Walgreens CEO Says Rite Aid Deal Still Under Review With FTC

January 26 2017 - 11:33AM

Dow Jones News

By Sharon Terlep

Walgreens Boots Alliance Inc.'s chief executive said the

drugstore giant continues to discuss its proposed takeover of rival

Rite Aid Corp. with antitrust regulators, who have been reviewing

the combination for about 15 months.

At a meeting with investors on Thursday, CEO Stefano Pessina

said the companies were discussing "all instruments and actions"

they could put in place to win approval from the Federal Trade

Commission.

Walgreens in October 2015 agreed to buy Rite Aid for about $9.4

billion, a combination that would result in a drugstore chain with

more than 10,000 U.S. stores.

The antitrust concern is that such a big company could hold too

much sway in negotiations with pharmacy-benefits managers like CVS

Health Corp.'s Caremark or Express Scripts Holding Co., which

handle corporate and government drug plans.

The companies, in response to those concerns, said in December

that they would sell 865 stores to Fred's Inc. , a regional

drugstore chain.

The proposed deal is set to expire by Friday unless the

companies extend their deadline.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

January 26, 2017 11:18 ET (16:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

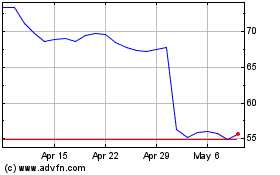

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

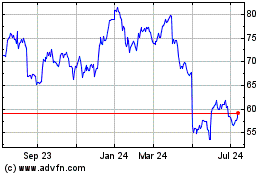

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024