HIGHLIGHTS

- Muted Q4 freight rate performance from extended seasonal

weakness

- Encouraging start for Q1 but confluence of factors likely to

impact from February

- Euronav balance sheet bolstered by sale & leaseback and new

financing facility

- Letter of award for FSO for five-year contract starting Q3

2017

- Return to shareholders' policy confirmed

ANTWERP, Belgium, 26 January 2017 - Euronav NV

(NYSE: EURN & Euronext: EURN) ("Euronav" or the

"Company") today reported its non-audited financial results for the

three months ended 31 December 2016.

Paddy Rodgers, CEO of Euronav said: "Euronav had

an active Q4 resulting in a letter of award for our FSO joint

venture for a five-year contract, refinancing over USD 400 million

of company debt on better terms and duration plus executing a sale

and leaseback on four vessels. This has further bolstered our

already strong balance sheet and gives us the flexibility to

navigate the tanker sector cycle from a position of strength.

Tanker owner sentiment and behavior continues to

be relatively brittle despite medium-term positive market

fundamentals. Freight rates in what historically is the strongest

quarter in any calendar year - Q4 - were subdued. Since November,

however, record cargo volumes ahead of OPEC production cuts, caused

by improving demand for crude, helped drive rates toward long-term

Q4 averages in December. However, 2017 will, in our view, present a

number of challenges: OPEC production cuts, peak delivery schedule

of the order book, continued restricted access to finance and

anemic owner confidence, which when combined, are all likely to

produce a difficult rate environment for 2017".

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The most

important key figures (unaudited) are: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands of

USD) |

|

|

Fourth Quarter 2016 |

|

|

Fourth Quarter 2015 |

|

|

Full Year 2016 |

|

|

Full Year 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

146,280 |

|

|

|

225,644 |

|

|

|

684,265 |

|

|

|

846,507 |

|

|

|

|

Other operating

income |

|

|

1,463 |

|

|

|

1,154 |

|

|

|

6,996 |

|

|

|

7,426 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses and

commissions |

|

|

(16,481 |

) |

|

|

(15,956 |

) |

|

|

(59,560 |

) |

|

|

(71,237 |

) |

|

|

|

Vessel operating

expenses |

|

|

(37,361 |

) |

|

|

(38,812 |

) |

|

|

(160,199 |

) |

|

|

(153,718 |

) |

|

|

|

Charter hire

expenses |

|

|

(2,920 |

) |

|

|

(6,438 |

) |

|

|

(17,713 |

) |

|

|

(25,849 |

) |

|

|

|

General and

administrative expenses |

|

|

(11,418 |

) |

|

|

(16,122 |

) |

|

|

(44,051 |

) |

|

|

(46,251 |

) |

|

|

|

Net gain (loss) on

disposal of tangible assets |

|

|

36,576 |

|

|

|

11,165 |

|

|

|

50,395 |

|

|

|

5,300 |

|

|

|

|

Net gain (loss) on

disposal of investments in equity accounted investees |

|

|

|

|

|

|

|

|

(24,150 |

) |

|

|

|

|

|

|

Depreciation |

|

|

(59,125 |

) |

|

|

(54,896 |

) |

|

|

(227,709 |

) |

|

|

(210,206 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net finance

expenses |

|

|

(16,095 |

) |

|

|

(9,799 |

) |

|

|

(44,849 |

) |

|

|

(47,630 |

) |

|

|

|

Share of profit (loss) of equity accounted investees |

|

|

8,637 |

|

|

|

13,520 |

|

|

|

40,194 |

|

|

|

51,592 |

|

|

|

|

Result

before taxation |

|

|

49,556 |

|

|

|

109,461 |

|

|

|

203,619 |

|

|

|

355,934 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax

benefit (expense) |

|

|

475 |

|

|

|

(4,602 |

) |

|

|

174 |

|

|

|

(5,633 |

) |

|

|

|

Profit

(loss) for the period |

|

|

50,031 |

|

|

|

104,859 |

|

|

|

203,793 |

|

|

|

350,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to:

