Yankee Analyst Reports Strong ALYI Technicals Following USMJ Cannabis Retail Payment Deal

January 27 2017 - 1:51PM

InvestorsHub NewsWire

January 27, 2017 - InvestorsHub NewsWire -- Wall Street Corner

Report

Yankee Analysts has published an article with an analysis of the

technical trading of Alternet Systems, Inc. (USOTC:

ALYI) following a recent deal with North American Cannabis

Holdings, Inc. (USOTC: USMJ) for the two Companies

to launch a retail cannabis payment system. The deal includes

a dividend of 50 million ALYI shares to

USMJ shareholders. The deal between

USMJ and ALYI has been well

received with the PPS of both companies showing a

strong up trend. The analyisis by Yankee

Analysts focuses on ALYI and includes a detailed

review of multiple technical indicators that point to a strong

potential for a continued increase in the ALYI

PPS. The articles is included in its entirety

below:

Shares to Watch: Indicator Update on Alternet Systems Inc.

(ALYI)

Traders keeping an eye on technicals are watching shares of

Alternet Systems Inc. (ALYI). The Williams Percent Range or

Williams %R is a technical indicator that was developed to measure

overbought and oversold market conditions. The Williams %R

indicator helps show the relative situation of the current price

close to the period being observed. Alternet Systems Inc. (ALYI)’s

Williams Percent Range or 14 day Williams %R presently is at

-34.33. In general, if the reading goes above -20, the stock may be

considered to be overbought. Alternately, if the indicator

goes under -80, this may show the stock as being oversold.

We can also take a look at the Average Directional Index or ADX

of the stock. For traders looking to capitalize on trends, the ADX

may be an essential technical tool. The ADX is used to measure

trend strength. ADX calculations are made based on the moving

average price range expansion over a specified amount of time. ADX

is charted as a line with values ranging from 0 to 100. The

indicator is non-directional meaning that it gauges trend strength

whether the stock price is trending higher or lower. The 14-day ADX

for Alternet Systems Inc. (ALYI) presently sits at 29.85. In

general, and ADX value from 0-25 would represent an absent or weak

trend. A value of 25-50 would indicate a strong trend. A value of

50-75 would indicate a very strong trend, and a value of 75-100

would signify an extremely strong trend.

At the time of writing, Alternet Systems Inc. (ALYI) has a

14-day Commodity Channel Index (CCI) of 166.03. Developed by Donald

Lambert, the CCI is a versatile tool that may be used to help spot

an emerging trend or provide warning of extreme conditions. CCI

generally measures the current price relative to the average price

level over a specific time period. CCI is relatively high when

prices are much higher than average, and relatively low when prices

are much lower than the average.

A commonly used tool among technical stock analysts is the

moving average. Moving averages are considered to be lagging

indicators that simply take the average price of a stock over a

certain period of time. Moving averages can be very helpful for

identifying peaks and troughs. They may also be used to assist the

trader figure out proper support and resistance levels for the

stock. Currently, the 200-day MA is sitting at 0.01.

The Relative Strength Index (RSI) is a momentum oscillator that

measures the speed and change of stock price movements. The RSI was

developed by J. Welles Wilder, and it oscillates between 0 and 100.

Generally, the RSI is considered to be oversold when it falls below

30 and overbought when it heads above 70. RSI can be used to detect

general trends as well as finding divergences and failure swings.

The 14-day RSI is presently standing at 66.14, the 7-day is 71.78,

and the 3-day is resting at 69.45.

Wall

Street Corner Report is the premier discovery site for

promising, yet undiscovered small and micro-cap stocks featuring

opportunities in an ethical, professional, and responsible manner.

We're not fiendishly 'short' sighted nor are we here to dream the

impossibly 'long' dream. We take a practical view on the big

ideas of well-intentioned management and look to profit on each

reasonably achievable step the well intentioned mangers take toward

their big ideas.

http://www.wallstreetcornerreport.com/

https://twitter.com/WallStCornerRpt

This

press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended

(the "Exchange Act"), and as such, may involve risks and

uncertainties. These forward looking statements relate to, amongst

other things, current expectation of the business environment in

which the company operates, potential future performance,

projections of future performance and the perceived opportunities

in the market. The company's actual performance, results and

achievements may differ materially from the expressed or implied in

such forward-looking statements as a result of a wide range of

factors.

Jack Taylor

info@wallstreetcornerreport.com

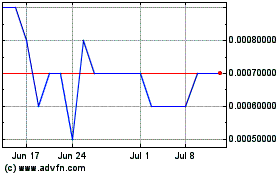

Alternet Systems (CE) (USOTC:ALYI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alternet Systems (CE) (USOTC:ALYI)

Historical Stock Chart

From Apr 2023 to Apr 2024