Details Emerge About Jeffrey Katzenberg's New-Media Venture

January 26 2017 - 11:47AM

Dow Jones News

By Erich Schwartzel

Longtime Hollywood executive Jeffrey Katzenberg has raised

nearly $600 million to invest in digital and technology ventures,

according to a regulatory filing.

The filing Thursday morning offers new details on the latest

career move for Mr. Katzenberg, who served as chief executive at

DreamWorks Animation SKG Inc. before it was sold last year to

Comcast Corp.'s NBCUniversal for $3.8 billion.

His new firm, called WndrCo LLC, has raised $591.5 million and

is on the hunt for investments in digital and technology

companies.

WndrCo draws inspiration from Barry Diller's IAC/InterActive

Corp., a publicly traded company whose investments and holdings

include digital brands About.com and CollegeHumor and dating

services Match.com and Tinder.

The Securities and Exchange Commission filing on Mr.

Katzenberg's first funding round didn't list the company's

investors or any current investments. The minimum outside

investment is $25 million.

Mr. Katzenberg cashed out nearly $400 million in company stock

following the DreamWorks Animation sale, but speculation has

swirled since then on what he would do next. Notably, the

66-year-old executive isn't venturing back into traditional

moviemaking, as other recent out-of-work studio chiefs have opted

to do.

WndrCo enters the scene as traditional content creators like

Hollywood studios must retain relevance in a marketplace that also

includes tech-oriented competitors like Apple Inc. and Netflix

Inc.

Mr. Katzenberg, who before co-founding DreamWorks worked at Walt

Disney Co. for many years, is joined at WndrCo by two co-founders,

Ann Daly and Sujay Jaswa. Ms. Daly was a longtime lieutenant of Mr.

Katzenberg's at DreamWorks Animation, and stepped down as president

of the company when it was sold. Mr. Jaswa worked as a principal at

New Enterprise Associates, a venture-capital firm, and as chief

financial officer at Dropbox Inc.

Mr. Katzenberg hasn't been coy about his interest in looking

beyond movies, saying in 2014 that movies were "not a growth

business."

At DreamWorks Animation, he took an interest in digital ventures

and purchased AwesomenessTV, a multichannel network that

specialized in mobile content, for an initial $33 million in 2013.

When Verizon Communications Inc. bought a 24.5% stake in

AwesomenessTV last April, it valued the network at $650

million.

(END) Dow Jones Newswires

January 26, 2017 11:32 ET (16:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

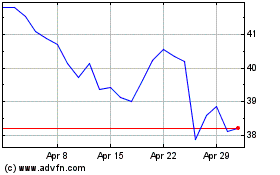

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024