By Brian Blackstone

VEVEY, Switzerland -- The Nesquik bunny is slimming down, and so

is the chocolate drink whose package it has adorned for

decades.

Nestlé SA is betting reduced sugar and a new advertising

strategy will boost sales amid a growing consumer backlash against

sweet drinks.

The revamp comes amid a broader makeover at the world's biggest

packaged-food company by sales, as it attempts to deploy its

research and marketing muscle to meet rapidly changing consumer

tastes -- and turn around lackluster revenue growth.

Nestlé for years has fallen short of its own 5% to 6% target for

annual organic growth. For a company with sales of around $90

billion a year, that's a tall order in the best of times. But

Nestlé and its rivals have struggled to boost volumes and lift

prices amid consumers' push for healthier fare and

super-competitive markets.

A recent push into health sciences offers hope, but that unit is

too small to make a big difference in the short term, analysts say.

That leaves Nestlé reliant on standbys including Stouffers's frozen

TV dinners, KitKat chocolate bars, Nescafé instant coffee and

powdered drinks like Nesquik.

Nesquik and Milo, a malted beverage popular in Asia, generate

combined sales in their various forms of about 3.5 billion Swiss

francs ($3.4 billion) a year for the company, according to analyst

estimates, or 4% of Nestlé's overall revenue. Nesquik's status has

endured with powdered, syrup and ready-to-drink options. It is No.

2 in the global flavored-powdered drinks market behind Milo,

according to market-intelligence firm Euromonitor.

Nesquik, launched in 1948 in the U.S. as Quik, once benefited

from some healthy-eating bona fides: chocolate powder got children

to drink milk. Today it faces a barrage of competition from cheaper

chocolate drinks sold by big supermarket chains. It also finds

itself, along with powdered competitors and sodas, at the epicenter

of debate over sugar content.

A few years ago, Nestlé executives concluded that Nesquik -- a

prized "billionaire" brand in Nestlé speak, meaning more than $1

billion a year in sales -- was showing its age. It had too much

sugar and a marketing theme centered on the omnipresent cartoon

bunny.

"We did not believe that where Nesquik was is a sustainable way

of continuing with this brand," said Nestlé executive vice

president Patrice Bula, who is spearheading the revamp, in an

interview.

In 2015, the company introduced a reduced sugar version in the

U.S. The next year, it launched an additional version in France,

cutting added sugar from 10.6 grams a serving to five grams. It

plans another new launch this spring in the U.K. and then other

European countries, cutting added sugar by an additional 30% to 3.4

grams a serving.

Nestlé plans a U.S. launch in 2018 of the lower-sugar version it

is introducing in Europe this year. That is something even big fans

of the drink say they would embrace.

"Sometimes, I worry that I'm overindulging the girls since they

do drink their milk with it twice a day," said Erica Chao, 37 years

old, of Miami, who has been drinking Nesquik since she can

remember, and now gives it to her daughters. "A new formula with

less sugar is not a bad idea at all. I really don't think the girls

will even notice it."

After Nestlé introduced its lower-sugar version in the U.S. two

years ago, Nesquik market share moved higher, to 10.8% of the U.S.

market for chocolate-flavored powder drinks in 2016, according to

Euromonitor, up from 9.8% in 2013.

Still, skeptics say there may be limits to what Nestlé can do.

Nestlé excels at R&D and traditional marketing, but it hasn't

reacted quickly enough to an era when parents and young children

get information on mobile devices as much as they do from TV, some

analysts say.

"The new generation is so different from the moms and kids they

were serving from the 1950s through 2010," said beverage-industry

consultant Tom Pirko. "How relevant is that bunny to four- or

five-year-olds on their iPad; how do they identify with that?"

With the Nesquik revamp, the company is taking steps to catch

up.

In November, Nestlé teamed up with Barcelona's soccer team to

promote Nesquik and Milo. Nestlé has made two global brand films

and plans a website, called Nesquik Studios, this year.

The Nesquik bunny, the cartoon rabbit that has appeared on the

package for decades, is smaller and no longer dominates the

packaging.

The urgency behind the Nesquik retooling forced executives to

overhaul how they make and execute decisions, Mr. Bula said:

"Nestlé has, and also I think it is part of a certain appetite or

sense of Swiss perfection, tried to get everything really right,

which delays you."

A short drive from company headquarters along Lake Geneva,

scientists at Nestlé's labyrinthine research center -- cut into the

hills near Lausanne -- are tackling the health-taste trade-off.

"The innovation is on the ingredients side," said Olivier Roger, a

12-year Nestlé veteran whose team of 10 scientists experiments with

ways to reduce sugar.

Mr. Roger looked at 160 suppliers over two years to create the

new formula for Nesquik. In the same building, Nestlé built a mini

factory where prototypes can be produced and tested quickly.

"We have a little more pressure to succeed," said Mr. Roger.

--Stu Woo contributed to this article.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

January 27, 2017 05:44 ET (10:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

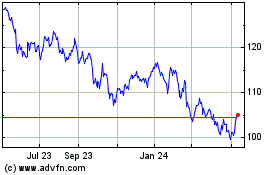

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024