Current Report Filing (8-k)

February 03 2017 - 3:06PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 25, 2017

Cadiz Inc.

(Exact name of Registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

0-12114

(Commission File Number)

|

77-0313235

(IRS Employer Identification No.)

|

|

550 South Hope Street, Suite 2850, Los Angeles, California

(Address of principal executive offices)

|

90071

(Zip Code)

|

Registrant's telephone number, including area code:

(213) 271-1600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01

Other Events

On January 25, 2017, the Superior Court of the State of California, County of Los Angeles (the "Superior Court of California"), entered an order: (i) preliminarily approving a proposed settlement of the shareholder derivative lawsuit, entitled

Herman Boschken v. Keith Brackpool et. al

., Case No. BC 609038, pending in the Superior Court of California (the "Derivative Action") and (ii) approving for dissemination the Notice of Derivative Settlement (the "Notice") to current Cadiz Inc. (the "Company" or "Cadiz") shareholders. The proposed settlement is subject to final approval by the Superior Court of California.

As required by the preliminary approval order, the Notice is attached to this Current Report on Form 8-K as Exhibit 99.1. The Notice and the Stipulation and Agreement of Settlement dated December 5, 2016 (the "Stipulation") are also available on the Investor Relations page of the Company's website at http://cadizinc.com/investor-relations/. Other information contained in or accessible through the Company's website does not constitute part of, and is not incorporated into, this Current Report on Form 8-K.

Subject to final approval of the settlement by the Superior Court of California, and in exchange for a release of all claims by the plaintiffs and a dismissal of the Derivative Action with prejudice, the Company has agreed (i) to implement certain corporate governance reforms, (ii) to instruct the Company's insurer to pay the plaintiffs' attorneys fees and expenses in an amount not to exceed $230,000 (the "Fee and Expense Amount") and (iii) that $5,000 of the Fee and Expense Amount be paid to the plaintiff.

Use of Forward-Looking Statements

Except for the historical information contained herein, this Form 8-K contains forward-looking statements made pursuant to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that statements in this Form 8-K regarding: (i) the stipulation and agreement of settlement, (ii) the impact of such settlement, including related activities, approvals and payments, and (iii) other statements that are not historical facts, constitute forward-looking statements. These statements involve risks and uncertainties that can cause actual results to differ materially from those in such forward-looking statements. These risks and uncertainties, include, without limitation, risks and uncertainties related to: (i) the settlement not receiving the requisite final approval; (ii) the settlement not having the expected impact, including resolving the Derivative Action; and (iii) the settlement requiring more activity or expense than expected. Additional information on the above risks and uncertainties and additional risks, uncertainties and factors that could cause actual results to differ materially from those in the forward-looking statements are contained in Cadiz's periodic reports filed with the Securities and Exchange Commission under the heading "Risk Factors," including Cadiz's quarterly report on Form 10-Q for the quarter ended September 30, 2016. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made, and the facts and assumptions underlying the forward-looking statements may change. Except as required by law, Cadiz disclaims any obligation to update these forward-looking statements to reflect future information, events or circumstances.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Notice of Derivative Settlement

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Cadiz Inc.

|

|

|

|

|

|

By:

|

/s/ Timothy J. Shaheen

|

|

|

|

Timothy J. Shaheen

|

|

|

|

Chief Financial Officer

|

Dated: February 3, 2017

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Notice of Derivative Settlement

|

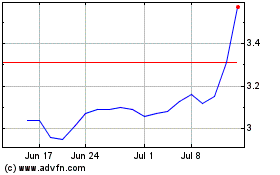

Cadiz (NASDAQ:CDZI)

Historical Stock Chart

From Mar 2024 to Apr 2024

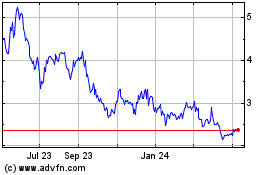

Cadiz (NASDAQ:CDZI)

Historical Stock Chart

From Apr 2023 to Apr 2024