Amended Statement of Beneficial Ownership (sc 13d/a)

February 07 2017 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

Under the

Securities Exchange Act of 1934

(Amendment

No. 43)*

Coca-Cola

Bottling Co. Consolidated

(Name of Issuer)

Common Stock, Par Value $1.00 Per Share

(Title and Class of Securities)

191098102

(CUSIP Number)

Bernhard Goepelt

Senior Vice President, General Counsel

and Chief Legal Counsel

The Coca-Cola Company

One Coca-Cola Plaza

Atlanta, Georgia 30313

(404) 676-2121

(Name, Address and Telephone Number of

Person

Authorized to Receive Notices and Communications)

February 6, 2017

(Date of Event Which Requires Filing of

this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

☐

Note

: Schedules filed in paper

format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties

to whom copies are to be sent.

* The remainder of this cover page

shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

(continued on following pages)

SCHEDULE 13D/A

CUSIP No. - 191098102

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

|

|

THE COCA-COLA COMPANY

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☐

|

|

|

|

(b) ☒

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS*

|

|

|

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

State of Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

2,482,165

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

2,482,165

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

2,482,165

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW 11 EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

34.76%

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

*SEE INSTRUCTIONS BEFORE FILLING OUT

SCHEDULE 13D/A

CUSIP No. - 191098102

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

|

|

THE COCA-COLA TRADING COMPANY LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☐

|

|

|

|

(b) ☒

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS*

|

|

|

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

State of Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

2,482,165

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

2,482,165

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

2,482,165

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW 11 EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

34.76%

|

|

14

|

TYPE OF REPORTING PERSON*

OO

|

*SEE INSTRUCTIONS BEFORE FILLING OUT

SCHEDULE 13D/A

CUSIP No. - 191098102

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

|

|

COCA-COLA OASIS LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☐

|

|

|

|

(b) ☒

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS*

|

|

|

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

State of Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

2,482,165

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

2,482,165

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

2,482,165

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW 11 EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

34.76%

|

|

14

|

TYPE OF REPORTING PERSON*

OO

|

*SEE INSTRUCTIONS BEFORE FILLING OUT

SCHEDULE 13D/A

CUSIP No. - 191098102

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

|

|

CAROLINA COCA-COLA BOTTLING INVESTMENTS, INC.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☐

|

|

|

|

(b) ☒

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS*

|

|

|

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

State of Delaware

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

2,482,165

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

2,482,165

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

2,482,165

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW 11 EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

34.76%

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

*SEE INSTRUCTIONS BEFORE FILLING OUT

This Amendment No. 43 amends and supplements

the original Schedule 13D filed on May 18, 1987 by The Coca-Cola Company, as amended by Amendments 1 through 42 (the “Schedule

13D”). Terms used herein and not otherwise defined shall have the meanings given such terms in the Schedule 13D.

Item 4. Purpose of the Transaction

Item 4 is hereby amended and supplemented as follows:

On February 6, 2017, The Coca-Cola

Company and Coca-Cola Bottling Co. Consolidated (“Coke Consolidated”) entered into a non-binding letter of intent (the

“February 2017 LOI”) pursuant to which Coca-Cola Refreshments USA, Inc. (“CCR”), a wholly-owned subsidiary

of The Coca-Cola Company, would grant Coke Consolidated certain exclusive rights for the distribution, promotion, marketing and

sale of beverage products owned and licensed by The Coca-Cola Company in territory in and around Cleveland, Ohio (the “Cleveland

Territory”) currently served by another unaffiliated Coca-Cola bottler (the “Cleveland Transaction”). The February

2017 LOI contemplates that CCR would acquire this distribution business in the Cleveland Territory from the existing Coca-Cola

bottler immediately prior to selling it to Coke Consolidated. Pursuant to the February 2017 LOI, Coke Consolidated and The Coca-Cola

Company also amended their non-binding letter of intent dated February 8, 2016, as described in Coke Consolidated’s

Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 10, 2016

and filed as Exhibit 99.2 thereto, to remove the portion of the distribution territory located in northern West Virginia served

by CCR’s distribution facilities in Wheeling and Fairmont, West Virginia from the distribution territory expansion transaction

contemplated by such letter of intent and agreed that CCR will sell the distribution rights and assets associated with such territory

to another unaffiliated Coca-Cola bottler.

