipated on our PC-12 Authothrottle in the second quarter.

Activity is already improving, with the first quarter’s increased

order activity likely to benefit future results. I remain confident

we will get back on track to increased profitable sales and

positive cash flow in the coming quarters.”

At December 31, 2016, the Company had $18.2 million of cash on

hand, down marginally from $18.8 million from September 30,

2016.

New orders in the first quarter of fiscal 2017 were $5.3 million

and backlog as of December 31, 2016 was $6.0 million, up from $4.6

million at September 30, 2016. Backlog excludes potential future

sole-source production orders from products in development under

the Company’s engineering development contracts, including the

Pilatus PC-24, and the KC-46A, all of which the Company expects to

remain in production for a decade following completion of their

respective development phases. The Company expects that these

contracts will add to production sales already in backlog.

Shahram Askarpour, President of IS&S, added, "The addition

of an MRO distribution channel is also beginning to produce

results. In addition, we increased our commitment to research and

development in the quarter. We believe these are signs of the

underlying strength of our franchise. We are very excited about the

new products we have been introducing and will be introducing in

2017, as they target large market opportunities with a very

compelling value proposition, as we continue to build the value of

our brand for our shareholders.”

Conference Call

The Company will be hosting a conference call February 9, 2017

at 10:00 a.m. ET to discuss these results and its business outlook.

Please use the following dial in number to register your name and

company affiliation for the conference call: 877-883-0383 and enter

the PIN Number 2573587. The call will also be carried live on the

Investor Relations page of the Company web site at

www.innovative-ss.com.

About Innovative Solutions & Support, Inc.

Headquartered in Exton, Pa., Innovative Solutions & Support,

Inc. (www.innovative-ss.com) is a systems integrator that designs

and manufactures flight guidance and cockpit display systems for

Original Equipment Manufacturers (OEM’s) and retrofit applications.

The company supplies integrated Flight Management Systems (FMS) and

advanced GPS receivers for precision low carbon footprint

navigation.

Certain matters contained herein that are not descriptions of

historical facts are “forward-looking” (as such term is defined in

the Private Securities Litigation Reform Act of 1995). Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause results to

differ materially from those expressed or implied by such

forward-looking statements include, but are not limited to, those

discussed in filings made by the Company with the Securities and

Exchange Commission. Many of the factors that will determine the

Company’s future results are beyond the ability of management to

control or predict. Readers should not place undue reliance on

forward-looking statements, which reflect management’s views only

as of the date hereof. The Company undertakes no obligation to

revise or update any forward-looking statements, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

Innovative Solutions and Support, Inc.

Consolidated Balance Sheets December 31,

September 30, 2016 2016 (unaudited)

ASSETS

Current assets Cash and cash equivalents $ 18,161,147 $ 18,767,661

Accounts receivable, net 3,786,980 4,511,091 Unbilled receivables,

net 1,604,069 1,597,672 Inventories 4,198,432 3,645,828 Prepaid

expenses and other current assets 1,222,595

847,207

Total current assets 28,973,223 29,369,459 Property and

equipment, net 6,901,566 6,962,562 Other assets 156,948

156,948 Total assets $ 36,031,737

$ 36,488,969

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current liabilities Accounts payable $ 1,713,616 $ 1,503,771

Accrued expenses 2,246,154 1,889,908 Deferred revenue

351,229 179,585 Total current

liabilities 4,310,999 3,573,264 Non-current deferred income

taxes 67,708 67,701 Total

liabilities 4,378,707 3,640,965

Commitments and contingencies (See Note 6) Shareholders'

equity

Preferred stock, 10,000,000 shares

authorized, $.001 par value, of which 200,000 shares are authorized

as Class A Convertible stock. No shares issued and outstanding at

December 31, 2016 and September 30, 2016

$ - $ -

Common stock, $.001 par value: 75,000,000

shares authorized, 18,812,465 issued at December 31, 2016 and

September 30, 2016

18,813 18,813 Additional paid-in capital 51,392,159

51,392,159 Retained earnings 1,610,595 2,805,569

Treasury stock, at cost, 2,096,451 shares

at December 31, 2016 and September 30, 2016

(21,368,537 ) (21,368,537 ) Total

shareholders' equity 31,653,030 32,848,004

Total liabilities and shareholders' equity $

36,031,737 $ 36,488,969

Innovative

Solutions and Support, Inc. Consolidated Statements of

Operations (unaudited) Three months ended

December 31, 2016 2015 Gross sales $ 3,824,047 $ 6,583,578

Returns and allowances (458,181 ) - Net Sales

3,365,866 6,583,578 Cost of sales 1,828,052

3,267,767 Gross profit 1,537,814 3,315,811

Operating expenses: Research and development 1,085,988

931,600 Selling, general and administrative 2,047,121

2,692,944 Total operating expenses 3,133,109

3,624,544 Operating loss (1,595,295 ) (308,733 )

Interest income 9,876 7,025 Other income 19,114

32,410 Loss before income taxes (1,566,305 ) (269,298

) Income tax benefit (371,331 ) (53,860 )

Net loss $ (1,194,974 ) $ (215,438 ) Net loss per

common share: Basic $ (0.07 ) $ (0.01 ) Diluted $ (0.07 ) $ (0.01 )

Weighted average shares outstanding: Basic

16,716,014 16,909,638

Diluted

16,716,014

16,909,638

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170208006246/en/

Innovative Solutions & Support, Inc.Relland WinandChief

Financial Officer610-646-0350rwinand@innovative-ss.com

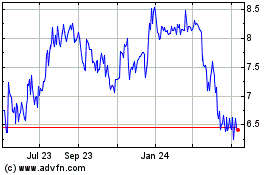

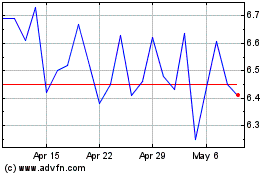

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Apr 2023 to Apr 2024