Owners of the company |

|

|

50,031 |

|

|

|

104,859 |

|

|

|

203,793 |

|

|

|

350,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The contribution to

the result is as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands of

USD) |

|

|

Fourth Quarter 2016 |

|

|

Fourth Quarter 2015 |

|

|

Full Year 2016 |

|

|

Full Year 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tankers |

|

|

41,630 |

|

|

|

96,697 |

|

|

|

169,324 |

|

|

|

317,347 |

|

|

|

|

FSO |

|

|

8,401 |

|

|

|

8,162 |

|

|

|

34,469 |

|

|

|

32,954 |

|

|

|

|

Result after taxation |

|

|

50,031 |

|

|

|

104,859 |

|

|

|

203,793 |

|

|

|

350,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in USD per share) |

|

|

Fourth Quarter 2016 |

|

|

Fourth Quarter 2015 |

|

|

Full Year 2016 |

|

|

Full Year 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number

of shares (basic) * |

|

|

158,166,534 |

|

|

|

158,628,151 |

|

|

|

158,262,268 |

|

|

|

155,872,171 |

|

|

|

|

Result after

taxation |

|

|

0.32 |

|

|

|

0.66 |

|

|

|

1.29 |

|

|

|

2.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * The

number of shares issued on 31 December 2016 is 159,208,949. |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

reconciliation (unaudited): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands of

USD) |

|

|

Fourth Quarter 2016 |

|

|

Fourth Quarter 2015 |

|

|

Full Year 2016 |

|

|

Full Year 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the

period |

|

|

50,031 |

|

|

|

104,859 |

|

|

|

203,793 |

|

|

|

350,301 |

|

|

|

|

|

+ Depreciation |

|

|

59,125 |

|

|

|

54,896 |

|

|

|

227,709 |

|

|

|

210,206 |

|

|

|

|

|

+ Net finance

expenses |

|

|

16,095 |

|

|

|

9,799 |

|

|

|

44,849 |

|

|

|

47,630 |

|

|

|

|

|

+ Tax expense

(benefit) |

|

|

(475 |

) |

|

|

4,602 |

|

|

|

(174 |

) |

|

|

5,633 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

|

124,776 |

|

|

|

174,156 |

|

|

|

476,177 |

|

|

|

613,770 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+ Depreciation equity

accounted investees |

|

|

4,776 |

|

|

|

7,428 |

|

|

|

23,774 |

|

|

|

29,314 |

|

|

|

|

|

+ Net finance expenses

equity accounted investees |

|

|

521 |

|

|

|

966 |

|

|

|

3,212 |

|

|

|

5,288 |

|

|

|

|

|

+ Tax expense (benefit)

equity accounted investees |

|

|

66 |

|

|

|

(184 |

) |

|

|

182 |

|

|

|

(184 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proportionate EBITDA |

|

|

130,139 |

|

|

|

182,366 |

|

|

|

503,345 |

|

|

|

648,188 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proportionate EBITDA

per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in USD per share) |

|

|

Fourth Quarter 2016 |

|

|

Fourth Quarter 2015 |

|

|

Full Year 2016 |

|

|

Full Year 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number

of shares (basic) * |

|

|

158,166,534 |

|

|

|

158,628,151 |

|

|

|

158,262,268 |

|

|

|

155,872,171 |

|

|

|

|

|

Proportionate

EBITDA |

|

|

0.82 |

|

|

|

1.15 |

|

|

|

3.18 |

|

|

|

4.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| All figures have been prepared under IFRS as

adopted by the EU (International Financial Reporting Standards) and

have not been audited nor reviewed by the statutory auditor. |

|

|

|

|

|

For the fourth quarter of 2016 the Company had a

net profit of USD 50.0 million (fourth quarter 2015: USD 104.9

million) or USD 0.32 per share (fourth quarter 2015: USD 0.66 per

share). Proportionate EBITDA (a non-IFRS measure) for the same

period was USD 130.1 million (fourth quarter 2015: USD 182.4

million).

