By Peter Grant

Some prominent real-estate investors are reducing their holdings

and getting more selective about new deals, in a sign that the

eight-year bull market for U.S. commercial property is coming to a

close.

Asset managers at pension funds and endowments, as well as

private-equity firms and other big investors, are throttling back

on new acquisitions, selling more assets and shifting to less risky

strategies as a way to protect against potential losses in a

downturn.

Additional selling could put stress on the market because demand

for property has started to flag, especially at current price

levels. Deal volume decreased by $58.3 billion, or 11%, in 2016,

the first annual decrease since 2009, according to data firm Real

Capital Analytics, a sign that investor appetite is waning.

Investors that have picked up the pace of selling to lock in

profits include private-equity firm Blackstone Group LP,

real-estate giant Brookfield Asset Management, United Parcel

Service Inc.'s pension trust and Harvard Management Company, which

manages Harvard University's endowment.

When these big investors do buy, they are focusing more on niche

properties such as self-storage warehouses and biomedical

facilities, which haven't seen the sharp price rise of trophy

office buildings and rental apartments.

"We definitely have a risk-off mentality," said Judy McMahan, a

portfolio manager for UPS's $32 billion pension trust. "We're being

careful." The pension trust sold more property than it bought last

year, and its new acquisitions included senior housing and

industrial space in the U.K., said Ms. McMahan.

Brookfield also increased the pace of its selling, unloading

about $3 billion in property in 2016 compared with about half that

much in 2015. The company recently put on the block a 49% stake in

its sprawling Brookfield Place complex in Manhattan. The complex

just finished overhauling its retail space and filling the 2.5

million square feet of office space emptied in 2013 when Bank of

America Corp. moved out.

"We think now is an opportune time to reduce some of our

exposure to that asset," said Brian Kingston, Brookfield senior

managing partner. "We can recycle the capital into higher returning

investment opportunities."

Caution among investors in the $11 trillion U.S. commercial

property sector is being driven by lofty prices, the length of the

market cycle so far and the recent rise in interest rates, which

makes bonds look more attractive compared with commercial property.

Also, developers are adding new supply of some property types at

the fastest rate since the recovery began.

Few investors predict a crash along the lines of the 2008

downturn because debt levels aren't nearly as high and the economy

continues to show signs of strength. Some believe office buildings,

malls, apartment buildings and other commercial property will

continue to enjoy rising rents and occupancy rates if President

Donald Trump's pro-growth economic plans work as intended.

Since 2009, investors have been handsomely rewarded for

purchases of office buildings, warehouses, apartment buildings and

other commercial property. Thanks to low interest rates and the

improving U.S. economy, a valuation index published by Green Street

Advisors has increased 107% since hitting its crash-era low in May

2009. But that rocketing growth is slowing. The Green Street index,

which focuses on top-quality U.S. property owned by real-estate

investment trusts, has stayed flat since mid-2016, according to

Green Street.

Another closely followed metric -- an index compiled by the

National Council of Real Estate Investment Fiduciaries -- showed

total returns from commercial real estate rising 9.2% in the year

ending Sept. 30, 2016, a sharp decline from 13.5% for the 12 months

ending in the third quarter of 2015 and growth ranging from 11% to

14% in each of the previous five years.

Fund investors are pulling back as well. Quarterly distributions

and redemptions from open-ended funds that buy low-risk properties,

a popular investment vehicle among institutional investors, doubled

during the first nine months of 2016, after ticking up just 11% in

2015, according to the council.

Much of the bull market has been fueled by low interest rates,

which encouraged investors to forsake bonds and stretch for more

yield. But rates have jumped since Election Day. Real-estate

investment trusts took the first hit, with equity REITs declining

2.9% in the fourth quarter of last year compared with a gain of

5.3% for the S&P 500, according to Green Street.

So far this year, equity REITs have had a total return of only

0.38%, compared with 1.9% for the S&P 500, Green Street

said.

Also, until recently, the rise in property values was fueled by

developers keeping new supply in check. But that, too, is beginning

to change with certain property types. For example, more than

378,000 new apartments are expected to be completed across the

country this year, almost 35% more than the 20-year average,

according to real-estate tracker Axiometrics Inc.

Private investors say the real estate they are chasing these

days often is either real estate that's less risky or properties

that can be improved and sold quickly, rather than those -- like

developments -- that might not be finished until the economy is

well into the next down cycle.

For example, private-equity giant KKR & Co. moved quickly to

find a buyer last year after it purchased the landmark Sullivan

Center in the Chicago Loop for $267 million. A few months after the

deal closed, KKR sold the retail portion of the 946,000-square-foot

building to Acadia Realty Trust.

"Given we are in the later stage of the real-estate cycle, we

have been focused on business plans that require less time to

create value," said Chris Lee, chair of KKR's real-estate valuation

committee.

Blackstone sold more property than it bought last year,

according to Kenneth Caplan, the firm's chief investment officer

for real estate. Sales have included more traditional property

types such as apartment buildings and hotels. One of its biggest

buys last year was BioMed Realty Trust Inc., which leases offices

to the life science industry. "It's later in the cycle where you

have to be more targeted," Mr. Caplan said.

Harvard's endowment is among the big institutions that sold more

property last year than it purchased, according to people familiar

with the matter. A spokeswoman for the endowment declined to

comment.

Institutions that sell property acknowledge values could keep

rising, but said they want to play it safe.

"Some of the investments we disposed of, if we held on to them

another year or so, it's possible we'd make more money," said Ms.

McMahan of UPS. "However, we felt it was the appropriate time to

monetize our gains."

Write to Peter Grant at peter.grant@wsj.com

(END) Dow Jones Newswires

February 07, 2017 05:44 ET (10:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

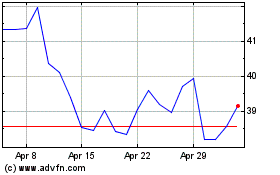

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Apr 2023 to Apr 2024