JetBlue Airways Corporation (NASDAQ:JBLU) today reported its

results for the fourth quarter 2016 and the full year 2016:

- Operating income of $296 million in the

fourth quarter and $1.3 billion for the full year, a decline of

10.4% from the fourth quarter of 2015 and a full year increase of

7.9% over 2015.

- Pre-tax income of $274 million in the

fourth quarter and $1.2 billion for 2016, a decrease of 9.6% from

the fourth quarter of 2015 and a full year increase of 10.8% over

2015.

- Fourth quarter net income of $172

million, or $0.50 per diluted share. For the full year 2016, net

income of $759 million or $2.22 per diluted share. This compares to

JetBlue’s fourth quarter 2015 net income of $190 million, or $0.56

per diluted share and 2015 net income of $677 million or $1.98 per

diluted share.

Financial Performance

JetBlue reported fourth quarter operating revenues of $1.6

billion. Revenue passenger miles for the fourth quarter increased

6% to 11.2 billion on a capacity increase of 4.5%, resulting in a

fourth quarter load factor of 84.7%, a 1.1 point increase year over

year.

Yield per passenger mile in the fourth quarter was 13.20 cents,

down 3.1% compared to the fourth quarter of 2015. Passenger revenue

per available seat mile (PRASM) for the fourth quarter 2016

decreased 1.7% year over year to 11.19 cents and operating revenue

per available seat mile (RASM) decreased 1.5% year over year to

12.43 cents.

Compared with last year, operating expenses for the quarter

increased 6.5%, or $81 million. Interest expense for the quarter

declined 13.2%, or $4 million, as JetBlue continued to reduce its

debt. JetBlue’s operating expense per available seat mile (CASM)

for the fourth quarter increased 1.9% year over year to 10.19

cents. Excluding fuel, profit sharing and related taxes, fourth

quarter CASM1 increased 5.6% to 7.69 cents.

“I would like to thank our over 20,000 crewmembers for going

above and beyond once again last year. They are truly JetBlue’s

greatest asset and I want to congratulate each of them on an

outstanding 2016. We are focused on achieving the operational and

financial excellence that will give us the platform to grow our

culture even further than the 100 destinations we serve today,”

said Robin Hayes, JetBlue’s President and CEO.

Fuel Expense and Hedging

In the fourth quarter JetBlue had hedges in place for

approximately 25% of its fuel consumption. The realized fuel price

in the quarter was $1.56 per gallon, a 7.3% decrease versus fourth

quarter 2015 realized fuel price of $1.68.

JetBlue has hedged approximately 10% of its first quarter and

full year 2017 projected fuel consumption using jet fuel swaps.

Based on the fuel curve as of January 13th, JetBlue expects an

average price per gallon of fuel, including the impact of hedges

and fuel taxes, of $1.73 in the first quarter of 2017.

Liquidity and Cash Flow

JetBlue ended the year with $971 million in unrestricted cash

and short term investments, or about 15% of trailing twelve month

revenue. In addition, JetBlue maintains approximately $600 million

in undrawn lines of credit.

During the fourth quarter, JetBlue repaid $220 million in

regularly scheduled debt and capital lease obligations. JetBlue

anticipates paying approximately $50 million in regularly scheduled

debt and capital lease obligations in the first quarter 2017 and

approximately $195 million for the full year 2017.

“We ended 2016 with a debt to adjusted capitalization ratio of

35%, in the middle of our target range of 30% to 40%. Our efforts

to de-risk the balance sheet in recent years allows JetBlue to

evolve towards a more balanced approach to capital allocation,

starting with our $120 million in share repurchases in fourth

quarter 2016,” said Jim Leddy, JetBlue’s Interim Chief Financial

Officer and Treasurer.

First Quarter and Full Year

Outlook

For the first quarter of 2017, year over year CASM excluding

fuel is expected to grow between 3% and 5%. For the full year 2017,

JetBlue expects year over year CASM excluding fuel to grow between

1% and 3%, consistent with prior guidance.

In the first quarter 2017, capacity is expected to increase

between 4.5% and 6.5%. For the full year 2017, JetBlue continues to

expect capacity to increase between 6.5% and 8.5%.

JetBlue will conduct a conference call to discuss its quarterly

earnings today, January 26, at 10:00 a.m. Eastern Time. A live

broadcast of the conference call will be available via the internet

at http://investor.jetblue.com.

