Altria Profit Lifted on Anheuser-Busch InBev Stake -- Update

February 01 2017 - 12:09PM

Dow Jones News

By Anne Steele and Jennifer Maloney

Altria Group Inc.'s stake in beer behemoth Anheuser-Busch InBev

NV proved a boon in the final quarter of the year as cigarette

volumes continued to wane and market share in the company's lead

segment remained flat.

Cigarette-shipment volume fell 4.8% amid an overall industry

decline and one fewer shipping day. For the year, the company's

cigarette shipments fell 2.5%, in step with the industry, Altria

executives estimated.

On a conference call Wednesday, Chief Executive Marty Barrington

said cigarette volumes declined faster in the second half of 2016

than earlier in the year. He expects that to continue this year,

but the company plans to offset the declines with price increases,

which have averaged 4% to 5% in recent years.

One development that may weigh on results this year is

California voters' approval in November of a new cigarette tax,

which will raise taxes by $2 to $2.87 a pack starting in April. Mr.

Barrington called California a high-volume state and noted "there

are already proposals in several states to raise excise taxes

further."

Altria, the U.S.'s largest tobacco company, faces strong

competition from No. 2 player Reynolds American Inc. In the latest

quarter, Altria's cigarette market share remained flat from a year

ago at 51.4%, as Marlboro remained flat while a 0.1% increase in

discount brands retail share was offset by and a 0.1% decrease in

other premium cigarette sales. For cigars, Altria's market share

slipped to 26.6% from 27.4%.

But during the quarter, Altria received a share of the newly

enlarged Anheuser-Busch InBev following the Belgian brewer's

just-completed roughly $100 billion takeover of rival SABMiller

PLC.

The U.S. tobacco company received $5.3 billion in cash and a

9.6% share of AB InBev in exchange for its 27% stake in SABMiller.

Altria said it would have two seats on AB InBev's board of

directors, allowing it to continue using equity accounting

practices to report its share of the brewer's profit as

earnings.

Mr. Barrington declined to offer details on Altria's plans to

introduce Philip Morris International's heat-not-burn device, iQOS,

to the U.S. market. Philip Morris plans to submit an application

this quarter to the Food and Drug Administration for approval to

sell the device in the U.S.

Unlike e-cigarettes, which contain nicotine-laced liquid,

heat-not-burn devices heat tobacco to a high temperature,

vaporizing it. As of December, the device had been introduced in 20

overseas markets. Mr. Barrington said Altria was studying those

markets in anticipation of a U.S. rollout.

"What we're going to try to do, of course, is to introduce adult

smokers to the product, try to explain what it is and its

attributes, and then give them an opportunity to see if it is for

them," he said.

In all for the December period, Altria's earnings rose to $10.28

billion, or $5.27 a share, from $1.25 billion, or 64 cents a share,

a year prior. Earnings were lifted largely by the AB

InBev/SABMiller transaction gain. Excluding items, per-share

earnings rose to 68 cents. Analysts polled by Thomson Reuters had

forecast earnings of 67 cents.

Net revenue after excise taxes grew 0.1% to $4.7 billion, just

short of analyst estimates for $4.8 billion.

Altria forecast 2017 adjusted earnings in a range of $3.26 to

$3.32 a share. That is just below the $3.33 a share analysts have

predicted.

Write to Anne Steele at Anne.Steele@wsj.com and Jennifer Maloney

at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

February 01, 2017 11:54 ET (16:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

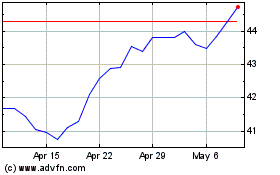

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

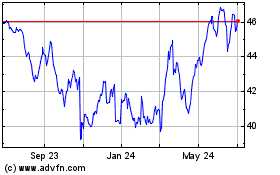

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024