The average daily time charter equivalent rates

(TCE, a non IFRS-measure) can be summarized as follows:

|

In USD per day |

Fourth quarter 2016 |

Fourth quarter 2015 |

Full year 2016 |

Full year 2015 |

| VLCC |

|

|

|

Average spot rate (in TI pool) |

33,161 |

61,482 |

41,863 |

55,055 |

|

Average time charter rate |

43,833 |

41,776 |

42,618 |

41,981 |

| SUEZMAX |

|

|

|

Average spot rate |

21,243 |

41,596 |

27,498 |

41,686 |

|

Average time charter rate |

24,662 |

36,042 |

26,269 |

35,790 |

Including profit share where

applicable

Excluding technical offhire days

EURONAV TANKER FLEET

On 3 October 2016 Euronav signed two long-term

time charter contracts of seven years each starting in 2018 with

Valero Energy Inc. for Suezmax vessels with specialized Ice Class

1C capability. In order to fulfil these contracts, Euronav has

ordered two high specification Ice Class Suezmax vessels from

Hyundai Heavy Industries shipyard in South Korea. Delivery of these

vessels is expected in early 2018 in good time for commencement of

the charters.

On 13 October 2016 Euronav agreed with Hyundai

Heavy Industries shipyard in South Korea to defer the delivery of

the two VLCC ex-yard resale vessels, it recently purchased, to the

first quarter of 2017. These vessels, previously expected to be

delivered between October and November 2016, were delivered in

January 2017.

On 27 October 2016 the VLCC KHK Vision (2007 -

305,749 dwt) which was time chartered in, was redelivered to its

owner.

On 16 December 2016 Euronav signed a new USD 410

million senior secured amortizing revolving credit facility for the

purpose of refinancing 11 vessels as well as Euronav's general

corporate purposes. The credit facility was used to refinance the

USD 500 million senior secured credit facility dated 25 March 2014

and will mature on 31 January 2023 carrying a rate of LIBOR plus a

margin of 2.25%.

On 22 December 2016 together with joint venture

partner International Seaways, Inc. ("INSW"), Euronav received a

letter of award for a five-year contract for the service of its two

FSO units. The existing contracts will remain in force until expiry

in Q3. If negotiations and documentation are successfully

concluded, the new contracts are expected to generate revenues for

the joint venture in excess of USD 360 million over their full

duration, excluding reimbursement for agreed operating expenses.

The signing of final services contracts remains subject to an

agreement on substantive business terms and no assurance can be

given that such agreement will be reached.

On 22 December 2016 Euronav entered into a

five-year sale and leaseback agreement for four VLCC vessels with

investment vehicles advised by Wafra Capital Partners Inc., a

private equity partnership. The four VLCCs are the Nautilus (2006 -

307,284 dwt), Navarin (2007 - 307,284 dwt), Neptun (2007 - 307,284

dwt) and Nucleus (2007 - 307,284 dwt). The terms of the transaction

include an aggregate sales price of USD 186 million, resulting in a

capital gain of USD 36.5 million. The leaseback transaction is

accounted for as an operating lease under IFRS and includes certain

contingent elements linked to the fair market value of the vessels

during and at the expiry of the charter period. As per our return

to shareholders' policy, this capital gain will not be eligible for

dividend distribution. After repayment of the existing debt, the

transaction generated in excess of USD 100 million free cash.

Euronav has leased back the four vessels, which were built by

Dalian Shipbuilding Industry Co., Ltd. (DSIC), under a five-year

bareboat contract at an average rate of USD 22,000 per day per

vessel and at the expiry of each contract the vessels will be

redelivered to their new owners.

On 10 January 2017 the naming ceremony for the

two VLCC resales, the Ardeche (2017 - 298,642 dwt) and the

Aquitaine (2017 - 298,768 dwt) took place at the Hyundai Samho yard

in Mokpo, South Korea. Euronav took delivery of these on 12 January

and on 20 January respectively.

RETURN TO SHAREHOLDERS

Euronav's return to shareholders' policy is to

distribute 80% of net income over the full financial year. Under

Belgian corporate law the final full year dividend must be approved

by the Annual General Meeting of Shareholders (AGM) on the basis of

the fully audited results of the financial year. The AGM is

scheduled on 11 May 2017.

As per our return to shareholders' policy, any

capital gains are not eligible for dividend distribution.

Management is therefore pleased to announce that it intends to

recommend to the Board of Directors, subject to final audited

results being identical to the preliminary ones and absent material

adverse circumstances, that the Board proposes for approval of the

AGM a final full year dividend of USD 0.77 per share. Taking into

account the interim dividend announced in August in the amount of

USD 0.55 per share, the expected dividend payable after the AGM

should be USD 0.22 per share. The total final USD 0.77 dividend per

share complies with the 80% commitment when compared to underlying

earnings for the full year 2016 of USD 0.96 per share (after

stripping out capital gains).