The exclusive rights for the distribution,

promotion, marketing and sale of The Coca-Cola Company-owned and -licensed beverage products in the Cleveland Territory would be

granted to Coke Consolidated by CCR pursuant to a final comprehensive beverage agreement (the “Final CBA”), which agreement

is described in Coke Consolidated’s Current Report on Form 8-K filed with the SEC on September 28, 2015 (the “September

2015 Form 8-K”). A form of the Final CBA was filed as Exhibit 1.1 to the territory conversion agreement filed as Exhibit

10.1 to the September 2015 Form 8-K.

The February 2017 LOI also contemplates

that CCR would sell, transfer and assign to Coke Consolidated exclusive rights for the distribution, promotion, marketing and sale

in the Cleveland Territory of various cross-licensed brands to be acquired by CCR at the time it acquires the Cleveland Territory,

subject to the consent of the third-party brand owners. CCR would also sell to Coke Consolidated certain of CCR’s distribution

assets and the working capital associated therewith, as may be necessary to distribute, promote, market and sell both The Coca-Cola

Company-owned and -licensed products and the cross-licensed branded products in the Cleveland Territory. Coke Consolidated would

pay to CCR at the closing for the Cleveland Territory a cash amount that reflects the agreed value of the exclusive rights to distribute,

promote, market and sell in the Cleveland Territory the cross-licensed brands (and the distribution assets and working capital

applicable thereto) and the net book value of the distribution assets and working capital associated with the distribution, promotion,

marketing and sale of The Coca-Cola Company-owned and -licensed products in the Cleveland Territory. Coke Consolidated would also

agree in the Final CBA entered into at the closing of the Cleveland Transaction to make periodic sub-bottling payments to CCR on

a continuing basis after such closing for the grant of exclusive rights in the Cleveland Territory for The Coca-Cola Company-owned

and -licensed beverage products.

The February 2017 LOI addresses

several other matters related to the ongoing expansion of the Coke Consolidated’s distribution territories and the implementation

of the national product supply system, including the current intentions of Coke Consolidated and The Coca-Cola Company with respect

to (i) the implementation of a binding system governance in the Cleveland Territory consistent with Coke Consolidated’s

implementation of such governance in its existing distribution territories for Coca-Cola products, and (ii) the process pursuant

to which Coke Consolidated would be provided opportunities to participate economically in the existing business of The Coca-Cola

Company in the United States involving non-direct store delivery of products and future non-direct store delivery of products and/or

business models developed by The Coca-Cola Company.

The Cleveland Transaction will be

subject to the terms of a definitive purchase agreement. In addition to the negotiation and execution of the definitive agreement,

the February 2017 LOI sets forth certain customary conditions to the closing of the Cleveland Transaction, as well as a number

of other conditions that Coke Consolidated and The Coca-Cola Company currently intend to be satisfied prior to such closing and/or

to be addressed in the definitive agreement, including CCR’s acquisition, at or immediately prior to the closing of the Cleveland

Transaction, of the distribution business in the Cleveland Territory currently operated by another unaffiliated Coca-Cola bottler.

The foregoing description of the February

2017 LOI is only a summary and is qualified in its entirety by reference to the full text of such agreement and all exhibits thereto,

which is filed as Exhibit 99.2 to this Amendment No. 43 to the Schedule 13D and incorporated herein by reference.

Item 5. Interest in Securities of the Issuer

Item 5 is hereby amended and restated as follows:

As of the date of this report, each Reporting

Person may be deemed to have beneficial ownership (within the meaning of Rule 13d-3 under the Act) and shared power to vote or

direct the vote of the amounts of Common Stock, par value $1.00, of Coke Consolidated (the “Common Stock”) listed below

and may be deemed to constitute a “group” under Section 13(d) of the Act.

