Fox Profit Jumps 27% on Sports, Political Advertising -- Update

February 06 2017 - 7:02PM

Dow Jones News

By Keach Hagey

21st Century Fox Inc. posted a 27% increase in profit for the

most recent quarter, driven by stronger advertising and affiliate

fees at its broadcast and cable-television segments.

The company, which owns the Fox television network, cable

channels such as Fox News and the Twentieth Century Fox movie and

television studios, reported net income of $856 million, or 46

cents a share, up from $672 million, or 34 cents, a year earlier,

for the three months ended Dec. 31. Revenue rose 4% to $7.68

billion.

After years of being a laggard, the Fox network was the star of

the quarter, thanks to strong advertising revenue from sports

events such as the World Series, higher spending on political

advertising and higher fees from distributors. The broadcaster

helped push television segment revenue up 12% in the quarter.

Politics and sports also helped boost revenue and profit at the

cable division, home to Fox News and the FS1 sports network.

"The power of sports can't really be overstated," said Chief

Executive James Murdoch on a call with analysts, noting the

strength of Fox's baseball and NFL postseason ratings, as well as

viewership for Super Bowl Sunday on Fox.

About 111.3 million people tuned in for the New England

Patriots' shocking comeback to beat the Atlanta Falcons 34-28 in

the first-ever Super Bowl overtime, and more than 2 million others

watched the game online or on Fox's Spanish-language service. Fox

had charged advertisers as much as $5 million for 30 seconds of TV

commercial time during the game.

21st Century Fox Executive Co-Chairman Lachlan Murdoch said on

the call that the Super Bowl "powered Fox's first

half-billion-dollar revenue day."

Adjusted for one-time items, Fox reported earnings from

continuing operations of 53 cents a share. Analysts polled by

Thomson Reuters had been expecting revenue of $7.718 billion and

earnings of 49 cents a share.

Fox's Class A shares were up 1.1% in after-hours trading.

At the cable division, domestic advertising revenue grew 12%,

thanks to higher ratings at Fox News and FS1. Meanwhile, the

division's domestic affiliate revenue grew 7% due to distribution

rate increases at Fox Networks, FS1, Fox News and the regional

sports networks.

Internationally, advertising revenue decreased 6% because of

lower ad revenues at STAR India. The unit was affected by the

Indian government's demonetization effort, in which

high-denomination notes were taken out of circulation to curb

corruption. But it also had significant effects on businesses and

the economy.

In the television segment, revenues were boosted by the World

Series, particularly game 7, which was the most-watched baseball

game in the last quarter century. Adjusted operating income, the

company's measure of profitability, was up 35% from the previous

year.

In the filmed entertainment division, which includes the

Twentieth Century Fox studio, adjusted operating income was up 29%

from the year-earlier quarter, primarily due to lower costs from

fewer films being released. Revenues decreased 4% in the

segment.

The media company announced in December that it had formally

submitted a roughly $14.6 billion offer to buy the rest of British

pay-TV giant Sky PLC that it doesn't already own. The deal, if

approved by regulators, would help Fox integrate content with

distribution, an argument similar to the one made by AT&T Inc.

and Time Warner Inc. in their proposed merger.

Fox's predecessor's prior effort to buy the U.K. pay-TV company

was thwarted in 2011, amid a phone hacking scandal at one of its

British newspapers. 21st Century Fox and News Corp, parent company

of The Wall Street Journal and other newspapers, split in 2013 but

still share common ownership.

Fox executives have repeatedly pointed to Sky's

direct-to-consumer capabilities as a key reason for wanting to do

the deal. At the moment, Fox has no direct commercial relationship

with its viewers, though the company is in the midst of an overhaul

of its streaming apps -- today only accessible to people who

already subscribe to pay-TV -- that could lead to a

direct-to-consumer offering in the mold of CBS All Access in the

future.

James Murdoch said the key goal of the streaming overhaul, which

will start rolling out in a month, is to make the login process to

streaming apps smoother for pay-TV customers, make shows easier to

discover with things like a recommendation engine, and create

opportunities for more innovative ad formats that allow Fox to

reduce ad loads.

"Certainly it's also an option for us in the future, whether or

not we'd like to have an independently priced access to that suite

of apps," he said. "That's a decision we haven't yet made, but one

certainly that we feel we have the capability and the general

wherewithal in terms of managing direct-to-consumer business,

subscriber business, to tackle."

Write to Keach Hagey at keach.hagey@wsj.com

(END) Dow Jones Newswires

February 06, 2017 18:47 ET (23:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

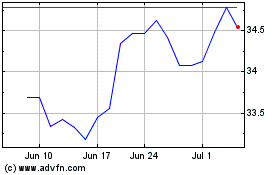

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Mar 2024 to Apr 2024

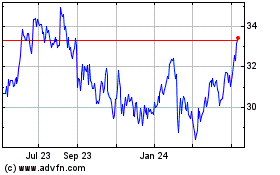

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Apr 2023 to Apr 2024