About JetBlue

JetBlue is New York's Hometown Airline®, and a leading carrier

in Boston, Fort Lauderdale - Hollywood, Los Angeles (Long Beach),

Orlando, and San Juan. JetBlue carries more than 38 million

customers a year to 100 cities in the U.S., Caribbean, and Latin

America with an average of 925 daily flights. For more information

please visit JetBlue.com.

Notes

(1) Consolidated operating cost per

available seat mile, excluding fuel, profit sharing and related

taxes (CASM Ex-Fuel and Profit Sharing) is a non-GAAP financial

measure that we use to measure our core performance. Note A

provides a reconciliation of non-GAAP financial measures used in

this release and provides the reasons management uses those

measures.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

which represent our management's beliefs and assumptions concerning

future events. When used in this document and in documents

incorporated herein by reference, the words “expects,” “plans,”

“anticipates,” “indicates,” “believes,” “forecast,” “guidance,”

“outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar

expressions are intended to identify forward-looking statements.

Forward-looking statements involve risks, uncertainties and

assumptions, and are based on information currently available to

us. Actual results may differ materially from those expressed in

the forward-looking statements due to many factors, including,

without limitation, our extremely competitive industry; volatility

in financial and credit markets which could affect our ability to

obtain debt and/or lease financing or to raise funds through debt

or equity issuances; volatility in fuel prices, maintenance costs

and interest rates; our ability to implement our growth strategy;

our significant fixed obligations and substantial indebtedness; our

ability to attract and retain qualified personnel and maintain our

culture as we grow; our reliance on high daily aircraft

utilization; our dependence on the New York and Boston metropolitan

markets and the effect of increased congestion in these markets;

our reliance on automated systems and technology; our being subject

to potential unionization, work stoppages, slowdowns or increased

labor costs; our reliance on a limited number of suppliers; our

presence in some international emerging markets that may experience

political or economic instability or may subject us to legal risk;

reputational and business risk from information security breaches

or cyber-attacks; changes in or additional government regulation;

changes in our industry due to other airlines' financial condition;

acts of war or terrorist attacks; global economic conditions or an

economic downturn leading to a continuing or accelerated decrease

in demand for domestic and business air travel; the spread of

infectious diseases; adverse weather conditions or natural

disasters; and external geopolitical events and conditions. It is

routine for our internal projections and expectations to change as

the year or each quarter in the year progresses, and therefore it

should be clearly understood that the internal projections, beliefs

and assumptions upon which we base our expectations may change

prior to the end of each quarter or year.

Given the risks and uncertainties surrounding forward-looking

statements, you should not place undue reliance on these

statements. You should understand that many important factors, in

addition to those discussed or incorporated by reference in this

press release, could cause our results to differ materially from

those expressed in the forward-looking statements. Potential

factors that could affect our results include, in addition to

others not described in this press release, those described in Item

1A of our 2015 Form 10-K under "Risks Related to JetBlue" and

"Risks Associated with the Airline Industry". In light of these

risks and uncertainties, the forward-looking events discussed in

this press release might not occur.

JETBLUE AIRWAYS CORPORATION CONSOLIDATED

STATEMENTS OF OPERATIONS (in millions, except per share

amounts) (unaudited) Three Months Ended

Twelve Months Ended December 31, Percent

December 31, Percent 2016 2015

Change 2016 2015 Change OPERATING

REVENUES Passenger $ 1,477 $ 1,438 2.7 $ 6,013 $ 5,893 2.0

Other 164 156 5.4 619

523 18.5 Total operating revenues 1,641 1,594 3.0

6,632 6,416 3.4

OPERATING EXPENSES Aircraft fuel and

related taxes 291 300 (2.7 ) 1,074 1,348 (20.3 ) Salaries, wages

and benefits 427 401 6.5 1,698 1,540 10.2 Landing fees and other

rents 81 78 3.8 357 342 4.3 Depreciation and amortization 103 93

12.5 393 345 13.9 Aircraft rent 27 30 (10.5 ) 110 122 (9.6 ) Sales

and marketing 63 65 (4.0 ) 259 264 (1.7 ) Maintenance materials and

repairs 136 119 14.3 563 490 14.9 Other operating expenses

217 178 21.3 866 749

15.7 Total operating expenses 1,345

1,264 6.5 5,320 5,200 2.3

OPERATING INCOME 296 330 (10.4 ) 1,312 1,216 7.9

Operating margin 18.0 % 20.7 % (2.7 ) pts. 19.8 % 19.0 % 0.8 pts.

