Coca-Cola Bottling Co. Consolidated Signs Letter of Intent to Expand Distribution Territory to Cleveland, Ohio

February 07 2017 - 6:45AM

Coca-Cola Bottling Co. Consolidated (NASDAQ:COKE) (the "Company")

today announced that it has signed a non-binding letter of intent

with The Coca-Cola Company (the “February 2017 Letter of Intent”)

to expand the Company's distribution territory in northern

Ohio. The transaction proposed in the February 2017 Letter of

Intent would provide exclusive distribution rights for the Company

in territories located in and around Cleveland, Ohio currently

served by another Coca-Cola bottler. Coca-Cola Refreshments

USA, Inc. (“CCR”), a wholly-owned subsidiary of The Coca-Cola

Company, is to acquire the distribution business in these

territories from that bottler immediately prior to selling it to

the Company.

Since May 2014, the Company has expanded its

distribution territory in parts of Delaware, Kentucky, Illinois,

Indiana, Maryland, North Carolina, Ohio, Pennsylvania, Tennessee,

Virginia, West Virginia and the District of Columbia and purchased

manufacturing facilities in Maryland, Ohio and Virginia.

Under the February 2017 Letter of Intent, the

Company and The Coca-Cola Company also have agreed that

distribution territory in northern West Virginia associated with

CCR’s Wheeling and Fairmont, West Virginia sales centers will no

longer be part of the distribution territory expansion transaction

contemplated by the previously announced non-binding letter of

intent between the Company and The Coca-Cola Company dated February

8, 2016 (the “February 2016 Letter of Intent”) and will be

transferred by The Coca-Cola Company to another Coca-Cola

bottler. The Company is continuing to work towards definitive

agreements with The Coca-Cola Company for the remaining

transactions described in the February 2016 Letter of Intent,

including (i) the expansion of distribution territories in

parts of northern Ohio and (ii) the purchase of a

manufacturing facility in Twinsburg, Ohio.

The Company is also continuing to work towards

completion of the transactions contemplated by other previously

announced definitive agreements and non-binding letters of intent

with The Coca-Cola Company and CCR, including:

- closing the remaining transactions contemplated by definitive

agreements executed with CCR in September 2016 to acquire

distribution territory in parts of Indiana, Illinois and Ohio and

to acquire two manufacturing facilities in Indiana; and

- reaching a definitive agreement with CCR for the transactions

described in the letter of intent dated June 14, 2016 for the

exchange of distribution territory in the southern parts of

Alabama, Georgia and Mississippi and a manufacturing facility in

Mobile, Alabama for distribution territory in parts of Arkansas,

southwestern Tennessee and northwestern Mississippi and

manufacturing facilities in Memphis, Tennessee and West Memphis,

Arkansas.

The Company is also continuing to work towards a

definitive agreement with Coca-Cola Bottling Company United, Inc.

(“United”) for the exchange of distribution territory in

south-central Tennessee, northwest Alabama, and northwest Florida

for distribution territory in and around Spartanburg and Bluffton,

South Carolina, as proposed in the previously announced letter of

intent dated June 14, 2016 between the Company and United.

The transaction proposed in the February 2017

Letter of Intent is subject to the parties reaching a definitive

agreement, with a transaction closing expected to occur by the end

of 2017. There is no assurance, however, that a definitive

agreement will be reached or that the closing of the transaction

contemplated by the February 2017 Letter of Intent will

occur. The Company will file a Current Report on Form 8-K

with the Securities and Exchange Commission with additional

information regarding the proposed territory expansion transaction

and certain other matters addressed in the February 2017 Letter of

Intent that will be available on the Commission’s website at

http://www.sec.gov and on the Company’s website at

http://www.cokeconsolidated.com. For more information about

the transaction, including the Company’s relationship with The

Coca-Cola Company, investors should read the information included

in the Company’s Current Report on Form 8-K that will be filed and

all exhibits thereto.

