UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K for January 26, 2017

Commission File Number 1-31615

Sasol Limited

50 Katherine Street

Sandton 2196

South Africa

(Name and address of registrant's principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F __X__ Form 40-F _____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an

attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission

in paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish

and make public under the laws of the jurisdiction in which the

registrant is incorporated, domiciled or legally organized

(the registrant's "home country"), or under the rules of the

home country exchange on which the registrant's securities are

traded, as long as the report or other document is not a press

release, is not required to be and has not been distributed to

the registrant's security holders, and, if discussing a material

event, has already been the subject of a Form 6-K submission or

other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing

the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes _____ No __X__

If "Yes" is marked, indicate below the file number assigned to

the registrant in connection with Rule 12g3-2(b):

82-_______________.

Enclosures: Trading statement for the six months ended

31 December 2016

Sasol Limited

(Incorporated in the Republic of South Africa)

(Registration number 1979/003231/06)

Sasol Ordinary Share codes: JSE: SOL NYSE: SSL

Sasol Ordinary ISIN codes: ZAE000006896 US8038663006

Sasol BEE Ordinary Share code: JSE: SOLBE1

Sasol BEE Ordinary ISIN code: ZAE000151817

("Sasol" or "the Company")

|

Trading statement for the six months ended 31 December 2016

Sasol's earnings per share (EPS) for the six months ended

31 December 2016 are expected to increase by between 12% and

22% (approximating R1,44 to R2,63 per share) compared to the

2016 financial half year (prior period) EPS of R11,97.

Headline earnings per share (HEPS) for the same period are

expected to decrease by between 34% and 44%

(approximating R8,26 to R10,68 per share) from the prior

period HEPS of R24,28.

Overall, Sasol delivered a strong business performance across

most of the value chain. Secunda Synfuels' production volumes

increased by 1% and our Eurasian operations increased

production volumes by 8% on the back of stronger product

demand. Natref's production volumes were down 7% mainly due

to planned shutdowns during the period under review.

Normalised sales volumes increased by 11% for our Base

Chemicals business and 2% for our Performance Chemicals

business compared to the prior period mainly on the back of

stronger demand, higher chemical margins and improved plant

stability. Liquid fuels sales volumes decreased by 2% due to

the Natref planned shutdowns and more volumes allocated to the

higher margin yielding chemical businesses. ORYX GTL achieved

a utilization rate of 95% with the run-rate of production in

line with previous market guidance provided. A detailed

production summary and key business performance metrics for

the first half of the 2017 financial year for all our

businesses are available on our website, www.sasol.com.

We have seen a steady and continued recovery in global oil

and product prices during the period under review. Normalised

cash fixed costs continued to trend well within inflation for

the period under review. HEPS was however negatively impacted

by the following items:

* Although the average rand/US dollar exchange rate weakened

by 3% to R13,99 during the period under review, the closing

rand/US dollar exchange rate, however, strengthened to

R13,74 at 31 December 2016 (30 June 2016 - R14,71)

resulting in translation losses of approximately R1,3

billion on the valuation of the balance sheet compared to

translation gains of R2,6 billion, which includes foreign

exchange contracts, recognised in the prior period. The

valuation impact of the stronger closing exchange rate for

the period under review negatively impacted earnings by

approximately R1,46 per share;

* The impact of labour actions at our Secunda mining

operations, during the six month period, resulted in a 16%

decrease in mining production volumes and significantly

higher once-off costs to ensure a continuous supply of coal

to our Secunda Synfuels Operations. The additional net cost

associated with the labour action is estimated at

approximately R1 billion or R1,06 per share; and

* Once-off items in the prior year of R2,3 billion or R3,77

per share relating mainly to the reversal of the Escravos

GTL provision.

Our results for the first half of the 2017 financial year may

be further affected by any adjustments resulting from our half

year-end closure process. This may result in a change in the

estimated earnings noted above. This trading statement only

deals with the comparison to the first half of the 2016

financial year.

The financial information on which this trading statement is

based has not been reviewed and reported on by the Company's

external auditors. Sasol's financial results for the six months

ended 31 December 2016 will be announced on Monday,

27 February 2017.

26 January 2017

Johannesburg

Sponsor: Deutsche Securities (SA) Proprietary Limited

Disclaimer - Forward-looking statements: Sasol may, in this

document, make certain statements that are not historical facts

and relate to analyses and other information which are based on

forecasts of future results and estimates of amounts not yet

determinable. These statements may also relate to our future

prospects, developments and business strategies. Examples of

such forward-looking statements include, but are not limited to,

statements regarding exchange rate fluctuations, volume growth,

increases in market share, total shareholder return, executing

our growth projects and cost reductions, including in connection

with our Business Performance Enhancement Programme and Response

Plan. Words such as "believe", "anticipate", "expect", "intend",

"seek", "will", "plan", "could", "may", "endeavour", "target",

"forecast" and "project" and similar expressions are intended to

identify such forward-looking statements, but are not the

exclusive means of identifying such statements. By their very

nature, forward-looking statements involve inherent risks and

uncertainties, both general and specific, and there are risks

that the predictions, forecasts, projections and other forward-

looking statements will not be achieved. If one or more of these

risks materialise, or should underlying assumptions prove

incorrect, our actual results may differ materially from those

anticipated. You should understand that a number of important

factors could cause actual results to differ materially from the

plans, objectives, expectations, estimates and intentions

expressed in such forward-looking statements. These factors are

discussed more fully in our most recent annual report on Form

20-F filed on 27 September 2016 and in other filings with the

United States Securities and Exchange Commission. The list of

factors discussed therein is not exhaustive; when relying on

forward-looking statements to make investment decisions, you

should carefully consider both these factors and other

uncertainties and events. Forward-looking statements apply only

as of the date on which they are made, and we do not undertake

any obligation to update or revise any of them, whether as a

result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant, Sasol Limited, has duly caused this

report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date January 26, 2017 By: /s/ V D Kahla

Name: Vuyo Dominic Kahla

Title: Company Secretary

|

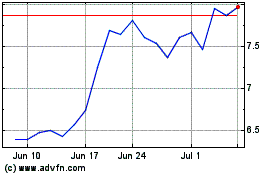

Sasol (NYSE:SSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

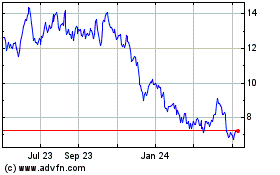

Sasol (NYSE:SSL)

Historical Stock Chart

From Apr 2023 to Apr 2024