OTHER INCOME (EXPENSE) Interest expense (26 ) (30 )

(13.2 ) (111 ) (128 ) (12.9 ) Capitalized interest 2 2 19.6 8 8

(0.4 ) Interest income and other 2 1

177.5 7 1 3,675.4 Total other income

(expense) (22 ) (27 ) (19.5 ) (96 ) (119 ) (19.1 )

INCOME

BEFORE INCOME TAXES 274 303 (9.6 ) 1,216 1,097 10.8

Pre-tax margin 16.7 % 19.0 % (2.3 ) pts. 18.3 % 17.1 % 1.2 pts.

Income tax expense 102 113 (9.7

) 457 420 8.9

NET INCOME

$ 172 $ 190 (9.5 ) $ 759 $ 677 12.0

EARNINGS PER COMMON SHARE: Basic $ 0.51 $ 0.60

$ 2.32 $ 2.15 Diluted $ 0.50 $ 0.56

$ 2.22 $ 1.98

WEIGHTED AVERAGE

SHARES OUTSTANDING: Basic 335.1 318.9 326.5 315.1 Diluted 341.6

342.4 342.2 344.8

JETBLUE AIRWAYS CORPORATION

COMPARATIVE OPERATING STATISTICS (unaudited)

Three Months

Ended Twelve Months Ended December 31,

Percent December 31, Percent 2016

2015 Change 2016 2015 Change

Revenue passengers (thousands) 9,532 8,911 7.0 38,263 35,101

9.0 Revenue passenger miles (millions) 11,185 10,554 6.0 45,619

41,711 9.4 Available seat miles (ASMs) (millions) 13,198 12,626 4.5

53,620 49,258 8.9 Load factor 84.7 % 83.6 % 1.1 pts. 85.1 % 84.7 %

0.4 pts. Aircraft utilization (hours per day) 11.6 11.6 (0.6 ) 12.0

11.9 0.8 Average fare $ 154.94 $ 161.35 (4.0 ) 157.14 $

167.89 (6.4 ) Yield per passenger mile (cents) 13.20 13.62 (3.1 )

13.18 14.13 (6.7 ) Passenger revenue per ASM (cents) 11.19 11.39

(1.7 ) 11.21 11.96 (6.3 ) Revenue per ASM (cents) 12.43 12.62 (1.5

) 12.37 13.03 (5.0 ) Operating expense per ASM (cents) 10.19 10.01

1.9 9.92 10.56 (6.0 ) Operating expense per ASM, excluding fuel and

related taxes (cents)(1) 7.98 7.64 4.6 7.92 7.82 1.3 Operating

expense per ASM, excluding fuel, profit sharing and related taxes

(cents)(1) 7.69 7.29 5.6 7.59 7.51 1.1 Departures 83,976

80,135 4.8 337,302 316,505 6.6 Average stage length (miles) 1,077

1,093 (1.5 ) 1,093 1,092 0.1 Average number of operating aircraft

during period 222.4 212.7 4.6 218.9 207.9 5.3 Average fuel cost per

gallon, including fuel taxes $ 1.56 $ 1.68 (7.3 ) $ 1.41 $ 1.93

(26.9 ) Fuel gallons consumed (millions) 187 178 5.9 760 700 8.6

Average number of full-time equivalent crewmembers 15,696 14,537

8.0 (1) Refer to Note A, Consolidated operating cost per available

seat mile, excluding fuel, profit sharing and related taxes, at the

end of our Earnings Release for more information on this non-GAAP

measure.

JETBLUE AIRWAYS

CORPORATION SELECTED CONSOLIDATED BALANCE SHEET DATA

(in millions) December

31, December 31, 2016 2015

(unaudited) Cash and cash equivalents $ 433 $ 318 Total

investment securities 628 607 Total assets 9,487 8,644 Total debt

1,384 1,827 Stockholders' equity 4,013 3,210

SOURCE: JetBlue Airways

Corporation

Note A – Non-GAAP Financial Measures

JetBlue sometimes uses non-GAAP measures that are derived from

the Consolidated Financial Statements, but that are not presented

in accordance with generally accepted accounting principles

(“GAAP”). JetBlue believes these metrics provide a meaningful

comparison of our results to others in the airline industry and our

prior year results. Under the U.S. Securities and Exchange

Commission rules, non-GAAP financial measures may be considered in

addition to results prepared in accordance with GAAP, but should

not be considered a substitute for or superior to GAAP results. The

table below shows a reconciliation of non-GAAP financial measures

used in this press release to the most directly comparable GAAP

financial measures. It should be noted as well that our non-GAAP

information may be different from the non-GAAP information provided

by other companies.

