Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

January 30 2017 - 5:14PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-203074

January 30, 2017

Crown

Castle International Corp.

$500,000,000 4.000% Senior Notes due 2027

January 30, 2017

Pricing Term Sheet

The information in this

pricing term sheet supplements the Issuer’s Preliminary Prospectus Supplement, dated January 30, 2017, and supersedes the information in the Preliminary Prospectus Supplement to the extent it is inconsistent with the information contained

therein. This pricing term sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. Financial information presented in the Preliminary Prospectus Supplement or incorporated by reference therein is deemed to have

changed to the extent affected by the changes described herein. This pricing term sheet should be read together with the Preliminary Prospectus Supplement, including the documents incorporated by reference therein, and the accompanying prospectus

dated March 27, 2015 before making a decision in connection with an investment in the securities. Capitalized terms used in this pricing term sheet but not defined have the meanings given to them in the Preliminary Prospectus Supplement.

|

|

|

|

|

Issuer:

|

|

Crown Castle International Corp.

|

|

Security Description:

|

|

4.000% Senior Notes due 2027 (the “Notes”)

|

|

Ratings (Moody’s / S&P / Fitch)*:

|

|

Baa3 (Stable) / BBB- (Stable) / BBB- (Stable)

|

|

Distribution:

|

|

SEC-registered

|

|

Aggregate Principal Amount:

|

|

$500,000,000

|

|

Gross Proceeds:

|

|

$497,890,000

|

|

Maturity Date:

|

|

March 1, 2027

|

|

Coupon:

|

|

4.000%

|

|

Benchmark Treasury:

|

|

2.000% due November 15, 2026

|

|

Benchmark Treasury Price and Yield:

|

|

95-27; 2.481%

|

|

Spread to Benchmark Treasury:

|

|

T + 157 basis points

|

|

Price to Public:

|

|

99.578% of principal amount

|

|

Yield to Maturity:

|

|

4.051%

|

|

Interest Payment Dates:

|

|

March 1 and September 1, commencing September 1, 2017

|

|

Record Dates:

|

|

February 15 and August 15

|

|

Make-Whole Call:

|

|

Prior to December 1, 2026 (three months prior to the maturity date of the Notes), at greater of par and make-whole at discount rate of

Treasury plus 25 basis points

|

|

|

|

|

|

Par Call:

|

|

At any time on or after December 1, 2026 (three months prior to the maturity date of the Notes)

|

|

Trade Date:

|

|

January 30, 2017

|

|

Settlement Date:

|

|

February 2, 2017 (T+3)

|

|

Use of Proceeds:

|

|

We expect to receive net proceeds of approximately

$493 million from the sale of the Notes to the underwriters, after deducting the estimated underwriting discount and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering to repay a portion of the outstanding borrowings under the Revolver.

After giving effect to the Conversion and the Acquisition, and the Equity Offering and the

offering of the notes hereby, and the use of proceeds therefrom, as of September 30, 2016, we would have had a total of approximately $8.7 billion of outstanding indebtedness, all of which would have been unsecured, and our subsidiaries would have

had a total of approximately $4.6 billion of outstanding indebtedness, all of which would have been secured.

Certain of the underwriters or their respective affiliates are lenders under the Credit Facility and affiliates of certain underwriters serve other roles under

the Credit Facility. As a result, certain of the underwriters or their affiliates would receive a portion of the net proceeds from this offering.

|

|

CUSIP:

|

|

22822VAE1

|

|

ISIN:

|

|

US22822VAE11

|

|

Denominations/Multiple:

|

|

$2,000 x $1,000

|

|

Joint Book-Running Managers:

|

|

Barclays Capital Inc.

J.P. Morgan Securities LLC

Mizuho Securities USA Inc.

RBC Capital Markets, LLC

TD Securities (USA)

LLC

|

|

|

|

|

|

|

|

Citigroup Global

Markets Inc.

Fifth Third Securities, Inc.

Credit Agricole

Securities (USA) Inc.

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Morgan Stanley & Co. LLC

MUFG Securities Americas Inc.

SMBC Nikko Securities America, Inc.

SunTrust Robinson Humphrey,

Inc.

|

|

Senior Co-Managers:

|

|

Citizens Capital Markets, Inc.

SG Americas Securities, LLC

Wells Fargo Securities,

LLC

|

|

Co-Manager:

|

|

PNC Capital Markets LLC

|

* A securities rating is not a recommendation to buy, sell, or hold securities and should be evaluated independently of any

other rating. The rating is subject to revision or withdrawal at any time by the assigning rating organization.

The issuer has filed a registration

statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more

complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at

www.sec.gov

. Alternatively, the issuer, any underwriter or any dealer participating in the offering will

arrange to send you the prospectus if you request it by calling Barclays Capital Inc. (toll-free) at 1-888-603-5847, J.P. Morgan Securities LLC (collect) at 1-212-834-4533, Mizuho Securities USA Inc. (toll-free) at 1-866-271-7403, RBC Capital

Markets, LLC (toll-free) at 1-866-375-6829 or TD Securities (USA) LLC (toll-free) at 1-855-495-9846.

This pricing term sheet does not constitute

an offer to sell, or a solicitation of an offer to buy any security in any state or jurisdiction in which such offer, solicitation or sale would be unlawful.

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was

automatically generated as a result of this communication being sent by Bloomberg or another email system.

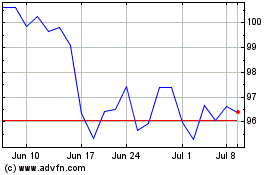

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

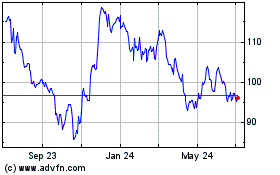

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024