Novartis Weighs Alcon Spinoff -- WSJ

January 26 2017 - 3:02AM

Dow Jones News

Eye-care business, which Novartis paid $51.6 billion to control,

is still struggling

By Denise Roland

Novartis AG is considering spinning off its ailing eye-care

business Alcon, one year into a slower-than-expected turnaround for

that business.

The Swiss pharmaceutical giant said it would explore all options

for the Alcon business, which sells eye-care technology such as

contact lenses, lens implants and associated surgical tools.

The potential spinoff comes seven years after Novartis gained

full ownership of Alcon, a move that it had hoped would allow it to

capitalize on the fast-growing eye-care market. In total, it paid

$51.6 billion for the business.

Chief Executive Joe Jimenez said he wouldn't rule anything out,

but suggested that a spinoff could "create a big opportunity for

our shareholders" due to the scarcity of listed eye-care device

companies of its size. He said the company would announce its

decision near the end of the year.

The decision comes as the company struggles to revive growth at

Alcon. A year ago, Mr. Jimenez had hoped that fresh leadership and

a new focus on devices like lenses, lens implants and surgical

tools -- he moved Alcon's ophthalmology drugs into Novartis's

broader pharmaceuticals division -- would return Alcon to growth in

the second half of 2016.

Instead, Alcon is still struggling, with sales flat in the

fourth quarter, though Mr. Jimenez said there were signs of

improvement, noting that contact-lens sales had grown for the third

consecutive quarter.

Novartis on Wednesday said earnings and revenue for the whole

company fell in the fourth quarter, largely due to the strength of

the dollar. It also announced a share buyback worth up to $5

billion.

Net profit fell 11% to $936 million in the three months to Dec.

31, compared with $1.05 billion in the same period a year earlier,

while revenue declined 2% to $12.32 billion.

Adjusting for the strength of the dollar, revenue and net income

were flat, as falling sales from old cancer medicine Gleevec offset

growth of some of Novartis's newer drugs.

Novartis is leaning heavily on two newer drugs -- Entresto for

heart disease and Cosentyx for psoriasis and some rheumatoid

diseases -- to offset a sharp decline in sales from Gleevec, which

last year started to face competition from cheaper

alternatives.

While Cosentyx has ramped up quickly since its launch in 2015,

notching sales of $1.1 billion last year, Entresto has so far

proven a disappointment. Also launched in 2015, it generated sales

of just $170 million last year, missing even Novartis's own modest

goal of $200 million.

Still, Mr. Jimenez said he expected momentum to increase this

year, thanks to the company's heavy investment in an expanded sales

force, more favorable coverage from health insurers and the recent

endorsement of major cardiology groups in the U.S. and Europe.

"Everything we're seeing on Entresto is giving us confidence for

the future," he said, adding that the company expects prescriptions

to triple over the course of 2017.

Novartis said it expected 2017 sales to be broadly in line with

last year at constant currencies.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

January 26, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

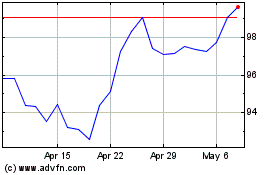

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

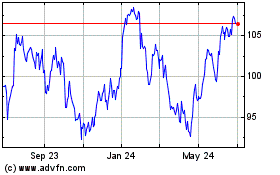

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024