Current Report Filing (8-k)

January 30 2017 - 9:29AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 30, 2017

BROADWIND ENERGY, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-34278

|

|

88-0409160

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

3240 South Central Avenue, Cicero, Illinois 60804

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code:

(708) 780-4800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry Into A Material Definitive Agreement

.

On January 30, 2017, Broadwind Energy, Inc., a Delaware corporation (the “Company”), issued a press release announcing that it had agreed upon the material terms pursuant to which it will purchase 100% of the outstanding membership interests of Red Wolf Company, LLC, a North Carolina limited liability company (“Red Wolf”), from Red Wolf’s members (the “Proposed Acquisition”). Following the closing of the Proposed Acquisition, Red Wolf would become a wholly-owned subsidiary of the Company.

The Proposed Acquisition contemplates the payment of $16.5 million in cash at closing, a portion of which will be applied to pay off Red Wolf’s outstanding indebtedness. The purchase price is subject to a customary net working capital adjustment and an earn-out structure under which the sellers may become entitled to contingent consideration of up to $9.9 million, payable in cash and, at the election of the Company, up to 50% in the form of shares of the Company’s common stock. Completion of the Proposed Acquisition is subject to the execution of definitive transaction agreements. The parties are targeting a signing of the definitive agreement and closing of the Proposed Acquisition on February 1, 2017. The definitive agreement will include customary representations, warranties, covenants and indemnities by the parties.

A copy of the press release issued by the Company announcing the Proposed Acquisition is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

|

|

|

|

EXHIBIT NUMBER

|

DESCRIPTION

|

|

99.1

|

Broadwind Energy, Inc. Press Release, dated January 30, 2017

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BROADWIND ENERGY, INC.

|

|

|

|

|

|

January 30, 2017

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

|

|

|

|

Stephanie K. Kushner

|

|

|

|

Chief Executive Officer and Chief Financial Officer

|

|

|

|

(Principal Executive Officer and Principal Financial Officer)

|

EXHIBIT INDEX

|

|

|

|

EXHIBIT NUMBER

|

DESCRIPTION

|

|

99.1

|

Broadwind Energy, Inc. Press Release, dated January 30, 2017

|

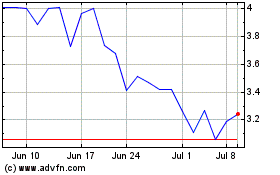

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

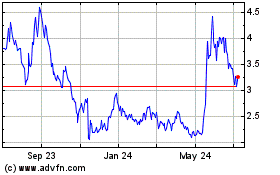

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Apr 2023 to Apr 2024