Number of shares of Common Stock as to which The Coca-Cola

Company has:

|

(i)

|

sole power to vote or direct the vote: 0

|

|

(ii)

|

shared power to vote or to direct the vote: 2,482,165

|

|

(iii)

|

the sole power to dispose of or to direct the disposition of: 0

|

|

(iv)

|

shared power to dispose of or to direct the disposition of: 2,482,165

|

Number of shares of Common Stock as to which The Coca-Cola

Trading Company LLC has:

|

(i)

|

sole power to vote or direct the vote: 0

|

|

(ii)

|

shared power to vote or to direct the vote: 2,482,165

|

|

(iii)

|

sole power to dispose of or to direct the disposition of: 0

|

|

(iv)

|

shared power to dispose of or to direct the disposition of: 2,482,165

|

Number of shares of Common Stock as to which Coca-Cola Oasis

LLC has:

|

(i)

|

sole power to vote or direct the vote: 0

|

|

(ii)

|

shared power to vote or to direct the vote: 2,482,165

|

|

(iii)

|

sole power to dispose of or to direct the disposition of: 0

|

|

(iv)

|

shared power to dispose of or to direct the disposition of: 2,482,165

|

Number of shares as to which Carolina Coca-Cola Bottling Investments,

Inc. has:

|

(i)

|

sole power to vote or direct the vote: 0

|

|

(ii)

|

shared power to vote or to direct the vote: 2,482,165

|

|

(iii)

|

sole power to dispose of or to direct the disposition of: 0

|

|

(iv)

|

shared power to dispose of or to direct the disposition of: 2,482,165

|

The Reporting Persons beneficially own 34.76% of the

outstanding shares of Common Stock based upon 7,141,447 shares of Common Stock outstanding on November 4, 2016.

Item 7. Material to be Filed as Exhibits

|

|

Exhibit

|

|

Name

|

|

Incorporated By

Reference To

|

|

|

Exhibit 99.1

|

|

Directors, Officers and Managers of the Reporting Persons

|

|

Filed herewith

|

|

|

|

|

|

|

|

|

|

Exhibit 99.2

|

|

Letter of Intent, dated February 6, 2017, by and between

Coca-Cola Bottling Co. Consolidated and The Coca-Cola Company.

|

|

Exhibit 99.2 of Coca-Cola Bottling Co. Consolidated’s Current Report on Form 8-K filed on February 7, 2017

|

SIGNATURES

After reasonable inquiry and to the best of my knowledge and

belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

THE COCA-COLA COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Bernhard Goepelt

|

|

|

|

Name:

|

Bernhard Goepelt

|

|

|

|

Title:

|

Senior Vice President and General Counsel

|

|

|

Date: February 7, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE COCA-COLA TRADING COMPANY LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Christopher P. Nolan

|

|

|

|

Name:

|

Christopher P. Nolan

|

|

|

|

Title:

|

Vice President and Treasurer

|

|

|

Date: February 7, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COCA-COLA OASIS LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Christopher P. Nolan

|

|

|

|

Name:

|

Christopher P. Nolan

|

|

|

|

Title:

|

Vice President, Chief Executive Officer and Treasurer

|

|

|

Date: February 7, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAROLINA COCA-COLA BOTTLING INVESTMENTS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Christopher P. Nolan

|

|

|

|

Name:

|

Christopher P. Nolan

|

|

|

|

Title:

|

Vice President and Treasurer

|

|

|

Date: February 7, 2017

|

|

|

|

Exhibit Index

|

|

Exhibit

|

|

Name

|

|

Incorporated By

Reference To

|

|

|

Exhibit 99.1

|

|

Directors, Officers and Managers of the Reporting Persons

|

|

Filed herewith

|

|

|

|

|

|

|

|

|

|

Exhibit 99.2

|

|

Letter of Intent, dated February 6, 2017, by and between

the Coca-Cola Bottling Co. Consolidated and The Coca-Cola Company.

|

|

Exhibit 99.2 of Coca-Cola Bottling Co. Consolidated’s Current Report on Form 8-K filed on February 7, 2017

|

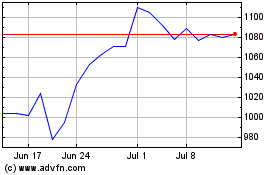

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Apr 2023 to Apr 2024