Consolidated operating cost per available seat mile,

excluding fuel, profit sharing and related taxes (“CASM Ex-Fuel and

Profit Sharing”). CASM is a common metric used in the airline

industry. We exclude aircraft fuel, profit sharing and related

taxes from operating cost per available seat mile to determine CASM

Ex-Fuel and Profit Sharing. We believe CASM Ex-Fuel and Profit

Sharing provides investors the ability to measure financial

performance excluding items beyond our control such as (i) fuel

costs, which are subject to many economic and political factors

beyond our control and (ii) profit sharing, which is sensitive to

volatility in earnings. We believe this measure is more indicative

of our ability to manage costs and is more comparable to measures

reported by other major airlines.

NON-GAAP FINANCIAL MEASURE RECONCILIATION OF

OPERATING EXPENSE PER ASM, EXCLUDING FUEL, PROFIT SHARING AND

RELATED TAXES (in millions, per ASM data in cents)

(unaudited)

Three Months Ended Twelve Months

Ended December 31, December 31, 2016

2015 2016 2015 $ per ASM

$ per ASM $ per ASM $ per

ASM Total operating expenses $ 1,345 $ 10.19 $ 1,264

10.01 $ 5,320 $ 9.92 5,200 10.56 Less: Aircraft fuel and related

taxes 291 2.21 300 2.37 1,074

2.00 1,348 2.74 Operating expenses, excluding fuel and related

taxes 1,054 7.98 964 7.64 4,246 7.92 3,852 7.82 Less: Profit

sharing and related taxes 39 0.29 44 0.35

176 0.33 151 0.31 Operating expense, excluding fuel,

profit sharing and related taxes $ 1,015 $ 7.69 $ 920 7.29 $ 4,070

$ 7.59 3,701 7.51

Return On Invested Capital (“ROIC”). ROIC is a non-GAAP

financial measure we believe provides useful supplemental

information for management and investors by measuring the

effectiveness of our operations' use of invested capital to

generate profits. We use ROIC to track how much value we are

creating for our shareholders as it represents an important

financial metric we believe provides meaningful information as to

how well we generate returns relative to the capital invested in

our business.

NON-GAAP FINANCIAL MEASURE Reconciliation of

Return on Invested Capital (Non-GAAP) (in millions)

(unaudited) Twelve Months Ended

December 31, 2016 2015 Numerator

Operating Income $ 1,312 $ 1,216 Add: Interest income and other 7 1

Add: Interest component of capitalized aircraft rent (a) 58

64 Subtotal 1,377 1,281 Less: Income tax

expense impact 520 491 Operating Income

After Tax, Adjusted 857 790 Denominator Average

Stockholders' equity $ 3,611 $ 2,869 Average total debt 1,606 2,038

Capitalized aircraft rent (a) 771 853

Invested Capital 5,988 5,760

Return on Invested

Capital 14.3 % 13.7 % (a)

Capitalized Aircraft Rent Aircraft rent, as reported 110 122

Capitalized aircraft rent (7 * Aircraft rent) (b) 771 853 Interest

component of capitalized aircraft rent (Imputed interest at 7.5%)

58 64 (b) In determining the Invested Capital component of

ROIC we include a non-GAAP adjustment for aircraft operating

leases, as operating lease obligations are not reflected on our

balance sheets but do represent a significant financing obligation.

In making the adjustment we used a multiple of seven times our

aircraft rent as this is the multiple which is routinely used with

in the airline community to represent the financing component of

aircraft operating lease obligations.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170126005292/en/

JetBlue Investor RelationsTel: +1

718-709-2202ir@jetblue.comorJetBlue Corporate

CommunicationsTel: +1 718-709-3089corpcomm@jetblue.com

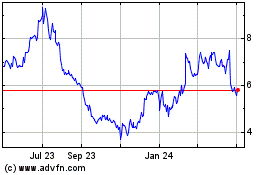

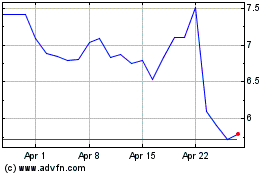

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024