Amended Statement of Beneficial Ownership (sc 13d/a)

January 27 2017 - 6:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1 )

Provectus

Biopharmaceuticals, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

74373F100

(CUSIP Number)

with copies to:

|

|

|

|

|

Peter R. Culpepper

P.O. Box 32429

Knoxville,

TN 37930

(865) 604-0657

|

|

David W. Bernstein, Esq.

Goodwin Procter LLP

The

New York Times Building

620 Eighth Avenue

New York, NY 10018

(212)

813-8808

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

January 26, 2017

(Date

of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐.

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for

other parties to whom copies are to be sent.

(Continued on following pages)

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Persons

Peter R. Culpepper

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group*

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Source of Funds*

PF

|

|

5

|

|

Check Box if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

6

|

|

Citizenship or Place of

Organization

United States

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting Person With

|

|

7

|

|

Sole Voting Power

3,474,998

|

|

|

8

|

|

Shared Voting Power

0

|

|

|

9

|

|

Sole Dispositive Power

3,474,998

|

|

|

10

|

|

Shared Dispositive Power

0

|

|

11

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,474,998

|

|

12

|

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares* ☐

|

|

13

|

|

Percent of Class Represented by Amount

in Row (11)

1.4%

|

|

14

|

|

Type of Reporting Person*

IN

|

|

*

|

SEE INSTRUCTIONS BEFORE FILLING OUT!

|

|

Item 1.

|

Security and Issuer

|

This Amendment No. 1 to a Statement on Schedule 13D (this

“Statement”) relates to common stock, par value $0.001 per share (“Common Stock”), of Provectus Biopharmaceuticals, Inc. (the “Issuer”). The address of the principal executive officer of the Issuer is: 7327 Oak Ridge

Highway, Suite A, Knoxville, Tennessee 37931. This Schedule 13D/A is being filed to amend Items 4 and 7.

|

Item 4.

|

Purpose of Transaction

|

Item 4 of this Schedule 13D is amended so that, as amended, it

states the following:

Until December 28, 2016, Culpepper was an officer of the Issuer. Culpepper acquired his shares of the Issuer

while he was an officer of the Issuer under incentive plans and otherwise, without any intention of taking action with regard to an extraordinary transaction, other than participating as an officer of the Issuer in transactions approved by the

Issuer’s board of directors (the “Board”), and without any intention of seeking to cause a change in the Board or management of the Issuer, other than through recommendations he made to the Board during 2016 in his capacity as an

officer of the Issuer.

On December 28, 2016, the Board terminated Culpepper as an officer of the Issuer, purportedly for cause. On January 3,

2017, Culpepper sent the Board a letter in which he stated that by abruptly terminating his involvement with the Issuer while the Issuer was in the process of seeking financing it needs to be able to continue its efforts to obtain approval from the

United States Food and Drug Administration (“FDA”) of its two prescription drug candidates and at a time when he was deeply involved in discussions with major pharmaceutical companies regarding production and marketing of one of those

prescription drug candidates when it is approved by the FDA, without anybody to replace him in either of those endeavors, the Board is putting the business of the Issuer in severe jeopardy. A copy of that letter is attached as Exhibit 1 to this

Statement.

On January 26, 2017, Culpepper sent a letter notifying the Secretary of Provectus that Culpepper proposes to nominate

Charles Littlejohn, Courtlandt G. Miller, Scott Palmer, Calvin Wallen III and himself for election at the 2017 annual meeting of stockholders of the Issuer to serve as directors of the Issuer. The notice was sent in order to meet an advance notice

requirement of the Issuer’s bylaws. A copy of the letter to the Secretary of Provectus is attached as Exhibit 2 to this Statement.

Culpepper has discussed with potential participants a possible offer to purchase securities of the Issuer in order to provide funds which

Culpepper believes the Issuer requires. However, no offer has been made, and it is possible that no offer ever will be made.

Even if

Culpepper does not participate in an offer to purchase securities of the Issuer, Culpepper may, in addition to seeking to replace the current directors of the Company, seek to cause the Issuer’s capital to be restructured, seek to identify

purchasers for the Issuer or substantial interests in the Issuer, seek to cause the Issuer to hire a new Chief Executive Officer and seek to be reinstated as a senior officer of the Issuer.

|

Item 7.

|

Material to be Filed as Exhibits

|

Exhibit 1 — Letter dated January 3, 2017

(previously filed)

Exhibit 2 – Letter dated January 26, 2017 (filed with this Amendment)

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

Dated: January 26, 2017

|

|

|

|

By:

|

|

/s/ Peter R. Culpepper

|

|

|

|

|

|

|

|

Peter R. Culpepper

|

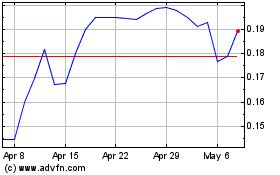

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

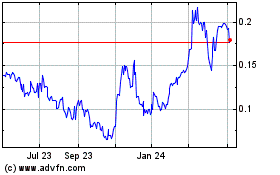

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024