Current Report Filing (8-k)

January 27 2017 - 6:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

January 26, 2017

Date of Report (Date of earliest event reported)

Canadian

Pacific Railway Limited

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Canada

|

|

001-01342

|

|

98-0355078

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

7550 Ogden Dale Road S.E., Calgary, Alberta,

Canada, T2C 4X9

(Address

of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (403) 319-7000

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

ITEM 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(b)

On January 26, 2017, Canadian

Pacific Railway Limited (the “Company”) and Mark Wallace, Vice President and Chief of Staff of the Company, agreed that Mr. Wallace will no longer serve as Vice President and Chief of Staff of the Company, effective at the close of

business on January 27, 2017. Mr. Wallace will begin a leave of absence from the Company beginning at the close of business on January 27, 2017.

(e)

In connection with the cessation of

his services as Vice President and Chief of Staff of the Company, on January 26, 2017, Mr. Wallace entered into a letter agreement (the “Agreement”) with the Company, which provides for a paid leave of absence beginning on

January 27, 2017 until the earlier of (a) March 31, 2017 and (b) Mr. Wallace’s voluntary resignation (the “Paid Leave Term”). Pursuant to the Agreement, if Mr. Wallace has not voluntarily resigned from

the Company on or prior to March 31, 2017, Mr. Wallace will begin an unpaid leave of absence beginning on April 1, 2017 until the earlier of (a) May 31, 2017 and (b) Mr. Wallace’s voluntary resignation (the

“Unpaid Leave Term” and, together with the Paid Leave Term, the “Leave of Absence”). If Mr. Wallace has not voluntarily resigned from the Company on or prior to May 31, 2017, the Agreement provides that the Company and

Mr. Wallace agree to engage in good faith negotiations regarding a senior management position for Mr. Wallace’s continued employment at the Company, beginning on June 1, 2017; however, if an agreement is not reached,

Mr. Wallace will tender his resignation effective as of May 31, 2017. In the event of such resignation, or any earlier voluntary resignation during the Leave of Absence, Mr. Wallace agrees to sign and return a resignation and release

form to the Company within 30 days of his resignation. Failure to sign and return such form will result in Mr. Wallace’s obligation to repay any payments made to him by the Company on or following January 27, 2017.

During the Paid Leave Term, Mr. Wallace will continue to (i) receive his current annual base salary, (ii) accrue vacation time

and pay, (iii) be eligible for a cash bonus based on actual results pursuant to the 2016 short-term incentive plan, provided Mr. Wallace remains employed with the Company on February 24, 2017, (iv) be eligible to participate in

the Company’s pension and benefits plans which he currently participates in and (v) remain eligible for the continued vesting of his equity awards, in accordance with the terms of the applicable equity compensation plans and grant

agreements. During the Unpaid Leave Term, Mr. Wallace will not receive a salary, will not accrue vacation time or pay and will not be eligible to participate in any Company pension or disability benefits plan, but he will continue to

participate in the Company’s group benefit plans (other than disability coverage) and his equity awards will continue to be eligible to vest in accordance with the terms of the applicable equity compensation plans and grant agreements. The

Agreement further provides that Mr. Wallace will receive title to his company vehicle and reimbursement for certain limited legal fees.

Without prior approval of the Company, Mr. Wallace will not perform any work or services for the Company during the Leave of Absence.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: January 26, 2017

|

|

|

|

|

CANADIAN PACIFIC RAILWAY LIMITED

|

|

|

|

|

By:

|

|

/s/ Jeffrey J. Ellis

|

|

|

|

Name: Jeffrey J. Ellis

Title:

Chief Legal Officer and Corporate Secretary

|

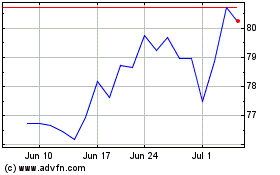

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

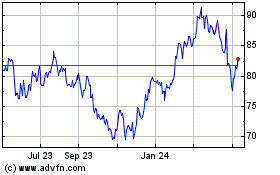

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024