TANKER MARKET

The tanker market finds itself at an interesting

intersection as medium and longer-term positives (restricted

financing driving limited contracting, increased environmental

regulation taking effect from 2017, robust demand for crude)

continue to build momentum but are likely to be overshadowed by a

number of negative short-term factors driving the market during

2017 (OPEC production cuts, delivery of new vessels, limited

scrapping, anemic owner sentiment). Euronav sees a number of

short-term factors dominating during 2017 before focus on a

positive medium-term market structure can develop.

In terms of short-term headwinds, firstly the

OPEC-led production cuts will begin to impact during Q1 (mid to

late January) and present a headwind for tanker markets until at

least the summer months when long established seasonal trading

patterns typically reduce demand. Secondly, 2017 will see the peak

of the order book delivery schedule with at least 40 VLCC

equivalents (VLCC & Suezmax vessels expressed as VLCC capacity)

expected to enter the global fleet in the first half of 2017 alone.

Owner sentiment and behavior has been weak in the face of similar

vessel delivery albeit at lower levels during the second half of

2016 suggesting potential freight rate pressure during this

delivery period.

Thirdly, older tonnage is likely to remain and

act as disruptive capacity in 2017 as pressure to scrap is

neutralized to some extent by an uncertainty over approved ballast

water and sulphur cap systems and an ability to defer direct

application of the new environmental regulations starting in

September 2017, as covered in more detail below. Lastly, continued

restrictive access to financing for ship owners and anemic owner

confidence are likely to combine all of these factors to produce a

challenging freight rate environment for 2017.

Medium-term drivers though remain positive.

Demand for crude oil remains supportive with upward pressure on

demand forecasts into 2017 as global GDP expectations are upgraded.

Whilst the oil price has risen since OPEC announced production

cuts, the resilience of the USA shale output and the return of

disrupted supply (Nigeria, Libya) suggest that increased crude

supply will respond quickly to higher prices and so prevent

price-based demand destruction.

Increased regulation under the Ballast Water

Management Convention coming into force in September 2017 and the

Sulphur Oxides (SOx) Regulation from 2020 limiting the maximum

sulphur content in fuel oil will help to increase pressure to scrap

over time. There are 267 VLCCs in total (38% of current fleet) that

will be at least 15 years old by 2020. This ageing profile will

encourage a more rational medium-term behavior as owners will face

increased regulatory costs over and above those from special

surveys which are scheduled for every 30 months on vessels older

than 15 years of age.

A combination of rationed capital from

traditional sources and a higher cost of capital have substantially

reduced contracting activity in the past 12 to 15 months. In VLCC

orders, 2016 was the third lowest year on record. The majority of

orders were also being industrial replacement rather than

speculative. Shipyards are also severely restricted in their

financial flexibility and are entering a phase of rationalization,

albeit with one caveat - political pressure to address overcapacity

has eased in recent months and requires monitoring.

We encourage investors to visit our website and

access our presentations which are updated regularly at

http://investors.euronav.com.

OUTLOOK

The Company remains consistent in its view

expressed in recent communications that vessel supply in totality

remains a manageable factor but that increased pockets of supply

would periodically have a detrimental effect. The lack of

contracting in the past 12 to 15 months encourages a positive

medium-term view supported by consistent crude demand growth (IEA

2017-2020 forecast 1.2m bpd growth every year), increasing effect

of environmental legislation toward 2020 and an adjustment to a

rationed supply of capital for all.

Euronav management has taken affirmative action

over the past six months in rejuvenating the fleet whilst

simultaneously improving our capital ratios and access to

liquidity. With the lowest leverage in the big tanker sector and

access to over USD 600 million of liquidity Euronav is well

positioned to navigate the cycle - to be strategically

opportunistic whilst remaining exposed to any potential upside from

an improved freight rate environment.

So far during the first quarter of 2017, the

Euronav VLCC fleet operated in the Tankers International Pool has

earned about 48,098 USD and 48% of the available days have been

fixed. Euronav's Suezmax fleet trading on the spot market has

earned about 24,070 USD per day on average with 41.5 % of the

available days fixed.

CONFERENCE CALL

Euronav will host a conference call at 09:30

a.m. EST / 3:30 p.m. CET on Thursday 26 January 2017 to discuss the

results for the fourth quarter 2016.

