Report of Foreign Issuer (6-k)

January 27 2017 - 4:53PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

Of Foreign Private Issuer

Pursuant

To Rule 13a-16 Or 15d-16 Of

The

Securities Exchange Act Of 1934

For the month

of January 2017

__________________

Commission

File Number: 000-54290

Grupo Aval Acciones y Valores S.A.

(Exact

name of registrant as specified in its charter)

Carrera

13 No. 26A - 47

Bogotá

D.C., Colombia

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GRUPO

AVAL ACCIONES Y VALORES S.A.

TABLE

OF CONTENTS

|

ITEM

|

|

|

|

|

|

1.

|

Notice of Relevant Information dated January 27, 2017

|

Bogota,

January 27, 2017

In

regard to the recent announcement made by Colombia’s National Agency of Infrastructure (Agencia Nacional de Infraestructura

– ANI) with respect to its request for the declaration of nullity of contract to the arbitral tribunal appointed in relation

to toll road concession “Ruta del Sol Sector 2”, Grupo Aval Acciones y Valores S.A. (“Grupo Aval” or the

“Company”) informs:

|

|

·

|

Grupo

Aval is the controlling shareholder of Corporación Financiera Colombiana S.A.

(“Corficolombiana”). Corficolombiana is the sole shareholder of Episol S.A.S

(“Episol”), and Episol is the owner of 33% of the shares of Concesionaria

Ruta del Sol S.A.S. (“CRDS”), company in charge of Ruta del Sol Sector 2,

in which

Odebrecht

and

CSS Constructores

own the remaining 62% and 5%,

respectively.

|

|

|

·

|

The

investment of Episol in CRDS amounts to Ps$0.35 trillion approx. (US$119 million), equivalent

to 1.7% of the total assets of Corficolombiana and to 0.2% of Grupo Aval’s total

consolidated assets.

|

|

|

·

|

The

indebtedness of CRDS with financial entities amounts to Ps$2.4 trillion (US$ 817 million)

as of December 31, 2016, of which 50% corresponds to loans granted by banks controlled

by Grupo Aval.

|

|

|

·

|

The

Ps$1.2 trillion (US$408 million) debt of CRDS granted by our banking subsidiaries, represents

0.8% of the consolidated loan portfolio of Grupo Aval as of September, 2016.

|

|

|

·

|

In

case of an eventual early liquidation of Ruta del Sol Sector 2, Grupo Aval’s estimations

indicate that the amounts to be paid in retribution of the roadworks completed to date

will be sufficient for the payment in full of the indebtedness with financial entities.

|

|

|

·

|

Since

2009, year in which the Ruta del Sol Sector 2 begun, Episol’s income derived from

its participation in CRDS represents approximately 5% of the accumulated net income recorded

by Corficolombiana, and 0.9% of Grupo Aval’s consolidated accumulated net income.

|

In this document,

Ps trillion refers to millions of millions. Amounts converted to USD using exchange rate of 2.937 pesos/USD.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: January

27, 2017

|

|

|

GRUPO AVAL ACCIONES Y VALORES S.A.

|

|

|

|

|

By:

|

/s/ Jorge Adrián

Rincón Plata

|

|

|

|

|

|

Name:

|

Jorge Adrián Rincón Plata

|

|

|

|

|

|

Title:

|

Chief Legal Counsel

|

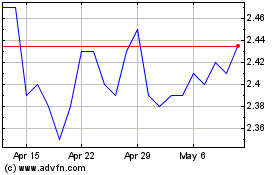

Grupo Aval Acciones y Va... (NYSE:AVAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

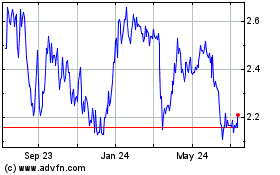

Grupo Aval Acciones y Va... (NYSE:AVAL)

Historical Stock Chart

From Apr 2023 to Apr 2024