About Coca-Cola Bottling Co. Consolidated:Coke

Consolidated is the largest independent Coca-Cola bottler in the

United States. Our Purpose is to honor God, serve others, pursue

excellence and grow profitably. For over 110 years, we have been

deeply committed to the consumers, customers and communities we

serve and passionate about the broad portfolio of beverages and

services we offer. We make, sell and distribute beverages of

The Coca-Cola Company and other partner companies in more than 300

brands and flavors across 16 states to over 43 million

consumers.

Headquartered in Charlotte, N.C., Coke

Consolidated is traded on the NASDAQ under the symbol COKE. More

information about the Company is available at

www.cokeconsolidated.com. Follow Coke Consolidated on Facebook,

Twitter, Instagram and LinkedIn.

Cautionary Information Regarding Forward-Looking

StatementsCertain statements contained in this news

release are “forward-looking statements” that involve risks and

uncertainties. The words “believe,” “expect,” “project,” “will,”

“should,” “could” and similar expressions are intended to identify

those forward-looking statements. These statements include, among

others, statements regarding the time frame for completing the

proposed territory expansions and manufacturing facility

acquisitions. Factors that might cause Coke Consolidated’s

actual results to differ materially from those anticipated in

forward-looking statements include, but are not limited to: lower

than expected selling pricing resulting from increased marketplace

competition; changes in how significant customers market or promote

our products; changes in our top customer relationships; changes in

public and consumer preferences related to nonalcoholic beverages;

unfavorable changes in the general economy; miscalculation of our

need for infrastructure or capital investment; our inability to

meet requirements under beverage agreements; material changes in

the performance requirements for marketing funding support or our

inability to meet such requirements; decreases from historic levels

of marketing funding support; changes in The Coca-Cola Company’s

and other beverage companies’ levels of advertising, marketing and

spending on brand innovation; the inability of our aluminum can or

plastic bottle suppliers to meet our purchase requirements; our

inability to offset higher raw material costs with higher selling

prices, increased bottle/can sales volume or reduced expenses;

consolidation of raw material suppliers; incremental risks

resulting from increased purchases of finished goods; sustained

increases in fuel costs or our inability to secure adequate

supplies of fuel; sustained increases in workers’ compensation,

employment practices and vehicle accident claims costs; sustained

increases in the cost of employee benefits; product liability

claims or product recalls; technology failures; changes in interest

rates; the impact of debt levels on operating flexibility and

access to capital and credit markets; adverse changes in our credit

rating (whether as a result of our operations or prospects or as a

result of those of The Coca-Cola Company or other bottlers in the

Coca-Cola system); changes in legal contingencies; legislative

changes affecting our distribution and packaging; adoption of

significant product labeling or warning requirements; additional

taxes resulting from tax audits; natural disasters and unfavorable

weather; global climate change or legal or regulatory responses to

such change; issues surrounding labor relations; bottler system

disputes; our use of estimates and assumptions; changes in

accounting standards; impact of obesity and health concerns on

product demand; public policy challenges regarding the sale of soft

drinks in schools; the impact of volatility in the financial

markets on access to the credit markets; the impact of acquisitions

or dispositions of bottlers by their franchisors; changes in the

inputs used to calculate our acquisition related contingent

consideration liability; and the concentration of our capital stock

ownership. These and other factors are discussed in the Company’s

regulatory filings with the Securities and Exchange Commission,

including those in our Annual Report on Form 10-K for the year

ended January 3, 2016 under Part I, Item 1A “Risk Factors,” as well

as those additional factors we may describe from time to time in

other filings with the Securities and Exchange Commission.

The forward-looking statements contained in this news release speak

only as of this date, and the Company does not assume any

obligation to update them except as required by law.

—Enjoy Coca-Cola—

Media Contact:

Kimberly Kuo

Senior Vice President, Public Affairs, Communications and Communities

704-557-4584

Investor Contact:

Clifford M. Deal, III

Senior Vice President & CFO

704-557-4633

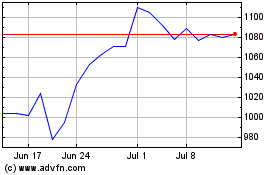

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

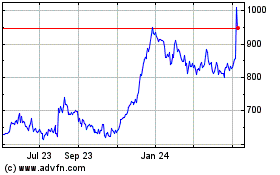

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Apr 2023 to Apr 2024