Mattel Shares Tumble After Reporting Weak Holiday Sales -- 2nd Update

January 25 2017 - 9:39PM

Dow Jones News

By Paul Ziobro

Last minute shoppers ruined Christmas for the toy industry.

After posting disappointing fourth-quarter results, Mattel Inc.

executives on Wednesday blamed deep discounts in the waning days

before Christmas that were needed to help retailers clear unsold

Barbie dolls, Hot Wheels sets and other toys.

The move revived lackluster sales for Mattel and the overall toy

industry, but at a steep cost in profits. Mattel, the largest U.S.

toy maker by sales, reported a 19% drop in earnings during its

critical fourth quarter. The company reported a week earlier than

planned, and Mattel shares fell more than 10% in late trading to

$28.33.

"It was a fairly ugly end to the quarter," said Chief Executive

Christopher Sinclair, who last week announced plans to step

aside.

The disappointing results marred what had otherwise seemed like

a return to stability at Mattel under Mr. Sinclair. Instead, the

company's turnaround efforts will be handed over to Margaret

Georgiadis, a former Google executive who next month becomes

Mattel's third CEO in as many years.

Shoppers did come out during the Black Friday holiday weekend,

but during the first three weeks of December, toy sales fell 7%,

Mr. Sinclair said Wednesday. "That's when the retail environment

became turbulent," he said on a conference call.

Retailers struggled with the sales cadence as well. Toys "R" Us.

Inc. Chief Executive David Brandon last week said that the loss of

momentum in the toy category caused its competitors to discount

aggressively, hurting its overall business. Sales for its holiday

period fell 2.5% in the U.S. at stores open at least a year.

The holiday season can easily derail an otherwise successful

year in the toy industry, as roughly half of retail sales occur in

final months. Mattel executives worked with worried retailers to

offer aggressive discounts to get people shopping.

"Because of a very short time frame, we had to activate and

execute these programs," Mattel President Richard Dickson said. "We

didn't know the financial impact until after year-end."

Mattel logged about 20% of its sales for the quarter in that

final week. But the pain was felt on the gross margin, which fell

to 47% from 50.2% last year.

Toy sales are also quickly shifting online, creating additional

challenges for retailers. One Click Retail, a research firm,

estimated that Amazon.com Inc.'s toy sales rose 24% last year, more

than three times faster than the overall industry.

The shift to online shopping not only increases price

transparency but it reduces shopper visits to stores, which saps

toy makers and retailers of impulse purchases.

"Holiday 2016 taught us that extra shopping days and earlier

online promotions don't necessarily translate to more overall

sales," said Juli Lennett, toys industry analyst at NPD Group.

Mattel's fourth-quarter profit fell 19% to $173.8 million, or 50

cents per share. Global sales declined 8.3% to $1.83 billion, hurt

by the loss of the Disney Princess dolls business to rival Hasbro

Inc. as well as currency swings. In North America, net sales fell

7%.

Excluding expenses related to acquisitions or asset sales,

restructuring costs or currency devaluations, Mattel reported

adjusted earnings of 52 cents a share for the quarter. On that

basis, analysts were expecting Mattel to report a profit of 71

cents a share.

The report also dragged down rival toy maker Hasbro Inc., whose

shares fell 4% in late trading. Hasbro is scheduled to report its

fourth-quarter results Feb. 6.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

January 25, 2017 21:24 ET (02:24 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

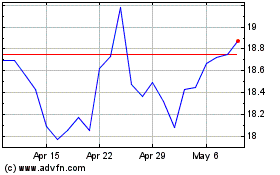

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

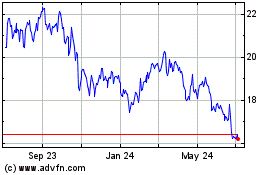

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Apr 2023 to Apr 2024