The call will be a webcast with an accompanying

slideshow. You can find details of this conference call below and

on the "Investor Relations" page of the Euronav website at

http://investors.euronav.com.

|

Webcast Information |

|

|

Event Type: |

Audio webcast with user-controlled slide presentation |

|

Event Date: |

26 January 2017 |

|

Event Time: |

09:30 a.m. EST / 3:30 p.m. CET |

|

Event Title: |

"Q4 2016 Earnings Conference Call" |

|

Event Site/URL: |

http://services.choruscall.com/links/euronav1701263ox6XmZ1.html |

Telephone participants may avoid any delays by

pre-registering for the call using the following link to receive a

special dial-in number and PIN conference call registration link:

http://dpregister.com/10099044. Pre-registration fields of

information to be gathered: name, company, email.

Telephone participants located in the U.S. who

are unable to pre-register may dial in to +1-877-328-5501 on the

day of the call. Others may use the international dial-in number

+1-412-317-5471.

A replay of the call will be available until 2

February 2017, beginning at 11:30 a.m. EST / 5:30 p.m. CET on 26

January 2017. Telephone participants located in the U.S. can dial

+1-877-344-7529. Others can dial +1-412-317-0088. Please reference

the conference number 10099044.

** * Forward-Looking

Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. The Company desires to take

advantage of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and is including this cautionary

statement in connection with this safe harbor legislation. The

words "believe", "anticipate", "intends", "estimate", "forecast",

"project", "plan", "potential", "may", "should", "expect",

"pending" and similar expressions identify forward-looking

statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, our management's examination of historical operating

trends, data contained in our records and other data available from

third parties. Although we believe that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond our control, we

cannot assure you that we will achieve or accomplish these

expectations, beliefs or projections.

In addition to these important factors, other

important factors that, in our view, could cause actual results to

differ materially from those discussed in the forward-looking

statements include the failure of counterparties to fully perform

their contracts with us, the strength of world economies and

currencies, general market conditions, including fluctuations in

charter rates and vessel values, changes in demand for tanker

vessel capacity, changes in our operating expenses, including

bunker prices, dry-docking and insurance costs, the market for our

vessels, availability of financing and refinancing, charter

counterparty performance, ability to obtain financing and comply

with covenants in such financing arrangements, changes in

governmental rules and regulations or actions taken by regulatory

authorities, potential liability from pending or future litigation,

general domestic and international political conditions, potential

disruption of shipping routes due to accidents or political events,

vessels breakdowns and instances of off-hires and other factors.

Please see our filings with the United States Securities and

Exchange Commission for a more complete discussion of these and

other risks and uncertainties.

Contact:Mr. Brian Gallagher - Euronav Investor

RelationsTel: +44 20 7870 0436Email:

IR@euronav.com

Announcement of final year results 2016:

Thursday 16 March 2017

About EuronavEuronav is an independent

tanker company engaged in the ocean transportation and storage of

crude oil. The Company is headquartered in Antwerp, Belgium, and

has offices throughout Europe and Asia. Euronav is listed on

Euronext Brussels and on the NYSE under the symbol EURN. Euronav

employs its fleet both on the spot and period market. VLCCs on the

spot market are traded in the Tankers International pool of which

Euronav is one of the major partners. Euronav's owned and operated

fleet consists of 55 double hulled vessels being 1 V-Plus vessel,

31 VLCCs, 19 Suezmaxes, two Suezmaxes under construction and two

FSO vessels (both owned in 50%-50% joint venture). The Company's

vessels mainly fly Belgian, Greek, French and Marshall Island

flags.

Regulated information within the meaning of the

Royal Decree of 14 November 2007.

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/9f721ab5-5fb1-4d38-9c42-f711d5d762ed

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/3a69e125-61a1-4690-a301-2dffbfb61d28

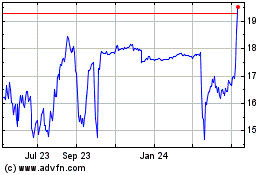

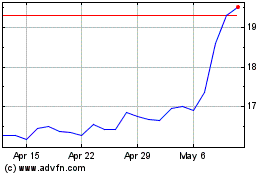

Euronav NV (NYSE:EURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Euronav NV (NYSE:EURN)

Historical Stock Chart

From Apr 2023 to Apr 2024