Amazon's Profit Jumps, But Sales Growth Disappoints--3rd Update

February 02 2017 - 7:51PM

Dow Jones News

By Laura Stevens

Amazon.com Inc.'s revenue growth and investments have for years

come at the expense of profit. Now, the retail giant appears to

have exhibited more discipline to preserve its bottom line.

The Seattle-based retail giant on Thursday said fourth-quarter

profit jumped 55% to $749 million, topping the company's own

guidance. On the other hand, revenue increased 22% to $43.7

billion, hitting the midpoint of Amazon's target, and below

analysts' expectations.

"There's always a number of things that can impact customer

spending, both positively and negatively during any quarter," said

CFO Brian Olsavsky on a conference call. "What we do, is continue

to focus on the things we can directly control: for us that's

price, selection, customer experience. And on those dimensions we

felt we made great progress."

Many retailers resorted to heavy promotions during the critical

holiday season last year. As a result, traditional brick-and-mortar

chains ranging from Target Corp. to Macy's Inc. have warned on

profits and reported disappointing sales.

Amazon said promotions -- which Mr. Olsavsky called "a cost of

doing business" -- weren't a major factor in fourth-quarter

revenue.

Amazon's stronger margins likely reflect more discipline in

spending and fewer promotions at the expense of profit, as well as

a larger percentage of sales stemming from its third-party sellers,

analysts said. Those sales are nearly pure profit margin because

Amazon doesn't have to buy and hold the product itself. It also

gets paid for items that sellers ship in for Amazon to fulfill.

The company has "plenty of runway to continue with the present

investment cycle," said Charlie O'Shea, lead retail analyst at

Moody's Investors Service.

Amazon's stock was trading down more than 4% after-hours

Thursday on disappointing fourth-quarter revenue and

softer-than-expected guidance for the first quarter.

Amazon often has bucked retail trends by dominating online

sales. It commanded an estimated 42% of total holiday online

spending growth last year, according to Slice Intelligence, which

analyzes customer receipts. Apple Inc. was second, accounting for

5% of holiday e-commerce growth.

Growth and investments have been Amazon's priorities since it

was a startup. In his first letter to shareholders in 1997, Chief

Executive Jeff Bezos declared that his strategy for creating

shareholder value prioritized customer and revenue growth "because

we believe that scale is central to achieving the potential of our

business model."

But the Amazon's streak of seven profitable quarters -- with a

big jump in the most recent period -- may come under pressure as

the company enters a heavier period of investment.

Last month, Amazon pledged to create 100,000 full-time jobs in

the U.S. by mid-2018 -- a tip of the hat to President Donald

Trump's employment drive. That would require building many more

warehouses, some of which have been planned or announced.

Moreover, the retail giant has started laying the groundwork for

its own shipping business to add more delivery capacity for the

holidays, with the grander ambition of one day hauling and

delivering packages for itself, other retailers and consumers,

according to people familiar with the matter.

Amazon this week announced it is building its first air cargo

hub in Kentucky, a $1.5 billion project. It also recently made its

debut in the ocean-freight sector, handling shipment of goods to

its U.S. warehouses from Chinese merchants selling on its site. It

is taking on a role it previously left to global

freight-transportation companies.

Those investments come in addition to Amazon's branching out

into industries other than retail, including web services,

smart-home devices and music and video content. It recently became

the first tech company to receive an Academy Award nomination for

Best Picture.

Amazon is reaping the rewards of one project it has plowed money

into: Prime, its $99 annual membership program that includes perks

such as free, two-day shipping, and music and video content.

Mr. Olsavsky, noting the tens of millions of customers who

joined Prime last year, said, "We're pleased with the results we're

seeing."

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

February 02, 2017 19:36 ET (00:36 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

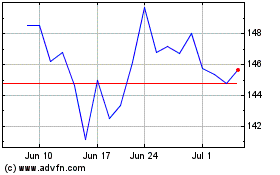

Target (NYSE:TGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

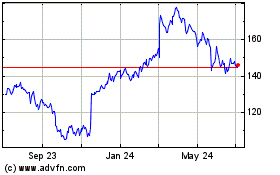

Target (NYSE:TGT)

Historical Stock Chart

From Apr 2023 to Apr 2024